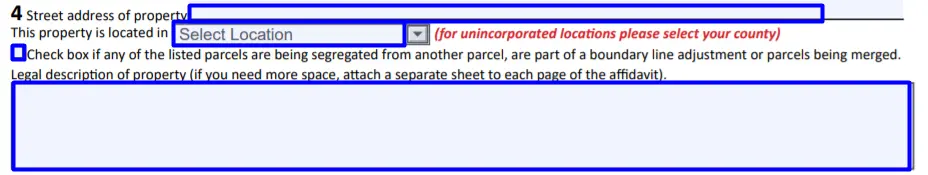

If you are planning to sell a property in Washington, then the Real Estate Excise Tax has to be paid. The State Law of WA demands an Excise Tax Affidavit be completed and signed before the registration of the legal document of transfer of the ownership of the property. In this article, we will discuss how to fill out this form and the main objective of this legal record.

What is a Real Estate Excise Tax Affidavit?

The Real Estate Excise Tax Affidavit form in Washington is a document that depicts the full amount of excise tax that is imposed on real estate. The tax is paid by the seller. The paper includes information about the seller and the buyer of the property, the type of the property, and its full description. The paper also depicts all of the data connected to the taxes and other payments concerning the property.

How to Fill Out WA Excise Tax Affidavit

In this segment, we will cover how to write out the form. The Tax Affidavit itself has many sections and subsections, so one must be careful while filling it out.

For this filling-out guide, we will utilize a single location affidavit. Nevertheless, there are other types of this document, for example, Multiple locations Affidavit and Real Estate Excise Tax Mobile Home Affidavit, and additional papers might be required to be filed for such forms.

But as of now, we are discussing the single location Real Estate Excise Tax Affidavit. We recommend using our modern form-building software to ensure the best result in form completion.

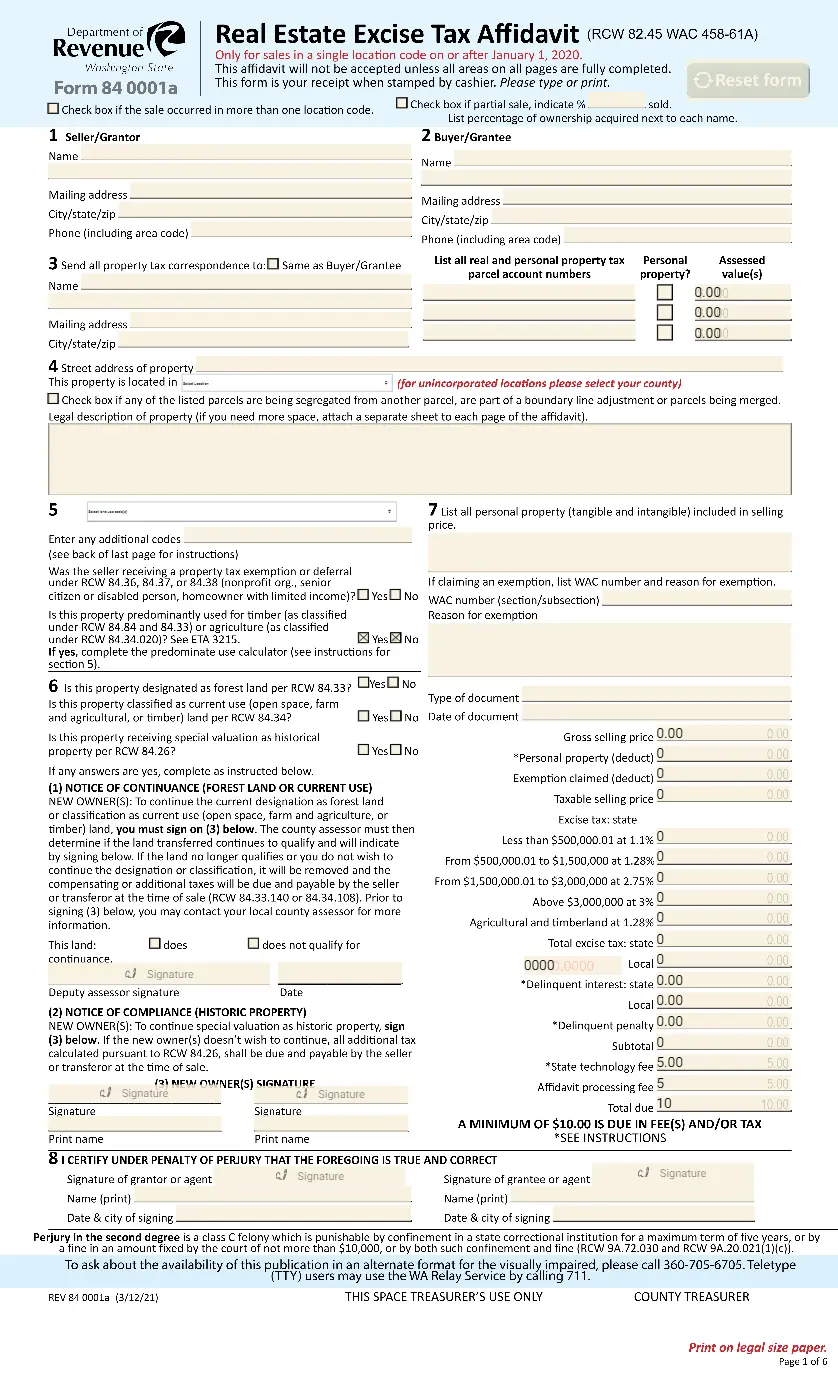

Section 1. Information About the Seller

Here, one will have to fill out the data about the seller: include full legal name, mailing address, and full address, as well as the cell phone number of the one who is releasing interest in the property.

Section 2. Information About the Buyer

In this subsection, data about the buyer has to be depicted: list the full legal name, mailing address, full address, and phone number.

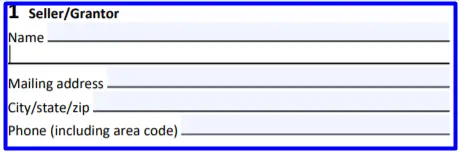

Section 3. New Taxpayer Data

In this part, you will have to fill out the information on the taxpayer: full legal name, mailing address, and regular address. Then, you will have to list all real and personal property tax parcel account numbers, they should contain 11 digits. Indicate if it is personal property or not, and then type in the estimated value of the property.

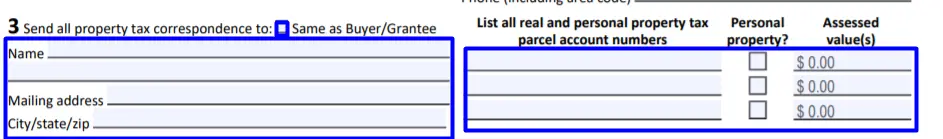

Section 4. Description of the Property

Fill out the address of the property and its location and include the legal description of the property.

Section 5. Enter the Land Use Code For Property

The codes themselves can be found on the official instructions page. Then, tick the appropriate boxes below:

- Tick ‘Yes’ in case the seller was receiving a property tax exemption or deferral under RCW 84.36, 84.37, or 84.38);

- Tick ‘Yes’ in case the land is originally used for timber or agriculture. If the sale includes many properties with various land use codes, one should complete another worksheet.

Section 6. Special Use of Land

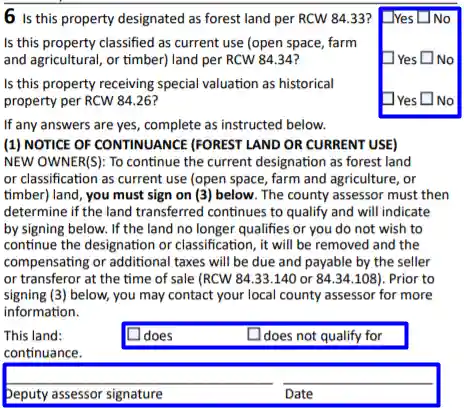

Here one will have to tick ‘Yes’ or ‘No’ in several subquestions. Tick ‘Yes’ in case the property is in any specific use classification, for example, agricultural use, farm, historic property, or timber.

If you chose the ‘Yes’ option for any of the questions listed, make sure to see the instructions below and complete an additional segment connected with specific land use. Do not forget to put the legal names and signatures of the new owners in case you chose to fill out this section.

Section 7. Personal Property Description

In this part, all information concerning the personal property will be depicted:

- Write out the information about personal property included in the selling price of the real property. In case the deal involves some kind of personal property such as furniture, for example, briefly describe those items in this subsection;

- If you are claiming for a tax exemption, write out the WAC section number and explain why you need to get an exemption;

- Write out the type of document (the title of the deed being used to transfer the ownership) and put the date of the document in an appropriate format;

- Enter the gross selling price of the property: a fair market value of the property;

- For the next line, one will have to deduct the amount of personal property included in the selling price, assuming there is any;

- Just as in the line above, deduct the amount of tax exemption claimed, in case there is any;

- Fill out the Taxable Selling Price. This field will be filled out automatically, taking into account the selling price and any amount for personal property and exemption claimed;

- The State Excise Tax will as well be automatically calculated for you;

- Indicate the delinquent Interest and Penalty. This is necessary if the registered document is more than 30 days old. One will have to reach the Treasurer’s office to find out the correct amount to enter here, if applicable; leave the field blank otherwise;

- Fill out the Total Due section: it will also be calculated automatically.

Section 8. Signatures

Both the buyer and the seller will have to sign the paper. Also, make sure to indicate the full legal names of the seller and the buyer, the current date, and the city where the document is signed.