Any time you intend to fill out 1099 irs, you won't have to download any kind of applications - just try using our online PDF editor. FormsPal is committed to providing you with the perfect experience with our editor by constantly presenting new functions and enhancements. Our tool has become even more helpful as the result of the latest updates! At this point, working with documents is easier and faster than before. In case you are seeking to begin, here's what it's going to take:

Step 1: Press the orange "Get Form" button above. It's going to open our editor so that you can begin completing your form.

Step 2: When you access the online editor, you'll see the document all set to be completed. Apart from filling in different fields, you may also perform several other actions with the Document, including adding your own textual content, editing the initial text, adding graphics, affixing your signature to the form, and much more.

It will be an easy task to finish the pdf using out detailed guide! Here is what you have to do:

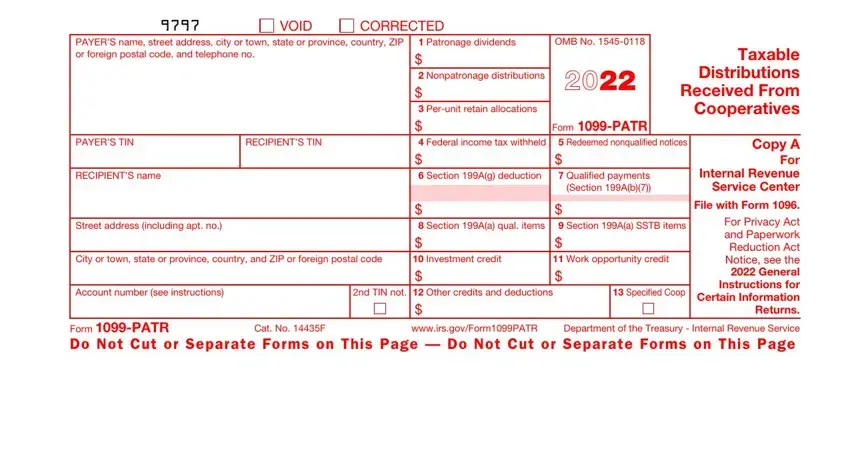

1. Whenever submitting the 1099 irs, be certain to incorporate all of the necessary blanks in their corresponding part. It will help expedite the process, which allows your details to be handled promptly and correctly.

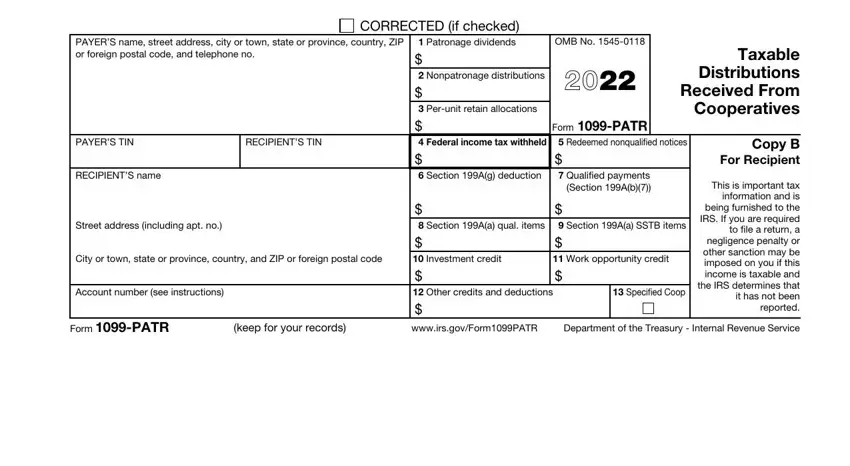

2. Just after performing the last section, go on to the subsequent stage and enter all required particulars in these fields - PAYERS name street address city or, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, CORRECTED if checked Patronage, OMB No , Taxable Distributions Received, Form PATR Redeemed nonqualified, Section Aa qual items , Section Aa SSTB items Work, Specified Coop, and Copy B For Recipient.

Be extremely attentive while completing Specified Coop and Taxable Distributions Received, as this is where many people make some mistakes.

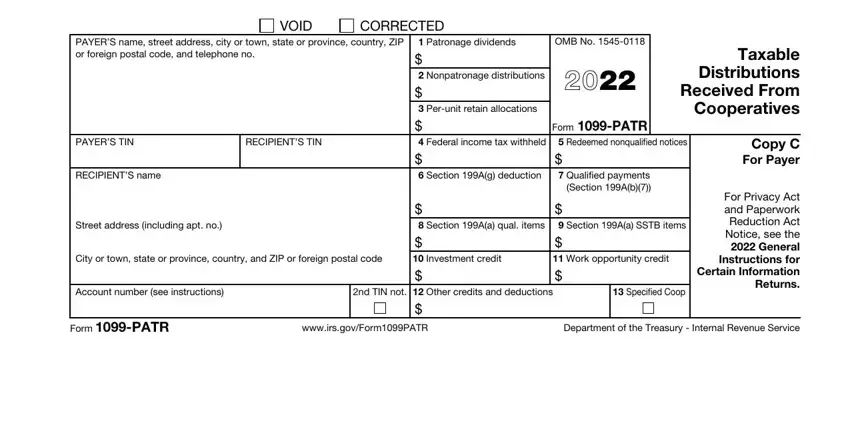

3. The next step will be simple - fill out every one of the blanks in VOID, CORRECTED, PAYERS name street address city or, PAYERS TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, nd TIN not, Patronage dividends , OMB No , Taxable Distributions Received, Form PATR Redeemed nonqualified, and Section Aa qual items to complete the current step.

Step 3: Be certain that the information is correct and then click "Done" to finish the task. Go for a free trial option at FormsPal and obtain instant access to 1099 irs - download or modify in your personal account. We don't share the details that you provide whenever filling out forms at our website.