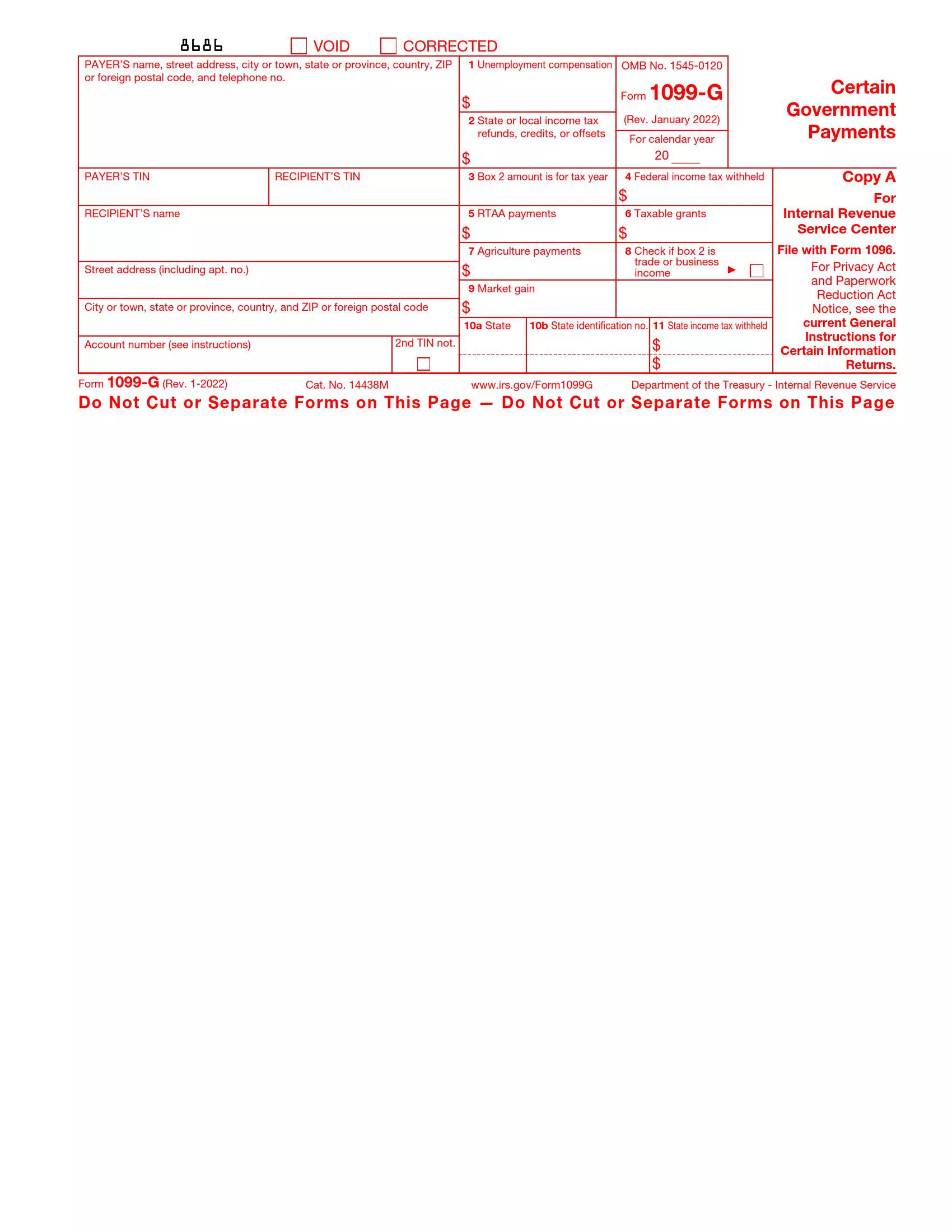

Form 1099-G is a document issued by federal, state, or local governments to report certain payments they’ve made during the tax year. Commonly, this form is used to report unemployment compensation, state and local income tax refunds, credits or offsets, and payments from qualified state tuition programs. The form helps the Internal Revenue Service (IRS) track these payments, which may be taxable under certain circumstances, ensuring taxpayers report these amounts on their annual tax returns.

The form is critical for individuals as it outlines the taxable income they have received from government sources other than wages. For instance, if someone has received a refund of state income taxes they overpaid in the previous year, Form 1099-G will show this amount, which might need to be reported as income if the taxpayer itemized deductions in the prior year. This helps maintain accurate income records and assists in correctly calculating tax liability, facilitating compliance with IRS requirements, and aiding in efficient tax return processing.

Other IRS Forms for Government

IRS forms serve various purposes and the needs of different categories of taxpayers. If you have not yet found the form that fits your particular needs, look through some other forms where you might find the right one.

How to Read the Form

Although this paper is not filled out by you, you must understand this document to check it and use it in the future to fill out the rest of the papers.

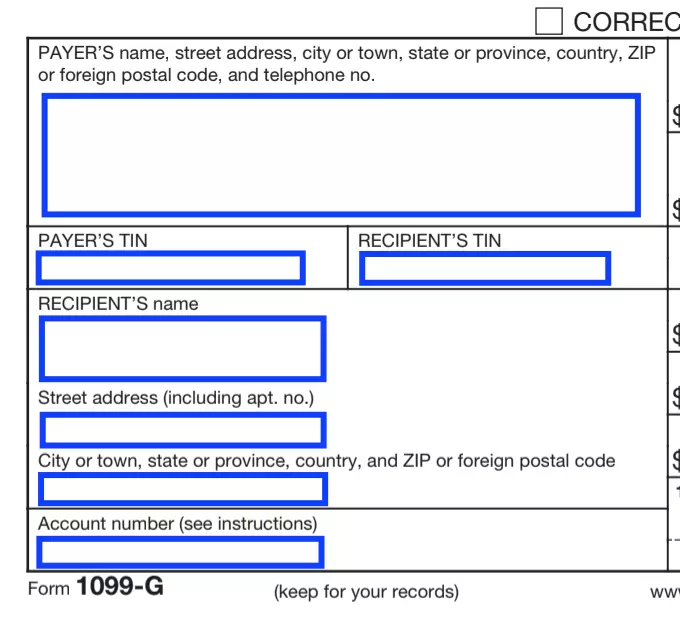

Check the left side

On the left side of the document, you will find your details and the department that made the payment to you. Please note that you are the recipient in this case, and the government department is the payer. Check carefully everything indicated for authenticity.

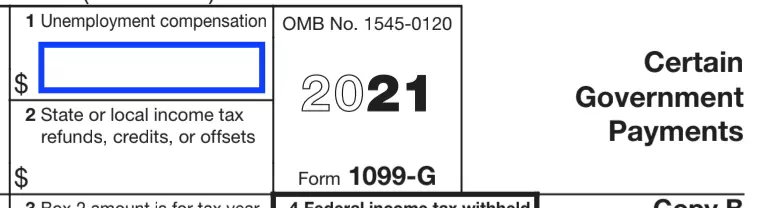

See Box 1

Here is the sum of unemployment benefits you got. Sometimes the recipient receives several 1099-Gs, in which case, when filling out the tax return, you need to indicate the amount received from the addition of all the indicators specified in Box-1 in all forms.

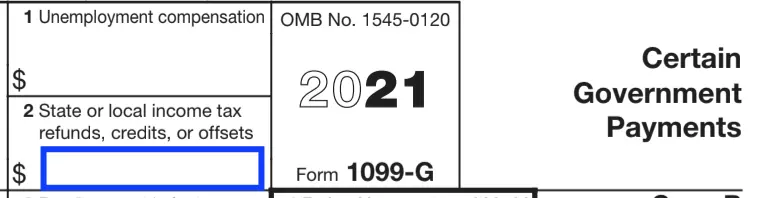

Check Box 2

The second field will show the sum of refunds, credits, or offsets of state or local income tax you received (if any).

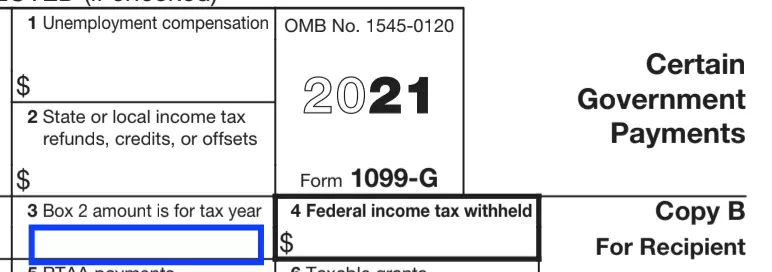

Check the year

Box 3 is sometimes left blank if numbers are shown for the current tax year.

Read boxes 4-7 and 9

The following lines show other types of payments you may have obtained from the government, including:

- Backup withholding

- Reemployment trade adjustment assistance pays

- Taxable grants

- Amounts from the Department of Agriculture

- Farmers market gain

See ox 8

If this field is checked, then the sum pointed in paragraph 2 is linked to an income tax.

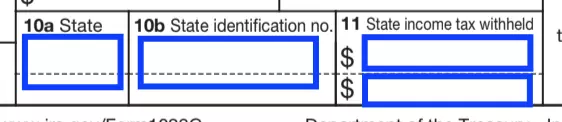

Check Boxes 10-11

Boxes 10a and 10b show your state abbreviation and its identification number.

In point 11, the sum of withheld state income tax is inserted.