Using PDF files online is certainly super easy using our PDF tool. You can fill in kentucky statements here effortlessly. The editor is constantly upgraded by our staff, receiving handy functions and turning out to be greater. For anyone who is looking to start, here is what it requires:

Step 1: Hit the "Get Form" button above. It's going to open our pdf editor so you can begin completing your form.

Step 2: After you start the editor, you will see the form all set to be filled in. Other than filling out different blank fields, you may as well do other sorts of actions with the form, namely putting on your own text, changing the initial text, adding illustrations or photos, affixing your signature to the PDF, and much more.

Be attentive when filling in this document. Ensure that each and every field is completed properly.

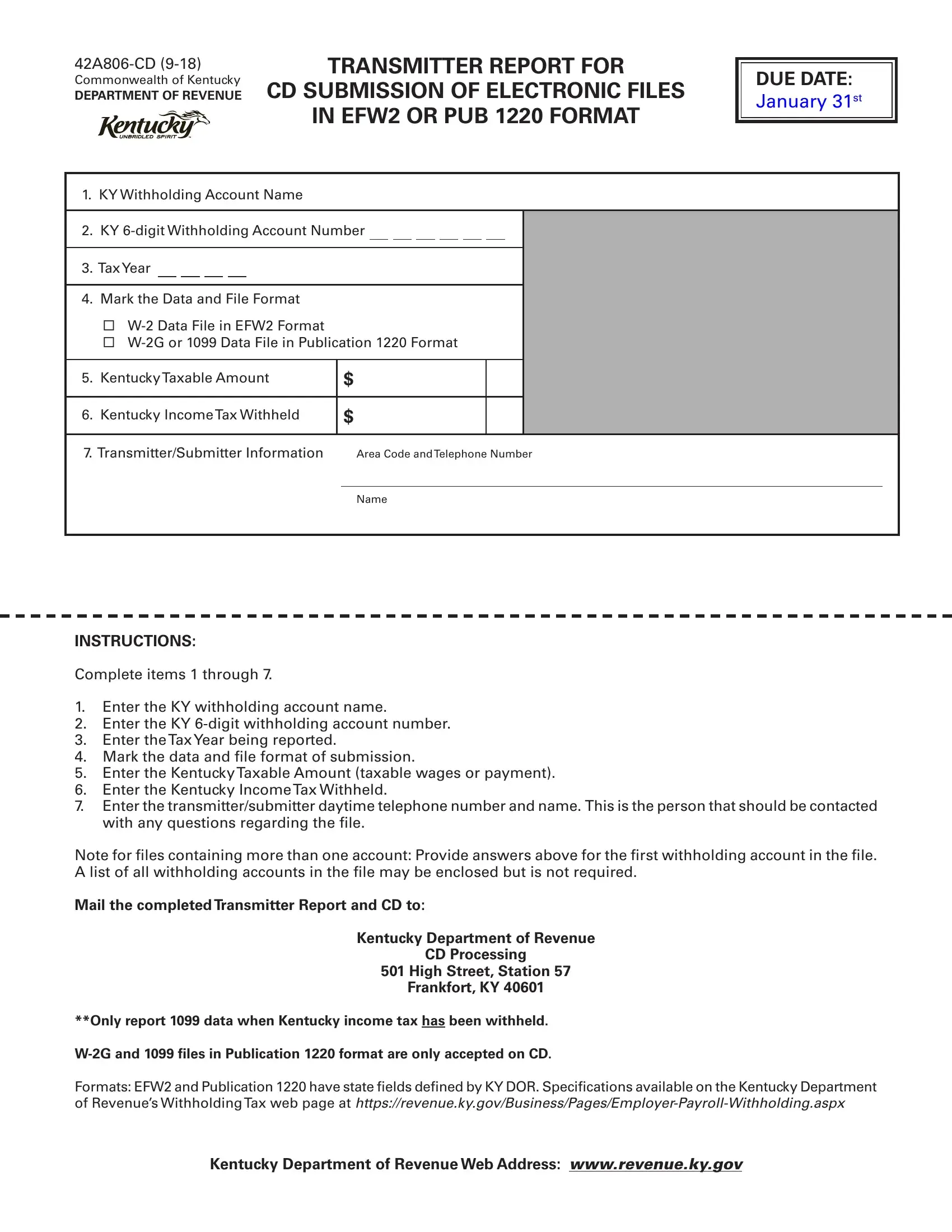

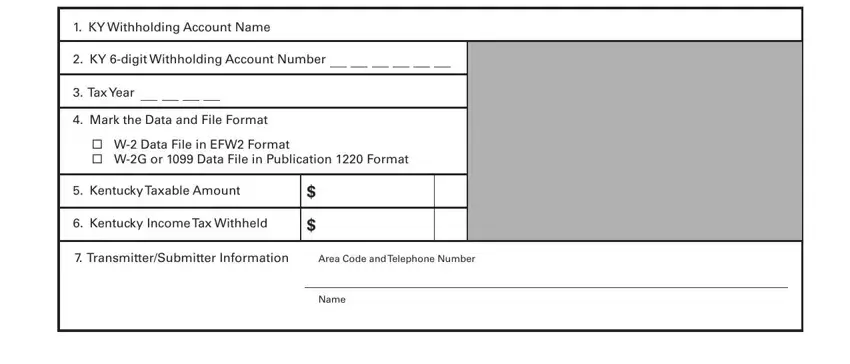

1. While filling out the kentucky statements, be certain to include all of the needed blank fields in its relevant form section. It will help facilitate the work, allowing your information to be handled without delay and appropriately.

Step 3: When you have glanced through the information in the blanks, simply click "Done" to conclude your form at FormsPal. Right after creating a7-day free trial account with us, you'll be able to download kentucky statements or send it via email right off. The PDF file will also be accessible through your personal account page with your each and every edit. At FormsPal, we aim to make sure all your information is kept protected.