In case you need to fill out lessors, it's not necessary to download and install any sort of programs - just make use of our online tool. Our editor is continually developing to give the best user experience possible, and that is thanks to our resolve for continual enhancement and listening closely to customer opinions. By taking some easy steps, it is possible to start your PDF journey:

Step 1: Click on the orange "Get Form" button above. It is going to open our pdf tool so you can begin completing your form.

Step 2: The tool enables you to customize your PDF in a range of ways. Change it by writing customized text, adjust what's already in the document, and add a signature - all within a few mouse clicks!

It really is straightforward to complete the document with our practical tutorial! Here's what you have to do:

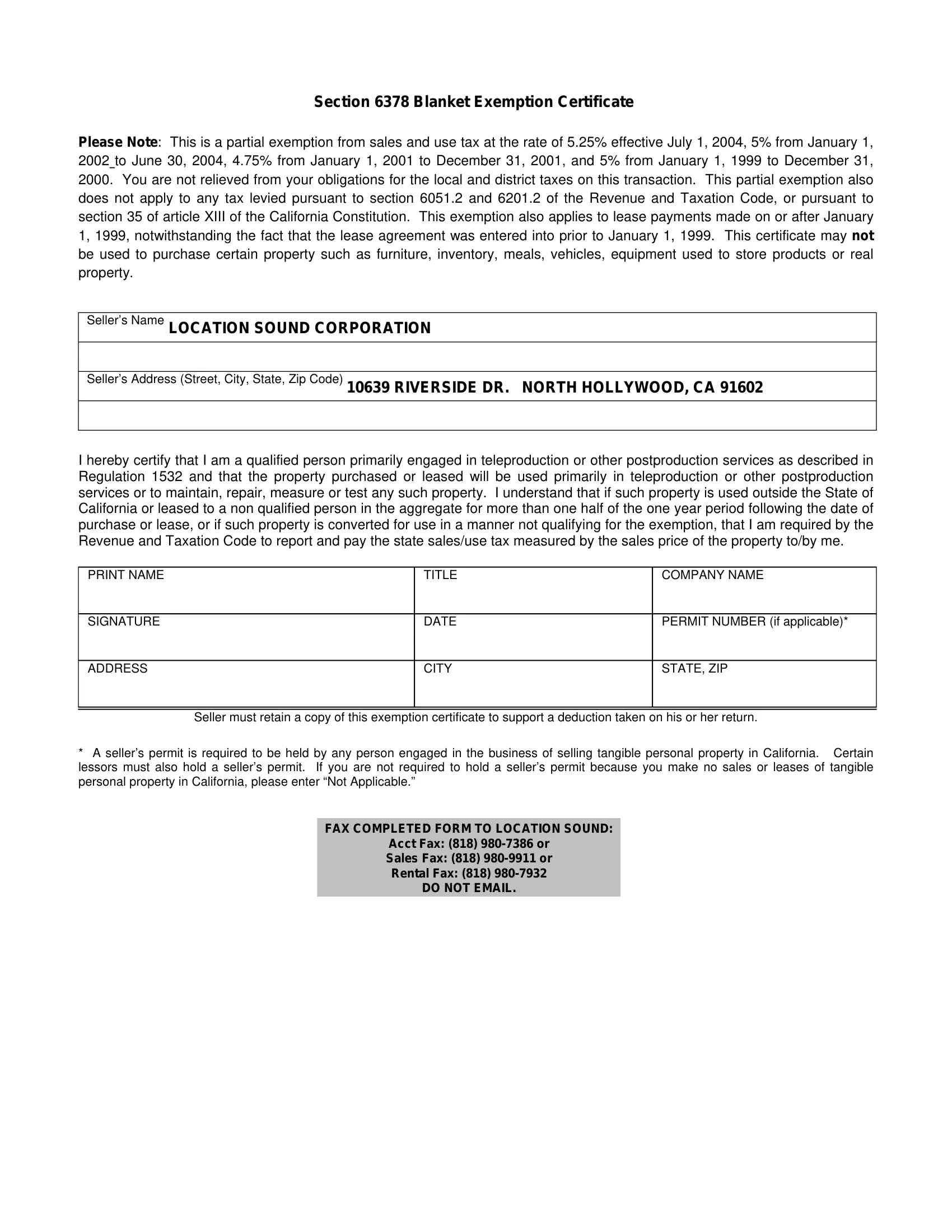

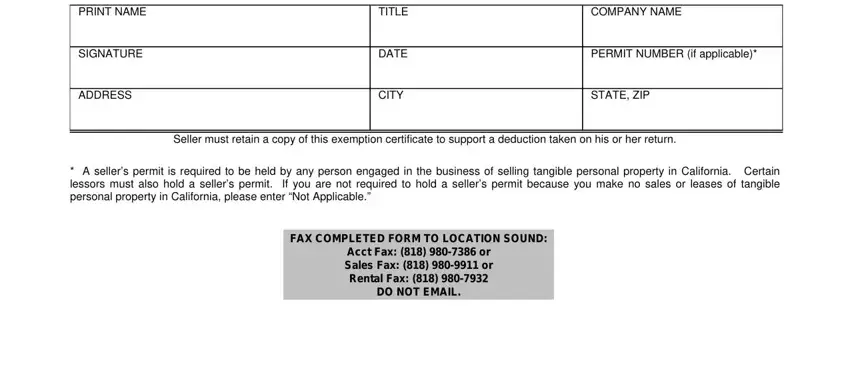

1. The lessors usually requires specific details to be typed in. Make sure the following fields are filled out:

Step 3: Right after looking through your fields and details, hit "Done" and you're done and dusted! Try a 7-day free trial option with us and obtain immediate access to lessors - with all adjustments preserved and accessible from your FormsPal account page. FormsPal guarantees your data privacy by having a protected system that never saves or distributes any sort of private data used in the form. Be assured knowing your docs are kept safe when you use our editor!