When you intend to fill out form 55a, you don't need to download and install any sort of software - just give a try to our PDF tool. In order to make our tool better and less complicated to use, we continuously develop new features, taking into consideration feedback coming from our users. Here is what you will want to do to start:

Step 1: Click the "Get Form" button above. It's going to open up our pdf editor so you could start completing your form.

Step 2: With this online PDF editing tool, you're able to do more than just complete blank form fields. Express yourself and make your docs seem sublime with customized text incorporated, or adjust the original input to excellence - all that comes with an ability to incorporate your own images and sign the file off.

Filling out this PDF typically requires attention to detail. Make sure all necessary blanks are done properly.

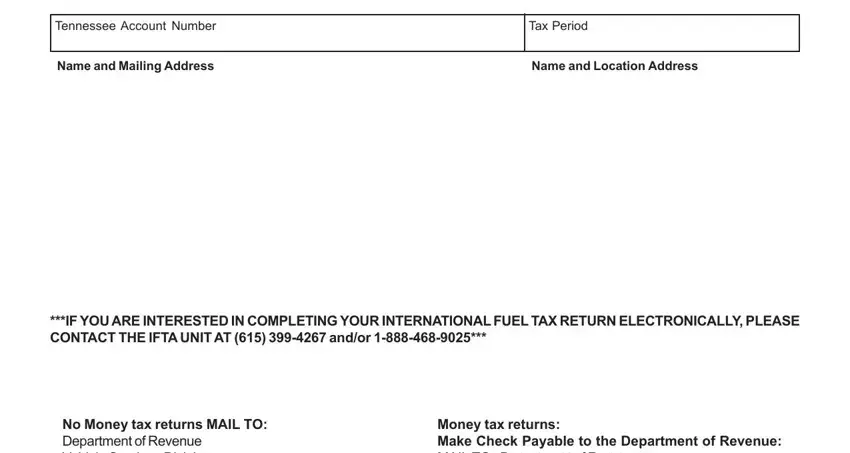

1. It's important to fill out the form 55a correctly, therefore be careful while working with the areas containing these particular blanks:

2. Soon after finishing the previous step, go to the next part and fill in the essential details in these fields - No Money tax returns MAIL TO, and TOTAL AMOUNT DUE.

In terms of TOTAL AMOUNT DUE and TOTAL AMOUNT DUE, be sure that you get them right in this current part. These two could be the key fields in the form.

Step 3: Check that the details are accurate and then simply click "Done" to continue further. Go for a 7-day free trial plan at FormsPal and acquire immediate access to form 55a - download or edit in your personal account. When you use FormsPal, you can complete forms without needing to be concerned about information breaches or entries being shared. Our secure platform ensures that your private data is kept safely.