You are able to work with 2014 1099 Form effortlessly by using our PDFinity® online PDF tool. In order to make our editor better and simpler to use, we continuously design new features, taking into consideration suggestions from our users. Getting underway is effortless! All you have to do is take these basic steps down below:

Step 1: Click the "Get Form" button above. It's going to open our pdf tool so you could begin filling in your form.

Step 2: With the help of our handy PDF tool, you are able to accomplish more than just fill out blanks. Try each of the functions and make your documents seem professional with custom text added in, or optimize the file's original input to excellence - all comes along with an ability to insert your personal photos and sign it off.

As a way to finalize this PDF form, make sure you provide the required details in each blank field:

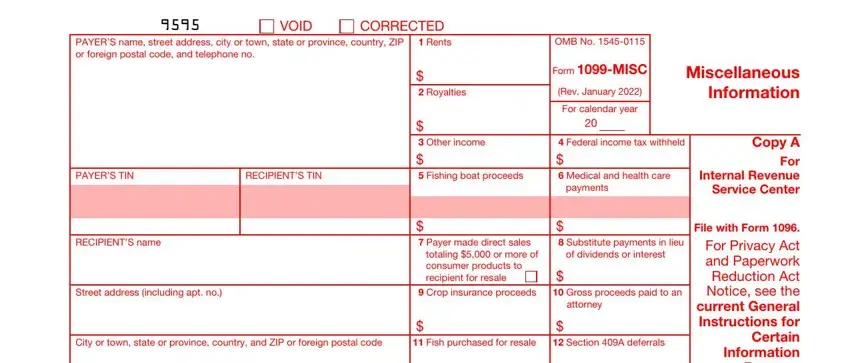

1. First, when completing the 2014 1099 Form, start out with the page that contains the next blanks:

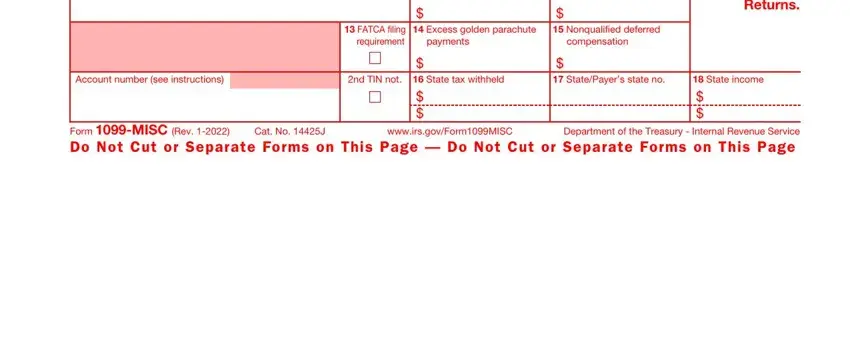

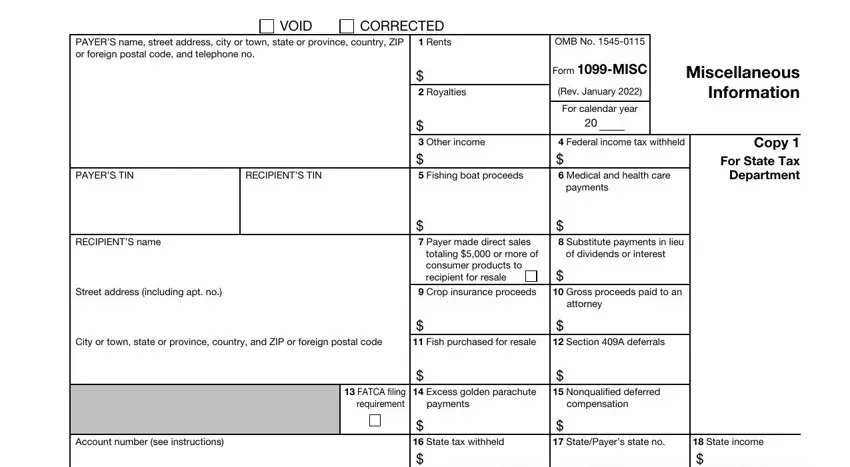

2. The next part would be to complete the following fields: File with Form For Privacy Act, FATCA filing requirement, Excess golden parachute, Nonqualified deferred, payments, compensation, Account number see instructions, nd TIN not, State tax withheld , StatePayers state no, State income , Form MISC Rev Department of the, wwwirsgovFormMISC, and Cat No J.

3. This next section is all about VOID, CORRECTED, PAYERS name street address city or, Rents, Royalties, Other income Fishing boat, OMB No , Form MISC Rev January , For calendar year, Miscellaneous Information, Federal income tax withheld , payments, Copy For State Tax Department, PAYERS TIN, and RECIPIENTS TIN - complete these fields.

Regarding Copy For State Tax Department and Federal income tax withheld , ensure you do everything properly in this section. These could be the key ones in the file.

4. You're ready to fill out this next segment! In this case you'll get these State tax withheld , State income , Form MISC Rev , wwwirsgovFormMISC, and Department of the Treasury form blanks to fill in.

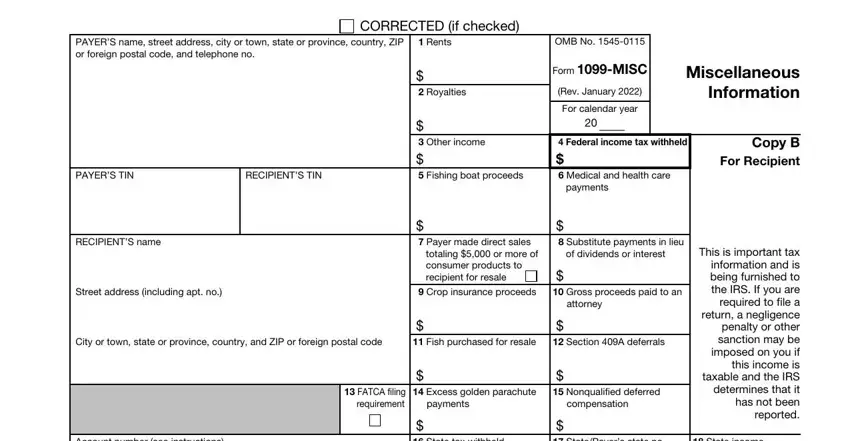

5. While you approach the conclusion of your document, you'll notice just a few more requirements that have to be met. Notably, CORRECTED if checked, PAYERS name street address city or, Rents, Royalties, Other income Fishing boat, OMB No , Form MISC Rev January , For calendar year, Miscellaneous Information, Federal income tax withheld , payments, Copy B For Recipient, PAYERS TIN, RECIPIENTS TIN, and RECIPIENTS name should all be filled in.

Step 3: Prior to finalizing your form, double-check that all form fields have been filled out the proper way. Once you are satisfied with it, click “Done." Join us today and immediately access 2014 1099 Form, prepared for downloading. Every single change made is handily saved , allowing you to customize the file later as needed. When using FormsPal, you're able to complete documents without needing to be concerned about personal information leaks or entries being distributed. Our protected software makes sure that your private information is stored safely.