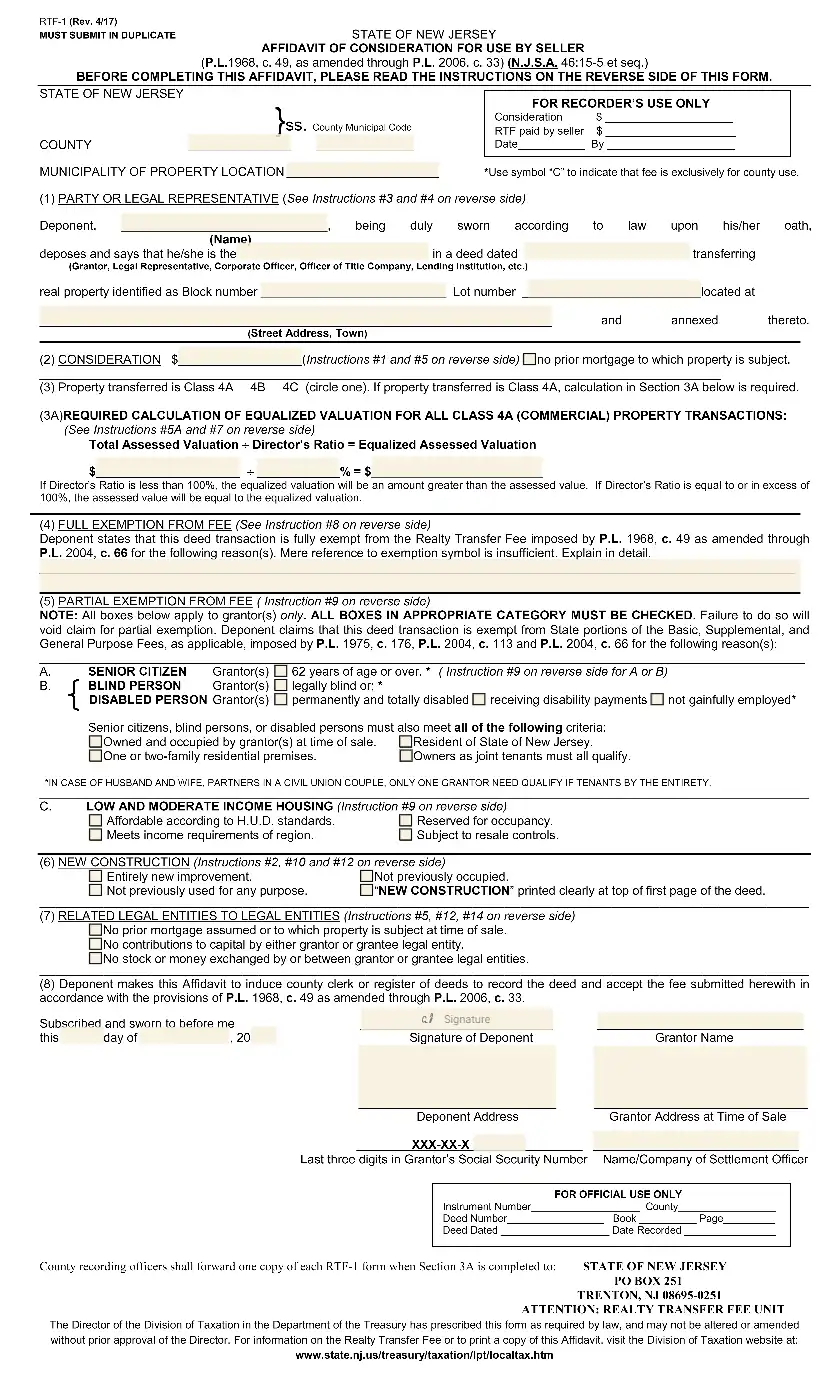

When you transfer or receive any real property in the United States (and New Jersey, particularly), sometimes you are required to pay a specific transfer fee. The New Jersey affidavit of consideration, also known as the RTF-1 form, is a certain document that one should create when they become a deponent (or a transferor) in the deals tied to real property transfers. This form should be sent if a selling (or transferring) party wants to avoid paying the transfer fee.

Another name of this form is the New Jersey affidavit of exemption. In this article, we will tell you the basics you should know about such affidavits, what laws are used in New Jersey to manage these documents, and how to create this document correctly in New Jersey.

What Is the New Jersey Affidavit of Consideration (or RTF-1) Form?

It is a form that consists of two pages and lets people call for exemption when real property is transferred. There are certain groups of buyers and sellers that are free from paying additional fees including the property transfer fees. The list of such groups may vary from state to state. However, you can often see disabled people or families with low income on the list.

An exemption can be full or partial. It depends on the candidate, their situation, and other factors. The Division of Taxation of the New Jersey Treasury suggests a guide that explains how to understand if you can be exempted or not. Before you start working on the template, we recommend checking this public authority’s website and finding out more details. This measure will probably help you to prepare for the template completion fully.

What Laws Should I Check When Creating the Form?

The New Jersey Statutes Annotated contain provisions regarding the real estate transfer fees and other related matters. Title 46 is all about the property and related issues.

In particular, one who seeks info shall turn to sections 46:15-7 and 46:15-10. As stated in section 46:15-7, every seller has to pay the fee for every deal, including real property transfers, by default. If the seller is subject to an exemption, they can use the RTF-1 form to apply and reduce or cancel the fee.

Sections 46:15-10 and 46:15-10.1 of the New Jersey Statutes Annotated tell more details about the categories of sellers who may avoid paying the fee. Check these sections to understand if you can do so or not.

To have a list of all the definitions used in the laws of New Jersey, we recommend checking section 46:15-5. It will explain who is considered a senior person or an individual with low income in New Jersey and clarify other points.

Realty transfer fees are thoroughly explained in section 46:15-7 that we mentioned before. You can get the guidelines to calculate your own approximate fee there.

Some realty transfers also have additional fees besides the standard ones. You can turn to section 46:15-7.2 to see the difference and reasons to impose additional fees. For instance, if the value of the real estate is more than $1,000,000 USD, there will likely be an increased realty transfer fee. Also, please note that for deals with such value, there is another form called RTF-1EE.

Who Fills Out the Form?

Usually, it is a seller (or transferor) who fills out the template to free themselves from the realty transfer fee. A grantor or their legal representative can be a deponent as well as a company representative if the deal is between entities. You can double-check the New Jersey Treasury, Division of Taxation to ensure that you can complete and file the form.

How to Fill Out the RTF-1 Form

The form may seem complicated to some filers. However, it is not that hard, and we provide you with detailed instructions that tell you what exactly to do during each step. Besides that, the template itself has a page with all the official guidelines you need to check before the RTF-1 form completion.

Even if everything seems to be quite clear to you after reading all of the guides, some questions and concerns still may occur. If this is your case, we strongly advise you to ask for professional help. The market in the United States and New Jersey is full of legal forms specialists who will be able to help you in the shortest terms.

Before we start explaining how to complete the RTF-1 form when the property transfer in New Jersey takes place, it is crucial to obtain the correct template. Our advanced form-building software will help you get the form with ease. Try the software on our site to get the demanded file quickly and proceed to the instructions below.

Read the Official Guide

On the form’s second page, you will find a complete set of the needed instructions. You should read all of them to ensure that the form will be filled out properly. Read them carefully at the moment when you start working on the template.

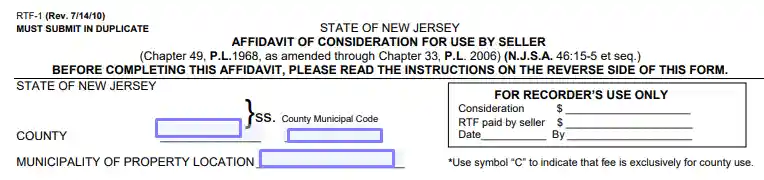

Insert Your County and Its Code

You have to indicate which county of New Jersey this record is made in and enter the county’s code in the designated position. Also, write the municipality location. If you have no idea what your county code is, check the New Jersey Treasury, Division of Taxation website.

On the right-hand side, you will see a block “For recorder’s use only”: do not write anything in there. This block should be left for the person who will register your paper.

Define the Deponent

You have to introduce the deponent who will sign the document. It can be a grantor, their legal representative, a corporate officer, an officer or title company, a lending institution, and so on.

Write the deponent’s full legal name, who they are exactly (see the options listed above or select another option that fits the case), and the deal date. Then, enter the real estate’s block number and lot number. Indicate the property’s address: street address and town will do.

Determine the Consideration

As stated in the official instructions on the template’s second page, consideration here is the compensation given for transferring the property ownership from one party to another. So, you should reveal the consideration sum in US dollars and mark one of the suggested options if any applies.

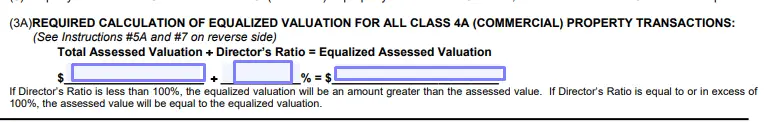

Count the Value of Property Transactions (If Needed)

There is a particular formula used to make calculations. You have to take the total assessed valuation and director’s ratio; then provide calculations as demanded in the template. Thus, you will get the equalized assessed valuation. Please note that this calculation should be made in certain cases defined in the template’s previous question.

Explain Why the Deal Is an Exemption

Move to sections 8 and 9 of the official instructions. In these sections, you will find detailed info on when deals can be considered a full or partial exemption, and parties can skip paying all the related fees. Explain your case in detail in the designated lines (for full or for partial exemption).

There are also various options if you fill out the partial exemption section. You can mark if you or a signer is a disabled or blind person or a senior citizen. Another reason to be exempted is the low or moderate income rates of you or your family members. You should mark the needed boxes and add the required details.

Besides the signers’ categories, you will see a list of requirements. Read them and mark options that apply to you. If you do not meet all of the requirements, you cannot complete and submit the New Jersey affidavit of consideration.

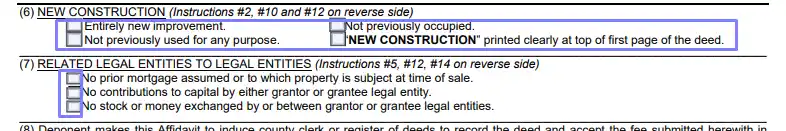

Answer Questions about the Property

You will see a couple of questions about the property in question. Firstly, you should answer if this is the result of a new construction or not (which often means that no one has used the property before). Then, you have to reply about legal entities’ relations if your deal is happening between the entities (if there is a mortgage assigned to the property and other questions).

Sign the RTF-1 Form

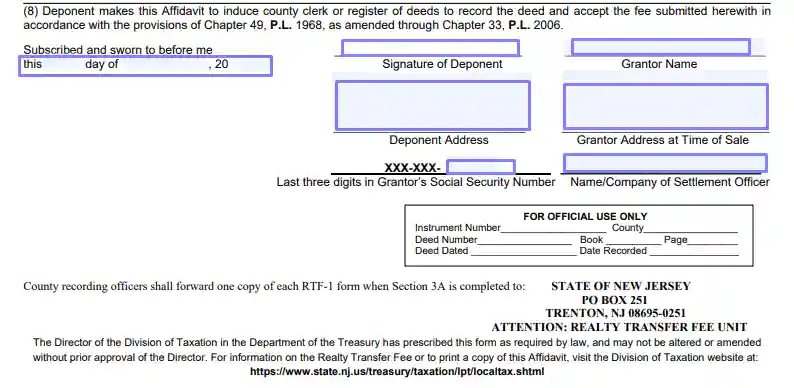

The document will not be valid without the signature of the person who has created this form (or the deponent). They must not only sign the paper but also write their physical address and the last three digits of their SSN (or social security number). They have to date the form as well.

Apart from that, you should enter the grantor’s name and address and the settlement officer’s name and company.

How to Submit the Form Correctly

When the form is ready, you may turn to the New Jersey Treasury Department of Taxation to understand where you have to bring or deliver the paper. Use the official site to clarify which submission methods are currently available for this form. You can email, call, or even visit the local office, and the department’s specialists will assist you with the document filing.

What Happens After I Submit the Form?

Your form must be considered and checked by the public authorities of the state of New Jersey. As a result, you will receive either a realty transfer fee or an exemption from it. The outcome depends on various factors, and in some cases, you cannot predict what decision will arrive.

If you are not content with the decision (for example, your claim was not satisfied at all, or you have to pay less but asked for paying nothing), you can re-claim and file a protest. You can use a specific legal template to restart the process: the RTF-4 Form (or Filing of Protest of Realty Transfer Fee Assessment).

Remember that regardless of the public authorities’ decision, you must pay the realty transfer fee if it was imposed. If you decide to skip paying or ignore notifications, you may face trouble and even bigger fees and fines in the future.