When you need to fill out 2020 oregon form, it's not necessary to install any kind of programs - simply try using our online PDF editor. Our development team is continuously working to improve the editor and ensure it is even easier for clients with its multiple features. Make use of today's innovative prospects, and discover a myriad of new experiences! Getting underway is effortless! All you should do is stick to these easy steps below:

Step 1: Just click the "Get Form Button" above on this site to open our pdf form editing tool. Here you'll find everything that is needed to work with your document.

Step 2: With this state-of-the-art PDF file editor, you'll be able to accomplish more than just fill in blanks. Try all the features and make your forms seem great with custom textual content added in, or tweak the file's original input to excellence - all comes along with an ability to insert stunning photos and sign the PDF off.

It's an easy task to complete the form adhering to our helpful tutorial! This is what you have to do:

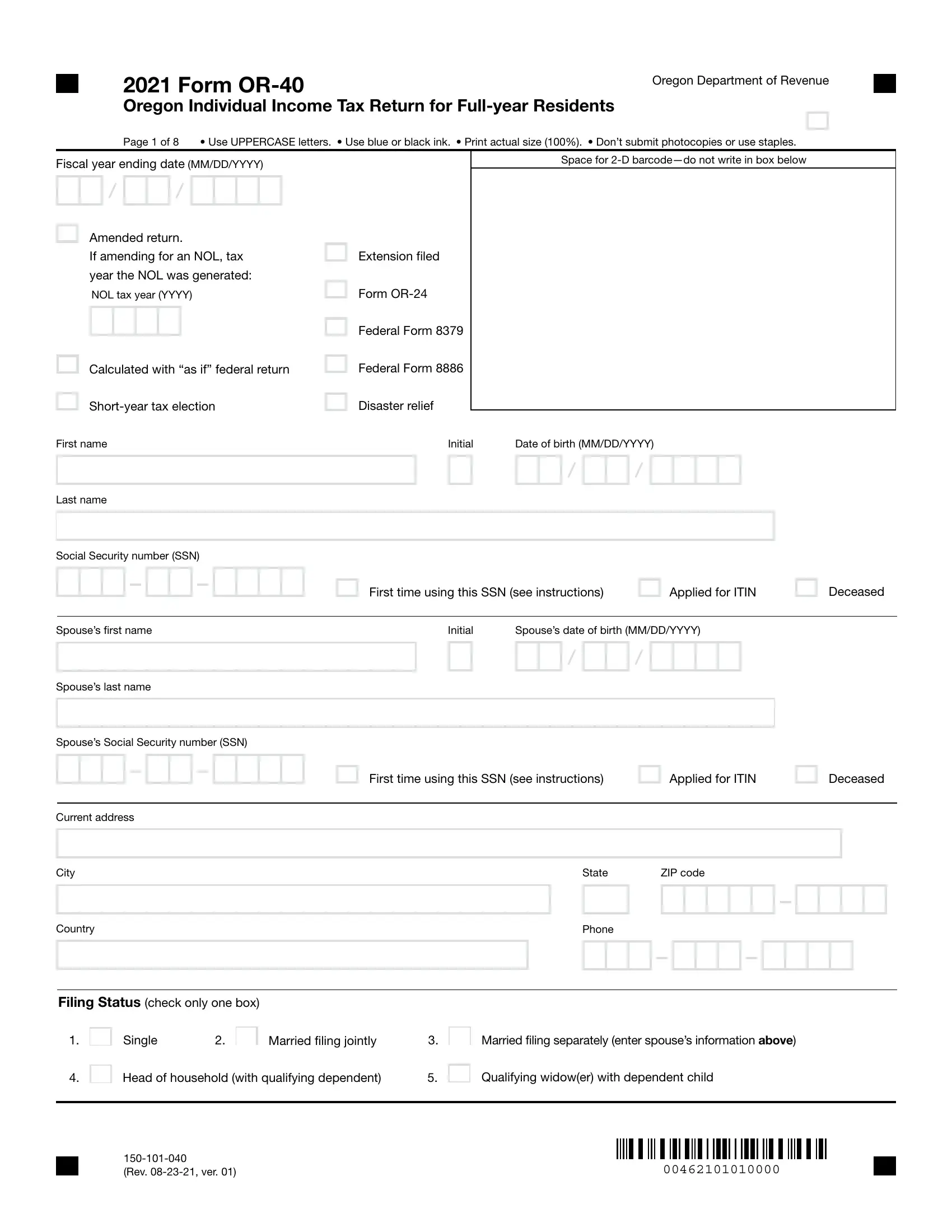

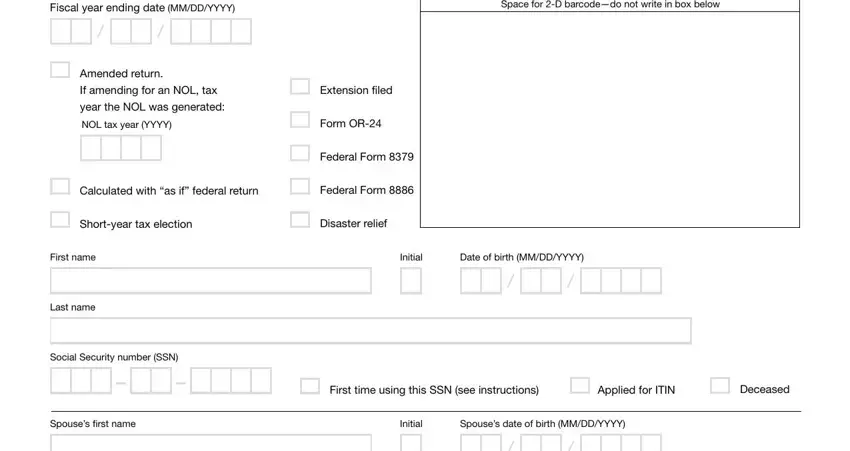

1. To start with, while filling in the 2020 oregon form, begin with the area that includes the next blank fields:

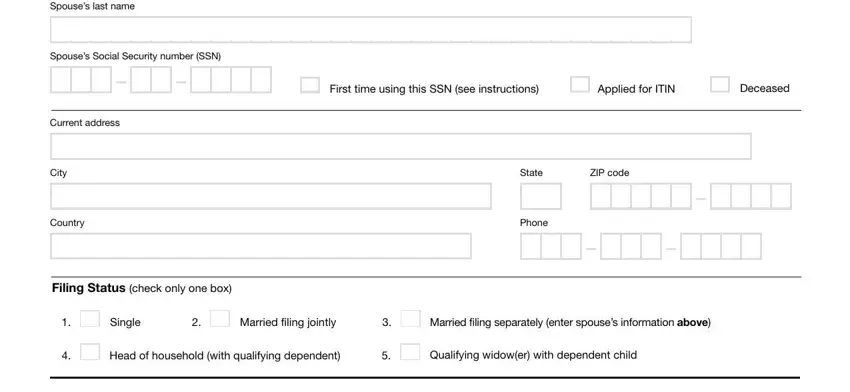

2. Once this array of fields is completed, it is time to add the necessary specifics in Spouses last name, Spouses Social Security number SSN, Current address, City, Country, First time using this SSN see, Applied for ITIN, Deceased, State, ZIP code, Phone, Filing Status check only one box, Single, Married filing jointly, and Head of household with qualifying so that you can progress further.

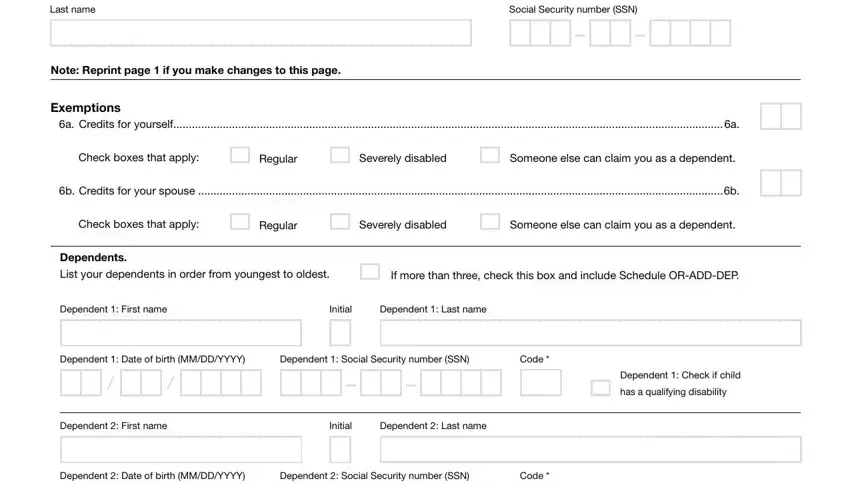

3. In this stage, examine Last name, Social Security number SSN, Note Reprint page if you make, Exemptions, a Credits for yourself a, Check boxes that apply, Regular, Severely disabled, Someone else can claim you as a, b Credits for your spouse b, Check boxes that apply, Regular, Severely disabled, Someone else can claim you as a, and Dependents List your dependents in. Each of these will have to be filled in with utmost accuracy.

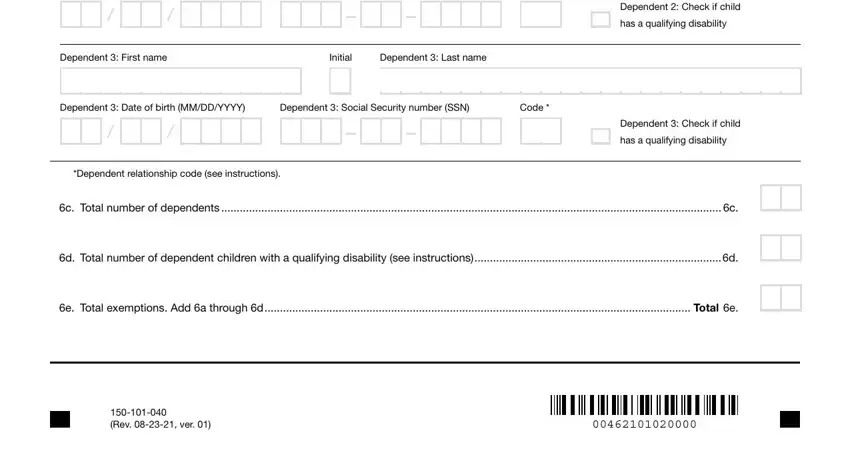

4. This particular subsection arrives with all of the following fields to enter your information in: Dependent First name, Initial, Dependent Last name, Dependent Date of birth MMDDYYYY, Dependent Social Security number, Code , Dependent relationship code see, Dependent Check if child, has a qualifying disability, Dependent Check if child, has a qualifying disability, c Total number of dependents c, d Total number of dependent, e Total exemptions Add a through d, and Rev ver .

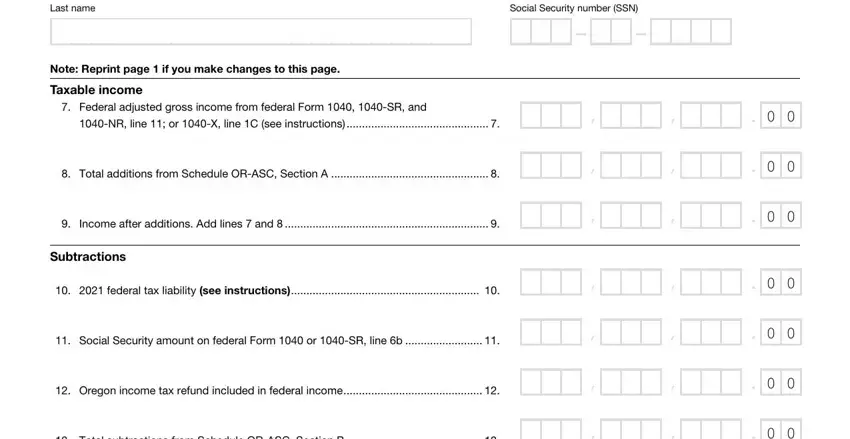

5. And finally, this last portion is what you'll want to wrap up prior to submitting the form. The fields in this case are the next: Last name, Social Security number SSN, Note Reprint page if you make, Taxable income Federal adjusted, NR line or X line C see, Total additions from Schedule, Income after additions Add lines , Subtractions, federal tax liability see, Social Security amount on federal, Oregon income tax refund included, and Total subtractions from Schedule.

As for Social Security amount on federal and Total additions from Schedule, be sure that you take a second look in this current part. Those two are certainly the key fields in this page.

Step 3: Spell-check all the details you have entered into the blank fields and then click on the "Done" button. Sign up with us right now and instantly obtain 2020 oregon form, all set for downloading. Every last change made is conveniently preserved , allowing you to modify the pdf later when required. At FormsPal.com, we aim to make sure that all of your details are stored protected.