IRS Form 8233 is a document used by nonresident aliens to claim exemption from withholding on income from U.S. sources that is not effectively connected with the conduct of a trade or business in the United States. The form is specifically designed for individuals receiving compensation for personal services performed in the U.S., such as wages, salaries, or honoraria.

By submitting this form, eligible nonresident aliens can certify that they qualify for tax treaty benefits. These benefits may reduce or eliminate U.S. tax withholding from their income based on the terms of a tax treaty between the United States and their country of residence.

Other IRS Forms

Charities and nonprofits are obliged to report certain information to the IRS. Learn what other IRS forms might be necessary for your organization.

How to Fill Out Form 8233

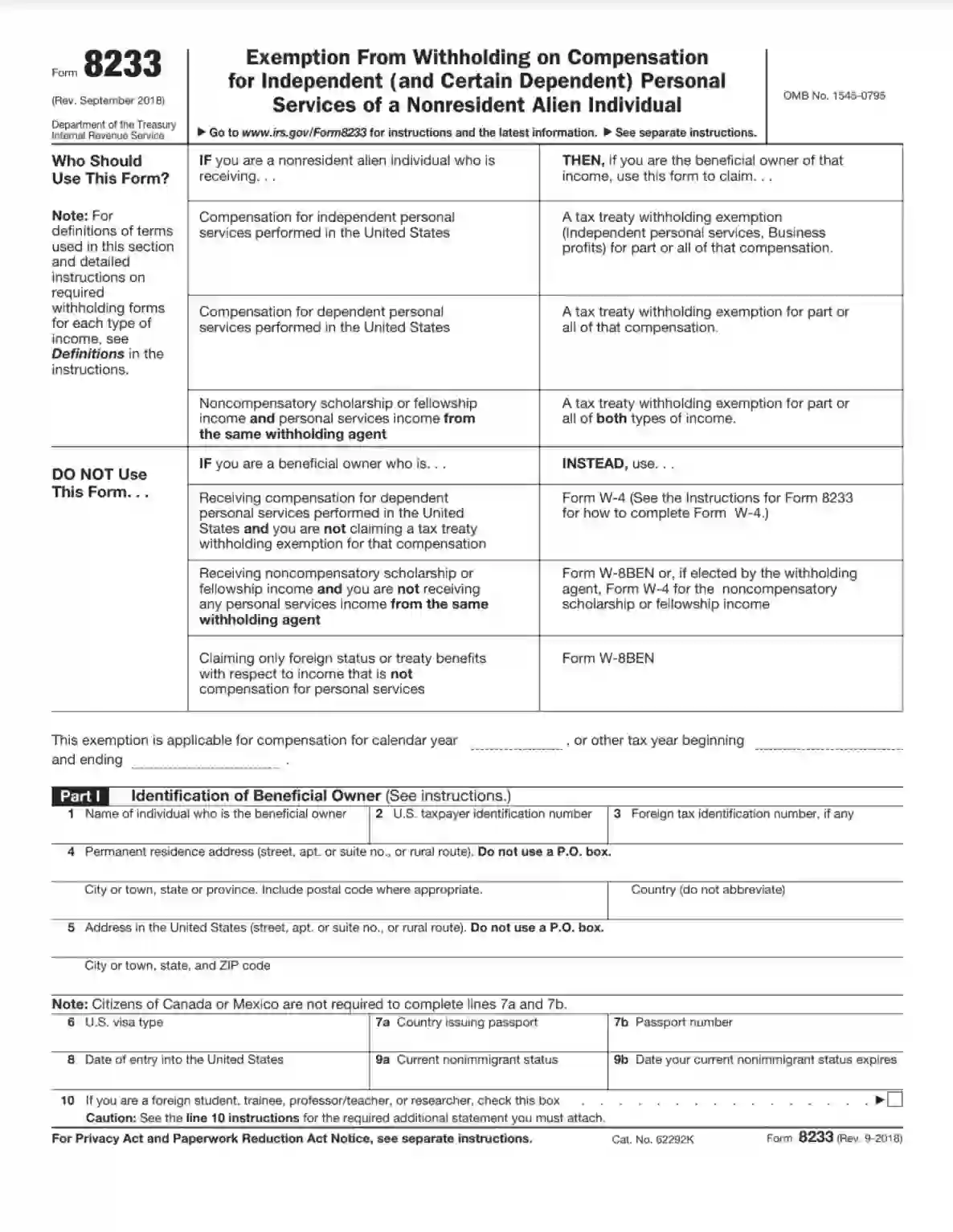

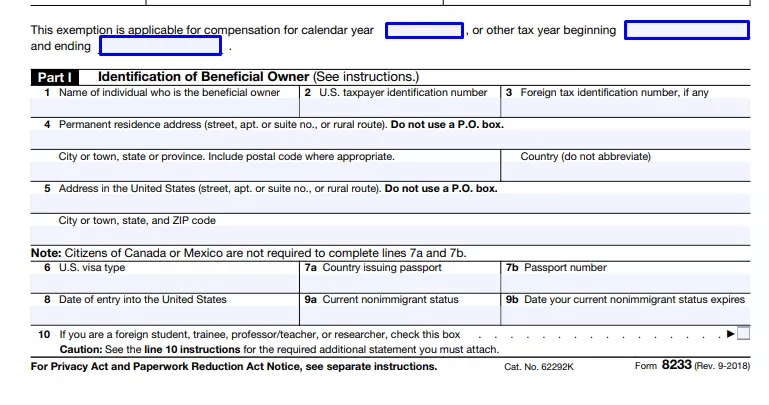

1. Identify the tax year

First of all, there are three empty fields you need to enter to specify the year related to your tax compensation application. Complete all of them according to the given instructions.

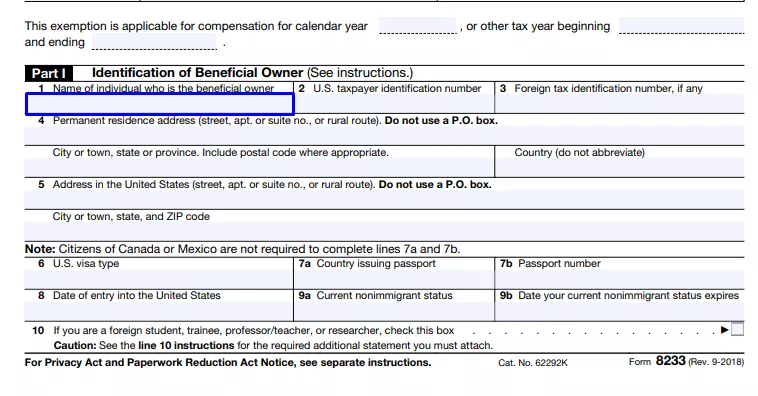

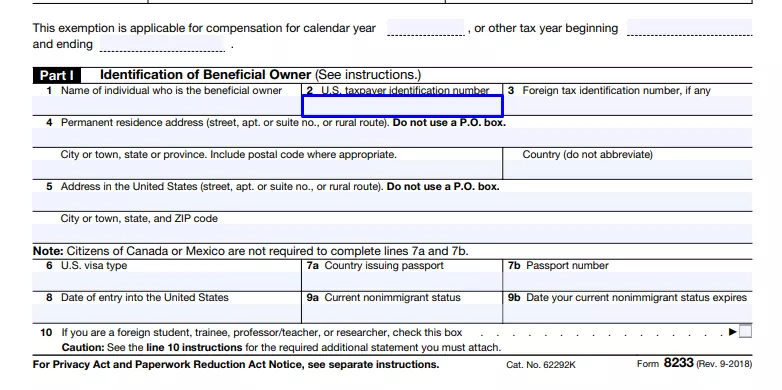

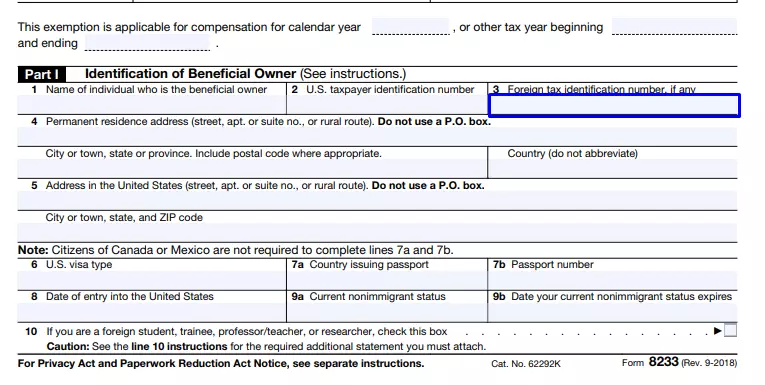

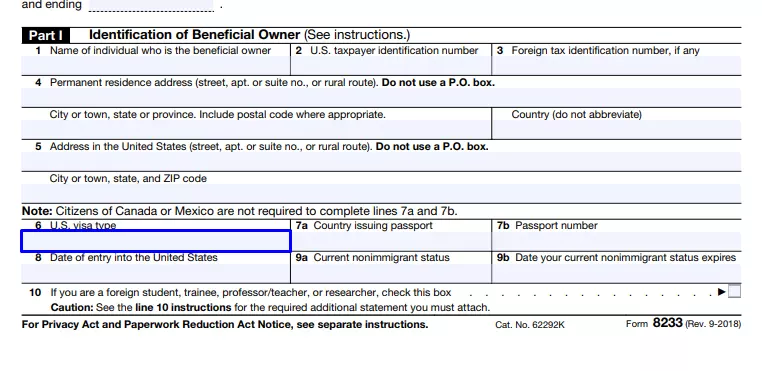

2. Enter the beneficial owner’s full name and identification numbers

Write the name in the first field and ensure you enter it correctly.

In the second line, you should write your SSN, or if you don’t have any, you should apply for ITIN in advance and to enter it in this field.

Fill out your foreign tax identification number if you have any in the third line as it is required. For instance, you can write here your Social Insurance Number if the country of your residence has issued you a tax identification number.

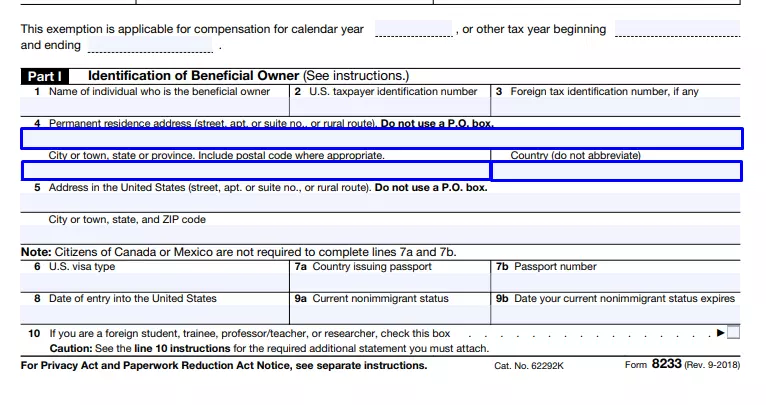

3. Enter your permanent residence address

Fill out the full address of the country where you claim to be a resident, including the name of the country, city, street, and postal code. If you don’t have any residency right now, your current address is what you should write in this field.

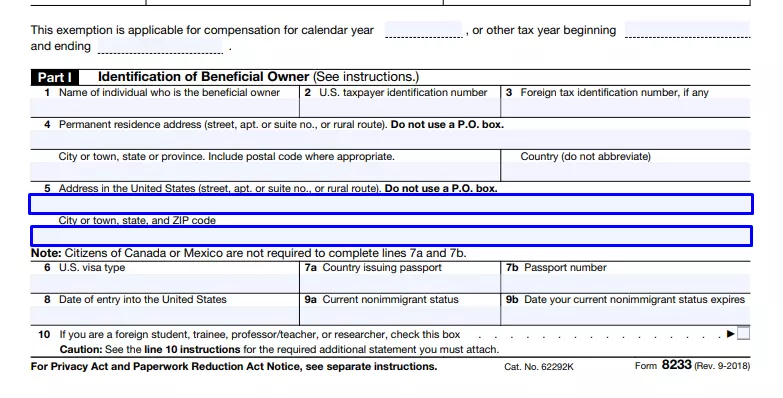

In the fifth line, you are required to enter your address in the US. Fill out the name of the state, city, street, and zip code here. Do not use any abbreviations for identifying the country.

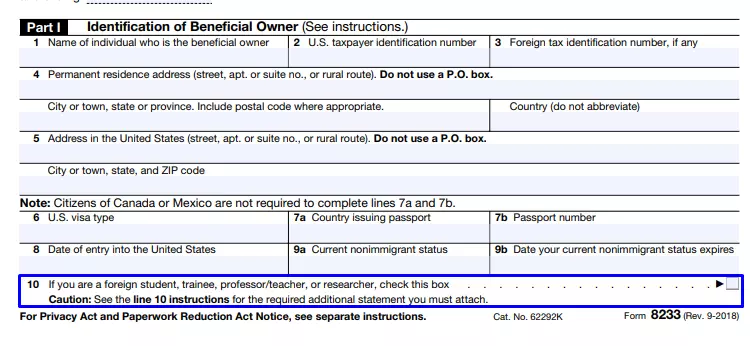

4. Complete the other fields in the first section

Filling out the sixth line, you need to specify the type of your visa in the US. Depending on the activity you perform on the territory of the US.

In the 7a and 7b fields, enter the country issuing passport and its number. Note that the residents of Mexico and Canada do not need to fill out these lines.

Enter the data about your current nonimmigrant status, including the dates of your entry into the US and of your nonimmigrant status expiration.

And finally, check the box in line number ten if you meet the specified requirements. In particular, you need to mark it if you are an international student, trainee, professor/teacher, or researcher.

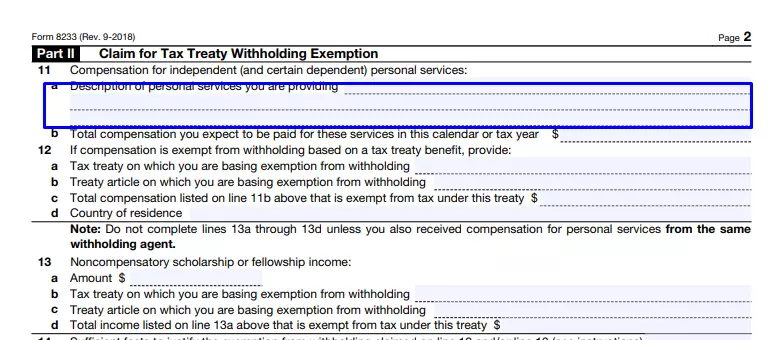

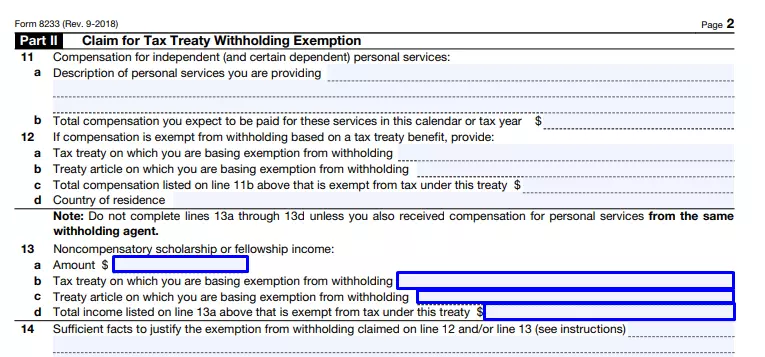

5. Specify the services you perform and the expected compensation

Filling a field identified as 11a, you need to describe what personal services you provide. For example, foreign teachers and professors can identify something like “teaching at the Harvard University,” and students can write about their part-time work such as library assistance or work at the restaurant.

Enter the total amount of compensation you expect to receive from the withholding agent. If you don’t know the specific figure, then enter an approximate one.

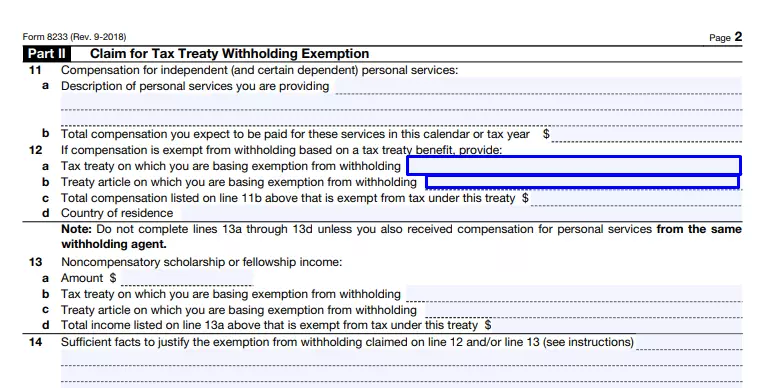

6. Specify your rights for exemption

Enter the specific document and the specific article on which you are basing your claim for exemption from retention.

Enter the amount of total compensation and identify the country of residence.

7. Enter the data about the non-compensatory scholarship or fellowship income

Complete the required information in fields 13a – 13d regarding the amount of scholarship or fellowship income, tax treaty, and articles from it that confirms your right for exemption from withholding and expects total income from tax.

8. Confirm your right for the exemption from withholding in details

Fill out the detailed and reasoned facts why you should receive the exemption from withholding. Ensure that the provided information is enough for allowing the IRS to determine the tax treaty benefit you are asking for.

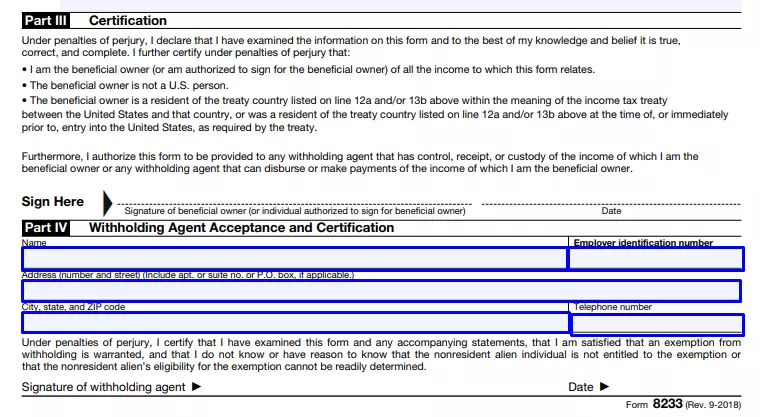

Put your signature and date of applying at the end of the section. Check all data one more time to avoid accidental mistakes.

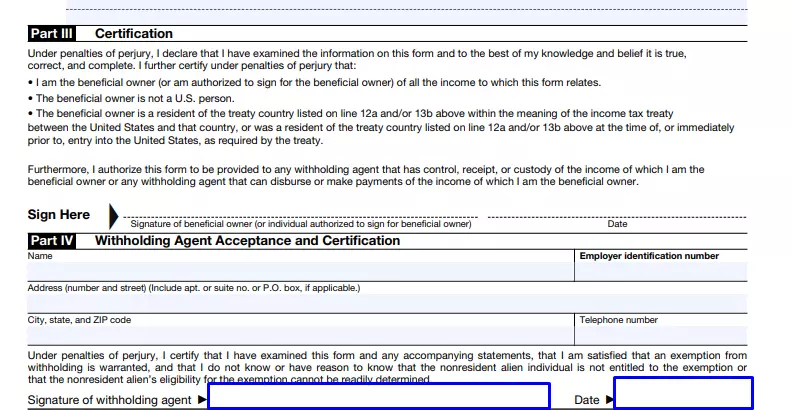

9. Complete the section devoted to responsibilities of Withholding Agent

Check Form 8233 filled out by the nonresident alien, and if you are satisfied with provided data, you can complete and sign the certification in Part IV. Enter your name, EIN, address, and phone number in the appropriate empty fields.

And finally, put your signature at the bottom of the Form as a withholding agent, and do not forget to indicate the date of filling in.