Working with PDF forms online can be a breeze with this PDF tool. Anyone can fill out form 1120 us return here and try out many other options we provide. The editor is constantly improved by our staff, receiving additional functions and turning out to be even more versatile. Getting underway is effortless! Everything you need to do is follow the next simple steps below:

Step 1: Access the PDF doc inside our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: The editor will allow you to customize PDF forms in various ways. Modify it with your own text, correct what's originally in the PDF, and put in a signature - all manageable within minutes!

It really is an easy task to finish the pdf with this helpful tutorial! This is what you need to do:

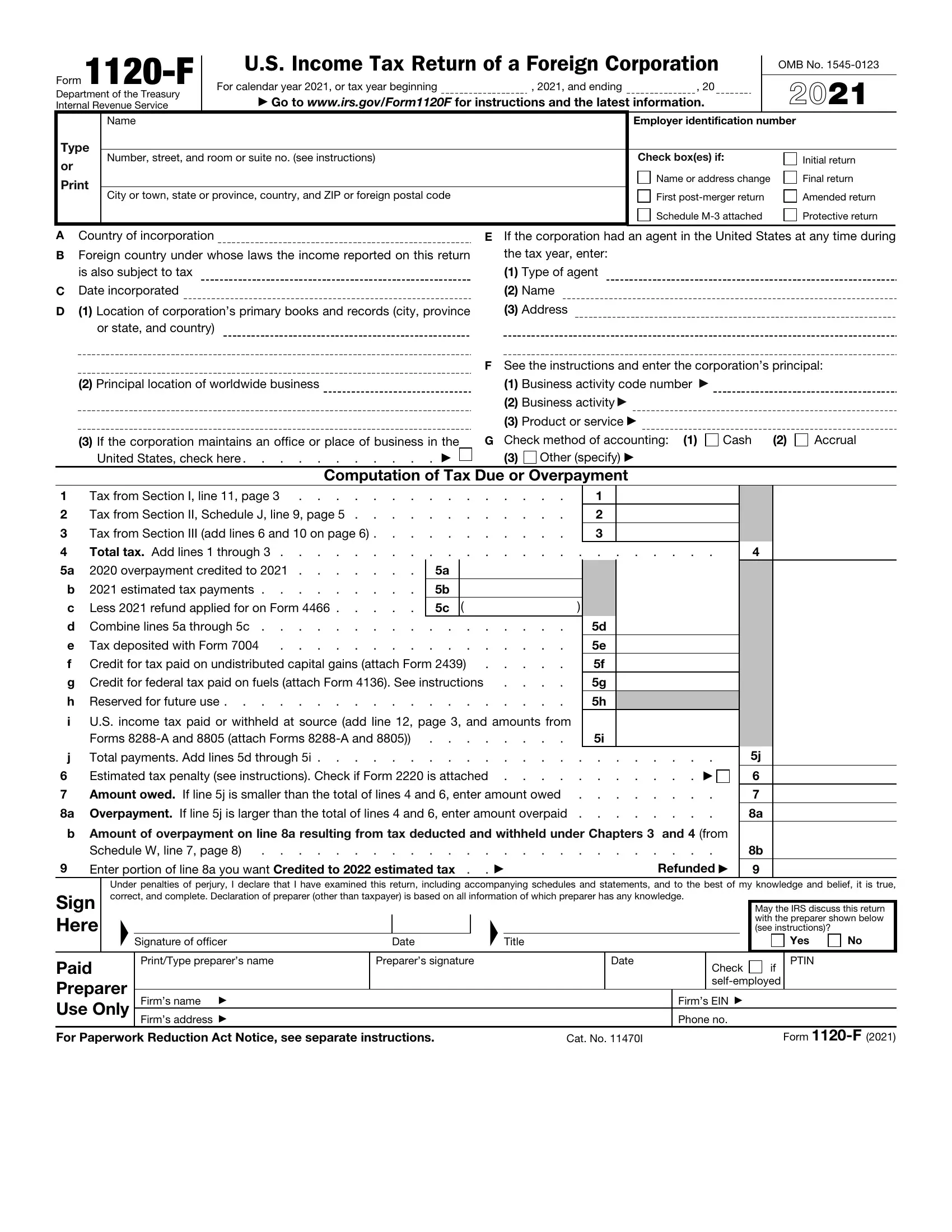

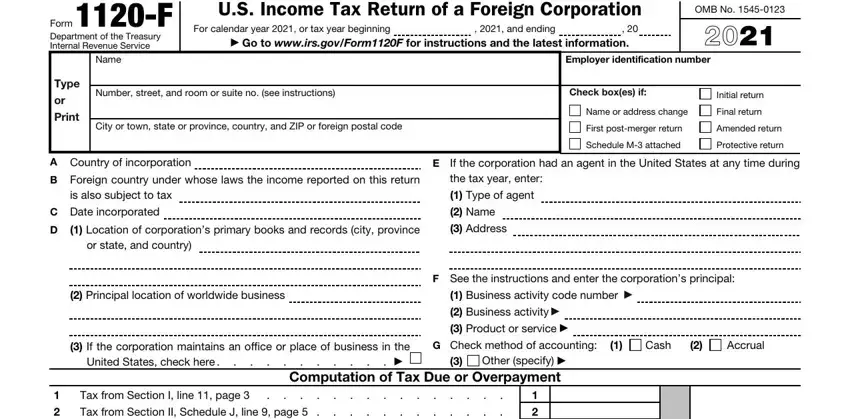

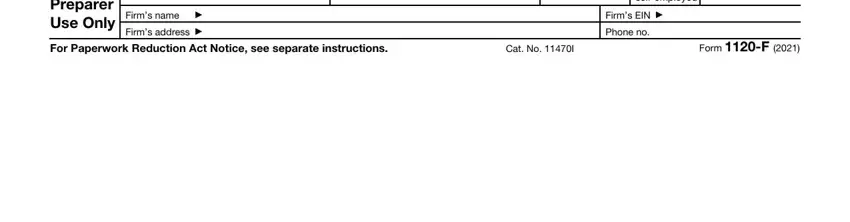

1. The form 1120 us return needs certain information to be typed in. Be sure that the next blanks are finalized:

2. After the prior part is done, proceed to type in the applicable information in these - Tax from Section I line page , b estimated tax payments c, US income tax paid or withheld at, a Overpayment If line j is larger, Amount of overpayment on line a, Refunded , Under penalties of perjury I, Sign Here, Signature of officer, Date, Title, Paid Preparer Use Only, PrintType preparers name, Preparers signature, and Date.

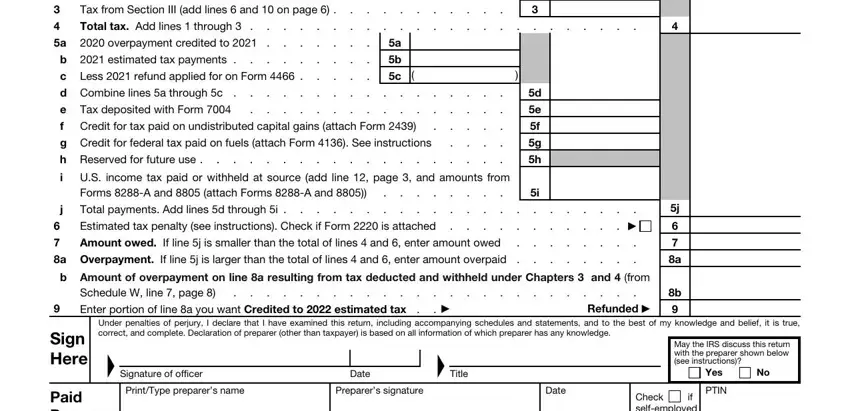

People frequently make mistakes when filling in Paid Preparer Use Only in this area. Ensure you re-examine what you type in here.

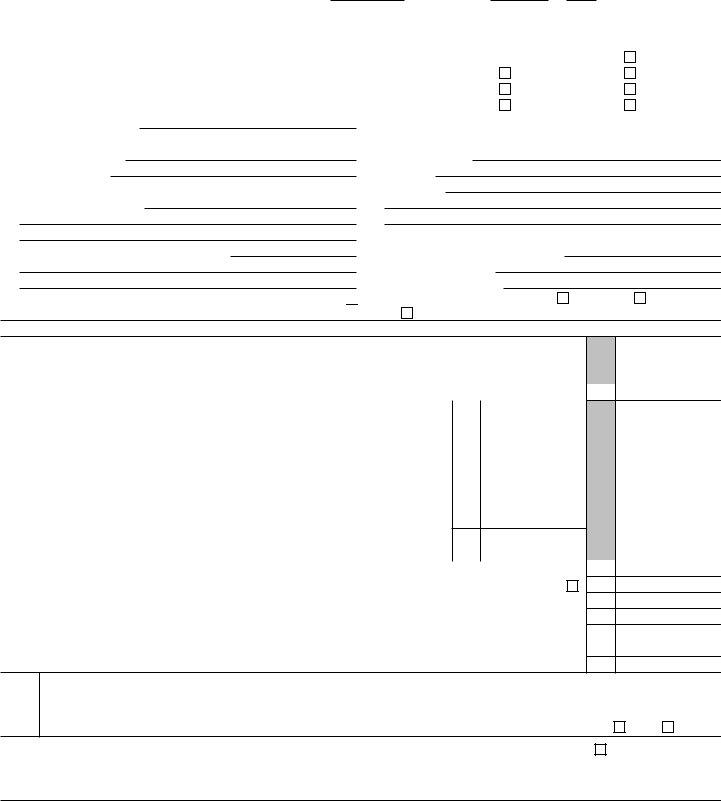

3. The following section is fairly simple, Paid Preparer Use Only, Firms name , Firms address , Check if selfemployed, Firms EIN , Phone no, For Paperwork Reduction Act Notice, Cat No I, and Form F - all these empty fields is required to be filled in here.

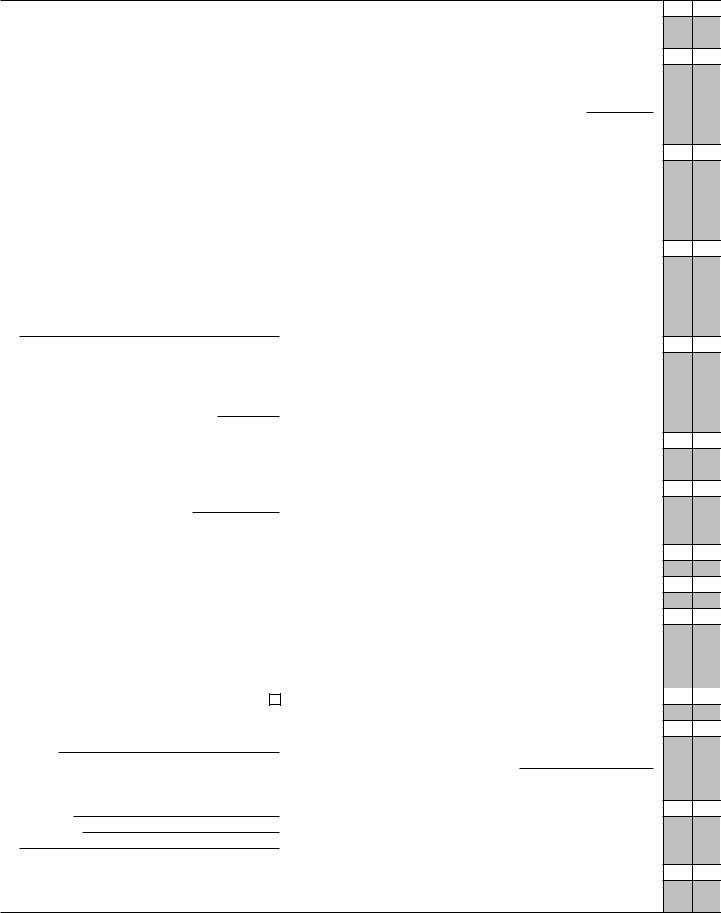

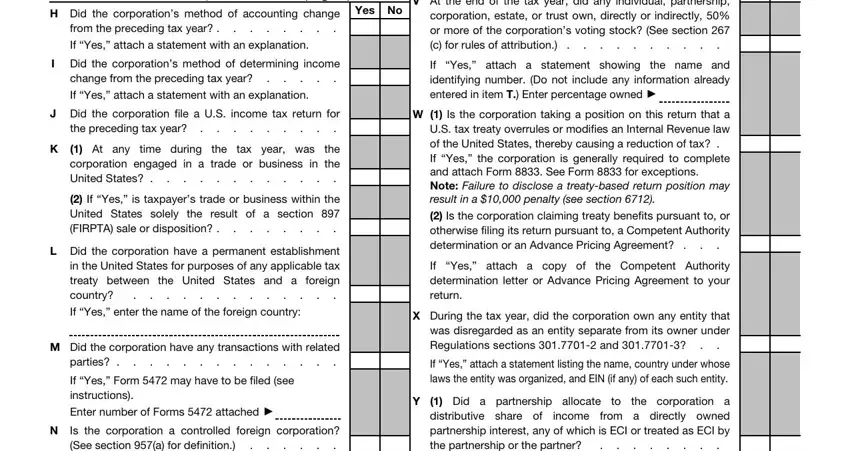

4. This specific part arrives with the next few empty form fields to fill out: Form F Additional Information, Did the corporations method of, Did the corporations method of, Did the corporation file a US, At any time during the tax year, If Yes is taxpayers trade or, Did the corporation have a, Did the corporation have any, If Yes Form may have to be filed, Is the corporation a controlled, Yes No, At the end of the tax year did any, If Yes attach a statement showing, Is the corporation taking a, and If Yes attach a copy of the.

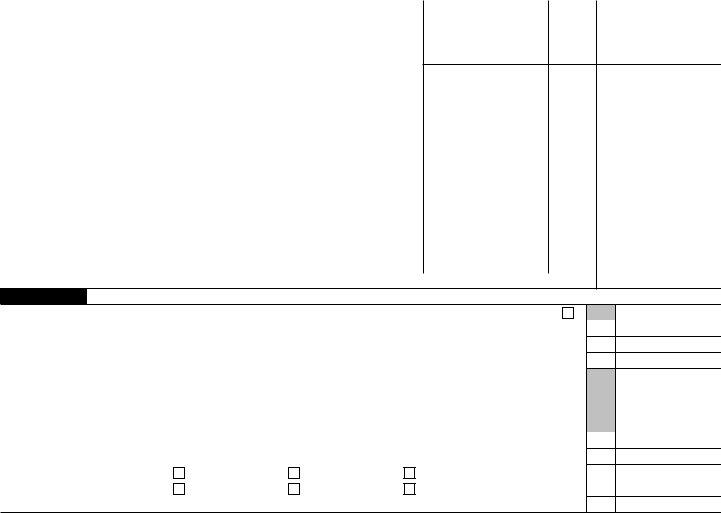

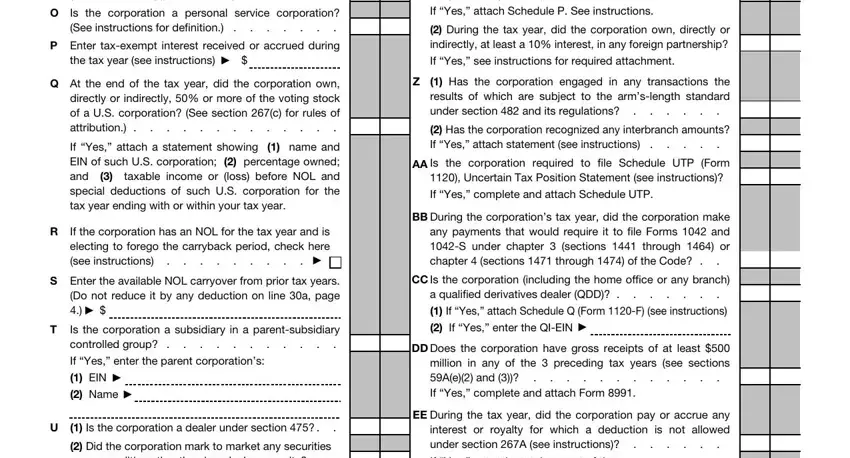

5. Finally, this final section is what you need to complete prior to closing the form. The fields at this stage include the following: Is the corporation a controlled, Is the corporation a personal, Enter taxexempt interest received, At the end of the tax year did the, If Yes attach a statement showing , If the corporation has an NOL for, Enter the available NOL carryover, Is the corporation a subsidiary in, Did a partnership allocate to the, During the tax year did the, Has the corporation engaged in, Has the corporation recognized, Is the corporation required to, During the corporations tax year, and Is the corporation including the.

Step 3: Once you've looked over the details in the fields, click on "Done" to conclude your FormsPal process. Go for a 7-day free trial plan at FormsPal and acquire instant access to form 1120 us return - download, email, or edit in your FormsPal account. FormsPal is dedicated to the privacy of our users; we make sure all information put into our tool is confidential.