nebraska individual estimated income tax can be filled out online without difficulty. Simply make use of FormsPal PDF editor to complete the task right away. In order to make our tool better and more convenient to utilize, we constantly develop new features, with our users' feedback in mind. If you are seeking to begin, this is what you will need to do:

Step 1: Hit the orange "Get Form" button above. It will open up our tool so that you can start filling in your form.

Step 2: With this advanced PDF editing tool, it is easy to do more than simply fill out forms. Edit away and make your docs look perfect with custom text added in, or adjust the original content to perfection - all that comes along with an ability to insert your personal graphics and sign it off.

Completing this form will require thoroughness. Ensure all necessary blank fields are filled out properly.

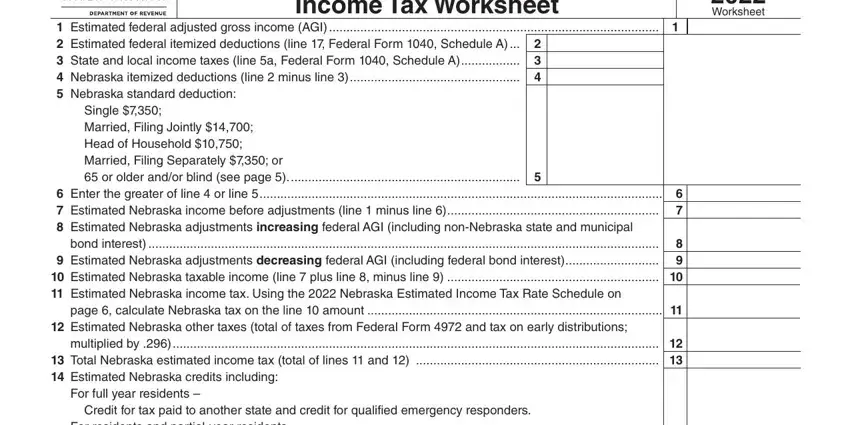

1. Fill out the nebraska individual estimated income tax with a group of necessary blanks. Collect all the required information and make certain there is nothing neglected!

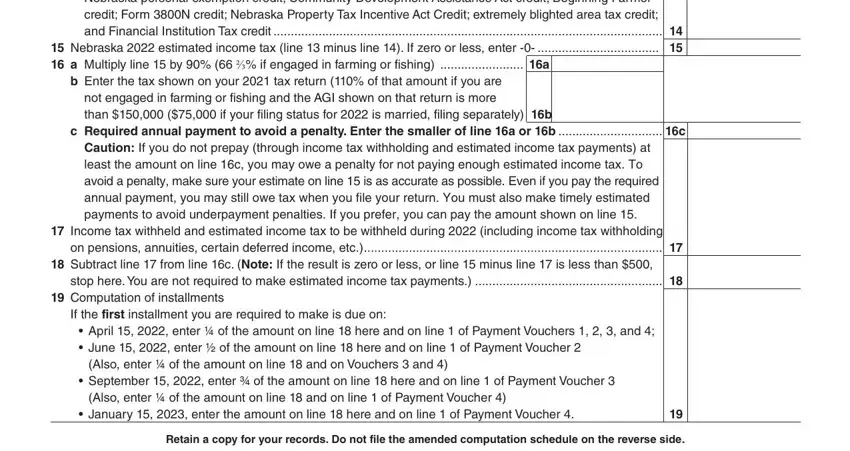

2. Soon after filling in the last section, go to the subsequent stage and complete the essential particulars in these fields - Estimated federal adjusted gross, b Enter the tax shown on your tax, If the first installment you are, January enter the amount on, on pensions annuities certain, stop here You are not required to, September enter of the amount, Retain a copy for your records Do, and than if your filing status for .

Always be very careful when completing January enter the amount on and September enter of the amount, because this is where most users make a few mistakes.

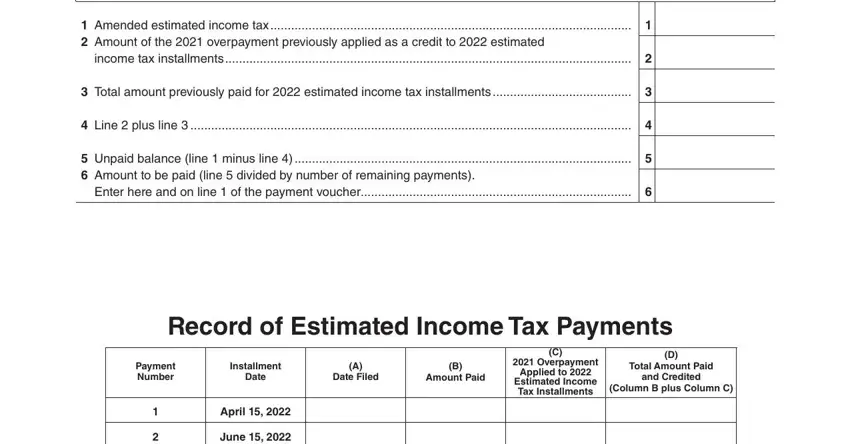

3. The next part will be straightforward - fill out all of the fields in Use this schedule if your, Amended estimated income tax , income tax installments , Total amount previously paid for , Line plus line , Unpaid balance line minus line , Enter here and on line of the, Record of Estimated Income Tax, Payment Number, Installment, Date, Date Filed, Amount Paid, Overpayment, and Applied to to conclude this segment.

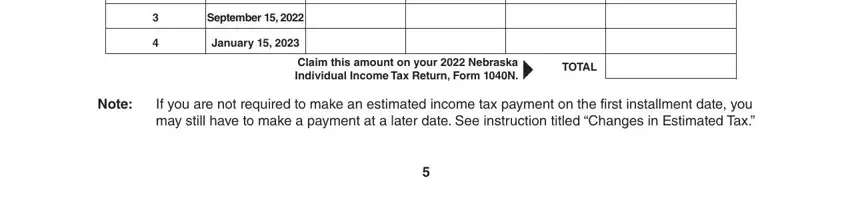

4. To go forward, your next stage will require typing in a few form blanks. Included in these are September , January , Claim this amount on your , TOTAL, Note, and If you are not required to make an, which are vital to going forward with this particular PDF.

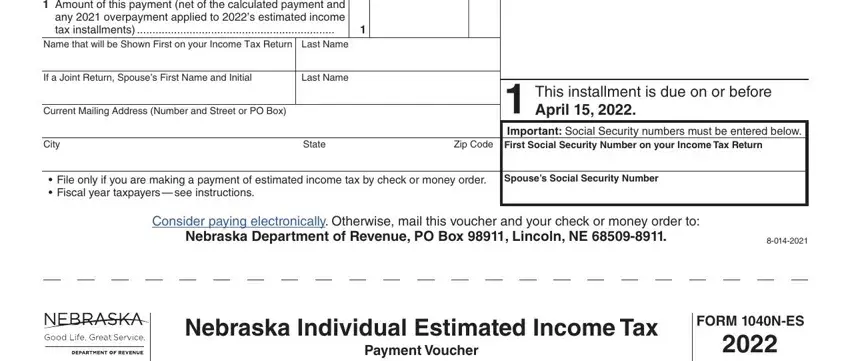

5. As a final point, this final segment is precisely what you need to wrap up before finalizing the form. The fields at this point include the next: Amount of this payment net of the, If a Joint Return Spouses First, Last Name, Current Mailing Address Number and, This installment is due on or, Important Social Security numbers, City, State, Zip Code, First Social Security Number on, File only if you are making a, Spouses Social Security Number, Consider paying electronically, Nebraska Department of Revenue PO, and Nebraska Individual Estimated.

Step 3: Right after you've reviewed the details provided, click on "Done" to conclude your form. Make a free trial option with us and obtain immediate access to nebraska individual estimated income tax - download or edit in your FormsPal cabinet. When you use FormsPal, you'll be able to fill out documents without stressing about personal data incidents or entries being shared. Our protected software makes sure that your private data is kept safely.