All necessary income and asset information; AND

All, if any, relevant, private medical treatment records and an identification of any relevant treatment records available at a Federal facility, such as a VA medical center.

NOTICE TO VETERAN OF EVIDENCE NECESSARY TO SUBSTANTIATE A CLAIM FOR

VETERANS PENSION BENEFITS

(This notice is applicable to veterans claims for: Veterans Pension (a needs based benefit) • Special Monthly Pension

• Benefits Based on a Veteran's Seriously Disabled Child)

Use this notice and the attached application to submit a claim for veterans pension.

This notice informs you of the evidence necessary to substantiate your claim.

Want your claim processed faster? The Fully Developed Claim (FDC) Program is the fastest way to get your claim processed and there is no risk to participate! To participate in the FDC Program, if you are making a claim for veterans pension, simply submit your claim in accordance with the "FDC Criteria" shown below. If you are making a claim for veterans disability compensation or related compensation benefits, use VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits. If you are making a claim for survivor benefits, use

VA Form 21P-534EZ, Application for DIC, Survivors Pension, and/or Accrued Benefits.

VA forms are available at www.va.gov/vaforms.

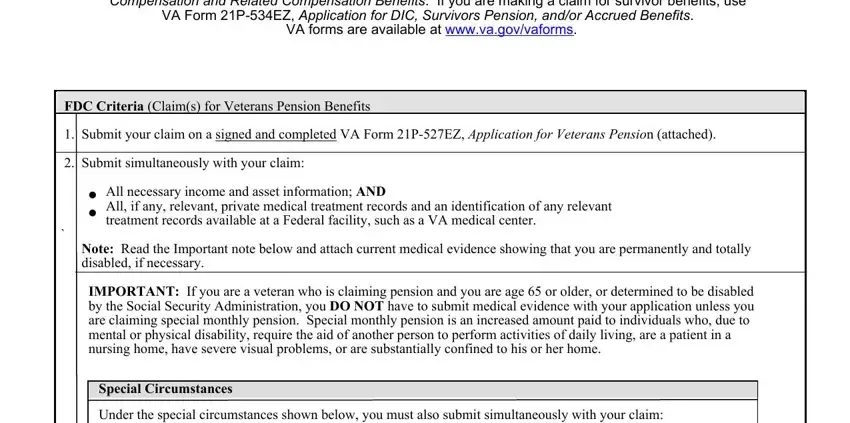

FDC Criteria (Claim(s) for Veterans Pension Benefits

1. Submit your claim on a signed and completed VA Form 21P-527EZ, Application for Veterans Pension (attached).

2. Submit simultaneously with your claim:

..

`

Note: Read the Important note below and attach current medical evidence showing that you are permanently and totally disabled, if necessary.

IMPORTANT: If you are a veteran who is claiming pension and you are age 65 or older, or determined to be disabled by the Social Security Administration, you DO NOT have to submit medical evidence with your application unless you are claiming special monthly pension. Special monthly pension is an increased amount paid to individuals who, due to mental or physical disability, require the aid of another person to perform activities of daily living, are a patient in a nursing home, have severe visual problems, or are substantially confined to his or her home.

Special Circumstances

Under. the special circumstances shown below, you must also submit simultaneously with your claim:

If claiming veterans pension with special monthly pension, a completed VA Form 21-2680, Examination for Housebound Status or Permanent Need for Regular Aid and Attendance, or (if a patient in a nursing home) a completed VA Form 21-0779, Request for Nursing Home Information in Connection with Claim for Aid

.and Attendance;

If claiming a child in school between the ages of 18 and 23, a completed VA Form 21-674, Request for

.Approval of School Attendance;

If claiming benefits for a seriously disabled child, all, if any, relevant, private medical treatment records for the child's pertinent disabilities.

3. Report for any VA medical examinations VA determines are necessary to decide your claim.

VA FORM |

21P-527EZ |

SUPERSEDES VA FORM 21P-527EZ, OCT 2018. |

Page 1 |

|

JAN 2021 |

|

|

WHERE TO SEND COMPLETED APPLICATION AND EVIDENCE

When you have completed this application, mail it to the Pension Intake Center listed below. Be sure to attach any materials that support and explain your claim. Also, make a photocopy of your application and all supporting material you submit to

VA before mailing it.

MAIL: Department of Veterans Affairs

Pension Intake Center

P. O. Box 5365

Janesville, WI 53547-5365

The Fully Developed Claim (FDC) Program is the fastest way to get your claim processed, and there is no risk to participate! Participation in the FDC Program is optional and will not affect the quality of care you receive or the benefits to which you are entitled. If you file a claim in the FDC Program and it is determined that other records exist and VA needs the records to decide your claim, then VA will simply remove the claim from the FDC Program (Optional Expedited Process) and process it in the Standard Claim Process. See below for more information. If you wish to file your claim in the FDC Program, see FDC Program (Optional Expedited Process). If you wish to file your claim under the process in which VA traditionally processes claims, see Standard Claim Process.

WHAT YOU NEED TO DO

You must submit all relevant evidence in your possession and provide VA information sufficient to enable it to obtain all relevant evidence not in your possession.

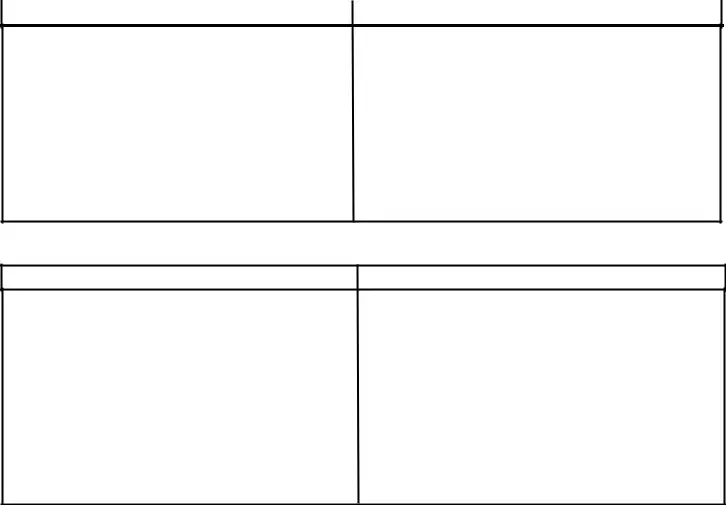

FDC Program (Optional Expedited Process) |

Standard Claim Process |

|

|

You must:

•Submit your claim in accordance with the "FDC Criteria" (see page 1)

You must:

•If you know of evidence not in your possession and want VA to try to get it for you, give VA enough information about the evidence so that we can request it from the person or agency that has it

If the holder of the evidence declines to give it to VA, asks for a fee to provide it, or otherwise cannot get the evidence, VA will notify you and provide you with an opportunity to submit the information or evidence. It is your responsibility to make sure we receive all requested records that are not in the possession of a Federal department or agency.

FDC Program (Optional Expedited Process) |

Standard Claim Process |

|

|

VA will:

•Retrieve relevant records from a Federal facility, such as a VA medical center, that you adequately identify and authorize VA to obtain

•Provide a medical examination for you, or get a medical opinion, if we determine it is necessary to decide your claim

VA will:

• Retrieve relevant records from a Federal facility such as a VA medical center, that you adequately identify and authorize VA to obtain

• Provide a medical examination for you, or get a medical opinion, if we determine it is necessary to decide your claim

• Make every reasonable effort to obtain relevant records not held by a Federal facility that you adequately identify and authorize VA to obtain. These may include records from State or local governments and privately held evidence and information you tell us about, such as private doctor or hospital records or records from current or former employers

VA FORM 21P-527EZ, JAN 2021 |

Page 2 |

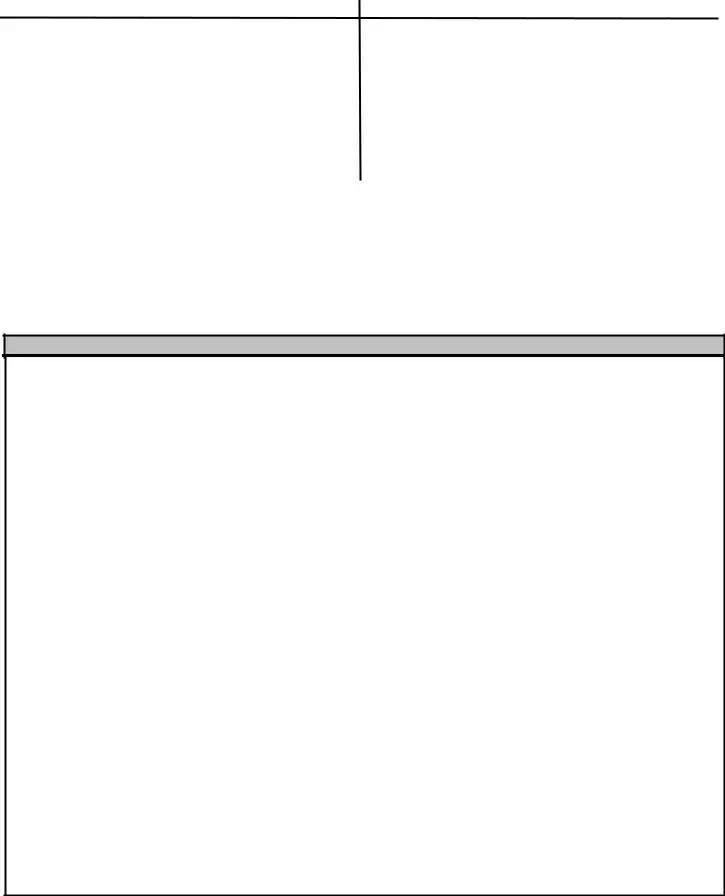

WHEN YOU SHOULD SEND WHAT WE NEED

|

FDC Program (Optional Expedited Process) |

Standard Claim Process |

|

|

You must: |

You are strongly encouraged to: |

|

|

• Send the information and evidence simultaneously with |

|

• Send any information or evidence as soon as you can |

|

|

your claim |

|

|

|

|

If you submit additional information or evidence after you |

You have up to one year from the date we receive the claim to |

|

|

submit your "fully developed" claim, then VA will remove the |

submit the information and evidence necessary to support your |

|

|

claim from the FDC Program Expedited Process and process |

claim. If we decide the claim before one year from the date we |

|

|

it in the Standard Claim Process. If we decide your claim before |

receive the claim, you will still have the remainder of the one |

|

|

one year from the date we receive the claim, you will still have |

year period to submit additional information or evidence |

|

|

the remainder of the one-year period to submit additional |

necessary to support the claim. |

|

|

information or evidence necessary to support the claim. |

|

|

|

|

|

|

|

WHAT THE EVIDENCE MUST SHOW TO SUPPORT YOUR CLAIM |

|

|

|

|

|

|

If you are claiming... |

|

See the evidence table titled... |

|

Veterans Pension (a needs-based benefit) |

|

Veterans Pension |

|

Special Monthly Pension |

|

Veterans Pension with Special Monthly Pension |

|

|

|

|

|

Benefits because your child is severely disabled |

|

Child Incapable of self-support |

|

|

|

|

|

EVIDENCE TABLES

Veterans Pension

To support a claim for veterans pension, the evidence must show:

1.You met certain minimum active service requirements during a period of war. Generally, those requirements are:

•90 days of service during a period of war; OR

•90 days of consecutive service at least one day of which was during a period of war; OR

•90 days of combined service during more than one period of war:

(Note: If your service began after September 7, 1980, additional length of service requirements may apply, typically requiring two years of continuous service or completion of active-duty obligation)

• OR, any length of active service during a period of war with a discharge due to a service-connected disability

2. You are age 65 or older or are permanently and totally disabled. Your disability or disabilities do not have to be related to your military service. You are considered permanently and totally disabled if medical evidence shows you are:

• A patient in a nursing home for long-term care or medical foster home; OR

• Receiving Social Security disability benefits; OR

• Unemployable due to a disability reasonably certain to continue throughout your lifetime; OR

• Suffering from a disability that is reasonably certain to continue throughout your lifetime that would make it impossible for an average person to follow a substantially gainful occupation; OR

• Suffering from a disease or disorder that VA determines causes persons who have that disease or disorder to be permanently and totally disabled

3. Your income and assets are within established limits. You must report income and assets for:

• Yourself

• Your spouse (unless you live apart and you are estranged and you do not contribute to your spouse's support)

• Your child (unless custody has been legally removed by a court and you do not contribute to your child's support or the child's income is not reasonably available to you).

Assets means the fair market value of all property that an individual owns, including all real and personal property (excluding the value of the primary residence including the residential lot area, not to exceed 2 acres) less the amount of mortgages or other encumbrances specific to the mortgaged or encumbered property). Personal property means the value of personal effects that are in excess of being suitable and consistent with a reasonable mode of life.

VA FORM 21P-527EZ, JAN 2021 |

Page 3 |

EVIDENCE TABLES (Continued)

Veterans Pension with Special Monthly Pension

To support a claim for increased pension eligibility based on the need for aid and attendance, the evidence must show:

• You have corrected visual acuity of 5/200 or less in both eyes; OR

• You have concentric contraction of the visual field to 5 degrees or less; OR

• You are a patient in a nursing home due to mental or physical incapacity; OR

• You need the aid of another person to perform activities of daily living (ADLs), such as bathing or showering, dressing, eating, toileting, and transferring (e.g. getting in and out of bed); OR

• You require regular supervision because you are unsafe if you are left alone due to a mental disorder, OR

• You are bedridden, in that your disability requires that you remain in bed apart from any prescribed course of convalescence or treatment.

To support your claim for increased pension eligibility based on being housebound, the evidence must show:

•You have a single permanent disability evaluated as 100 percent disabling; AND due to such disability, you are permanently and substantially confined to your immediate premises; OR

•You have a single permanent disability evaluated as 100 percent disabled, AND you have an additional disability or disabilities rated 60 percent or higher.

Child Incapable of Self-Support

To support a claim for benefits based on a veteran's child being incapable of self-support, the evidence must show that the child, before his or her 18th birthday, became permanently incapable of self-support due to a mental or physical disability.

IMPORTANT

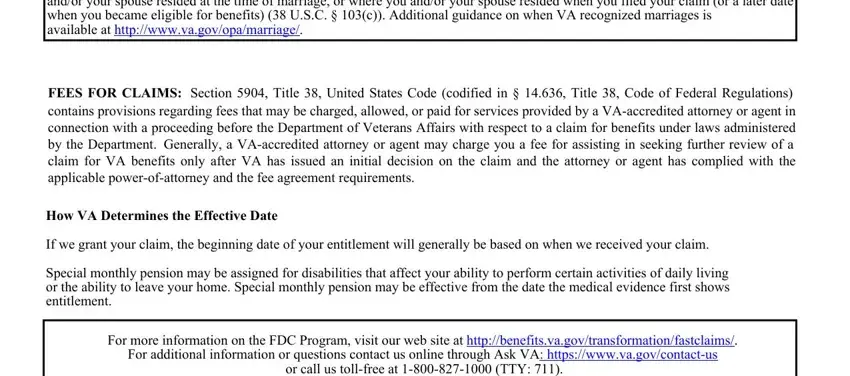

If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you became eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognized marriages is

available at http://www.va.gov/opa/marriage/.

FEES FOR CLAIMS: Section 5904, Title 38, United States Code (codified in § 14.636, Title 38, Code of Federal Regulations) contains provisions regarding fees that may be charged, allowed, or paid for services provided by a VA-accredited attorney or agent in connection with a proceeding before the Department of Veterans Affairs with respect to a claim for benefits under laws administered by the Department. Generally, a VA-accredited attorney or agent may charge you a fee for assisting in seeking further review of a claim for VA benefits only after VA has issued an initial decision on the claim and the attorney or agent has complied with the applicable power-of-attorney and the fee agreement requirements.

How VA Determines the Effective Date

If we grant your claim, the beginning date of your entitlement will generally be based on when we received your claim.

Special monthly pension may be assigned for disabilities that affect your ability to perform certain activities of daily living or the ability to leave your home. Special monthly pension may be effective from the date the medical evidence first shows entitlement.

For more information on the FDC Program, visit our web site at http://benefits.va.gov/transformation/fastclaims/.

For additional information or questions contact us online through Ask VA: https://www.va.gov/contact-us

or call us toll-free at 1-800-827-1000 (TTY: 711). VA forms are available at www.va.gov/vaforms.

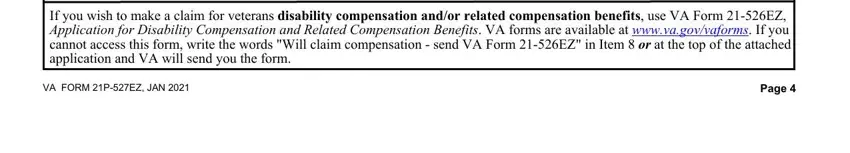

IMPORTANT

If you wish to make a claim for veterans disability compensation and/or related compensation benefits, use VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits. VA forms are available at www.va.gov/vaforms. If you cannot access this form, write the words "Will claim compensation - send VA Form 21-526EZ" in Item 8 or at the top of the attached application and VA will send you the form.

VA FORM 21P-527EZ, JAN 2021 |

Page 4 |

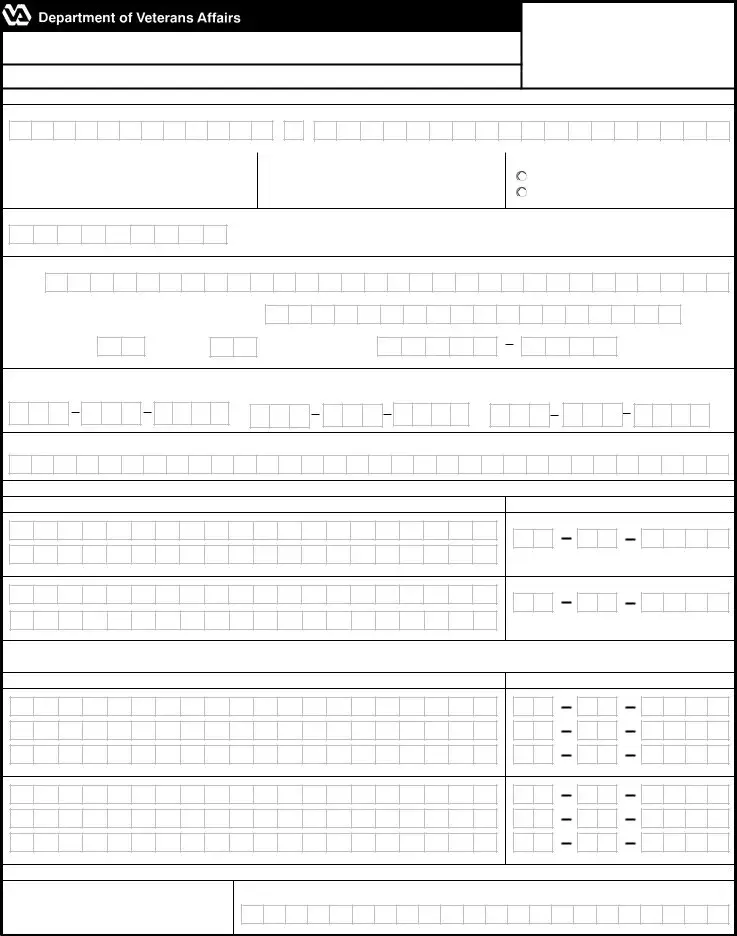

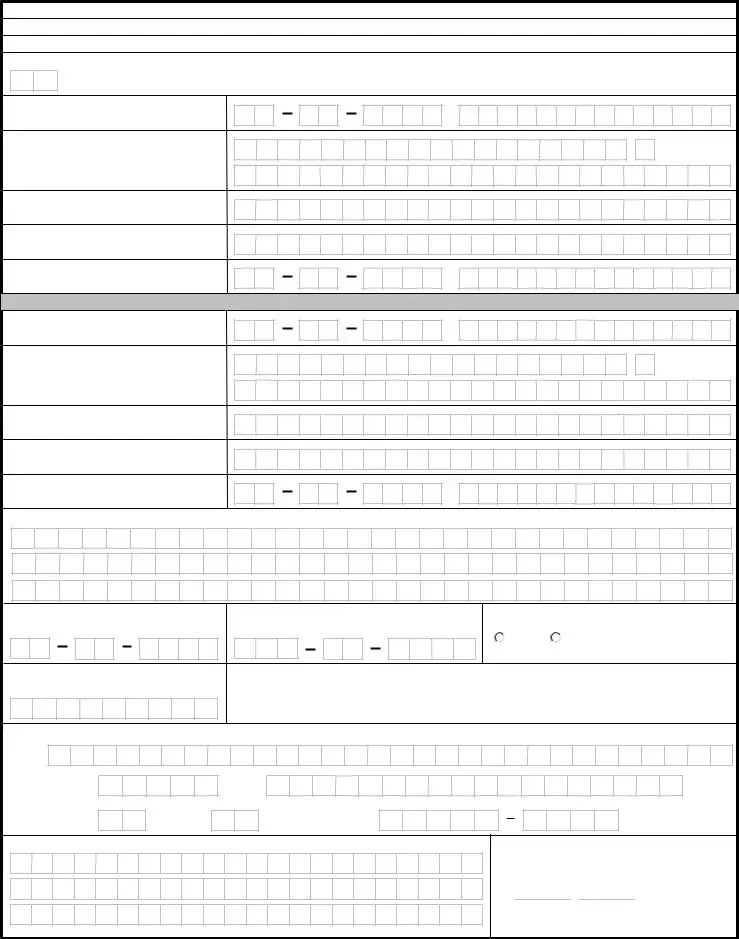

OMB Control No. 2900-0002

Respondent Burden: 25 minutes

Expiration Date: 01/31/2023

VA DATE STAMP

(DO NOT WRITE IN THIS SPACE)

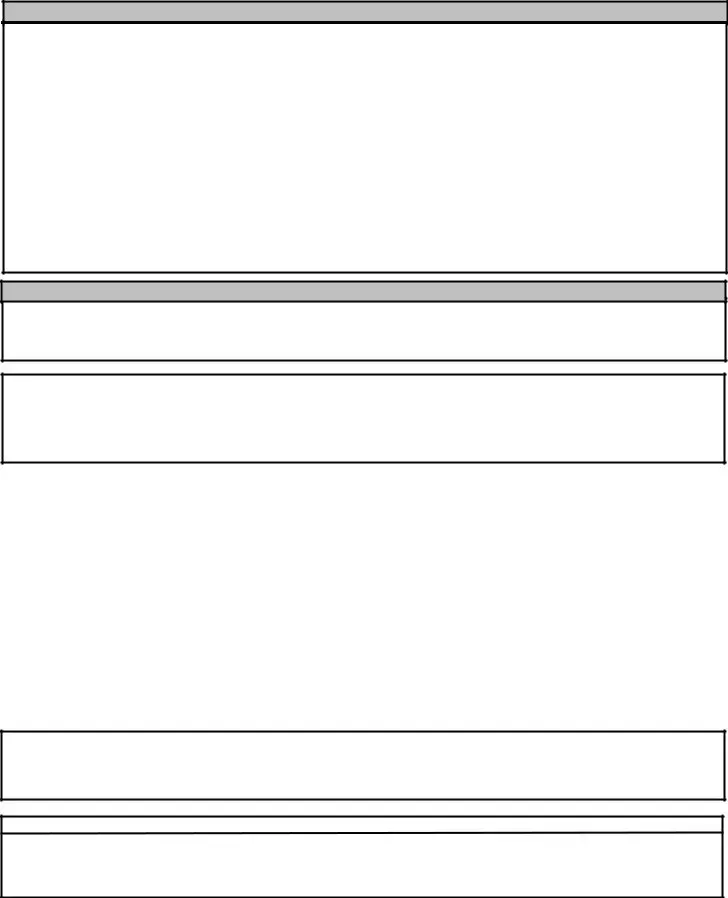

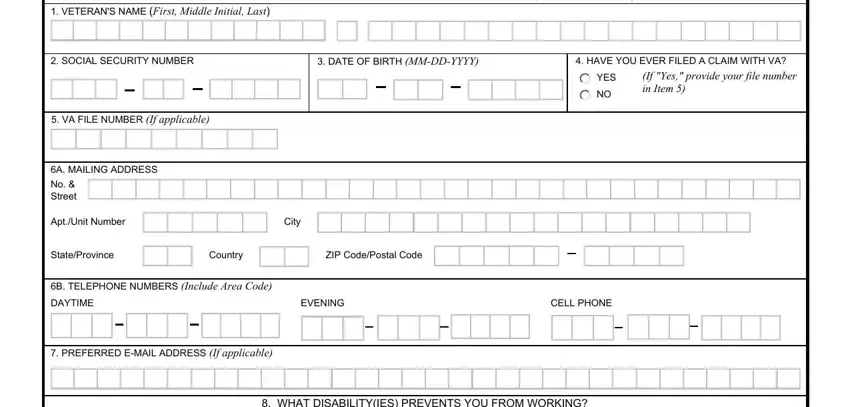

APPLICATION FOR VETERANS PENSION

IMPORTANT: Please read the Privacy Act and Respondent Burden on page 12 before completing the form.

SECTION I: VETERAN'S PERSONAL INFORMATION (MUST COMPLETE)

1.VETERAN'S NAME (First, Middle Initial, Last)

|

2. SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

3. DATE OF BIRTH (MM-DD-YYYY) |

4. HAVE YOU EVER FILED A CLAIM WITH VA? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

(If "Yes," provide your file number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO |

in Item 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.VA FILE NUMBER (If applicable)

6A. MAILING ADDRESS

No. &

Street

6B. TELEPHONE NUMBERS (Include Area Code) |

|

|

DAYTIME |

EVENING |

CELL PHONE |

7.PREFERRED E-MAIL ADDRESS (If applicable)

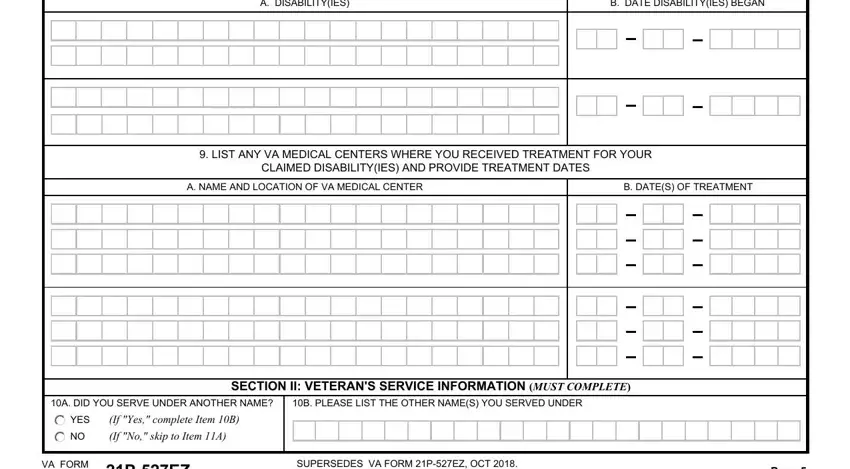

8.WHAT DISABILITY(IES) PREVENTS YOU FROM WORKING?

B. DATE DISABILITY(IES) BEGAN

9.LIST ANY VA MEDICAL CENTERS WHERE YOU RECEIVED TREATMENT FOR YOUR CLAIMED DISABILITY(IES) AND PROVIDE TREATMENT DATES

A. NAME AND LOCATION OF VA MEDICAL CENTER

SECTION II: VETERAN'S SERVICE INFORMATION (MUST COMPLETE)

10A. DID YOU SERVE UNDER ANOTHER NAME?

YES (If "Yes," complete Item 10B)

YES (If "Yes," complete Item 10B)

NO (If "No," skip to Item 11A)

NO (If "No," skip to Item 11A)

10B. PLEASE LIST THE OTHER NAME(S) YOU SERVED UNDER

VA FORM |

21P-527EZ |

SUPERSEDES VA FORM 21P-527EZ, OCT 2018. |

Page 5 |

JAN 2021 |

|

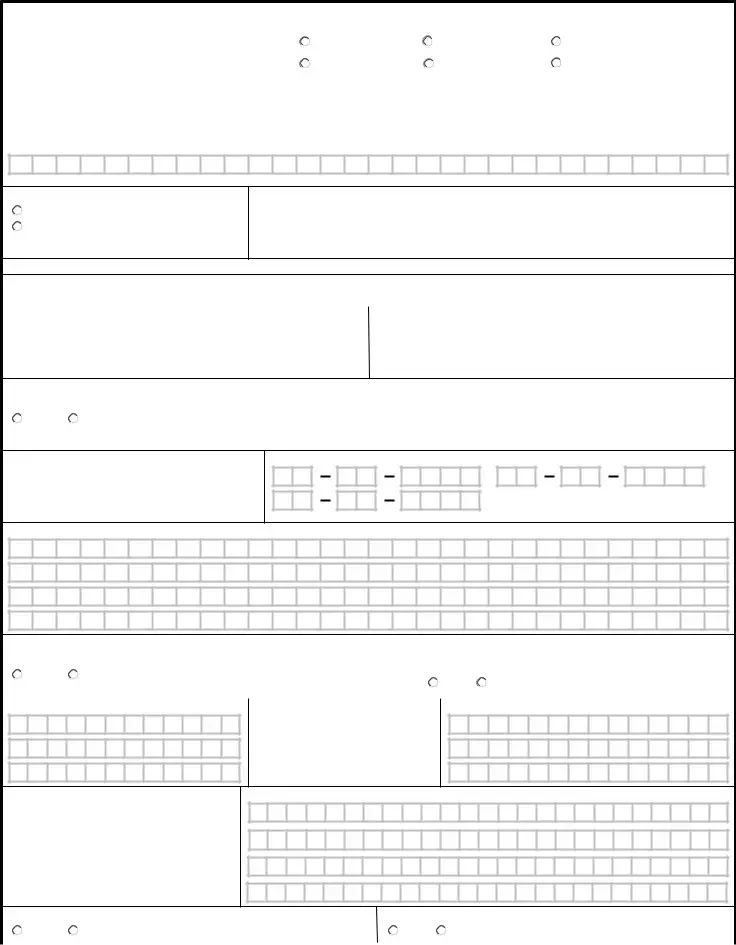

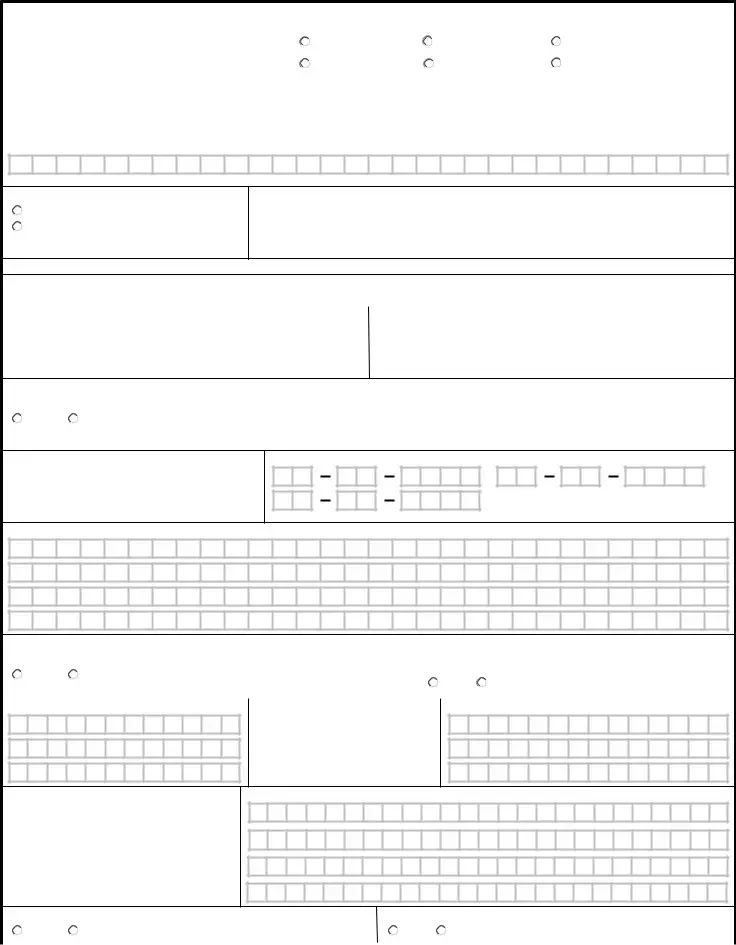

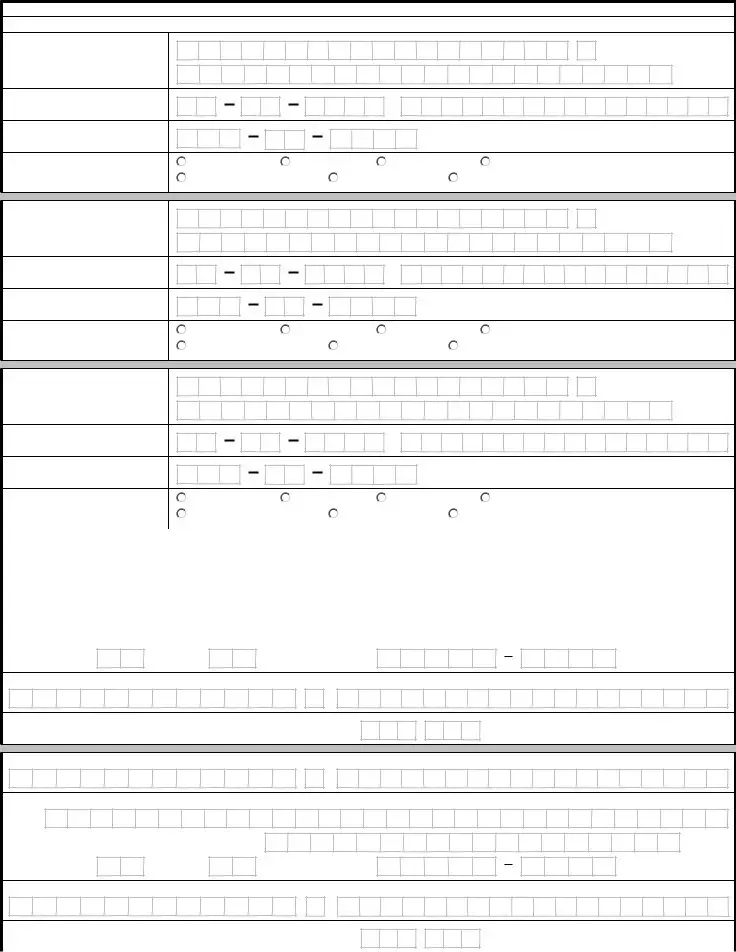

SECTION II: VETERAN'S SERVICE INFORMATION (MUST COMPLETE) (CONTINUED)

|

11A. I ENTERED ACTIVE SERVICE ON (MM-DD-YYYY) |

|

11B. BRANCH OF SERVICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARMY |

NAVY |

|

|

MARINE CORPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AIR FORCE |

COAST GUARD |

|

|

SPACE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11C. RELEASE DATE FROM ACTIVE SERVICE (MM-DD-YYYY) |

|

11D. SERVICE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11E. PLACE OF LAST SEPARATION

12A. HAVE YOU EVER BEEN A PRISONER OF WAR? |

12B. DATES OF CONFINEMENT ON (MM-DD-YYYY) |

YES |

(If "Yes," complete Item 12B) |

From: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO |

(If "No," skip to Item 13A) |

To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION III: VETERAN'S DISABILITY(IES) AND BACKGROUND (MUST COMPLETE)

NOTE: You do not have to submit medical evidence or list disabilities if you are age 65 or older, unless you are housebound, or require the regular assistance of another person.

|

13A. WHAT DISABILITY(IES) PREVENT YOU FROM WORKING? |

|

13B. WHEN DID THE DISABILITY(IES) BEGIN? (MM-DD-YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14A. ARE YOU CLAIMING SPECIAL MONTHLY PENSION BECAUSE YOU NEED THE REGULAR ASSISTANCE OF ANOTHER PERSON, HAVE SEVERE VISUAL PROBLEMS, OR ARE GENERALLY CONFINED TO YOUR IMMEDIATE PREMISES?

YES |

NO |

(If "Yes," complete and attach with this application, VA Form 21-2680, Exam for Housebound Status or Permanent Need for Regular Aid |

|

|

and Attendance. Please make sure every box is complete and signed by a Physician, Physician Assistant (PA), Certified Nurse Practitioner |

|

|

(CNP), or Clinical Nurse Specialist (CNS.)) |

14B. ARE YOU NOW OR HAVE YOU RECENTLY BEEN HOSPITALIZED OR GIVEN OUTPATIENT OR HOME CARE DUE TO THE DISABILITY(IES) LISTED IN ITEM 13A?

YES

YES  NO

NO

15A. DATE(S) OF RECENT HOSPITALIZATION OR CARE (MM-DD-YYYY)

15B. NAME AND MAILING ADDRESS OF FACILITY OR DOCTOR

NOTE: In the table below, tell us about all of your employment, including self-employment, for one year before you became disabled to the present.

16A. ARE YOU NOW EMPLOYED? |

|

16B. WHEN DID YOU LAST WORK? (MM-DD-YYYY) |

16C. WERE YOU SELF-EMPLOYED BEFORE BECOMING TOTALLY |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DISABLED? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO (If "Yes," complete Items 16D and 16E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16D. WHAT KIND OF WORK DID YOU DO?

16E. ARE YOU STILL SELF-EMPLOYED?

YES

YES  NO

NO

(If "Yes," complete Item 16F)

16F. WHAT KIND OF WORK DO YOU DO NOW?

17A. ARE YOU NOW IN A NURSING HOME?

YES

YES  NO

NO

(If "Yes," complete Items 17B and 17C and submit a statement from an official of the nursing home that tells us that you are a patient in the nursing home because of a physical or mental disability. The statement should include the monthly charge you are paying out-of-pocket for your care.)

17B. WHAT IS THE NAME AND COMPLETE MAILING ADDRESS OF THE FACILITY?

17C. DOES MEDICAID COVER ALL OR PART OF YOUR NURSING HOME COSTS? |

17D. HAVE YOU APPLIED FOR MEDICAID? |

YES |

NO (If "No," complete Item 17D) |

YES |

NO |

|

|

|

VA FORM 21P-527EZ, JAN 2021 |

|

Page 6 |

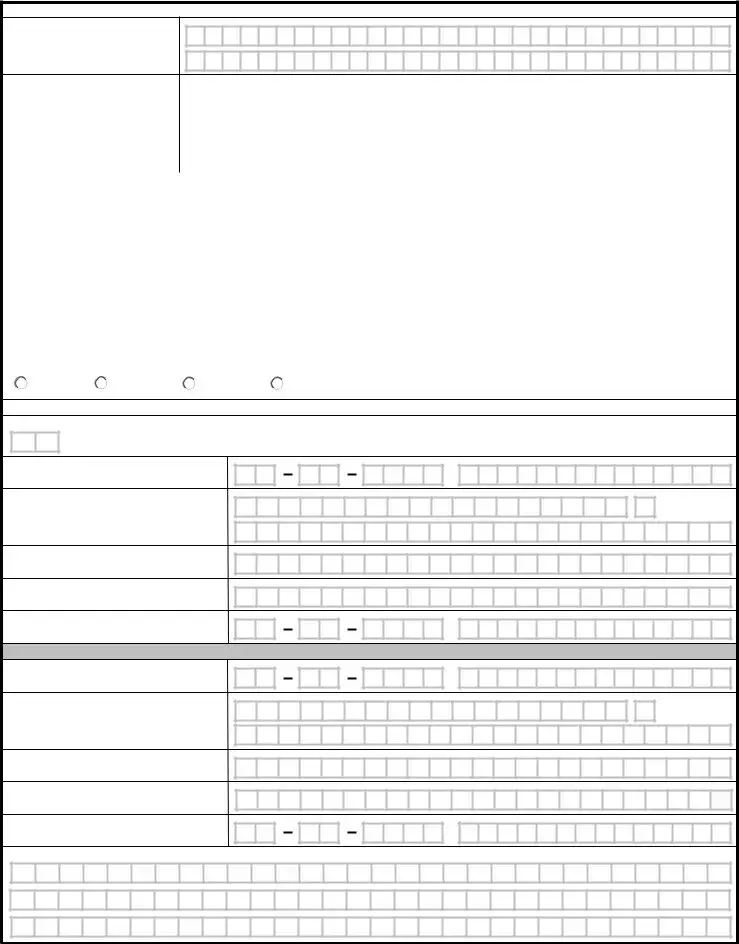

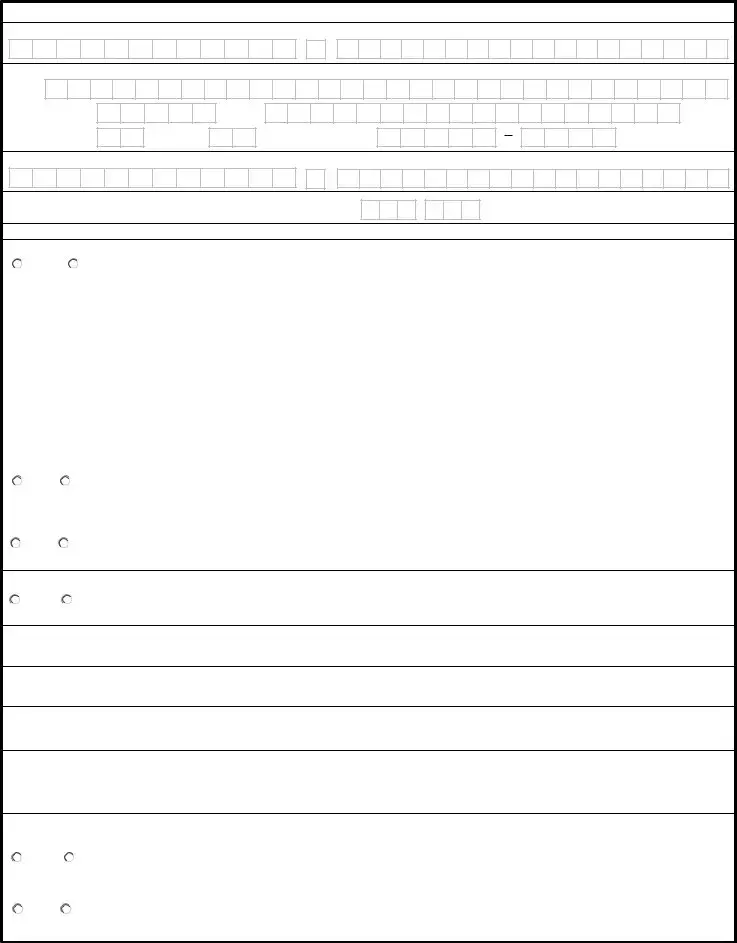

SECTION III: VETERAN'S DISABILITY(IES) AND BACKGROUND (MUST COMPLETE) (CONTINUED)

18A. WHAT WAS THE NAME AND ADDRESS OF YOUR EMPLOYER?

|

18B. WHAT WAS YOUR JOB TITLE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18C. WHEN DID YOUR JOB BEGIN? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18E. HOW MANY DAYS WERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOST DUE TO DISABILITY? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18D. WHEN DID YOUR JOB END? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18F. WHAT WERE YOUR TOTAL |

$ |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL EARNINGS? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18A. WHAT WAS THE NAME AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF YOUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18B. WHAT WAS YOUR JOB TITLE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18C. WHEN DID YOUR JOB BEGIN? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18E. HOW MANY DAYS WERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOST DUE TO DISABILITY? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18D. WHEN DID YOUR JOB END? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18F. WHAT WERE YOUR TOTAL |

$ |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL EARNINGS? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION IV: MARITAL STATUS (MUST COMPLETE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19A. WHAT IS YOUR MARITAL STATUS? (Check one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARRIED |

DIVORCED |

|

WIDOWED |

|

|

NEVER MARRIED (Skip to Section VI if never married) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELL US ABOUT YOUR MARRIAGE/PREVIOUS MARRIAGES

19B. HOW MANY TIMES HAVE YOU BEEN MARRIED? (Including current marriage)

20A. DATE (MM-DD-YYYY) AND PLACE OF MARRIAGE (City and State or Country)

20B. TO WHOM MARRIED

(First, Middle, Last Name)

20C. TYPE OF MARRIAGE (Ceremonial,

Common-Law, Proxy, Tribal, or Other)

20D. HOW MARRIAGE ENDED (Death, Divorce,

Marriage Has Not Ended)

20E. DATE (MM-DD-YYYY) AND PLACE MARRIAGE ENDED (City and State or Country)

20A. DATE (MM-DD-YYYY) AND PLACE OF MARRIAGE (City and State or Country)

20B. TO WHOM MARRIED

(First, Middle, Last Name)

20C. TYPE OF MARRIAGE (Ceremonial,

Common-Law, Proxy, Tribal, or Other)

20D. HOW MARRIAGE ENDED (Death, Divorce,

Marriage Has Not Ended)

20E. DATE (MM-DD-YYYY) AND PLACE MARRIAGE ENDED (City and State or Country)

20F. IF YOU INDICATED "OTHER" AS TYPE OF MARRIAGE IN ITEM 20C, PLEASE EXPLAIN:

VA FORM 21P-527EZ, JAN 2021 |

Page 7 |

SECTION V: CURRENT MARITAL INFORMATION (COMPLETE ONLY IF YOU ARE CURRENTLY MARRIED) Note - Skip to Section VI if not currently married.

TELL US ABOUT YOUR SPOUSE'S MARRIAGE/PREVIOUS MARRIAGES

21. HOW MANY TIMES HAS YOUR SPOUSE BEEN MARRIED? (Including current marriage)

22A. DATE (MM-DD-YYYY) AND PLACE OF MARRIAGE (City and State or Country)

22B. TO WHOM MARRIED

(First, Middle, Last Name)

22C. TYPE OF MARRIAGE (Ceremonial,

Common-Law, Proxy, Tribal, or Other)

22D. HOW MARRIAGE ENDED (Death, Divorce,

Marriage Has Not Ended)

22E. DATE (MM-DD-YYYY) AND PLACE MARRIAGE ENDED (City and State or Country)

22A. DATE (MM-DD-YYYY) AND PLACE OF MARRIAGE (City and State or Country)

22B. TO WHOM MARRIED

(First, Middle, Last Name)

22C. TYPE OF MARRIAGE (Ceremonial,

Common-Law, Proxy, Tribal, or Other)

22D. HOW MARRIAGE ENDED (Death, Divorce,

Marriage Has Not Ended)

22E. DATE (MM-DD-YYYY) AND PLACE MARRIAGE ENDED (City and State or Country)

22F. IF YOU INDICATED "OTHER" AS TYPE OF MARRIAGE IN ITEM 22C, PLEASE EXPLAIN:

23A. WHAT IS YOUR SPOUSE'S DATE OF BIRTH? (MM-DD-YYYY)

23D. WHAT IS YOUR SPOUSE'S VA FILE NUMBER (If any)?

23B. WHAT IS YOUR SPOUSE'S SOCIAL SECURITY NUMBER?

23E. DO YOU LIVE WITH YOUR SPOUSE?

YES

YES  NO (If "Yes," skip to Section VI) (If "No," complete Items 23F, 23G and 23H)

NO (If "Yes," skip to Section VI) (If "No," complete Items 23F, 23G and 23H)

23C. IS YOUR SPOUSE ALSO A VETERAN?

YES |

NO (If "Yes," complete Item 23D) |

23F. WHAT IS YOUR SPOUSE'S ADDRESS? (Number and street or rural route, P.O. Box, City, State, ZIP Code and Country)

No. &

Street

Apt./Unit Number

23G. TELL US THE REASON YOU ARE NOT LIVING WITH YOUR SPOUSE (i.e.; illness, work, etc.)

23H. HOW MUCH DO YOU CONTRIBUTE MONTHLY TO YOUR SPOUSE'S SUPPORT?

$  ,

,  .00

.00

VA FORM 21P-527EZ, JAN 2021 |

Page 8 |

SECTION VI: DEPENDENT CHILDREN (COMPLETE IF YOU HAVE DEPENDENT CHILDREN)

Note - Skip to Section VII if you have no dependent children.

24A. NAME OF DEPENDENT CHILD

(First, Middle initial, Last)

24B. DATE AND PLACE OF BIRTH

(City and State or Country)

24C. SOCIAL SECURITY NUMBER

|

|

|

|

|

|

|

|

|

(Check all that apply) |

24D. BIOLOGICAL |

24E. ADOPTED |

24F. STEPCHILD |

24G. 18-23 YEARS OLD (in school) |

|

24H. SERIOUSLY DISABLED |

24I. CHILD MARRIED |

24J. CHILD PREVIOUSLY MARRIED |

|

|

24A. NAME OF DEPENDENT CHILD

(First, Middle initial, Last)

24B. DATE AND PLACE OF BIRTH

(City and State or Country)

24C. SOCIAL SECURITY NUMBER

|

|

|

|

|

|

|

|

|

(Check all that apply) |

24D. BIOLOGICAL |

24E. ADOPTED |

24F. STEPCHILD |

24G. 18-23 YEARS OLD (in school) |

|

24H. SERIOUSLY DISABLED |

24I. CHILD MARRIED |

24J. CHILD PREVIOUSLY MARRIED |

|

|

24A. NAME OF DEPENDENT CHILD

(First, Middle initial, Last)

24B. DATE AND PLACE OF BIRTH

(City and State or Country)

24C. SOCIAL SECURITY NUMBER

|

|

(Check all that apply) |

|

|

|

|

|

24D. BIOLOGICAL |

24E. ADOPTED |

|

24F. STEPCHILD |

|

|

|

|

24G. 18-23 YEARS OLD (in school) |

|

|

|

|

|

|

|

24H. SERIOUSLY DISABLED |

|

|

|

24I. CHILD MARRIED |

|

|

24J. CHILD PREVIOUSLY MARRIED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note - In Items 25A through 25D, tell us about the children listed in Item 24A who do not live with you. |

|

25A. NAME OF DEPENDENT CHILD (First, middle initial, last) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25B. CHILD'S COMPLETE ADDRESS (Number and street or rural route, city or P.O., city, State, ZIP Code and country) |

No. & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt./Unit Number |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25C. NAME OF PERSON THE CHILD LIVES WITH (If applicable) (First, middle initial, last)

25D. MONTHLY AMOUNT YOU CONTRIBUTE TO THE CHILD'S SUPPORT $

25A. NAME OF DEPENDENT CHILD (First, middle initial, last)

25B. CHILD'S COMPLETE ADDRESS (Number and street or rural route, city or P.O., city, State, ZIP Code and country)

No. &

Street

25C. NAME OF PERSON THE CHILD LIVES WITH (If applicable) (First, middle initial, last)

25D. MONTHLY AMOUNT YOU CONTRIBUTE TO THE CHILD'S SUPPORT $

VA FORM 21P-527EZ, JAN 2021 |

Page 9 |

SECTION VI: DEPENDENT CHILDREN (COMPLETE IF YOU HAVE DEPENDENT CHILDREN) (CONTINUED)

25A. NAME OF DEPENDENT CHILD (First, middle initial, last)

25B. CHILD'S COMPLETE ADDRESS (Number and street or rural route, city or P.O., city, State, ZIP Code and country)

No. &

Street

Apt./Unit Number

State/Province

City

ZIP Code/Postal Code

25C. NAME OF PERSON THE CHILD LIVES WITH (If applicable) (First, middle initial, last)

25D. MONTHLY AMOUNT YOU CONTRIBUTE TO THE CHILD'S SUPPORT $

SECTION VII: QUESTIONS REGARDING INCOME AND ASSETS (If you need more space, attach a separate sheet.)

26. DO YOU OR YOUR DEPENDENTS RECEIVE SOCIAL SECURITY BENEFITS?

|

|

YES |

|

NO (If "Yes," complete Items A and B) (If "No," skip to Item 27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. SOCIAL SECURITY RECIPIENT (First, middle initial, last) |

B. GROSS MONTHLY AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

, |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

, |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

, |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

, |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

, |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. DO YOU OR YOUR DEPENDENTS OWN YOUR/YOUR FAMILY'S PRIMARY RESIDENCE? |

|

|

|

|

|

YES |

NO (If "Yes," complete Items 28A and 28B) |

(If "No," skip to Item 29A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28A. IS THE SIZE OF THE LOT ON WHICH THE PRIMARY |

|

28B. IF PRIMARY RESIDENCE SITS ON A LOT OVER 2 ACRES (87,120 SQ FT), WHAT IS |

RESIDENCE SITS, OVER 2 ACRES (87,120 SQ FT)? |

|

THE VALUE OF LAND OVER 2 ACRES? |

|

YES |

NO |

(If "Yes," complete Items 28B and 28C) (If |

|

$ |

|

|

|

, |

|

|

|

.00 |

(Do not include the value of the residence or the first |

|

|

|

|

|

|

|

"No," skip to Item 29A.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 acres.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

28C. IS THE LAND OVER 2 ACRES (87,120 SQ FT) LISTED IN ITEM 28B MARKETABLE? |

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: VA matches income information reported with Federal tax information. Report all income you and your dependents receive on the appropriate sections of this form and VA Form 21P-0969, Income and Asset Statement, if appropriate.

29A. OTHER THAN SOCIAL SECURITY, DO YOU OR YOUR DEPENDENTS RECEIVE ANY INCOME?

YES

YES  NO

NO

29B. OTHER THAN SOCIAL SECURITY, DID YOU OR YOUR DEPENDENTS RECEIVE ANY INCOME LAST YEAR?

YES

YES  NO

NO

29C. DO YOU OR YOUR DEPENDENTS HAVE MORE THAN $10,000 IN ASSETS? (Note: Assets are all the money and property you or your dependents own. Assets do not include your/your family's primary residence or personal effects such as appliances and vehicles you or your dependents need for transportation).

YES

YES  NO

NO

29D. IN THE THREE CALENDAR YEARS BEFORE THIS YEAR, DID YOU OR YOUR DEPENDENTS TRANSFER ANY ASSETS? (Examples of asset transfers include

giving them away, selling them, purchasing an annuity, or using them to establish a trust.)

YES |

NO |

|

|

29E. DID YOU ANSWER "YES" TO ANY OF THE ITEMS IN 29A - 29D? |

YES |

NO |

(If "Yes," you must also complete VA Form 21P-0969, Income and Asset Statement) |

VA FORM 21P-527EZ, JAN 2021 |

Page 10 |

YES

YES  NO

NO YES

YES  NO

NO YES

YES  NO

NO

,

,  .00

.00

YES

YES  NO

NO YES

YES  NO

NO YES

YES  NO

NO