Indemnification Agreement Template

An indemnification agreement also referred to as a hold harmless agreement (HHA), is a document that the indemnitor and indemnitee use to set forth the protection from unforeseen losses and damages that might occur in the future during their cooperation. By signing the document that has an indemnification clause, the indemnifier and indemnitee agree that an indemnitee is entitled to claim reimbursement if any damage or loss takes place.

If there is no indemnity agreement in place, an indemnitee might face legal action that arises from an unfortunate incident.

The main purpose of the agreement is to reduce to a certain extent the indemnitee’s liability for unexpected occurrences. The document often has a form of a clause in a contract but can sometimes act as a separate agreement as well.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Terms Used in an Indemnity Agreement

Every indemnification clause has the same terminology that might seem complicated in the beginning. Let’s break them down.

- Indemnitor (also called Indemnifier) – a party in an indemnity agreement who promises to compensate the other party for losses or damages that might take place during the activity specified in the agreement

- Indemnitee – a party in an indemnity agreement who gets protection from potential losses or damages

- Indemnity – a contractual obligation of the indemnifying party to pay for any damage or loss or liability another party is subject to

Types of Indemnity Agreements

Indemnity agreements can be one of two types based on how many parties take on financial liability arising from the activity mentioned in the contract.

- Mutual indemnity agreement – both indemnitee and indemnifier agree to hold harmless and indemnify the other party from any and all claims, liabilities, and damages

- Unilateral – only one party in the agreement is held harmless

There are also three forms of indemnity agreements based on the breadth and scope of liabilities shifted to a party.

Broad form

If the indemnity has a broad form, the fault of the indemnitee doesn’t play a role, as the indemnifier takes the entire responsibility for any damage or losses arising from the indemnity agreement. The indemnitee might be solely at fault but the indemnitor is the only one who bears the risks of loss involved in the activity specified in the contract.

The important thing to mention is that in the construction industry, it is easy for an indemnitee to abuse the right of indemnification as if the entire liability is solely on the subcontractor and a contractor or owner is not liable for their own actions, the indemnitee might use less care to avoid injury or loss.

This is why a lot of states (to date, 43) enacted anti-indemnity laws, namely, laws prohibiting a construction contract that requires a subcontractor to indemnify another party for their negligence. However, some states limit the application of these laws, for example, only to public projects.

Intermediate form

This form is the most used in the construction industry as it offers some flexibility for the indemnitor. They are entirely responsible for any injury, loss, or damage if both parties are at fault, even if the indemnitee is 99% at fault. But if there is the sole negligence of the indemnitee, the Indemnitor and indemnitee share the responsibility.

Limited form

Under the limited form of indemnity, the indemnitor is held liable only to the extent of their fault. It means that if there is 70% percent of their fault, they will be responsible for 70% of damages or losses arising from the contract, but no more than that.

Who Can Benefit from an Indemnity Agreement?

It is common to use indemnification in different types of work relations, for example:

- relations between contractors and subcontractors (most commonly in the construction industry)

- relations between employers and employees

- B2C types of businesses (liability insurance companies, rental car services, etc.)

- businesses involved in physical or high-risk activities (companies offering jeep safari, skydiving, shark diving, white water rafting services, etc.)

- businesses dealing with animals (pet kennels)

Indemnity Agreement and Similar Agreements

It is common to hear that indemnity agreement is used interchangeably with hold harmless agreement or waiver of liability. Is there any difference between them? Let’s figure it out.

Indemnity agreement and HHA

These two terms are often used to depict the same document that mitigates the financial liability of the indemnitee in the agreement. But some law experts think that there is a slight difference between those two. According to them, an HHA covers both liability and losses, while an indemnity agreement concentrates on losses more.

In any case, the documents have the same purpose – to shift the burden of liability of possible losses or damages to the indemnifier during involvement in the activity mentioned in the contract.

Indemnity agreement and waiver of liability

There is no huge difference between those two documents as well. The only distinguishing feature is that in an indemnity agreement, an indemnitee is released from liability, while in a waiver of liability, the party is giving up their right. The most illustrative example is the relations between a debtor and a creditor. The latter can decide to give up their legal right to collect a late fee if the payment is overdue.

Indemnity agreement and no-fault agreement

A no-fault agreement (or release of liability) is essentially a waiver of a legal claim that doesn’t let one party proceed with legal action. In exchange for that, they get an agreed amount of compensation. This way, the parties make sure the dispute is settled out of court.

The difference between such an agreement and an indemnity agreement is that the first can be used to waive a claim for loss or damage that already took place, while the second addresses only those that might happen in the future. However, a no-fault agreement can be used to waive future claims as well.

Indemnity agreement and insurance policy

They often go separately in contracts as they differ in coverage and scope of liability. They are also distinct due to the fact that in a policy agreement, the insurance company gets a specific premium from the policyholder for taking on the risk specified in the document.

Indemnity agreements imply transferring the risk through a non-insurance agreement without paying a premium for that. The important thing is that financial responsibility is transferred through the document, but the indemnitee still remains liable.

How to Make an Indemnity Agreement?

There is no specific form of an indemnity agreement required by federal or state laws. In addition, such agreements are tailored on a case by case basis, so one of the most important tasks is to choose proper legalese to cover the desired protections.

One of the most common situations an indemnity agreement is needed is when an individual orders renovating services for their home. In such a case, creating an indemnity agreement between a contractor (indemnifier) and a homeowner (indemnitee) will help avoid claims if something goes wrong during the construction project.

If you are the one who is ordering remodeling services, here are several steps you should take.

Chose the type of indemnity clause

If you choose the broad form of indemnity, you as an indemnitee will get indemnification from any loss or liability, of any nature whatsoever in any way connected with the contractor’s performance of their services, including loss or liability caused by your active negligence.

If you chose the intermediate indemnification form, the indemnitor, that is, the contractor indemnifies you for your negligence except when it was entirely caused by you. They are considered liable if there is even a small amount of their fault, but if you as an indemnitee are solely liable, you cannot be held harmless.

If your contract agreement includes a limited provision, you won’t be indemnified for your sole negligence or willful conduct.

As an indemnitee, you will most likely want to shift the entire liability to the contractor. An optimal choice for an indemnitor is to reduce their contractual indemnity and not bear responsibility for attorney fees and damages for which they are not liable. Try to choose the compromise solution for both indemnifier and indemnitee.

Check legal requirements

As we have mentioned before, a lot of states have anti-indemnity laws that don’t allow an indemnitee to shift the entire responsibility to an indemnifier. That’s why before including the provision in your renovation contract, make sure you can use an identification clause.

For instance, if you are renovating a home in California, you as an indemnitee cannot get indemnification against damages that result from your sole negligent or willful acts. The contract that will comprise such a clause will be considered void.

If you want to indemnify yourself from liability if the contractor hurts themselves, you should draft a proper indemnification clause that would correspond to the laws of your state.

Draft an indemnity document (or add a respective clause to your contract)

You can use a form of indemnity based on the comparative fault provided by the American Institute of Architects Form A-201 as the reference.

But to make sure your indemnity agreement is legally binding and provides the desired protection to you as an indemnitee, use our online document builder. It will help you get a proper indemnity agreement in less than 10 minutes, and the ready form is easy to download and print.

Revise and sign the document

Before signing the document, it would be wise to give it to an attorney for revision. Then, both the indemnitee and indemnitor should sign the document to make it official.

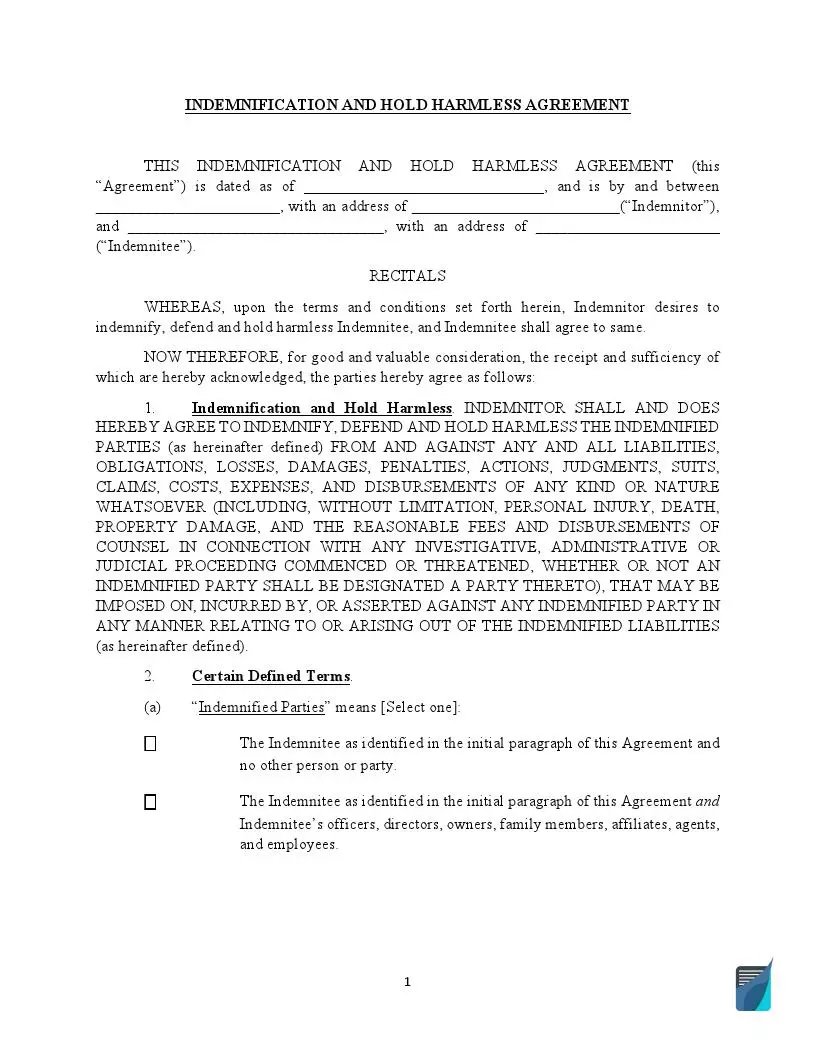

How to Fill Out an Indemnification Agreement

Step 1

At the beginning of the document, identify all parties subject to this agreement. Include the indemnitee’s and indemnitor’s names and addresses and the effective date of the document. Note that if the indemnitee and indemnitor want to involve their representatives, those people should write their names and sign the document on their behalf.

Step 2

It is wise to make a section with some crucial definitions in the agreement as it helps both indemnitee and indemnifier speak the same language and understand the terms they use in the same way.

Step 3

This section should include the purpose of the document – what indemnification the indemnitee gets, to whom it can be applied (for example, the document can address not just the indemnitee if it is an association, but all their directors, employees, members, officers, and agents).

If the indemnity agreement is mutual, both the indemnitee and indemnifier hold harmless each other which should be clearly stated in this section.

Another important thing is to add a thorough description of the activity or activities sought to be indemnified with as many details as possible.

Also, make sure to mention the cases when the indemnitee cannot be held harmless. For instance, the clause might cover the claims caused by negligence, acts in bad faith, deliberate dishonesty of the indemnitee, etc.

Step 4

Add the provision about severability. It should say that if any provision of the document is invalid or unenforceable, the entire agreement should not be considered void due to that.

Step 5

Indicate how long the indemnity agreement is in force and what events might lead to its termination.

Step 6

The next provision is called Applicable law. Here, choose the state which laws will apply to your document.

Step 7

The last thing you should do is sign the document. Signatures of both the indemnitor and indemnitee are needed. The signature might be electronic, which will simplify the signing process for both indemnifier and indemnitee.