When you would like to fill out sls 450 tennessee form, it's not necessary to download any sort of software - simply make use of our online tool. The editor is continually maintained by our team, acquiring powerful features and becoming greater. With a few simple steps, you'll be able to start your PDF journey:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" at the top of this page.

Step 2: After you launch the editor, you'll notice the document all set to be filled out. Besides filling out different blank fields, you can also perform various other things with the PDF, particularly writing custom textual content, editing the original textual content, inserting illustrations or photos, placing your signature to the document, and a lot more.

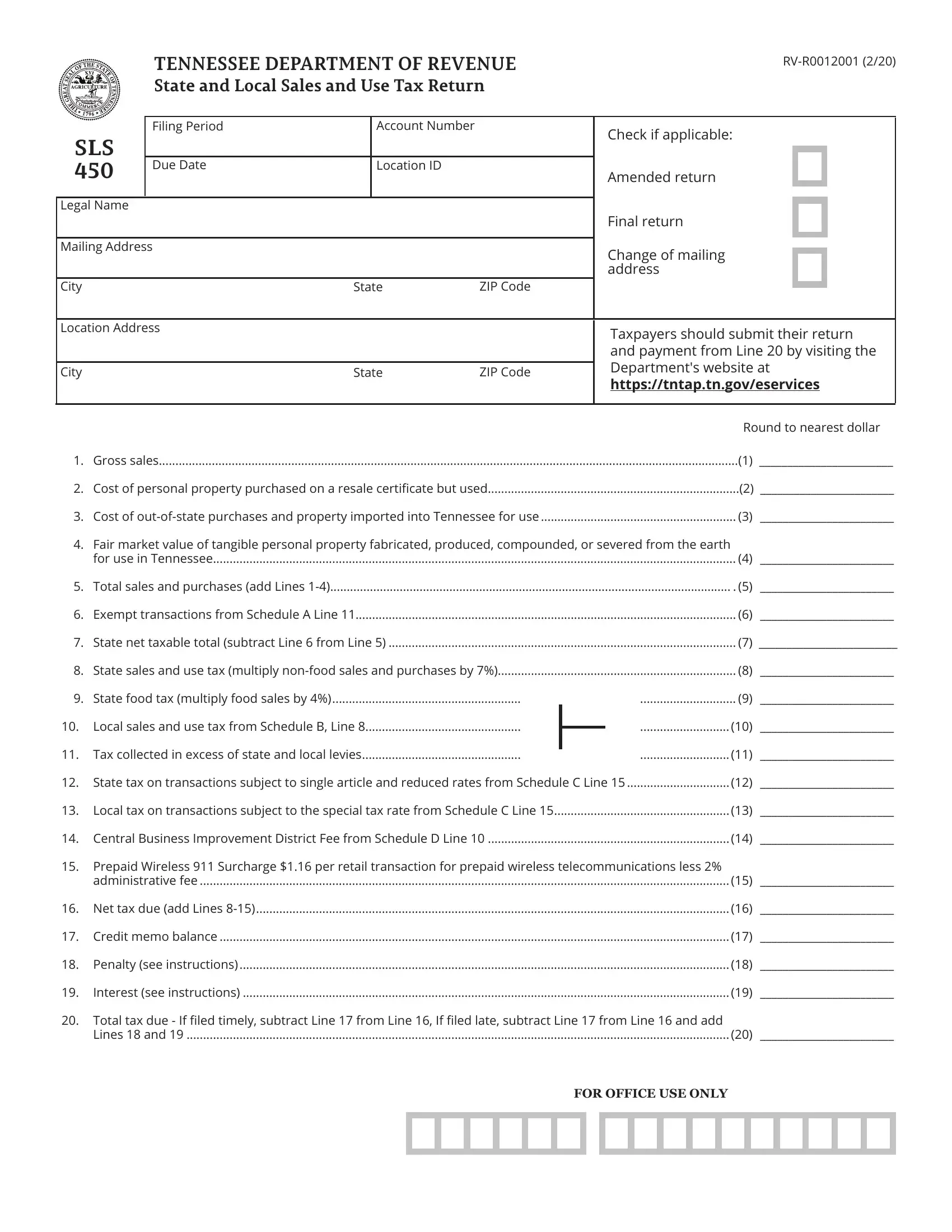

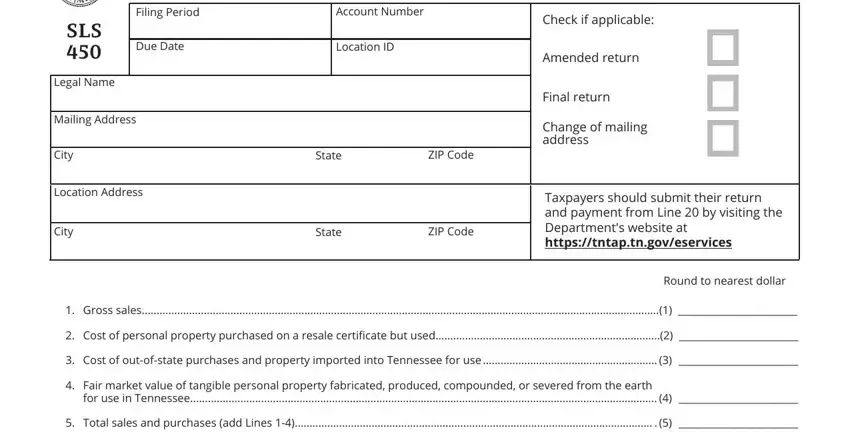

This form will need particular data to be filled in, so you should take your time to type in what's required:

1. Firstly, when filling out the sls 450 tennessee form, start with the area with the subsequent fields:

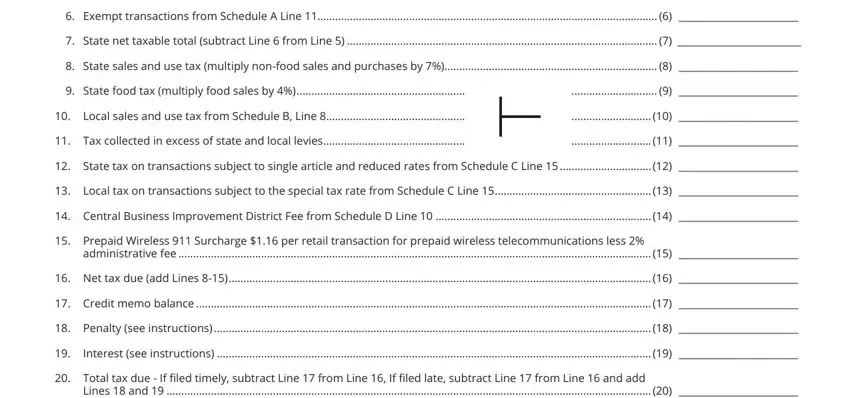

2. Once your current task is complete, take the next step – fill out all of these fields - Gross sales Cost of personal, Lines and , administrative fee , and Interest see instructions with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

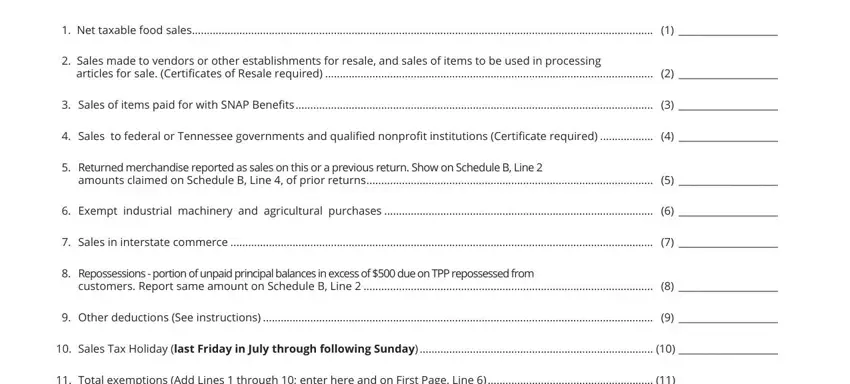

3. The next part is relatively simple, Net taxable food sales , Sales made to vendors or other, articles for sale Certificates of, Sales of items paid for with SNAP, Sales to federal or Tennessee, Returned merchandise reported as, amounts claimed on Schedule B Line, Exempt industrial machinery and, Sales in interstate commerce , Repossessions portion of unpaid, customers Report same amount on, Other deductions See instructions, Sales Tax Holiday last Friday in, and Total exemptions Add Lines - these blanks will have to be filled in here.

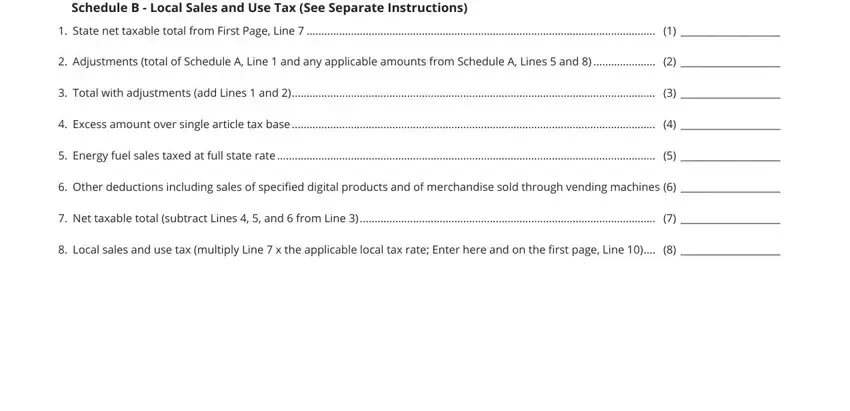

4. This subsection comes with these blanks to look at: Beginning October all sales that, State net taxable total from, Adjustments total of Schedule A, Total with adjustments add Lines , Excess amount over single article, Energy fuel sales taxed at full, Other deductions including sales, Net taxable total subtract Lines , and Local sales and use tax multiply.

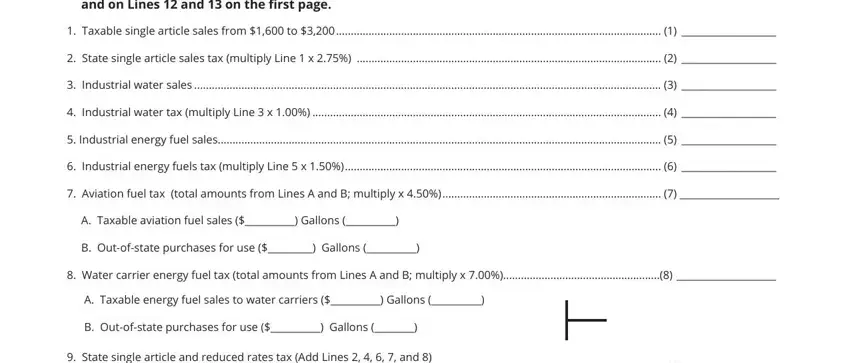

5. To conclude your document, this particular section has some extra fields. Filling out Schedule C State Single Article, Taxable single article sales from, State single article sales tax, Industrial water sales , Industrial water tax multiply, Industrial energy fuel sales , Industrial energy fuels tax, Aviation fuel tax total amounts, A Taxable aviation fuel sales , B Outofstate purchases for use , Water carrier energy fuel tax, B Outofstate purchases for use , and State single article and reduced will conclude everything and you'll be done in a tick!

Those who use this document frequently make some errors when completing Schedule C State Single Article in this area. You should definitely re-examine what you type in right here.

Step 3: Prior to finalizing this file, double-check that all blanks are filled in as intended. As soon as you believe it is all good, press “Done." After setting up a7-day free trial account with us, you'll be able to download sls 450 tennessee form or send it through email right off. The PDF will also be easily accessible through your personal account with your each edit. When using FormsPal, it is simple to fill out forms without having to be concerned about data leaks or data entries being distributed. Our secure software makes sure that your private information is kept safely.