When working in the online tool for PDF editing by FormsPal, you're able to fill in or alter kentucky revenue exoneration property search right here and now. Our team is aimed at making sure you have the absolute best experience with our editor by consistently presenting new functions and enhancements. Our tool is now much more user-friendly with the newest updates! So now, editing PDF forms is a lot easier and faster than ever. All it takes is a few basic steps:

Step 1: Click the "Get Form" button at the top of this webpage to get into our tool.

Step 2: After you open the editor, you will notice the document made ready to be filled out. Apart from filling in various fields, you might also do many other things with the file, that is writing any words, changing the original text, inserting illustrations or photos, putting your signature on the form, and much more.

Pay attention when filling in this form. Ensure all required fields are completed correctly.

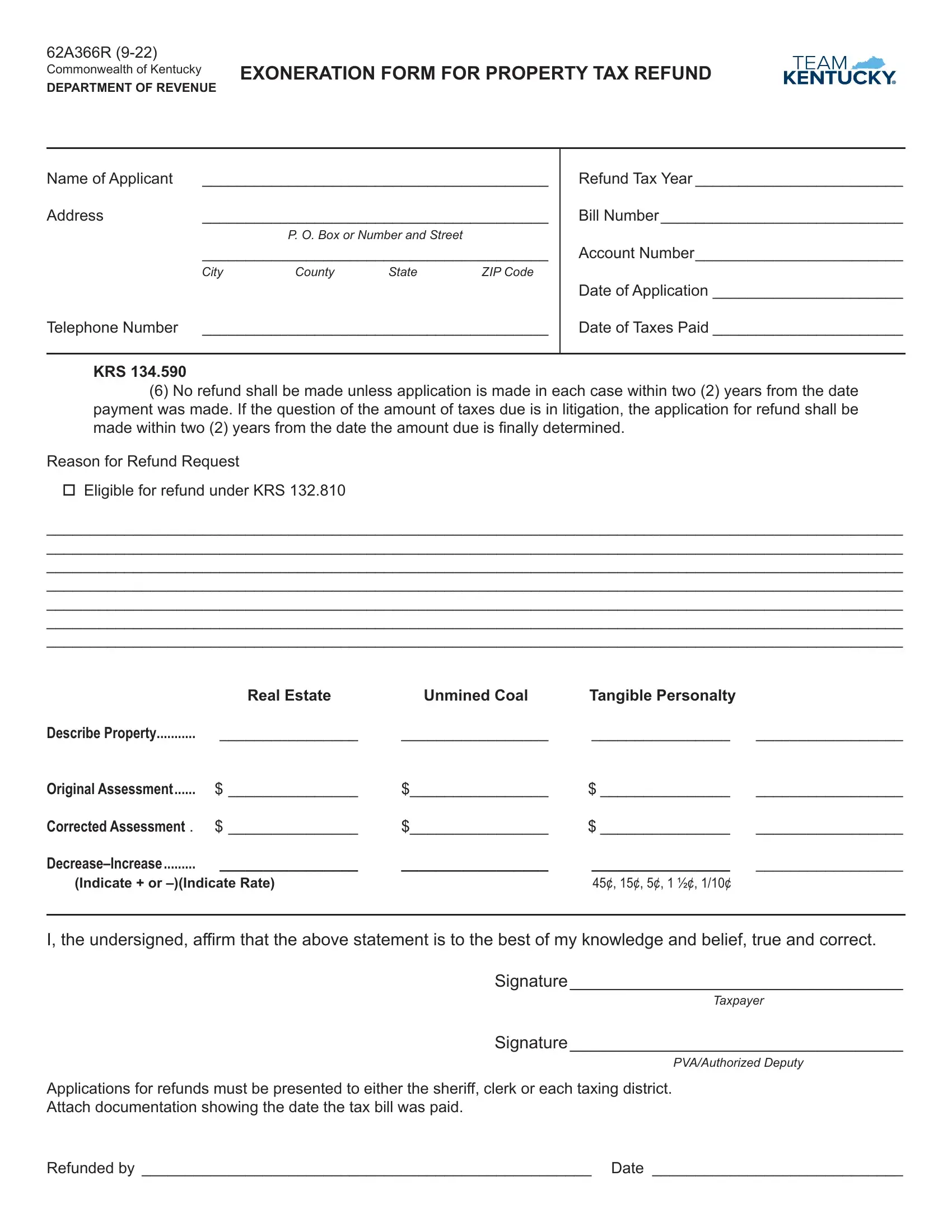

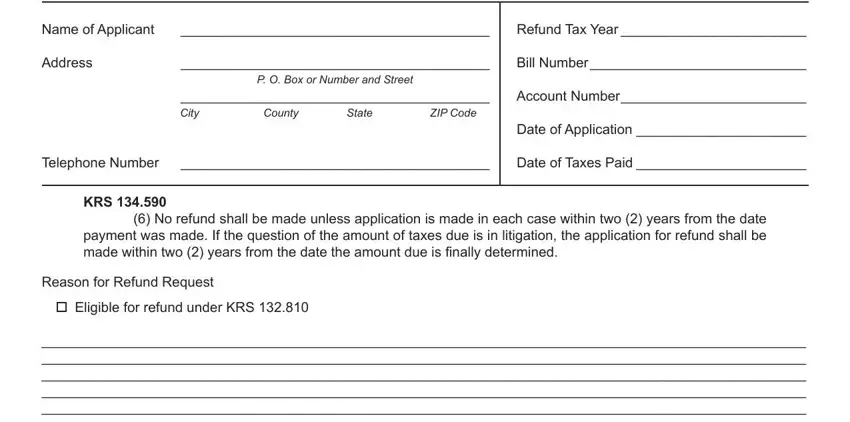

1. It's essential to complete the kentucky revenue exoneration property search correctly, hence be attentive while filling out the segments that contain all of these blank fields:

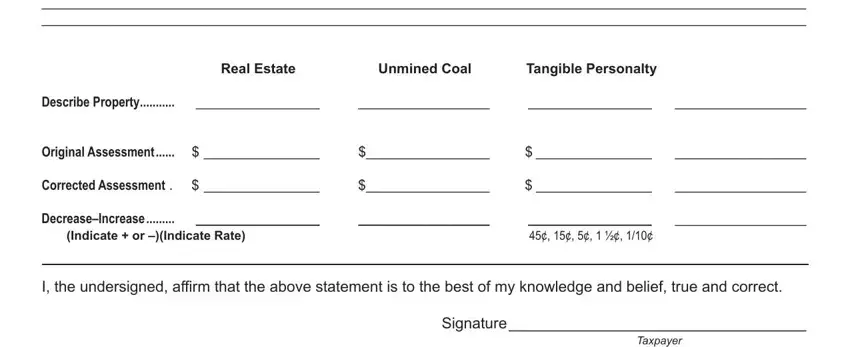

2. After the last part is done, proceed to enter the relevant information in all these - Eligible for refund under KRS , Real Estate, Unmined Coal, Tangible Personalty, Describe Property , Original Assessment , Corrected Assessment , DecreaseIncrease , Indicate or Indicate Rate, I the undersigned affirm that the, Signature , and Taxpayer.

Those who use this PDF generally get some things incorrect when completing Real Estate in this section. You should read again what you enter here.

3. The following section is considered quite uncomplicated, Signature , PVAAuthorized Deputy, Applications for refunds must be, and Refunded by Date - all these form fields will have to be filled in here.

Step 3: Look through all the information you've inserted in the form fields and then click on the "Done" button. After registering afree trial account here, you'll be able to download kentucky revenue exoneration property search or email it at once. The PDF form will also be available through your personal account page with your edits. We don't sell or share the information you type in whenever completing documents at FormsPal.