Any time you would like to fill out schedule m 3 1120, there's no need to download any programs - simply try our online PDF editor. The editor is consistently upgraded by our team, getting additional functions and turning out to be more versatile. All it requires is a few simple steps:

Step 1: Press the "Get Form" button in the top part of this webpage to access our PDF editor.

Step 2: Using this state-of-the-art PDF file editor, you may do more than just fill out blanks. Try all the features and make your docs look perfect with custom text incorporated, or adjust the original input to excellence - all that supported by the capability to incorporate stunning pictures and sign the file off.

With regards to the blanks of this particular document, here is what you should consider:

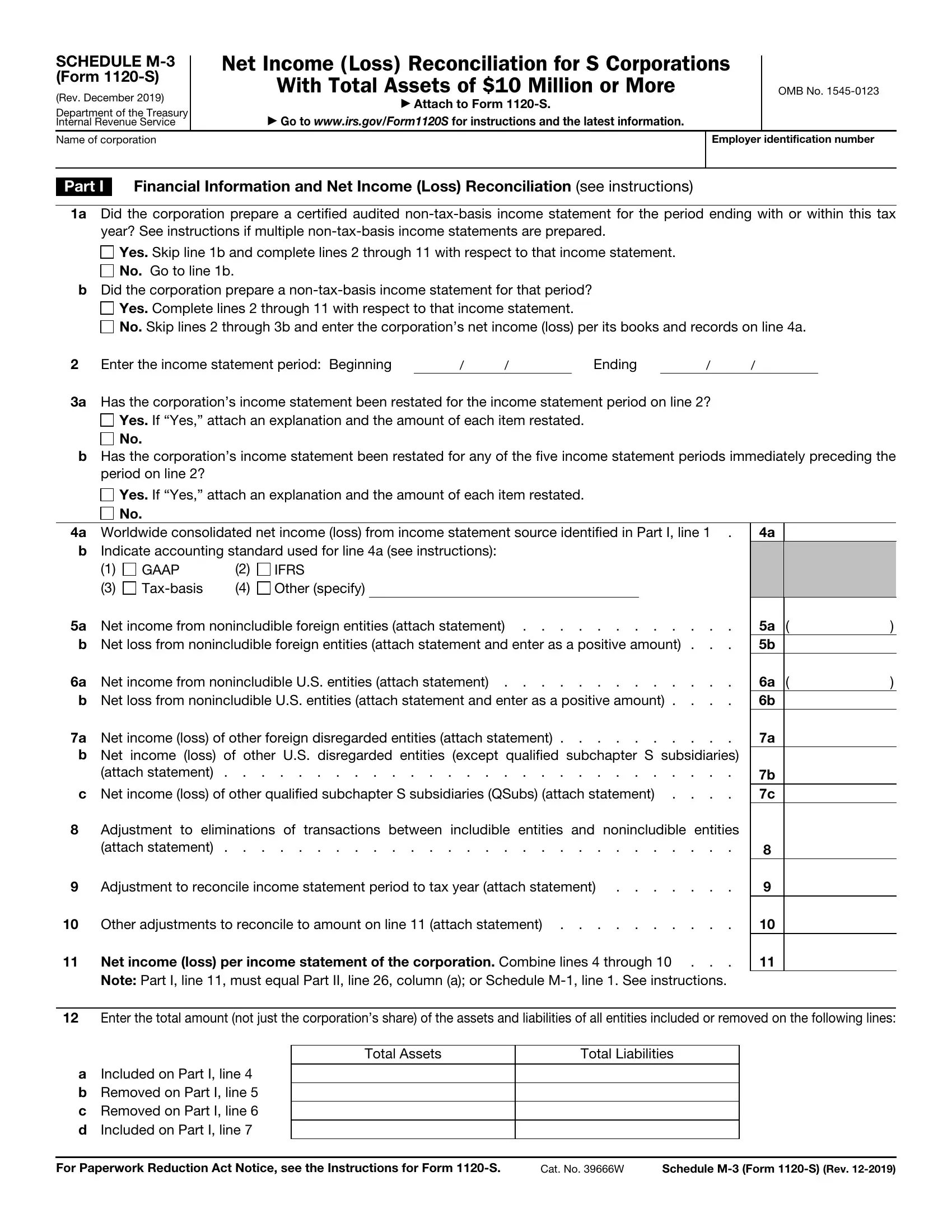

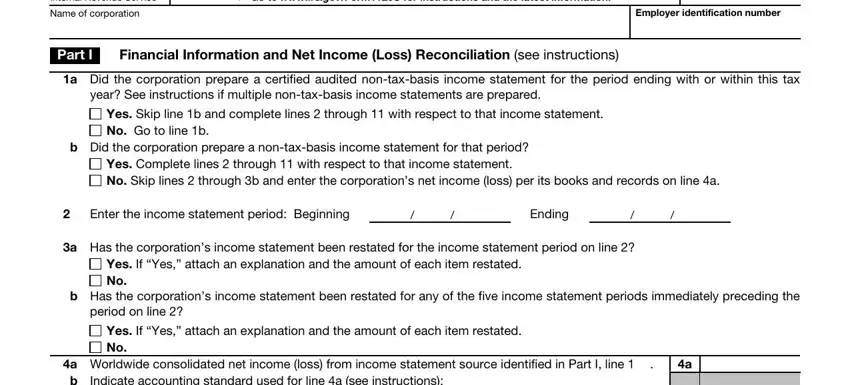

1. Start completing your schedule m 3 1120 with a number of necessary blanks. Get all of the information you need and be sure absolutely nothing is forgotten!

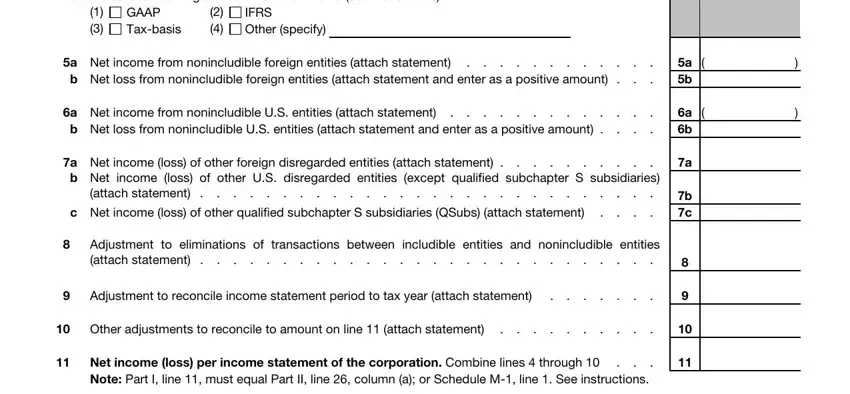

2. Now that this segment is finished, it is time to include the essential specifics in Indicate accounting standard used, Other specify, GAAP Taxbasis, IFRS, a Net income from nonincludible, b Net loss from nonincludible, a Net income from nonincludible, b Net loss from nonincludible US, a Net income loss of other foreign, b Net income loss of other US, attach statement , c Net income loss of other, Adjustment to eliminations of, Adjustment to reconcile income, and Other adjustments to reconcile to so you're able to proceed further.

Lots of people generally make some mistakes when filling in Indicate accounting standard used in this area. Be sure you read again everything you type in here.

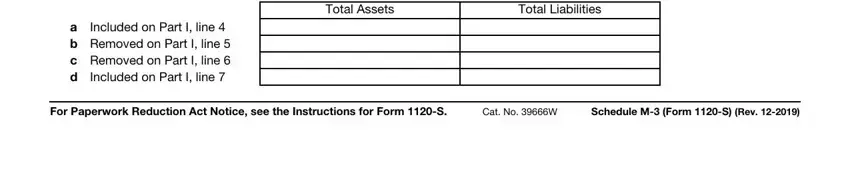

3. The next part will be hassle-free - fill out all of the blanks in Total Assets, Total Liabilities, Included on Part I line a b, For Paperwork Reduction Act Notice, Cat No W, and Schedule M Form S Rev to conclude this segment.

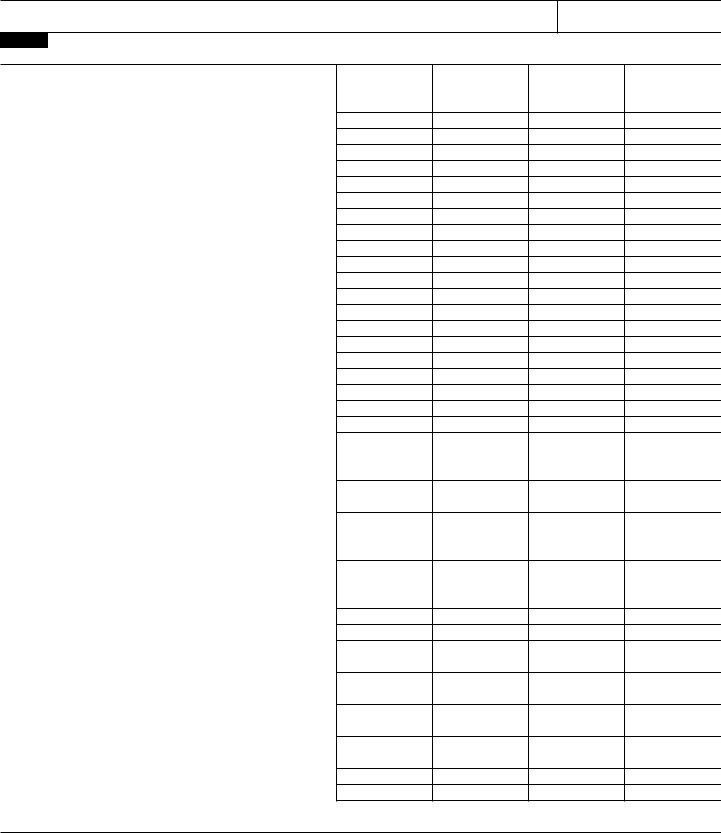

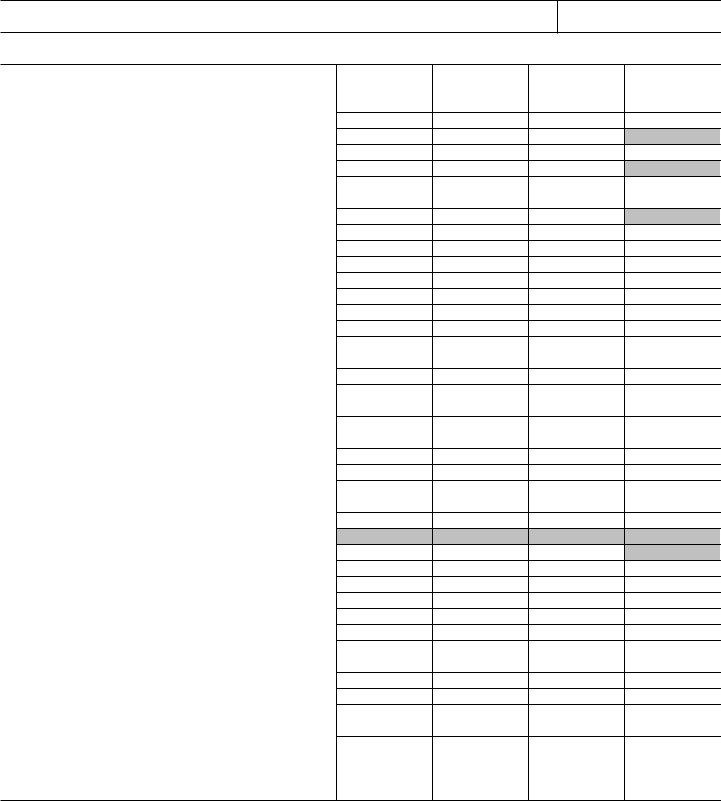

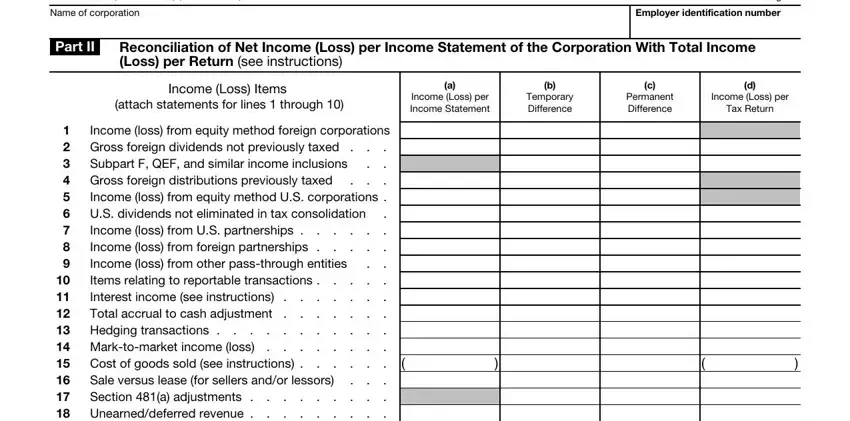

4. The subsequent section requires your input in the following parts: Schedule M Form S Rev , Name of corporation, Employer identification number, Page , Part II, Reconciliation of Net Income Loss, Income Loss Items, attach statements for lines , Income Loss per Income Statement, Temporary Difference, Permanent Difference, Income Loss per, Tax Return, Income loss from equity method, and Subpart F QEF and similar income. Just remember to give all needed details to move further.

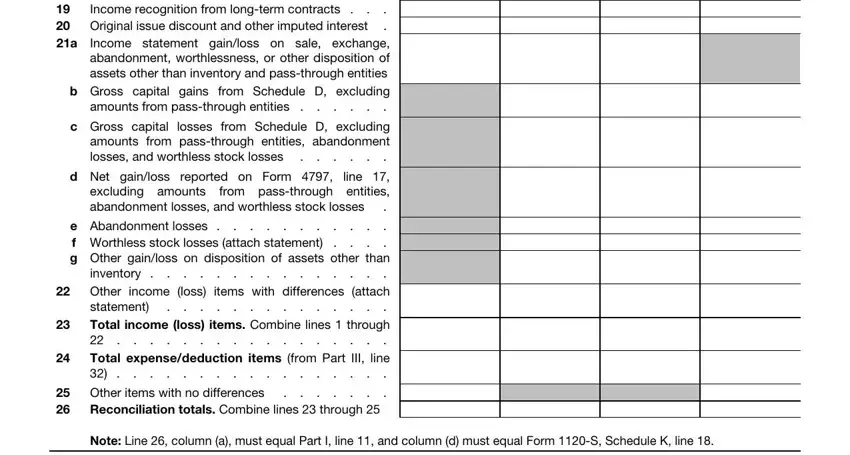

5. This last step to complete this document is integral. Be certain to fill out the mandatory blank fields, such as Income loss from equity method, Gross foreign dividends not, Income loss from US partnerships , Income statement gainloss on sale, b Gross capital gains from, amounts from passthrough entities , Gross capital losses from Schedule, Net gainloss reported on Form , e Abandonment losses f Worthless, inventory , Other income loss items with, statement, Total income loss items Combine, Total expensededuction items from, and Other items with no differences , before finalizing. Neglecting to do this may give you an unfinished and possibly unacceptable document!

Step 3: Proofread all the details you've entered into the blanks and then click on the "Done" button. Grab the schedule m 3 1120 once you register online for a free trial. Easily get access to the pdf in your personal account page, with any modifications and changes all saved! At FormsPal, we endeavor to make sure that your information is kept secure.