You are able to fill out Ky 10A104 Form effectively with the help of our online PDF editor. FormsPal team is devoted to making sure you have the best possible experience with our tool by constantly introducing new functions and upgrades. With these improvements, working with our tool becomes easier than ever! To get started on your journey, take these simple steps:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: With the help of this handy PDF tool, it's possible to accomplish more than just fill out blank form fields. Try each of the functions and make your documents seem high-quality with customized text added, or fine-tune the original content to excellence - all comes along with the capability to incorporate stunning graphics and sign it off.

Completing this PDF demands focus on details. Make sure that all required areas are completed properly.

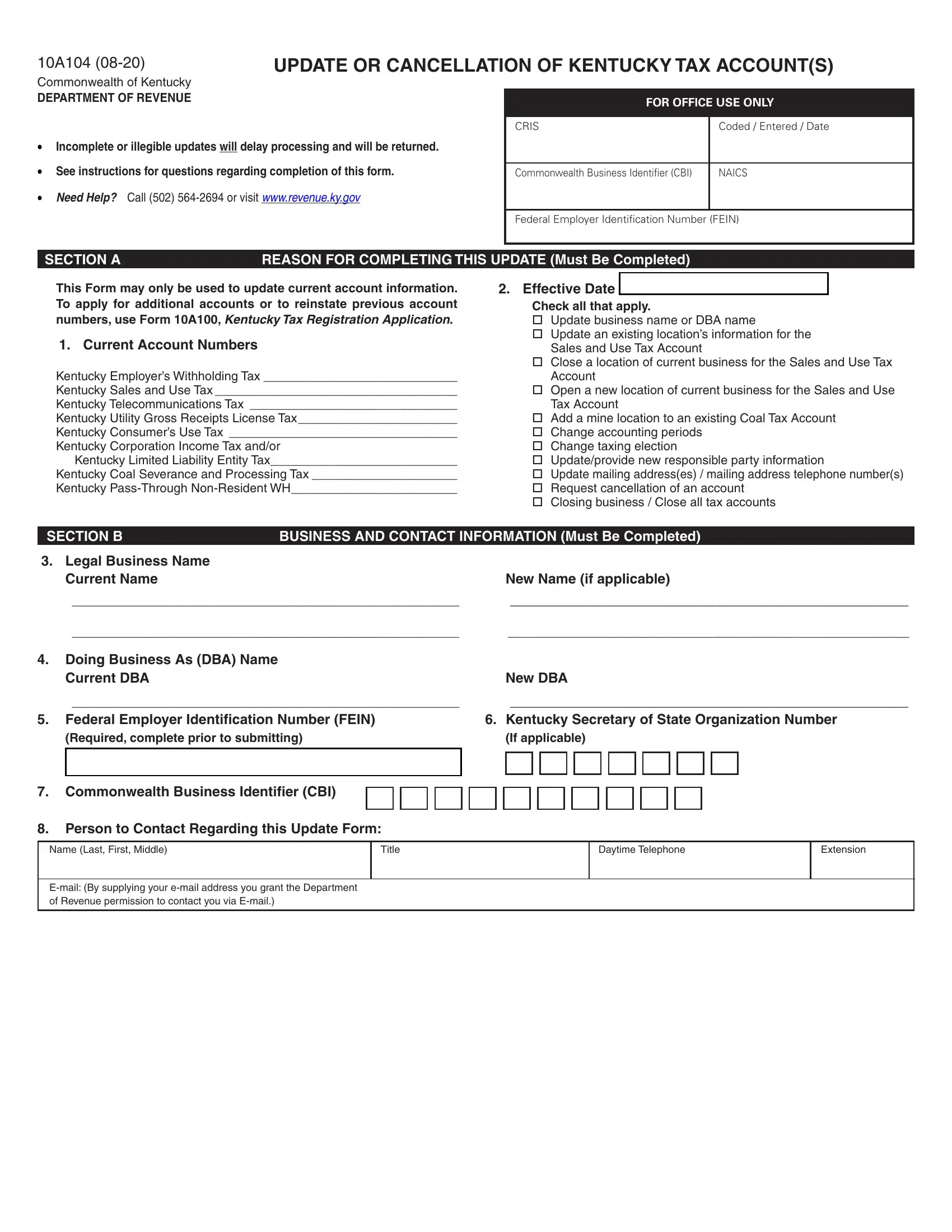

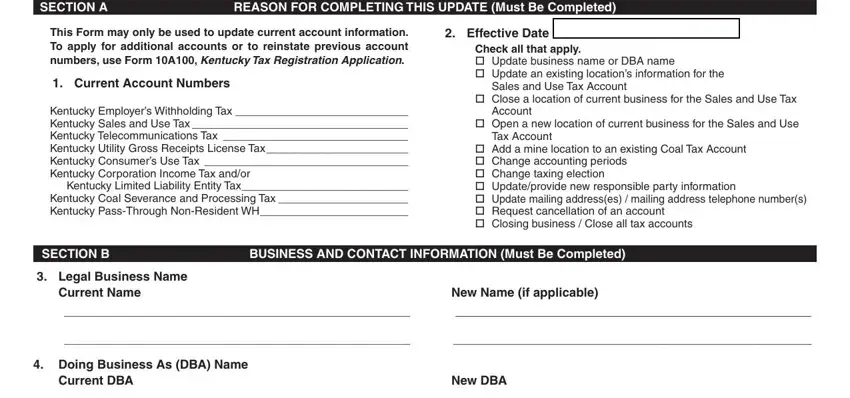

1. When submitting the Ky 10A104 Form, be sure to complete all needed fields within its relevant area. This will help to facilitate the process, which allows your information to be handled quickly and properly.

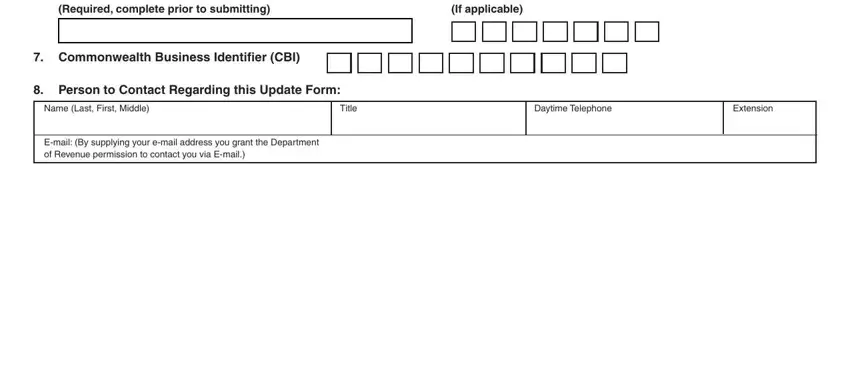

2. Once your current task is complete, take the next step – fill out all of these fields - Required complete prior to, Kentucky Secretary of State, If applicable, Commonwealth Business Identifier, Person to Contact Regarding this, Name Last First Middle, Title, Email By supplying your email, Daytime Telephone, and Extension with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very mindful while filling in Extension and Commonwealth Business Identifier, because this is where many people make some mistakes.

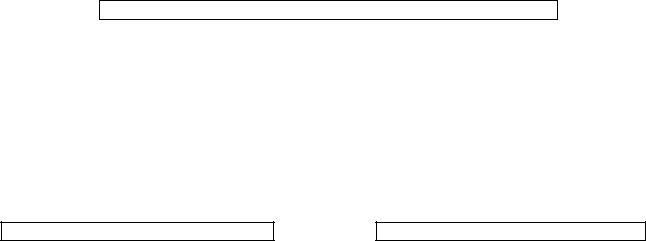

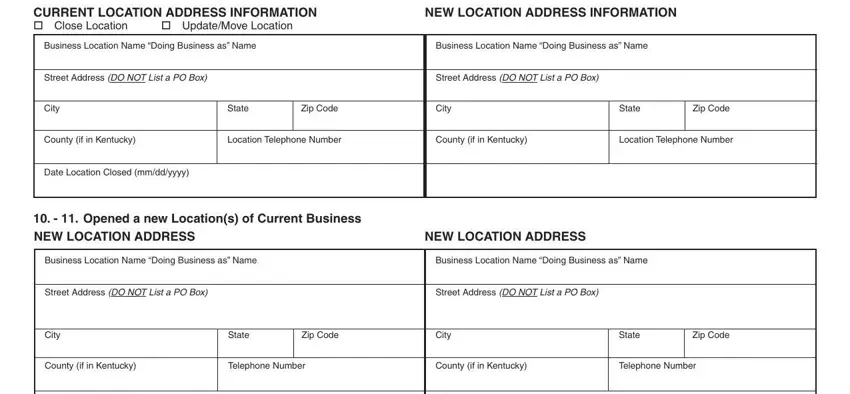

3. This next stage is generally hassle-free - complete all the blanks in CURRENT LOCATION ADDRESS, UpdateMove Location, NEW LOCATION ADDRESS INFORMATION, Business Location Name Doing, Business Location Name Doing, Street Address DO NOT List a PO Box, Street Address DO NOT List a PO Box, City, County if in Kentucky, Date Location Closed mmddyyyy, State, Zip Code, Location Telephone Number, City, and County if in Kentucky to finish the current step.

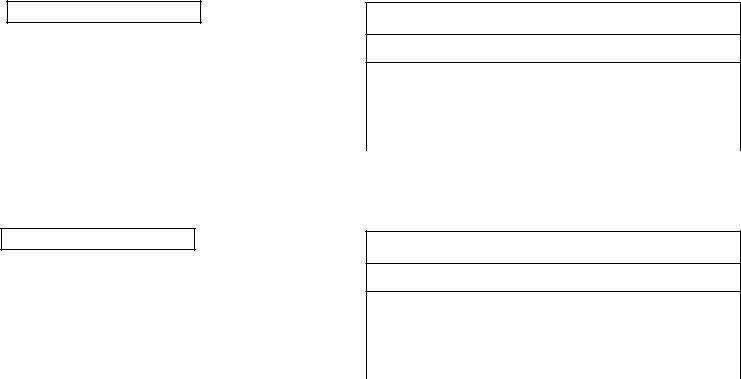

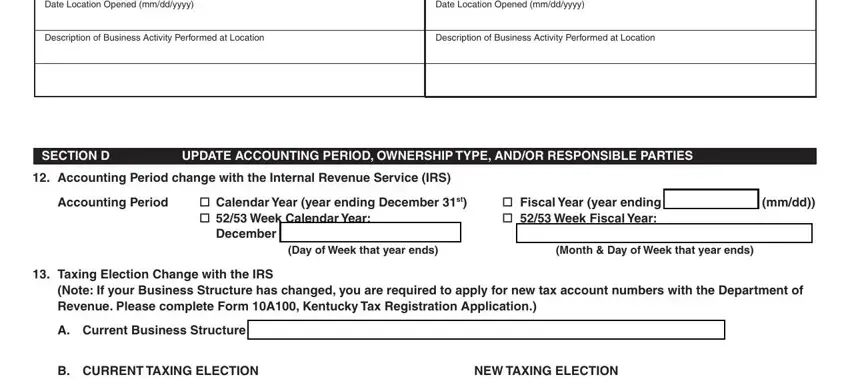

4. The next paragraph requires your details in the following areas: Date Location Opened mmddyyyy, Date Location Opened mmddyyyy, Description of Business Activity, Description of Business Activity, SECTION D, UPDATE ACCOUNTING PERIOD OWNERSHIP, Accounting Period change with the, Accounting Period, Calendar Year year ending, Day of Week that year ends, Fiscal Year year ending mmdd, Month Day of Week that year ends, Taxing Election Change with the, Note If your Business Structure, and A Current Business Structure. It is important to fill in all of the requested info to move forward.

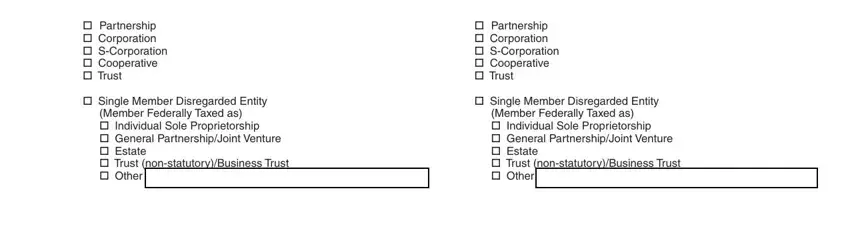

5. To conclude your form, the final subsection incorporates a couple of extra blanks. Filling out Partnership Corporation, Partnership Corporation, Member Federally Taxed as, Single Member Disregarded Entity, Member Federally Taxed as, and Single Member Disregarded Entity will wrap up the process and you'll be done quickly!

Step 3: After you've reread the details you filled in, simply click "Done" to finalize your form. Obtain your Ky 10A104 Form once you subscribe to a free trial. Readily get access to the pdf file in your personal account page, with any edits and changes being conveniently saved! Whenever you work with FormsPal, you'll be able to complete documents without the need to worry about information leaks or records getting distributed. Our secure software ensures that your personal details are maintained safe.