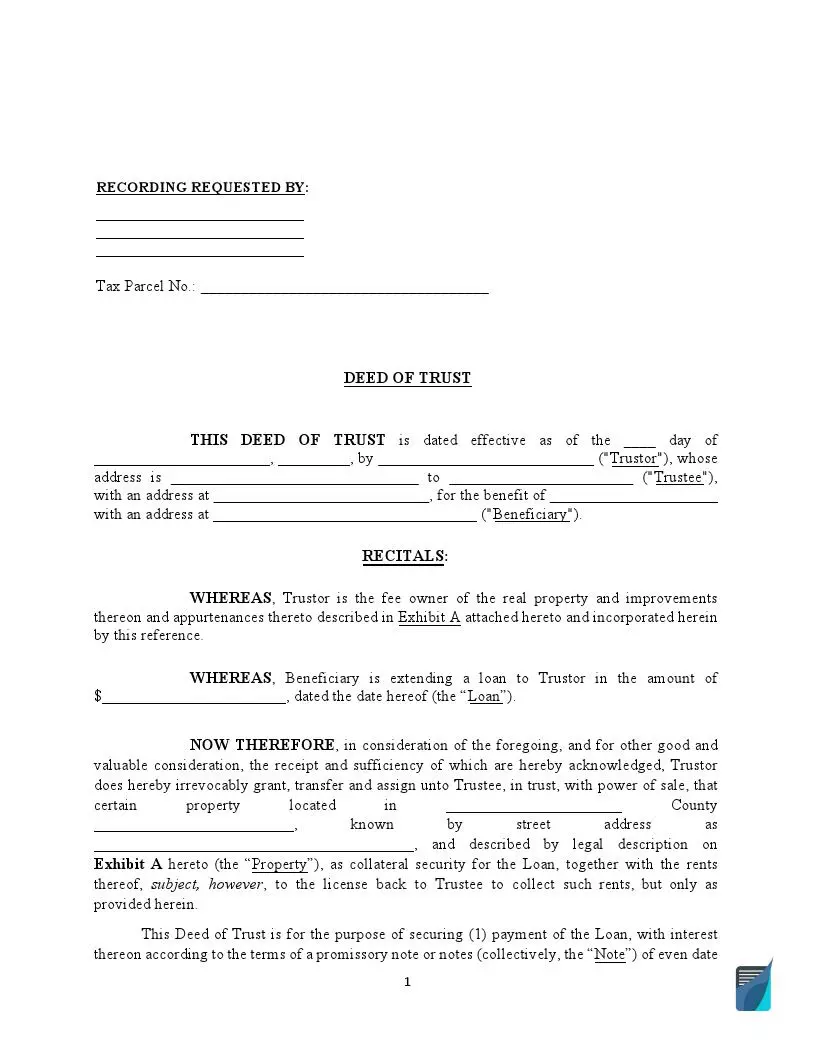

Texas Trust Deed Form

Trust covenants involve three parties—the borrower, the lender, the trustee—and establish financial responsibility for real property and lent of monetary funds. The focal aspect of a Texas trust deed is to ensure the borrower delivers their obligations and refunds the lender for financial assistance in acquiring premises.

As the borrower offers legal title to their sponsor, the covenant also guarantees that the lender will not abuse the trust by selling the estate illegally. Therefore, the trustee is involved: they become the assignor and interim titleholder-in-trust on behalf of the lender. To learn more about deed forms, check our full article: https://formspal.com/deed-forms/.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Trust Deed Laws and Requirements in Texas

Laws

Texas trust covenants are regulated by Title 2, Chapter 5 of the Texas Property Code and should include the below-listed aspects:

- The borrower’s, the lender’s, and the trustee’s names, addresses, and business details

- Amount lent, interest rate, and date due

- Estate legal description

- Additional terms that define the agreement

- Acknowledgment by all parties

Signing Requirements

Texas trust covenants must contain legal names and signatures of the three parties: the borrower, the lender, and the trustee. If any signatory has a legal representative acting on their behalf, submit the representative’s authorization.

Under Section 11.002 (c) of the Texas Property Code, the trust covenant must be certified in the presence of a notary public.

Filing Requirements

Once the paperwork is verified, the preparer should record the free fillable deed of trust form at the local Register of Deeds in the County Clerk’s Office. Use the district department where the real estate is situated.

How to Fill Out and File a Trust Deed in Texas

We encourage you to use our latest online tools to generate and complete the needed Texas trust covenant template. Follow the below-listed instructions and prepare the paperwork effortlessly.

1. Specify the Jurisdiction

Enter the state name at the top of page one.

2. Enter the Date

Specify the calendar date the specific trust covenant is created on.

3. Identify the Lenders

In this section, the preparer should define the individuals or entities they borrowed money from. Be sure to include the following:

- Person’s name or the entity’s business name

- Living address or the organization’s business address, including the state

The preparer can enter up to three sources of investment.

4. Introduce the Borrower(s)

Here, the preparer needs to enter all persons who can be collectively indicated as “the borrower.” Include this info:

- Borrower’s legal or business name (if an entity)

- Living (business) address, including the state

5. Specify the Co-Signers (If Applicable)

Fill out this unit only if there are persons to enter the deed on the borrower’s behalf. The borrower and the co-signer are collectively identified as “the Trustor.”

6. Identify the Trustee

Enter the trustee’s data in a similar way to the lender and the borrower sections.

7. Specify the Loan

Further on, the preparer needs to enter the loan details. You are encouraged to include the following:

- Amount in US dollars

- Interest rate

- Loan proof type (select and check the applicable box)

- The date the funds were lent

8. Define the Guarantee

Next, the preparer should describe the real property guarantee should the borrower default to pay the liability. Enter the estate’s description and address.

9. Read and Acknowledge the Terms

The terms of the covenant include 36 Units, but only some contain statements to select from. Follow the bulleted list to learn what statements should be cleared:

- Unit 3—Prepayments. Select one of the two options to define the pre-payment strategy.

- Unit 6—The Borrower’s Guarantees. Choose a suitable alternative following the section’s guidelines.

- Unit 11 specifies the mortgage guarantees; select one of the options described.

- Unit 12 defines the occupancy strategy and whether the borrower can use the premises as their permanent residency.

- Unit 18 states if the borrower trades the premises without a written allowance from the lender. The lender can demand compensation.

- Unit 20 defines the default policy measures. This section determines default events issues and policy.

- Unit 21—Acceleration notice. Here, the preparer should enter the number of days the borrower gets to settle arrears after the acceleration notice is delivered.

- In unit 22, the preparer must indicate the number of days they give the borrower before selling the premises if the debt is not paid.

- Unit 26 defines the obligation type: choose joint or several liabilities.

- Unit 30 defines the state of Jurisdiction.

- Unit 36 allows the parties to add other terms and amendments.

10. Collect the Parties’ Acknowledgment

Next, all trust covenant parties must enter their legal names and signatures to verify the deed. Should any signatory have a legal representative authorizing the contract on their behalf, the corresponding details must be indicated.

11. Notarize the Trust Covenant

Under Texas laws, the trust covenant must be certified by a notary public. Sign the respected instrument in the presence of the notary public and indicate their jurisdiction, name, signature, date, and commission details.

12. Collect the Papers and Apply for Recording

Once all documents are ready and authorized, collect and file the set with the Register of Deeds in the County Clerk’s Office where the premises are situated.