Dealing with PDF forms online is simple using our PDF editor. Anyone can fill out 12180 authorization form pdf here painlessly. To have our editor on the forefront of efficiency, we work to implement user-oriented features and improvements regularly. We're routinely looking for feedback - play a pivotal role in revolutionizing PDF editing. For anyone who is seeking to start, here is what it will take:

Step 1: Hit the "Get Form" button above. It will open our editor so that you can begin filling in your form.

Step 2: After you launch the tool, you will get the form made ready to be completed. Other than filling out various blanks, you may as well do various other actions with the form, specifically putting on your own textual content, modifying the initial text, inserting graphics, signing the PDF, and a lot more.

It is actually straightforward to finish the document using out detailed guide! Here's what you need to do:

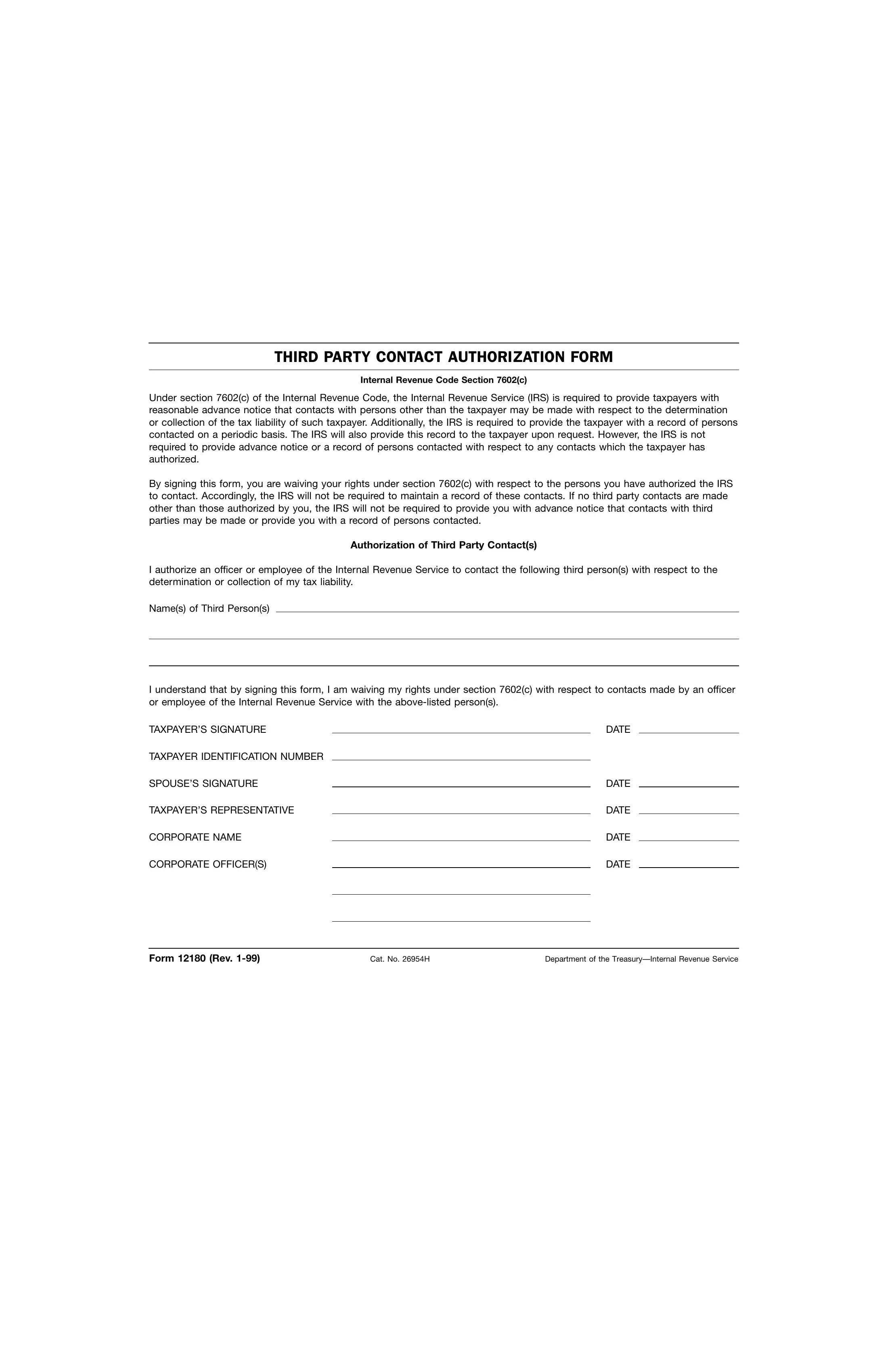

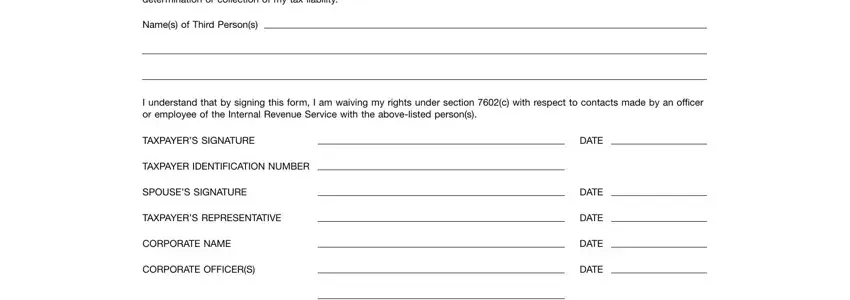

1. It's important to complete the 12180 authorization form pdf properly, therefore pay close attention when filling in the parts including all these blank fields:

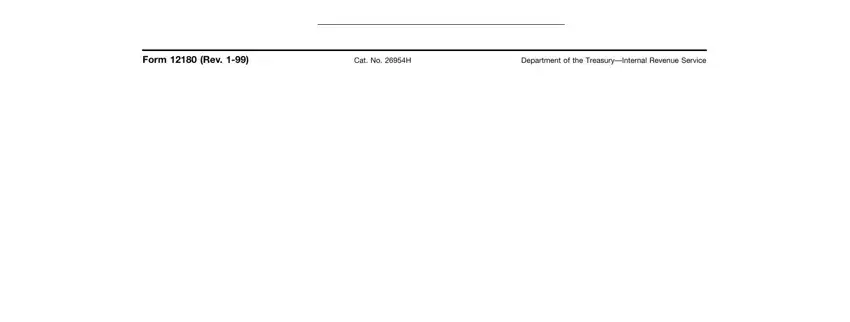

2. After the prior selection of fields is completed, proceed to type in the suitable details in all these: Form Rev , Cat No H, and Department of the TreasuryInternal.

As to Department of the TreasuryInternal and Cat No H, ensure you take a second look in this section. These are considered the key fields in this form.

Step 3: After going through your fields and details, click "Done" and you are all set! Sign up with us now and instantly access 12180 authorization form pdf, all set for downloading. All adjustments you make are saved , so that you can customize the pdf later on if needed. We do not sell or share the details that you use while dealing with forms at FormsPal.