The North Carolina state income tax form is known as the 405 Nc form. This document is used by taxpayers to file their state income taxes each year. The form is relatively straightforward, and most taxpayers will be able to complete it with little difficulty. There are a few optional sections that taxpayers may choose to use, depending on their specific tax situation. Completing the 405 Nc form accurately is important, as it can impact the amount of taxes owed or refunded. Taxpayers who need assistance completing the form can consult a tax professional or the North Carolina Department of Revenue website.

| Question | Answer |

|---|---|

| Form Name | 405 Nc Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names |

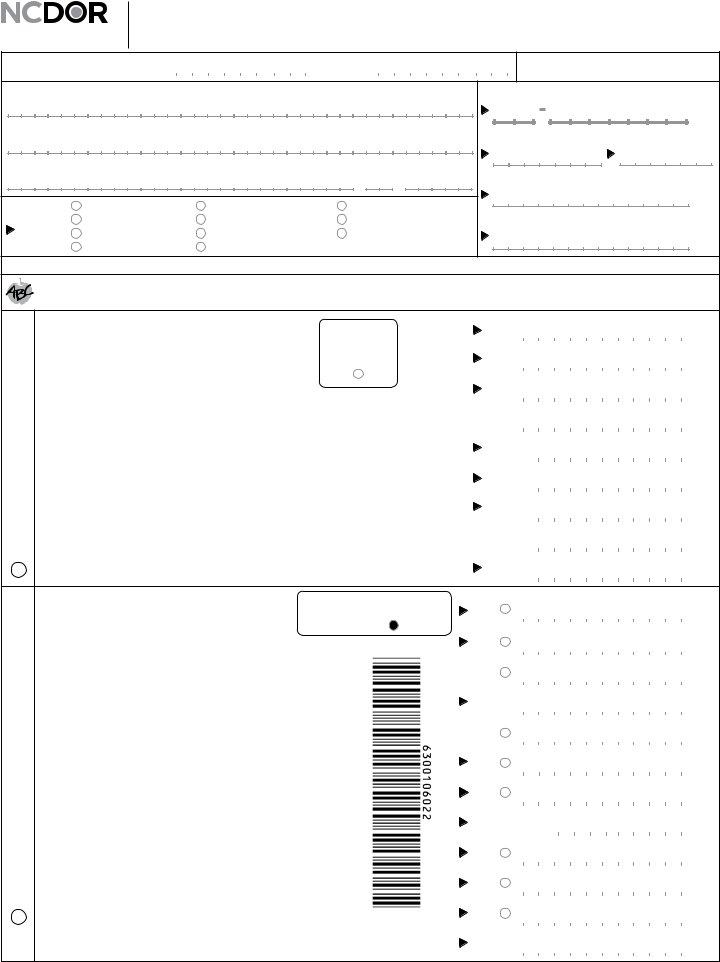

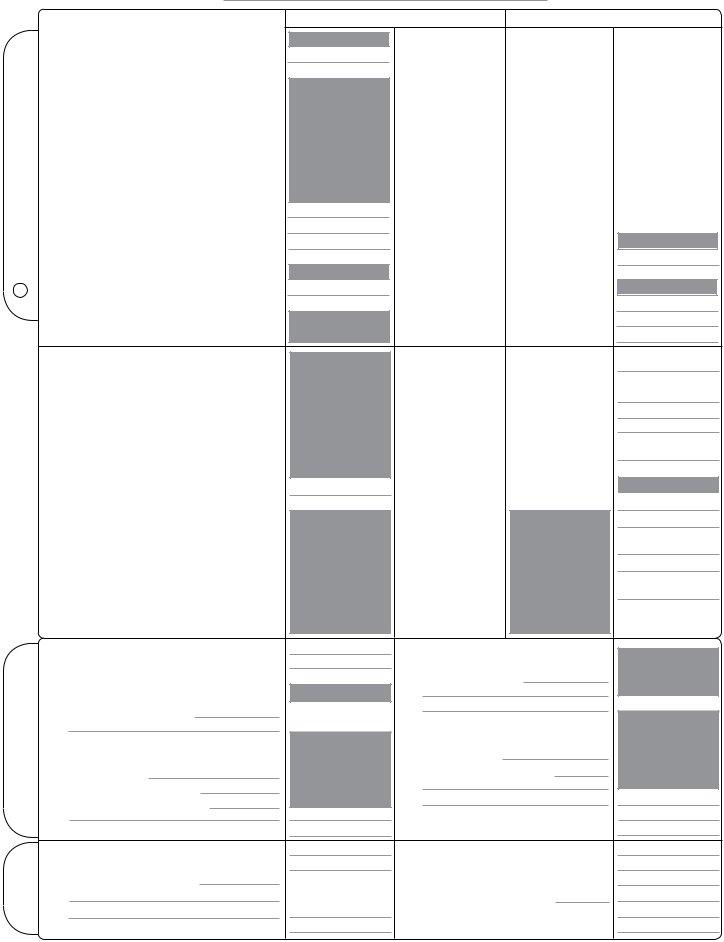

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

Web

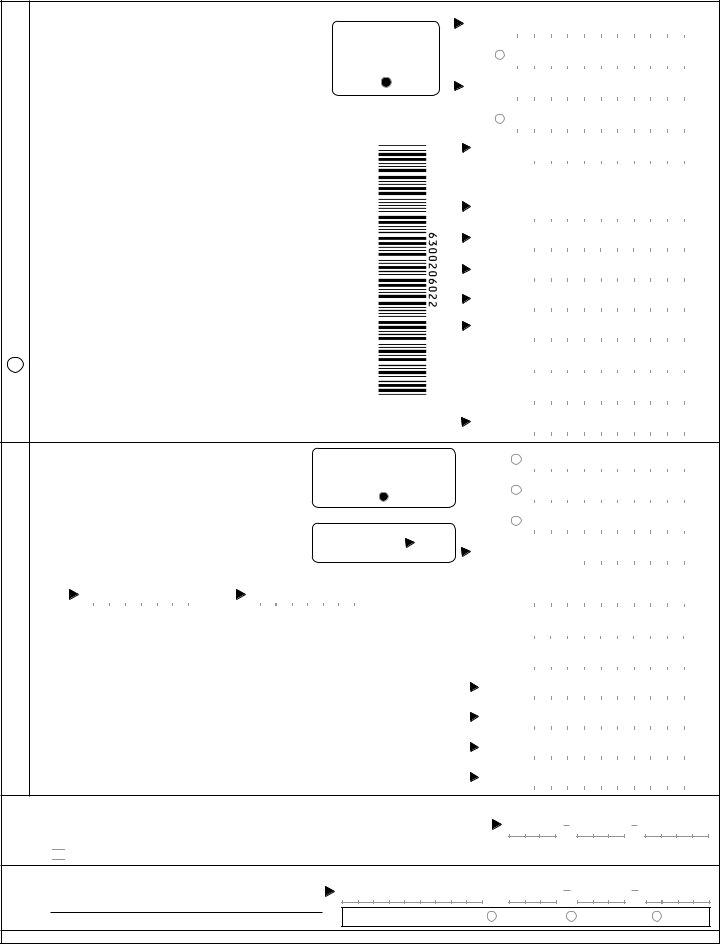

For calendar year 2020 or |

|

|

|

|

|

|

|

|

|

2 0 |

|

and ending |

|

|

|

|

|

|

|

|

|

|

|

DOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use |

|||

other tax year beginning |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Only |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Name (First 35 Characters)(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) |

|

|

Federal Employer ID Number |

|

||||||

Address |

|

|

|

|

Secretary of State ID |

NAICS Code |

|

|||

|

|

|

|

|

|

|||||

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Gross Receipts / Sales |

|

|

|||

|

Initial Return |

Captive REIT |

, |

, |

, |

, |

.00 |

|||

Fill in all |

Final Return |

Tax Exempt |

Total Assets per Balance Sheet |

|

||||||

applicable |

Short Year Return |

Non U.S./Foreign |

Has Escheatable Property |

, |

, |

, |

, |

.00 |

||

circles: |

||||||||||

|

|

|

|

|||||||

|

Amended Return |

Combined Return (Approved Taxpayers Only) |

||||||||

Federal Extension Were you granted an automatic extension to file your 2020 federal income tax return (Form 1120)? Yes No

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or all of your overpayment to the Fund. To make a contribution, enclose Form

To designate your overpayment to the Fund, enter the amount of your designation on Page 2, Line 40. See instructions for information about the Fund.

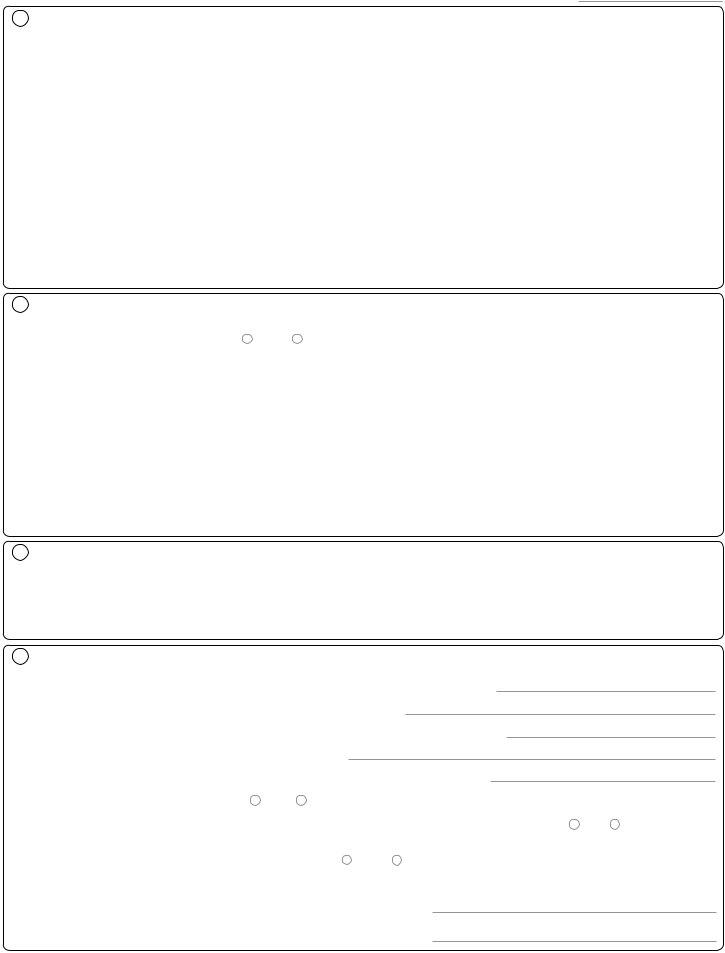

A Computation of Franchise Tax

B Computation of Corporate Income Tax

1. Net Worth |

Holding |

1. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

(From Schedule C, Line 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Company |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2. Investment in N.C. Tangible Property |

Exception |

2. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

(See instructions) |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(From Schedule D, Line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Appraised Value of N.C. Tangible Property |

|

3. |

|

, |

|

|

|

|

|

|

|

|

|

|

.00 |

||||

|

|

|

, |

|

|

|

|

, |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(From Schedule E, Line 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Taxable Amount |

|

4. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Line 1, 2, or 3, whichever is greatest |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5. Total Franchise Tax Due |

|

5. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Multiply Line 4 by .0015 ($1.50 per $1,000.00 - minimum $200.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. Payment with Franchise Tax Extension (From Form |

6. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

When filing an amended return, see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. Tax Credits (From Form |

|

7. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

If a tax credit is taken on Line 7, Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

8. Franchise Tax Due - If the sum of Line 6 plus 7 is less |

8. |

$ |

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

than Line 5, enter difference here and on Page 2, Line 31 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9. Franchise Tax Overpaid - If the sum of Line 6 plus 7 is |

9. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

more than Line 5, enter difference here and on Page 2, Line 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

10. Federal Taxable Income Before NOL |

If amount on Line |

10. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(From Schedule G, Line 30 or Federal Form 1120, |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Line 28 minus 29b) |

Example: |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

||||

11. Adjustments to Federal Taxable Income |

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||

(From Schedule H, Line 5) |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

|||

12. Net Income Before Contributions |

|

12. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||

Add Lines 10 and 11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

13. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

||

13. Contributions to Donees Outside N.C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(From Schedule I, Line 1c) |

|

|

|

|

|

|

|

|

|

|

|

||||||||

14. N.C. Taxable Income |

|

14. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Line 12 minus Line 13 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

|||

15. Nonapportionable Income |

|

15. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||

(From Schedule N, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

|||

16. Apportionable Income |

|

16. |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||

Line 14 minus Line 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|||

17. Apportionment Factor - Enter to four decimal places |

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

||||

(From Schedule O, Part 1; Part 2 - Line 9 or Part 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

18. Income Apportioned to N.C. |

|

18. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Multiply Line 16 by factor on Line 17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19. Nonapportionable Income Allocated to N.C. |

19. |

|

, |

|

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

|

, |

|

|

|

|

, |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(From Schedule N, Line 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. Income Subject to N.C. Tax |

|

20. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Add Lines 18 and 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

21. Percentage Depletion over Cost Depletion on N.C. Property |

21. |

|

|

, |

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(See Instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Page 2,

B Computation of Corporate Income Tax

Tax Due or Refund

Legal Name |

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22. |

State Net Loss (Attach schedule) |

If amount on Line |

22. |

|

|

, |

|

, |

|

, |

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

23 or 25 is negative |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

, |

|

, |

|

, |

|

||||

23. |

Income Before Contributions to N.C. Donees |

fill in circle. |

23. |

|

|

|

|

|

.00 |

|||||||

|

Line 20 minus Lines 21 and 22 |

Example: |

|

|

|

|

|

|||||||||

|

|

|

|

, |

|

, |

|

, |

|

|||||||

24. |

Contributions to N.C. Donees |

|

24. |

|

|

|

|

|

.00 |

|||||||

|

(From Schedule I, Line 2e) |

|

|

|

|

|

|

|||||||||

25. |

Net Taxable Income |

|

25. |

|

|

, |

|

, |

|

, |

|

.00 |

||||

|

|

|

|

|

|

|||||||||||

|

Line 23 minus Line 24 |

|

|

|

|

|

|

|||||||||

26. |

N.C. Net Income Tax |

|

26. |

|

|

|

|

|

, |

|

, |

|

.00 |

|||

|

|

|

|

|

|

|

|

|||||||||

|

Multiply Line 25 by 2.5% |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

27.Payments and Credits

When filing an amended return, see instructions.

|

a. Income Tax Extension |

|

|

|

|

|

|

|

|

|

|

|

27a. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

.00 |

|||||||||

|

(From Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

b. 2020 Estimated Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

27b. |

|

|

|

|

|

, |

|

, |

|

|

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

c. Partnership (If a partnership payment is taken on |

|

|

|

|

|

|

|

|

|

27c. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

|

.00 |

||||||||||

|

Line 27c, a copy of Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

d. Nonresident Withholding |

|

|

|

|

|

|

|

|

|

|

|

27d. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

.00 |

|||||||||

|

(Include copy of 1099 or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

e. Tax Credits (From Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

27e. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

.00 |

||||||||||||

|

If a tax credit is taken on Line 27e, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

28. Add Lines 27a through 27e |

|

|

|

|

|

|

|

|

|

|

|

28. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. |

Income Tax Due - If Line 28 is less than Line 26, enter |

|

|

|

|

|

|

29. |

$ |

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

difference here and on Line 32, below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

30. Income Tax Overpaid - If Line 28 is more than |

|

|

|

|

|

|

|

|

|

30. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Line 26, enter difference here and on Line 32, below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. Franchise Tax Due or Overpayment |

If amount on Line |

31. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

.00 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

(From Schedule A, Line 8 or 9) |

|

|

|

overpayment fill in circle. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

|||||||||||||||||||||

32. Income Tax Due or Overpayment |

|

|

|

|

Example: |

32. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

(From Schedule B, Line 29 or 30) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

33. Balance of Tax Due or Overpayment |

|

|

|

|

|

|

|

|

|

33. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Add (or subtract) Lines 31 and 32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

Exception to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

34. |

Underpayment of Estimated Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

.00 |

|||||||||||||||||||

Underpayment |

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

(Enter letter in exceptions box, if applicable. See instructions.) |

of Estimated Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

35. |

a. Interest |

b. |

Penalties |

|

|

|

|

(Add Lines 35a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

, |

|

.00 |

|

|

, |

|

|

.00 |

and 35b and |

35c. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

.00 |

||||||||

|

|

|

|

|

|

|

|

|

|

enter the total |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on Line 35c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

36. Total Due - Add Lines 33, 34, and 35c and enter result here, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Pay in U.S. Currency |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

but not less than zero. If less than zero, enter amount on Line 37. |

From a Domestic Bank 36. |

|

|

|

|

|

|

|

|

|

|

00 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Pay your tax online. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

||||||||||||

37. Overpayment |

|

|

|

|

|

|

|

|

|

|

|

|

|

37. |

|

|

|

|

|

|

, |

|

|

|

|

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. |

Amount of Line 37 applied to 2021 Estimated Income Tax |

|

|

|

|

|

|

38. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39. |

Amount of Line 37 contributed to N.C. Nongame and Endangered Wildlife Fund |

39. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

40. Amount of Line 37 contributed to N.C. Education Endowment Fund |

40. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

.00 |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. Amount to be Refunded |

|

|

|

|

|

|

|

|

|

|

|

41. |

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

.00 |

||||||||||

|

Line 37 minus Lines 38, 39, and 40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

I declare and certify that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

Corporate Phone Number

(Include area code)

Signature and Title of Officer: |

Date |

PAID PREPARER USE ONLY

Check here if you authorize the North Carolina Department of Revenue to discuss this return and attachments with the paid preparer below.

If prepared by a person other than taxpayer, this certification is based on all |

Preparer’s FEIN, SSN, or PTIN |

Preparer’s Contact Phone Number (Include area code) |

information of which the preparer has any knowledge.

Signature of Paid Preparer: |

Date |

Fill in applicable circle: |

FEIN |

SSN |

PTIN |

|

|

|

|

MAIL TO: N.C. Dept. of Revenue, P.O. Box 25000, Raleigh, N.C.

Page 3, |

|

FEIN |

CNet Worth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total assets (See instructions for definition) |

1. |

|

|

|

|

|

|

.00 |

|

|||||||||

2. |

Total liabilities |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

3. |

Line 1 minus Line 2 |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

4. |

Accumulated depreciation, depletion, and amortization permitted for income tax purposes |

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

|

(Attach Schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

5. |

Line 3 minus Line 4 |

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

6. |

Affiliated indebtedness (Attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Line 5 plus (or minus) Line 6 |

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

||

|

|

|

|

8. |

|

|

|

|

|

. |

|

|

|

|

|

|

|

. |

|

8. Apportionment factor (From Schedule O, Part 1; Part 2 - Line 9; or Part 3) |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|||||

9. Net Worth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Multiply Line 7 by factor on Line 8 and enter result here and on Schedule A, Line 1. |

9. |

|

|

|

|

|

|

.00 |

|

|||||||||

|

If amount on Line 9 is less than zero, enter zero on Schedule A, Line 1. |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DInvestment in N.C. Tangible Property

|

|

Inventory valuation method: |

1. |

|

.00 |

|

||||

1. |

Total value of inventories located in N.C. |

FIFO |

Lower of cost or market Other |

|

|

|||||

|

|

|

|

|

|

|

.00 |

|

||

2. |

|

|

(LIFO valuation not permitted) |

|

|

|||||

Total value of furniture, fixtures, and machinery and equipment located in N.C. |

2. |

|

||||||||

3. |

Total value of land and buildings located in N.C. |

|

|

|

3. |

|

.00 |

|

||

4. |

Total value of leasehold improvements and other tangible property located in N.C. |

4. |

|

.00 |

|

|||||

|

Add Lines 1 through 4 and enter total |

|

|

|

|

5. |

|

. |

|

|

5. |

|

|

|

|

|

00 |

|

|||

6. |

Accumulated depreciation, depletion, and amortization with respect to N.C. tangible property |

6. |

|

.00 |

|

|||||

7. |

Debts existing for the purchase or improvement of N.C. real estate |

7. |

|

.00 |

|

|||||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

8. Investment in N.C. Tangible Property |

|

|

|

|

8. |

.00 |

|

|||

|

Line 5 minus Lines 6 and 7; enter amount here and on Schedule A, Line 2 |

|

||||||||

E Appraised Value of N.C. Tangible Property |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

1. |

Total appraised value of all N.C. tangible property, including motor vehicles |

1. |

|

|

.00 |

|

||||

|

(If tax year ends December 31, 2019 through September 30, 2020, enter the appraised county tax value |

|

|

|

||||||

|

of all real and tangible property located in N.C. as of January 1, 2019, including any motor vehicles |

|

|

|

||||||

|

|

|

|

|||||||

|

assessed during the tax year. Otherwise, enter value as of January 1, 2020.) |

|

|

|

|

|

||||

2. Appraised Value of N.C. Tangible Property |

|

|

|

2. |

.00 |

|

||||

|

Multiply Line 1 by 55%; enter here and on Schedule A, Line 3 |

|

||||||||

F Other Information - All Taxpayers Must Complete this Schedule |

|

|

|

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

1. State of incorporation |

|

Date incorporated |

2.Date Certificate of Authority was obtained from N.C. Secretary of State

3. Regular or principal trade or business in N.C. |

|

Everywhere |

4.Principal place from which business is directed or managed

5.What was the last year the IRS redetermined the corporation’s federal taxable income?

6. |

Were the adjustments reported to N.C.? |

Yes |

No |

If so, when? |

|

|

|

7. |

Does this corporation finance or discount its receivables through a related or an affiliated company? |

Yes |

No |

||||

8.Is this corporation subject to franchise tax but not N.C. income tax because the corporation’s income tax activities

are protected under P.L.

9.Officers’ names and addresses:

President |

|

|

Secretary |

|

Treasurer |

||

Page 4,

GFederal Taxable Income Before NOL Deduction

Complete this schedule if you do not attach a copy of your federal income tax return.

|

1. a. Gross receipts or sales |

.00 |

|

|||||||||

|

|

b. Returns and allowances |

|

|

|

|

|

|

.00 |

|

||

|

|

c. Balance (Line 1a minus Line 1b) |

|

|

|

.00 |

|

|||||

|

2. |

Cost of goods sold (Attach schedule) |

|

|

|

|

|

|

|

.00 |

|

|

|

3. |

Gross Profit (Line 1c minus Line 2) |

|

|

|

.00 |

|

|||||

|

4. |

Dividends (Attach schedule) |

|

|

|

|

|

|

.00 |

|

||

|

5. a. Interest on obligations of the |

.00 |

|

|||||||||

|

|

United States and its |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

instrumentalities |

|

|

|

|

|

|

|

.00 |

|

|

|

|

b. Other interest |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

.00 |

|

||

|

6. |

Gross rents |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

.00 |

|

|||

|

7. |

Gross royalties (Attach schedule) |

|

|

|

|

|

|

|

|

||

|

8. |

Capital gain net income (Attach schedule) |

|

|

|

|

.00 |

|

||||

|

|

|

|

|

|

|

|

.00 |

|

|||

|

9. |

Net gain (loss) (Attach schedule) |

|

|

|

|

|

|

|

|

||

|

10. |

Other income (Attach schedule) |

|

|

|

|

|

|

|

.00 |

|

|

|

11. |

Total Income |

|

|

|

|

|

|

|

.00 |

|

|

|

|

Add Lines 3 through 10 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Compensation of officers |

|

|

|

|

|

.00 |

|

||||

|

|

(Attach schedule, including addresses) |

|

|

|

|||||||

|

13. Salaries and wages |

|

|

|

|

|

.00 |

|

||||

|

|

(Less employment credits) |

|

|

|

|||||||

|

14. Repairs and maintenance |

|

|

.00 |

|

|||||||

|

15. Bad debts |

|

|

|

.00 |

|

||||||

|

16. Rents |

|

|

.00 |

|

|||||||

|

17. Taxes and licenses |

|

|

.00 |

|

|||||||

|

18. Interest |

|

.00 |

|

||||||||

|

19. Charitable contributions |

|

|

|

|

|

.00 |

|

||||

20.a. Depreciation

|

b. Depreciation included |

|

|

|

|

|

|||||

|

in cost of goods sold |

|

|

.00 |

|

||||||

|

c. Balance (Line 20a minus Line 20b) |

|

|

||||||||

21. |

Depletion |

|

|

.00 |

|

||||||

22. |

Advertising |

|

|

|

.00 |

|

|||||

23. |

Pension, |

|

|

.00 |

|

||||||

|

and similar plans |

|

|

|

|||||||

24. |

Employee benefit programs |

|

|

.00 |

|

||||||

25. |

Reserved for future use |

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||||

26. |

Other deductions (Attach schedule) |

|

|

.00 |

|

||||||

27. |

Total Deductions |

|

.00 |

|

|||||||

|

Add Lines 12 through 26 |

|

|

|

|||||||

|

|

|

|

||||||||

28. |

Taxable Income per Federal Return |

|

|

|

.00 |

|

|||||

|

Before NOL and Special Deductions |

|

|

|

|

||||||

|

Line 11 minus Line 27 |

|

|

|

|

||||||

29. |

Special Deductions |

|

|

|

.00 |

|

|||||

|

(From Federal Form 1120, Line 29b) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

30. |

Federal Taxable Income Before NOL |

|

|

|

|

|

|||||

|

Line 28 minus Line 29; enter amount here |

.00 |

|

||||||||

|

and on Schedule B, Line 10 |

|

|||||||||

FEIN

HAdjustments to Federal Taxable Income

1.Additions:

a.Taxes based on net income.00

b.Contributions.00

c.Royalties to related members.00

d.Net interest expense to related members.00

e. Expenses attributable to income |

|

|

.00 |

||

not taxed |

|

|

|||

f. Bonus depreciation |

|

|

.00 |

||

|

|

.00 |

|||

g. Section 179 expense deduction |

|

||||

h. Other (Attach explanation or schedule) |

|

|

|

.00 |

|

2. Total Additions (Add Lines |

|

|

.00 |

||

3. Deductions: |

|

.00 |

|||

a. U.S. obligation interest (net of expenses) |

|

||||

(Attach schedule) |

|

|

|||

|

|

||||

b. Other deductible dividends |

|

|

.00 |

||

c. Royalties from related |

|

.00 |

|||

members |

|

|

|||

d. Qualified interest expense to |

|

.00 |

|||

related members |

|

|

|||

e. Bonus depreciation |

|

|

.00 |

||

f. Section 179 expense deduction |

|

|

.00 |

||

g. Other (Attach explanation or schedule) |

|

|

.00 |

||

|

|

.00 |

|||

4. Total Deductions (Add Lines |

|

|

|||

|

|

||||

5. Adjustments to Federal |

|

|

|

||

Taxable Income |

|

|

|

|

|

|

.00 |

||||

Line 2 minus Line 4, enter amount |

|

||||

here and on Schedule B, Line 11 |

|

||||

IContributions

1.Contributions to Donees Outside N.C.

a. Enter total contributions to donees |

.00 |

|

||

|

|

|

|

|

outside N.C. |

|

|

|

|

b. Multiply the amount shown on |

|

|

|

|

Schedule B, Line 12 by 5% if Line |

.00 |

|

||

12 is greater than zero. Otherwise, |

|

|||

|

|

|

|

|

enter zero here. |

|

|

|

|

c. Amount Deductible |

|

|

|

|

|

.00 |

|

||

Enter the lesser of Line 1a or 1b |

|

|

||

here and on Schedule B, Line 13 |

|

|

||

|

|

|

|

|

2. Contributions to N.C. Donees |

|

|

|

|

|

|

|

|

|

a. Enter total contributions to N.C. |

.00 |

|

||

donees other than those listed in |

|

|||

|

|

|

|

|

Line 2d, below |

|

|

|

|

b. Multiply the amount shown on |

|

|

|

|

Schedule B, Line 23 by 5% if Line |

|

|

.00 |

|

23 is greater than zero. Otherwise, |

|

|

|

|

enter zero here. |

|

|

|

|

c. Enter the lesser of Line 2a or 2b |

|

|

.00 |

|

d. Enter total contributions to the State |

.00 |

|

||

|

|

|

|

|

of N.C. and its political subdivisions |

|

|

|

|

e. Amount Deductible |

|

|

|

|

Add Lines 2c and 2d; enter total |

|

.00 |

|

|

here and on Schedule B, Line 24 |

|

|

||

|

|

|

|

|

JExplanation of Changes for Amended Return

Attach additional sheets if necessary

Note: The letter K is not used to designate a schedule.

Page 5,

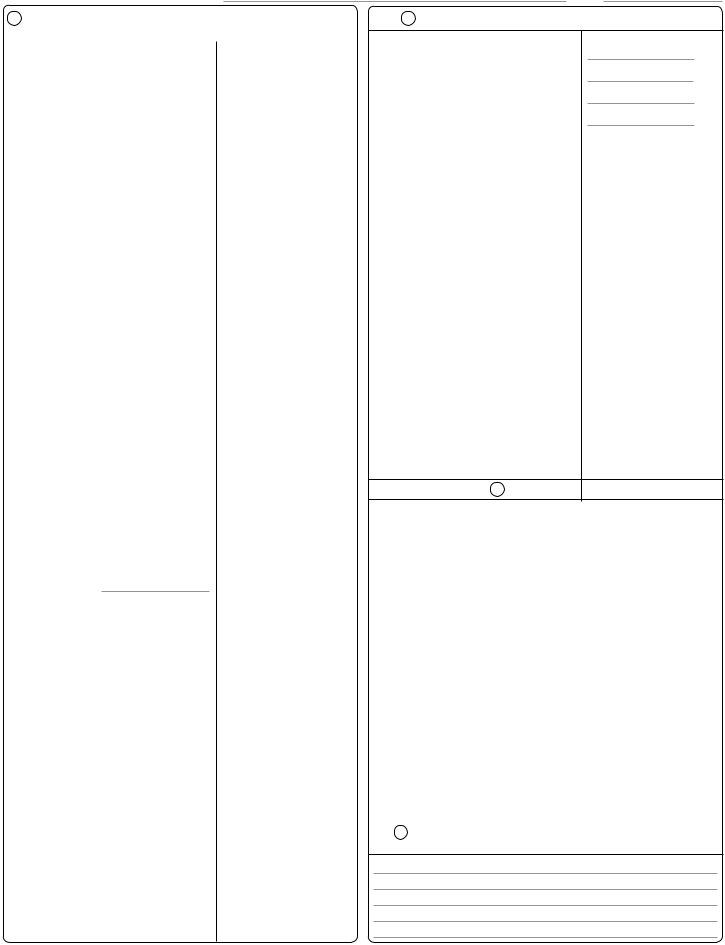

L Balance Sheet per Books

(Loss) per Books With Return |

|

Earnings Analysis |

Assets

1.Cash

2a. Trade notes and accounts receivable

b. Less allowance for bad debts |

( |

3.Inventories

4.a. U.S. government obligations b. State and other obligations

5.

6.Other current assets (Attach end of year schedule)

7.Loans to shareholders

8.Mortgage and real estate loans

9.Other investments (Attach end of year schedule)

10.a. Buildings and other depreciable assets

b. Less accumulated depreciation |

( |

|

|

11. a. Depletable assets |

|

b. Less accumulated depletion |

( |

|

12.Land (net of any amortization)

13.a. Intangible assets (amortizable only)

b. Less accumulated amortization |

( |

|

14.Other assets (Attach end of year schedule)

15.Total Assets

Liabilities and Shareholders’ Equity

16.Accounts payable

17.Mortgages, notes, and bonds payable in less than 1 year

18.Other current liabilities (Attach end of year schedule)

19.Loans from shareholders

20.Mortgages, notes, and bonds payable in 1 year or more

21.Other liabilities (Attach end of year schedule)

22.Capital stock: a. Preferred Stock b. Common Stock

23.Additional

24.Retained earnings – Appropriated

(Attach end of year schedule)

25.Retained earnings – Unappropriated

26.Adjustments to shareholders’ equity

(Attach end of year schedule)

27.Less cost of treasury stock

28.Total Liabilities and Shareholders’ Equity

1.Net income (loss) per books

2.Federal income tax

3.Excess of capital losses over capital gains

4.Income subject to tax not recorded on books this year (itemize):

5.Expenses recorded on books this year not deducted on this return (itemize):

a.Depreciation $

b.Charitable Contributions $

c.Travel and entertainment $

6.Add Lines 1 through 5

1.Balance at beginning of year

2.Net income (loss) per books

3.Other increases (itemize):

4.Add Lines 1, 2, and 3

|

|

|

|

|

FEIN |

|

|

||

Beginning of Tax Year |

|

|

End of Tax Year |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

( |

) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

( |

) |

|

|

|

|

|

|

7.Income recorded on books this year not included on this return (itemize):

8.Deductions on this return not charged against book income this year (itemize):

a.Depreciation $

b.Charitable Contributions $

9.Add Lines 7 and 8

10.Income (Line 6 minus Line 9)

5.Distributions: a. Cash

b.Stock

c.Property

6.Other decreases (itemize):

7.Add Lines 5 and 6

8.Balance at End of Year (Line 4 minus Line 7)

Page 6, |

|

FEIN |

N Nonapportionable Income

Complete this schedule if you have income classified as nonapportionable income. See the instructions for an explanation of what is apportionable income and what is nonapportionable income.

|

(A) Nonapportionable Income |

|

(B) Gross |

|

(C) Related |

|

(D) Net Amounts |

(E) Net Amounts Allocated |

||||||

|

|

Amounts |

|

Expenses* |

|

(Column B minus Column C) |

|

Directly to N.C. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Nonapportionable Income (Enter the total of Column D here and on Schedule B, Line 15) |

.00 |

|

|

2. |

Nonapportionable Income Allocated to N.C. (Enter the total of Column E here |

|

|

|

|

|

.00 |

||

|

and on Schedule B, Line 19) |

|

|

Explanation of why income listed in chart is nonapportionable income rather than apportionable income:

(Attach additional sheets if necessary)

*For an acceptable means of computing related expenses, see 17 N.C.A.C. 5C .0304.

Part 1. |

Domestic and Other Corporations Not Apportioning Franchise or Income Outside N.C. |

|

|

100.0000 |

% |

|

||

|

Enter 100% on Schedule B, Line 17 and Schedule C, Line 8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2. |

Corporations Apportioning Franchise or Income to N.C. and to Other States |

Example: |

|

|

|

|

|

|

|

|

|

99.9999 |

% |

|

|||

|

Note: Apportionment factors must be calculated 4 places to the right of the decimal. |

|

|

|

|

|||

|

|

|

|

|

|

|||

|

State Net Loss Apportionment: |

|

|

|

|

|

|

|

|

Are you electing to apportion receipts based on |

Yes |

No |

|

|

|||

of Apportionment Factor

1.Gross Receipts Subject to Apportionment

2.Gross Rents Subject to Apportionment

3.Gross Royalties Subject to Apportionment

4.Dividends Subject to Apportionment

5.Interest Subject to Apportionment

6.Other Apportionable Income

7.Share of Receipts from Noncorporate Entities Subject to Apportionment

8.Total (Add Lines 1 through 7 for each column)

1. Within North Carolina

2. Total Everywhere

O Computation

9. N.C. Apportionment Factor |

|

|

(Divide Line 8 Column 1 by Line 8 Column 2; enter the factor here, on Schedule B, Line 17, and Schedule C, Line 8. |

% |

|

See instructions and G.S. |

|

|

|

|

|

Part 3. Special Apportionment Formulas |

|

|

Special apportionment formulas apply to certain types of corporations such as banks, wholesale |

|

|

content distributors, electric power companies, air transportation companies, water transportation |

|

|

|

|

|

companies, pipeline companies, and railroad companies. If you use a special apportionment |

% |

|

formula, enter the computed apportionment factor here, on Schedule B, Line 17, and on Schedule |

|

|

C, Line 8. Attach a schedule to support the special apportionment calculation. (See instructions and |

|

|

G.S. 105