You could complete 1099 how to oid report effortlessly in our PDFinity® online tool. FormsPal team is dedicated to making sure you have the ideal experience with our editor by constantly adding new functions and improvements. Our tool has become much more user-friendly as the result of the most recent updates! Currently, working with PDF documents is simpler and faster than ever. To get the ball rolling, consider these easy steps:

Step 1: Click the "Get Form" button at the top of this webpage to access our PDF tool.

Step 2: The tool gives you the opportunity to customize your PDF in many different ways. Transform it by writing your own text, correct what's already in the file, and add a signature - all readily available!

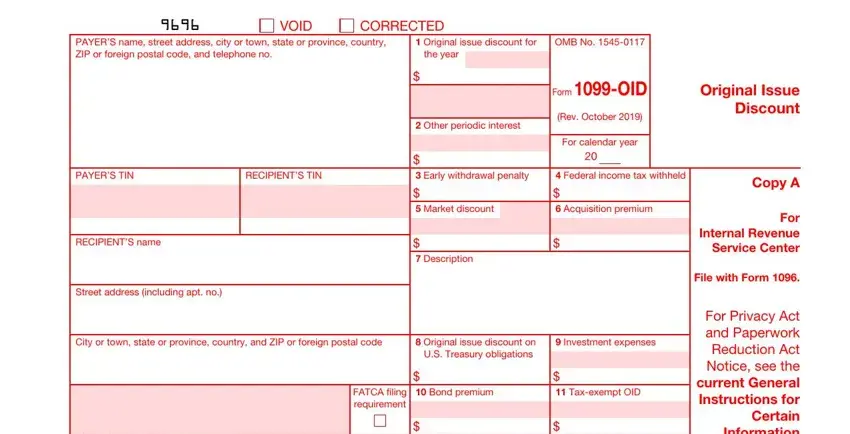

This PDF doc will need specific details; in order to guarantee accuracy, please be sure to take heed of the tips listed below:

1. When filling in the 1099 how to oid report, be sure to incorporate all of the important fields within its associated form section. This will help to hasten the process, allowing for your information to be handled quickly and properly.

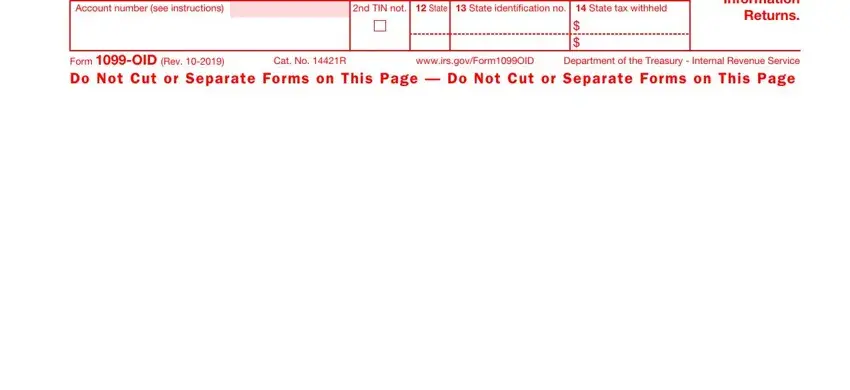

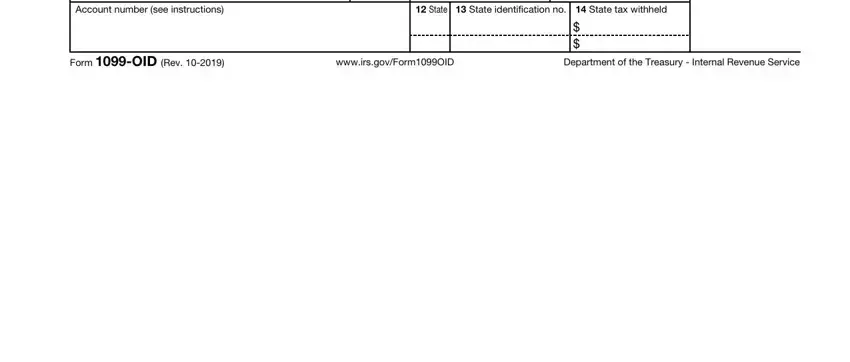

2. Just after completing this section, go to the subsequent step and enter all required particulars in these blank fields - Account number see instructions, nd TIN not, State State identification no , For Privacy Act and Paperwork, Form OID Rev Department of the, wwwirsgovFormOID, and Cat No R.

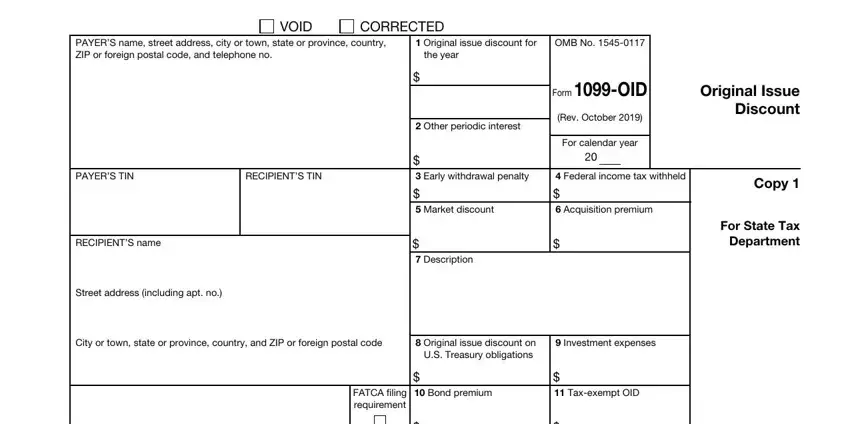

3. This subsequent section is normally fairly uncomplicated, VOID, CORRECTED, PAYERS name street address city or, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, Original issue discount for, OMB No , the year, Other periodic interest, Early withdrawal penalty, Form OID, Rev October , and For calendar year - each one of these fields will have to be filled out here.

4. Completing Account number see instructions, State State identification no , Form OID Rev , wwwirsgovFormOID, and Department of the Treasury is essential in the next stage - always don't rush and take a close look at each and every field!

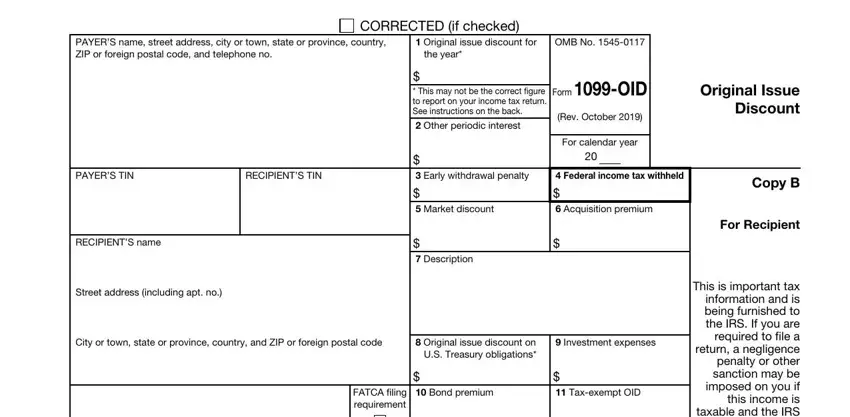

5. The form has to be completed by filling out this segment. Here you'll find a comprehensive listing of blanks that need accurate information for your form submission to be accomplished: CORRECTED if checked, PAYERS name street address city or, Original issue discount for, OMB No , the year, This may not be the correct, Other periodic interest, Early withdrawal penalty, Form OID, Rev October , For calendar year, Federal income tax withheld, Market discount, Acquisition premium, and Description.

It is easy to make errors while filling out your OMB No , and so you'll want to look again prior to when you finalize the form.

Step 3: Make sure the information is right and press "Done" to proceed further. Get your 1099 how to oid report once you sign up for a 7-day free trial. Immediately access the document from your personal cabinet, with any modifications and changes automatically kept! Here at FormsPal.com, we do our utmost to guarantee that all of your information is maintained secure.