Dealing with PDF documents online is certainly surprisingly easy using our PDF editor. Anyone can fill out letter cg 2010 here painlessly. Our team is dedicated to providing you with the absolute best experience with our tool by constantly introducing new functions and improvements. Our tool has become a lot more useful thanks to the most recent updates! Now, editing PDF files is simpler and faster than ever before. To get started on your journey, take these simple steps:

Step 1: Click the "Get Form" button above on this webpage to open our editor.

Step 2: With this handy PDF editing tool, you can actually accomplish more than merely complete blank fields. Try each of the features and make your forms appear faultless with customized textual content put in, or tweak the file's original content to perfection - all supported by an ability to add your own graphics and sign the file off.

It really is an easy task to fill out the document using out practical guide! Here's what you must do:

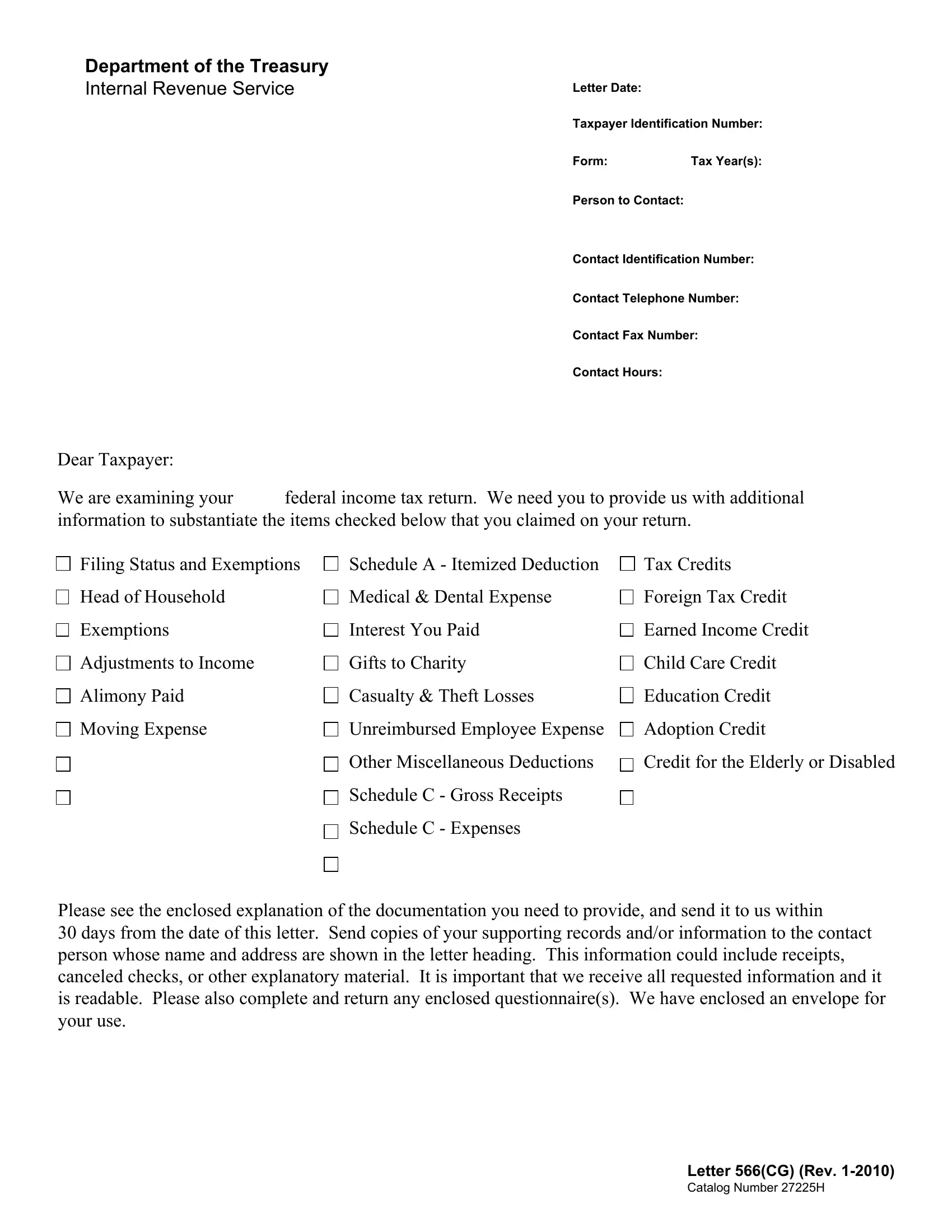

1. When filling in the letter cg 2010, ensure to incorporate all necessary blanks in its relevant area. It will help to speed up the process, enabling your details to be handled promptly and correctly.

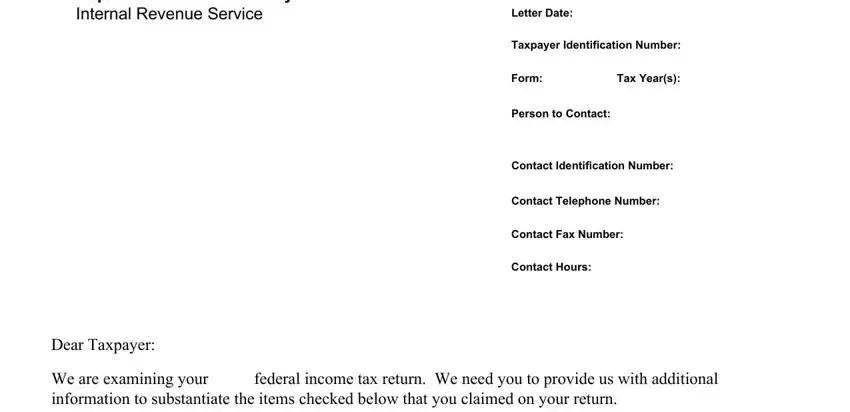

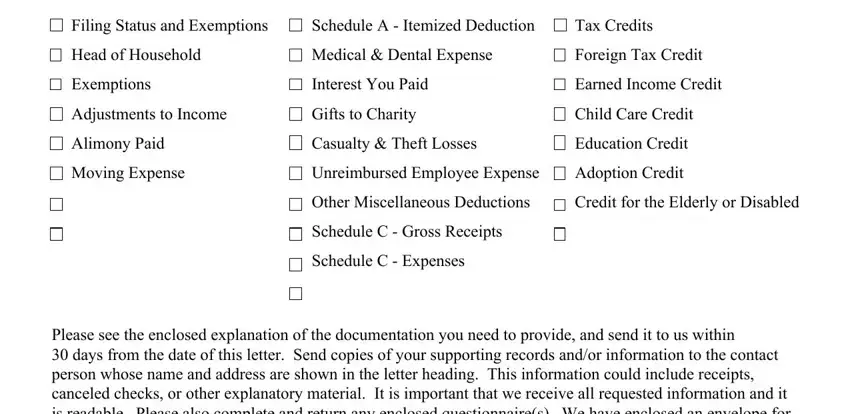

2. Once your current task is complete, take the next step – fill out all of these fields - Filing Status and Exemptions, Schedule A Itemized Deduction, Tax Credits, Head of Household, Medical Dental Expense, Foreign Tax Credit, Exemptions, Interest You Paid, Earned Income Credit, Adjustments to Income, Gifts to Charity, Child Care Credit, Alimony Paid, Casualty Theft Losses, and Education Credit with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. Completing Letter CG Rev Catalog Number H is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

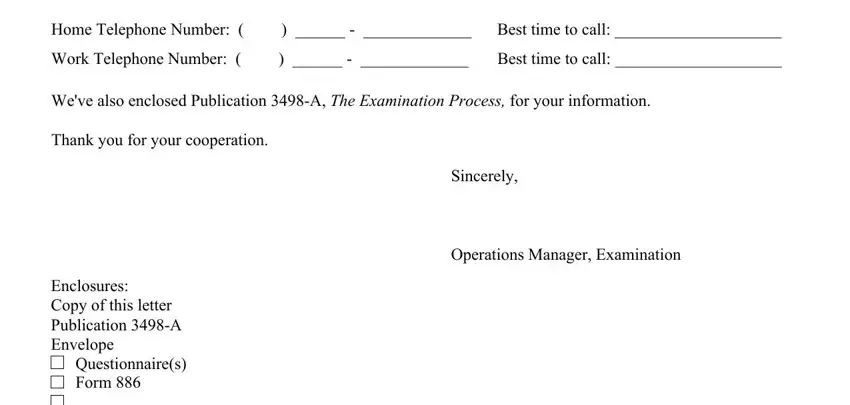

4. Your next paragraph requires your details in the subsequent parts: Home Telephone Number , Best time to call , Work Telephone Number , Best time to call , Weve also enclosed Publication A, Thank you for your cooperation, Sincerely, Operations Manager Examination, Enclosures Copy of this letter, and Questionnaires Form . Be sure to fill out all of the required info to move further.

5. To finish your document, this last segment requires several extra blank fields. Filling out Letter CG Rev Catalog Number H should conclude everything and you'll surely be done in no time at all!

You can easily make a mistake while filling in the Letter CG Rev Catalog Number H, thus be sure you go through it again before you'll send it in.

Step 3: Before finishing this form, it's a good idea to ensure that blanks have been filled in as intended. When you believe it's all fine, press “Done." Acquire the letter cg 2010 after you register online for a free trial. Instantly view the form in your FormsPal cabinet, together with any modifications and adjustments being conveniently preserved! Here at FormsPal, we do our utmost to make sure that all your information is kept secure.