A property damage incident report is a document used by individuals or businesses to report damage to property and initiate a claim for compensation through an insurance company or another entity responsible for the damage. This form is helpful in the claims process as it collects all the necessary details to assess the extent of damage and determine the appropriate compensation.

What Is Considered Property Damage?

Property damage is any physical harm or destruction to tangible property, affecting its value and use. This damage can stem from various sources, including accidents, natural disasters, or intentional acts. The types of property that can be subject to damage include, but are not limited to:

- Real estate, such as homes or commercial buildings.

- Personal property like vehicles, furniture, and electronics.

- Other tangible assets, such as machinery or artwork.

Property damage can manifest in several forms, from minor cosmetic issues to destruction. For example, a car might have a shattered windshield from a hailstorm, or a house could suffer structural failure due to an earthquake. Identifying property damage is important for handling claims and establishing responsibility in legal and insurance situations.

Why Use a Damage Report Template?

Using a damage report template provides substantial benefits to both entities and individuals. It ensures the efficient and precise recording of property damage incidents. Using a template guarantees that data collection for analysis, claims processing and legal proceedings is thorough and consistent. It simplifies the reporting procedure with a predefined format to expedite documentation and lower the chance of overlooking details.

Our property damage claim form template was created with user-friendliness in mind, so even those unfamiliar with the process can easily complete a report accurately. This strategy helps to standardize data, enabling organizations to examine trends, evaluate risks, and make better choices on preventive actions or insurance options.

Additionally, using a property incident report form helps adhere to legal and regulatory obligations. Detailed reports offer trustworthy proof of the occurrences and the level of harm in case of conflicts.

What Is Included in the Property Damage Report Template?

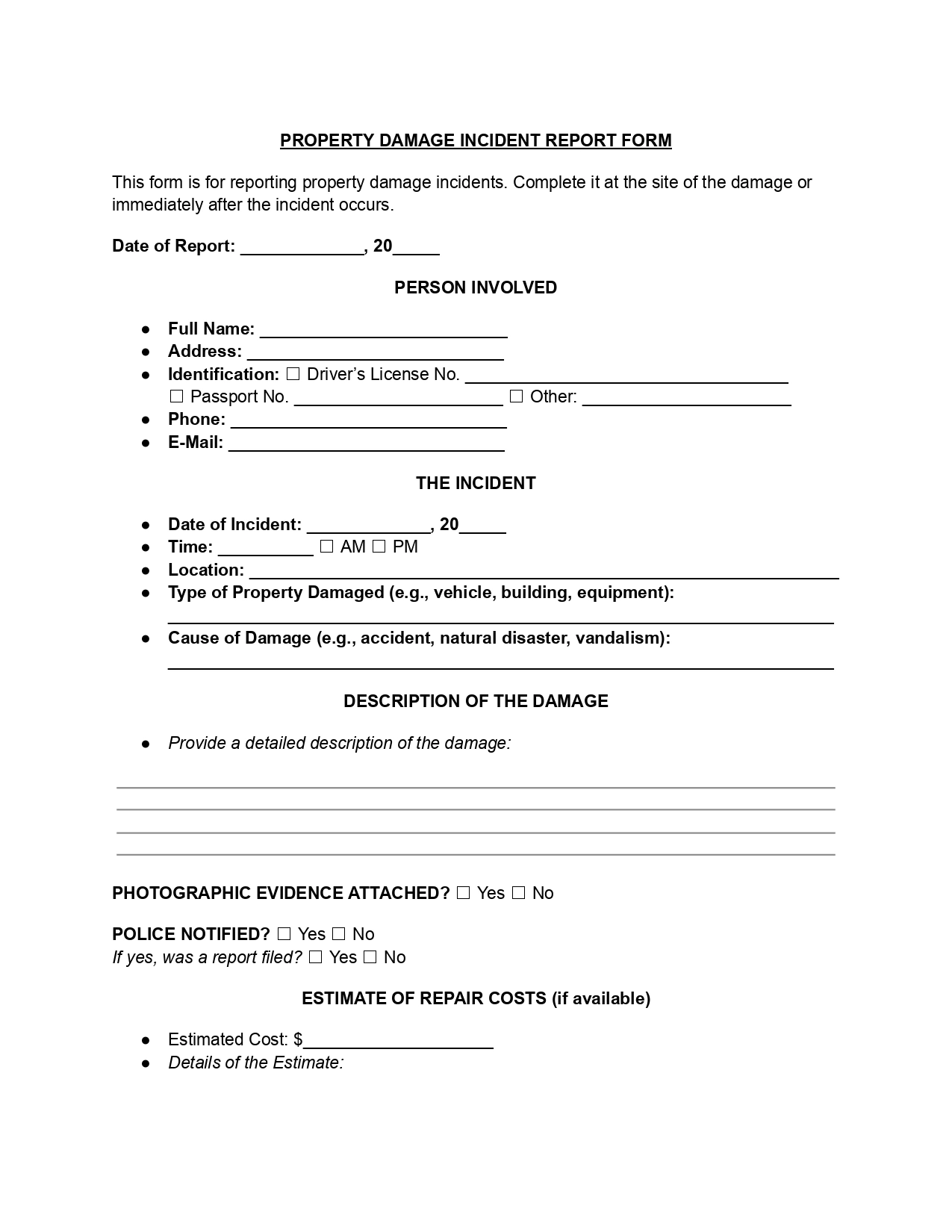

Here’s what typically goes into a property damage claim report form:

- Personal information. Name, contact details, and sometimes the policy number of the claimant.

- Incident details. Date, time, and location of the incident causing the property damage.

- Description of the damage. A detailed explanation of the damage incurred, including the type of property affected (e.g., building, vehicle, personal belongings).

- Estimate of repairs. Preliminary estimates of the repair costs from professionals, if available.

- Witness information. Details of any witnesses to the incident, if applicable.

Filing this form accurately can help ensure that the claim is processed efficiently and that the claimant receives the appropriate compensation for their losses. You can also add other relevant documents supporting the claim, such as police reports, fire department reports, or receipts for emergency repairs.

How to Fill Out Damage Report Form Template

When filling out the simple damage claim form template, it’s important to provide detailed and accurate information to facilitate processing your claim. Here is a step-by-step guide on how to complete this form.

1. Date of Report

Enter the current date when you are filling out the form.

2. Person Filing Report

Provide your full name, title, or role in the context of the incident, sign the form, and date your signature to verify the accuracy of the information provided.

3. The Incident

Detail the date and time of the incident, marking AM or PM appropriately. Specify the exact location of the incident and describe the type of property damaged (e.g., vehicle, building, equipment) and the cause of the damage (e.g., accident, natural disaster, vandalism).

4. Description of the Damage

Provide a comprehensive description of the property damage. Be as detailed as possible to ensure that the severity and extent of the damage are communicated.

5. Person(s) Involved

List all individuals involved in the incident. For each person, include their full name, address, type of identification (driver’s license number, passport number, or other), telephone number, and email address.

6. Photographic Evidence

Indicate whether photographic evidence of the damage is attached by checking “Yes” or “No.” Including photos can significantly aid in the processing of your report.

7. Estimate of Repair Costs

If available, provide an estimated cost of repairs and detail the basis of this estimate, such as quotes from repair services or assessments from insurance adjusters.

8. Witnesses

Note whether there were any witnesses to the incident. If yes, provide their names, phone numbers, and email addresses.

9. Police Notified

Indicate whether the police were notified and if a report was filed, which can be important in the context of insurance claims or legal action.

10. Insurance Information

If applicable, list your insurance provider’s name and policy number. This information is crucial for insurance claims.

11. Office Use Only

This section is typically filled out by the personnel receiving the report. It includes the name of the person who received the report, its date, and any follow-up actions taken.