You could fill out trec seller financing addendum effectively using our PDF editor online. Our tool is consistently evolving to provide the very best user experience attainable, and that's because of our commitment to continual development and listening closely to feedback from customers. With a few basic steps, you may begin your PDF editing:

Step 1: Hit the "Get Form" button above on this page to open our tool.

Step 2: This editor will give you the opportunity to modify your PDF in many different ways. Change it by adding customized text, adjust existing content, and put in a signature - all when you need it!

This document requires particular info to be filled in, therefore be sure you take the time to enter what is required:

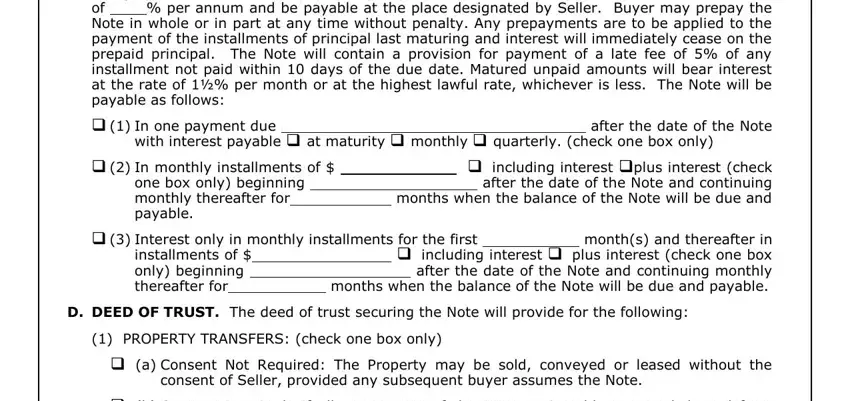

1. It is advisable to complete the trec seller financing addendum accurately, therefore be attentive while filling out the segments including all of these blank fields:

2. Once your current task is complete, take the next step – fill out all of these fields - C PROMISSORY NOTE The promissory, with interest payable at maturity, In monthly installments of , Interest only in monthly, D DEED OF TRUST The deed of trust, PROPERTY TRANSFERS check one box, a Consent Not Required The, consent of Seller provided any, and b Consent Required If all or any with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

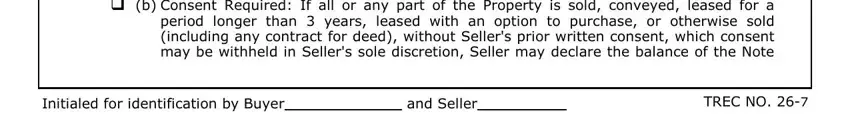

3. This third step is pretty uncomplicated, b Consent Required If all or any, Initialed for identification by, and TREC NO - all of these fields must be filled in here.

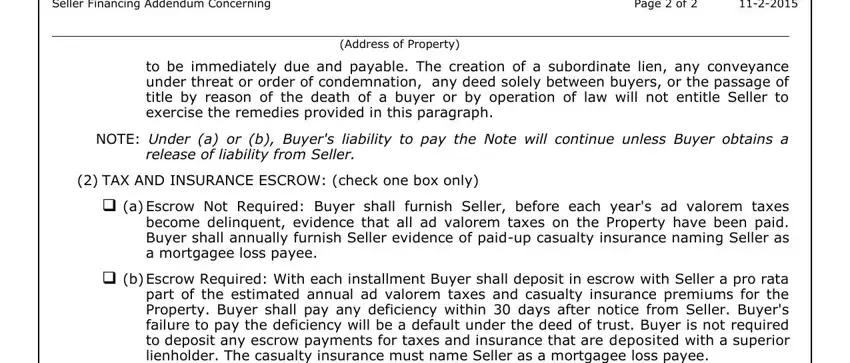

4. This next section requires some additional information. Ensure you complete all the necessary fields - Seller Financing Addendum, Page of , Address of Property, to be immediately due and payable, NOTE Under a or b Buyers liability, release of liability from Seller, TAX AND INSURANCE ESCROW check, a Escrow Not Required Buyer shall, become delinquent evidence that, and b Escrow Required With each - to proceed further in your process!

It's easy to make errors while filling out your release of liability from Seller, consequently you'll want to go through it again before you send it in.

5. To finish your form, the final subsection requires some extra blank fields. Filling out Buyer, Buyer, Seller, and Seller should wrap up the process and you'll be done in no time!

Step 3: Make sure the details are right and press "Done" to complete the project. Join FormsPal now and immediately access trec seller financing addendum, available for download. All changes you make are kept , which means you can change the form at a later point as needed. FormsPal guarantees your information confidentiality by using a protected system that never records or shares any type of sensitive information involved. Be confident knowing your documents are kept safe whenever you use our editor!