Whenever you wish to fill out iowa medical debt response, you won't need to download any sort of applications - just use our online tool. Our professional team is relentlessly endeavoring to enhance the editor and insure that it is much easier for people with its multiple functions. Take full advantage of the current revolutionary opportunities, and discover a trove of new experiences! Getting underway is effortless! Everything you need to do is take the next easy steps down below:

Step 1: Hit the orange "Get Form" button above. It'll open our pdf tool so that you could begin filling in your form.

Step 2: With our advanced PDF editing tool, you're able to accomplish more than merely fill in blank fields. Express yourself and make your docs seem great with custom textual content added, or adjust the file's original input to perfection - all comes with the capability to insert stunning pictures and sign the PDF off.

It is easy to finish the form with this practical guide! This is what you need to do:

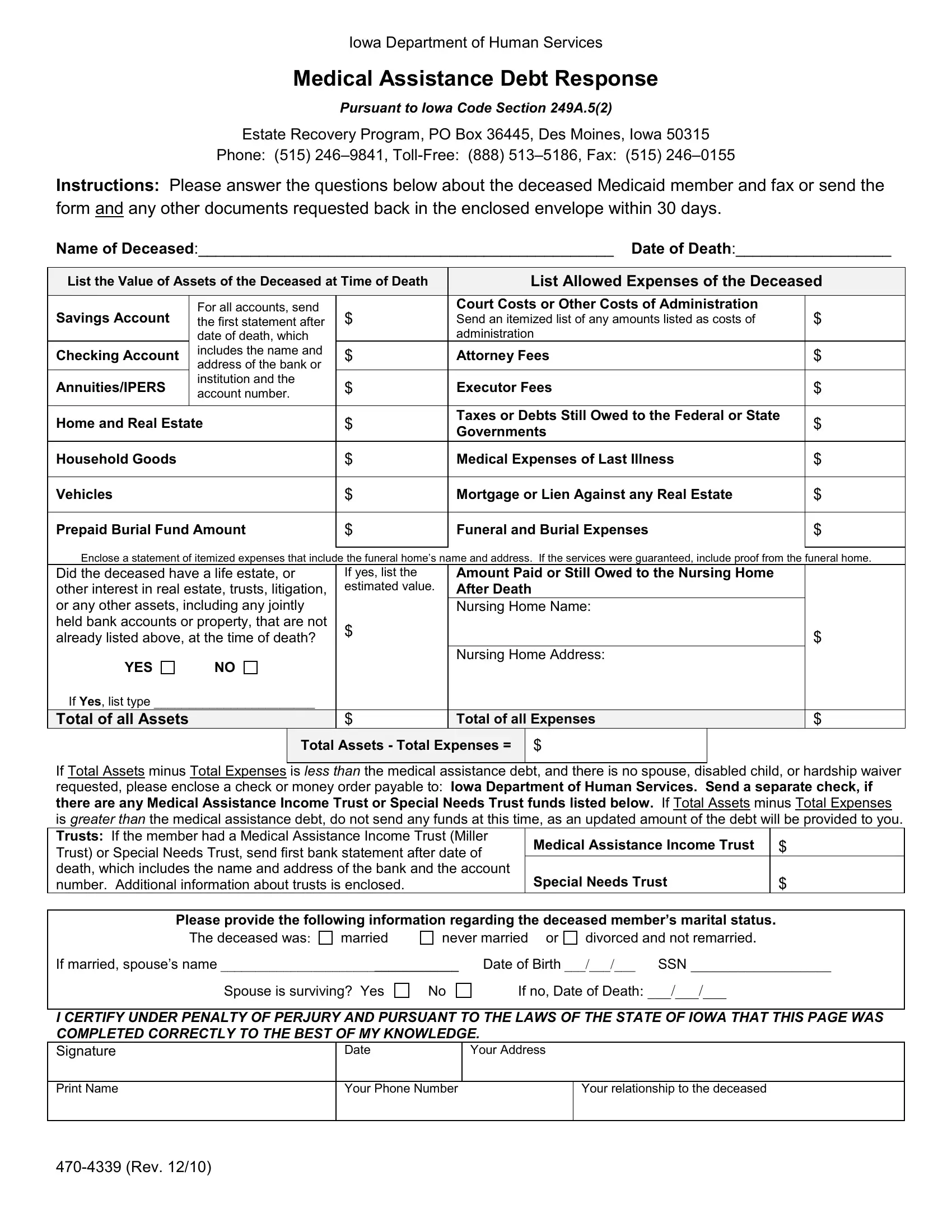

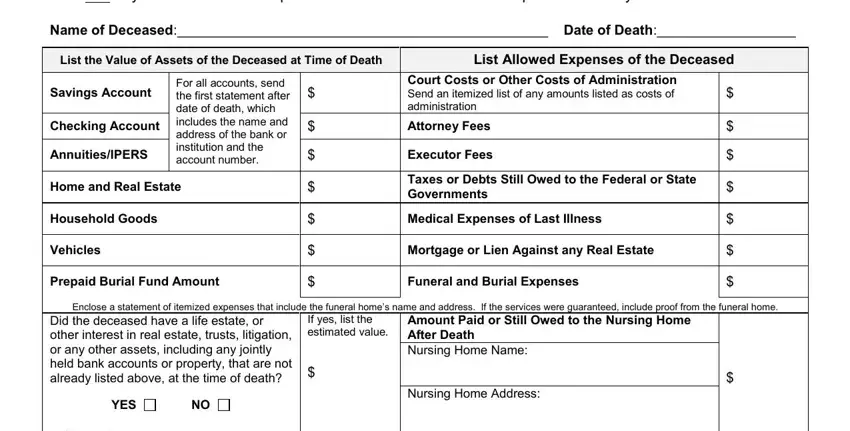

1. First, once filling out the iowa medical debt response, start in the page that contains the following fields:

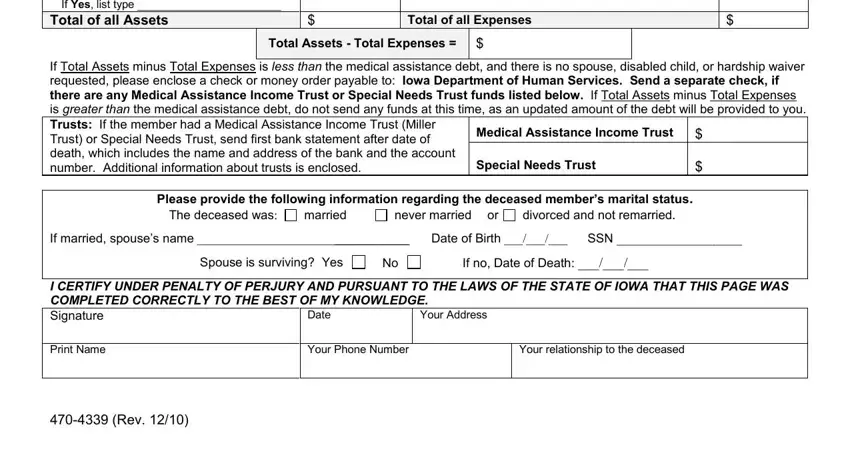

2. Once your current task is complete, take the next step – fill out all of these fields - If Yes list type , Total of all Assets, Total of all Expenses, Total Assets Total Expenses , If Total Assets minus Total, Medical Assistance Income Trust, Special Needs Trust, Please provide the following, The deceased was, married, never married or, divorced and not remarried, If married spouses name , Date of Birth , and SSN with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As for If Yes list type and Total Assets Total Expenses , make certain you take another look here. These are definitely the most significant ones in the page.

Step 3: Proofread everything you've typed into the blanks and then press the "Done" button. After getting a7-day free trial account with us, it will be possible to download iowa medical debt response or send it via email promptly. The document will also be accessible from your personal account with your each change. FormsPal ensures your data privacy by using a secure system that never records or distributes any sort of private data used in the PDF. Be assured knowing your files are kept safe every time you use our tools!