Using PDF files online is definitely a piece of cake with our PDF tool. You can fill out form 540nr here painlessly. We at FormsPal are focused on making sure you have the ideal experience with our tool by continuously releasing new functions and upgrades. Our editor has become a lot more intuitive thanks to the most recent updates! Now, filling out PDF forms is a lot easier and faster than before. If you are seeking to get started, here's what it will require:

Step 1: Click on the "Get Form" button above. It will open our pdf editor so you could start filling out your form.

Step 2: This tool helps you change most PDF documents in various ways. Enhance it by writing any text, correct what's originally in the file, and add a signature - all at your disposal!

This form needs specific information; to ensure accuracy, be sure to adhere to the recommendations further on:

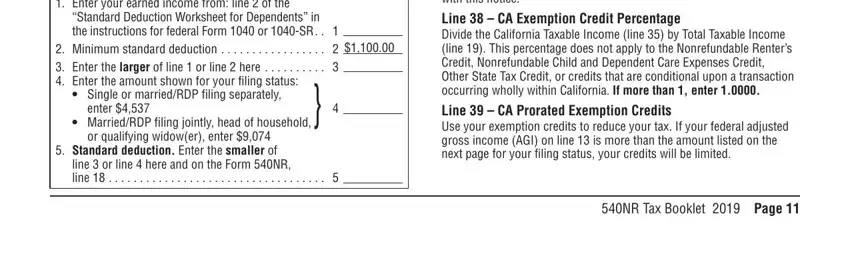

1. First of all, once completing the form 540nr, start out with the section that contains the subsequent blanks:

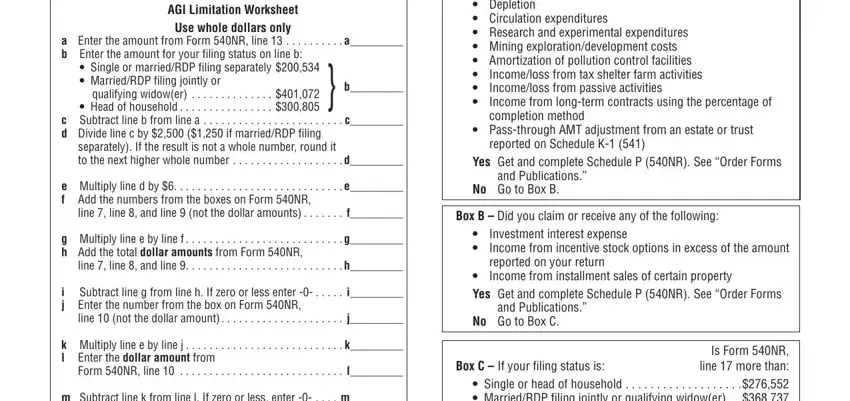

2. The next stage is usually to complete the following blanks: AGI Limitation Worksheet, Use whole dollars only, a Enter the amount from Form NR, Single or marriedRDP filing, qualifying widower , c Subtract line b from line a , separately If the result is not a, e Multiply line d by , line line and line not the, g Multiply line e by line f , line line and line , i Subtract line g from line h If, line not the dollar amount , k Multiply line e by line j , and Form NR line .

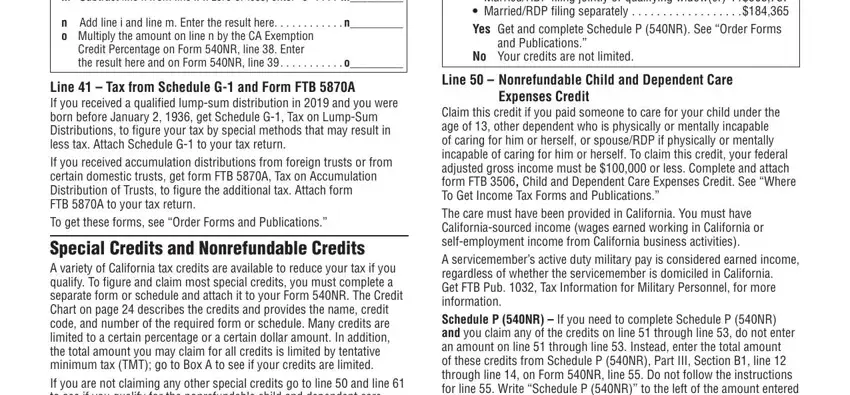

3. Within this step, examine m Subtract line k from line l If, n Add line i and line m Enter the, Credit Percentage on Form NR line , Line Tax from Schedule G and, Special Credits and Nonrefundable, Is Form NR line more than Box C , and Publications , No Your credits are not limited , Line Nonrefundable Child and, Expenses Credit, and Claim this credit if you paid. Every one of these must be completed with highest accuracy.

People often make mistakes when completing n Add line i and line m Enter the in this section. You should read again everything you enter right here.

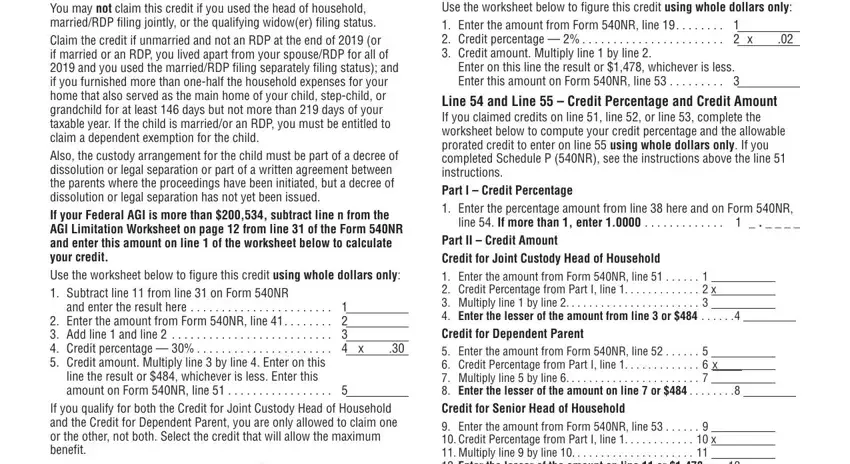

4. This fourth subsection arrives with these particular fields to look at: Code , You may not claim this credit if, and enter the result here , line the result or whichever is, If you qualify for both the Credit, If you meet all the conditions, Enter on this line the result or , Line and Line Credit Percentage, and Part II Credit Amount Credit for.

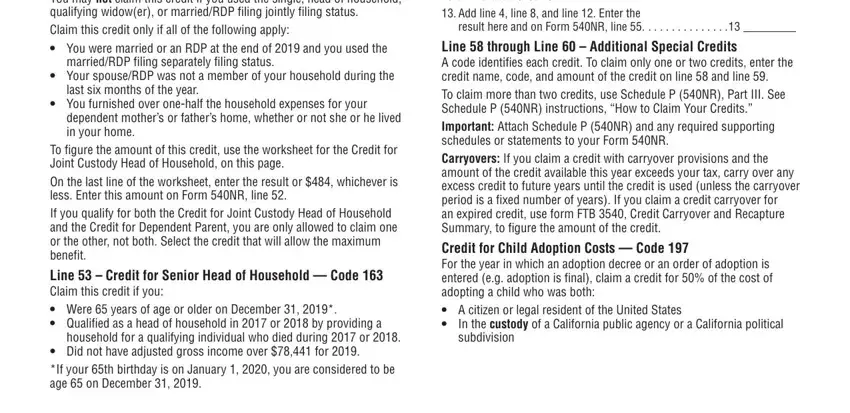

5. To wrap up your document, this particular subsection requires a couple of extra blank fields. Entering If you qualify for both the Credit, marriedRDP filing separately, Your spouseRDP was not a member, last six months of the year , You furnished over onehalf the, dependent mothers or fathers home, To figure the amount of this, household for a qualifying, Did not have adjusted gross, Part II Credit Amount Credit for, result here and on Form NR line , Line through Line Additional, and In the custody of a California will conclude everything and you're going to be done very quickly!

Step 3: Just after double-checking your entries, hit "Done" and you're good to go! Go for a free trial account with us and gain immediate access to form 540nr - downloadable, emailable, and editable from your FormsPal account page. FormsPal is dedicated to the confidentiality of our users; we make certain that all personal data put into our system is confidential.

I

I F

F

O R N I

O R N I A

A