Using the online editor for PDFs by FormsPal, you can fill in or alter 760 pmt form here and now. To keep our editor on the forefront of practicality, we work to put into operation user-driven features and enhancements regularly. We're routinely grateful for any suggestions - join us in revampimg PDF editing. To start your journey, consider these simple steps:

Step 1: Click on the orange "Get Form" button above. It's going to open our tool so that you could start filling out your form.

Step 2: The tool offers the ability to customize your PDF file in a range of ways. Modify it by writing your own text, adjust what's already in the PDF, and add a signature - all manageable within minutes!

Be mindful when completing this document. Make sure each blank field is done accurately.

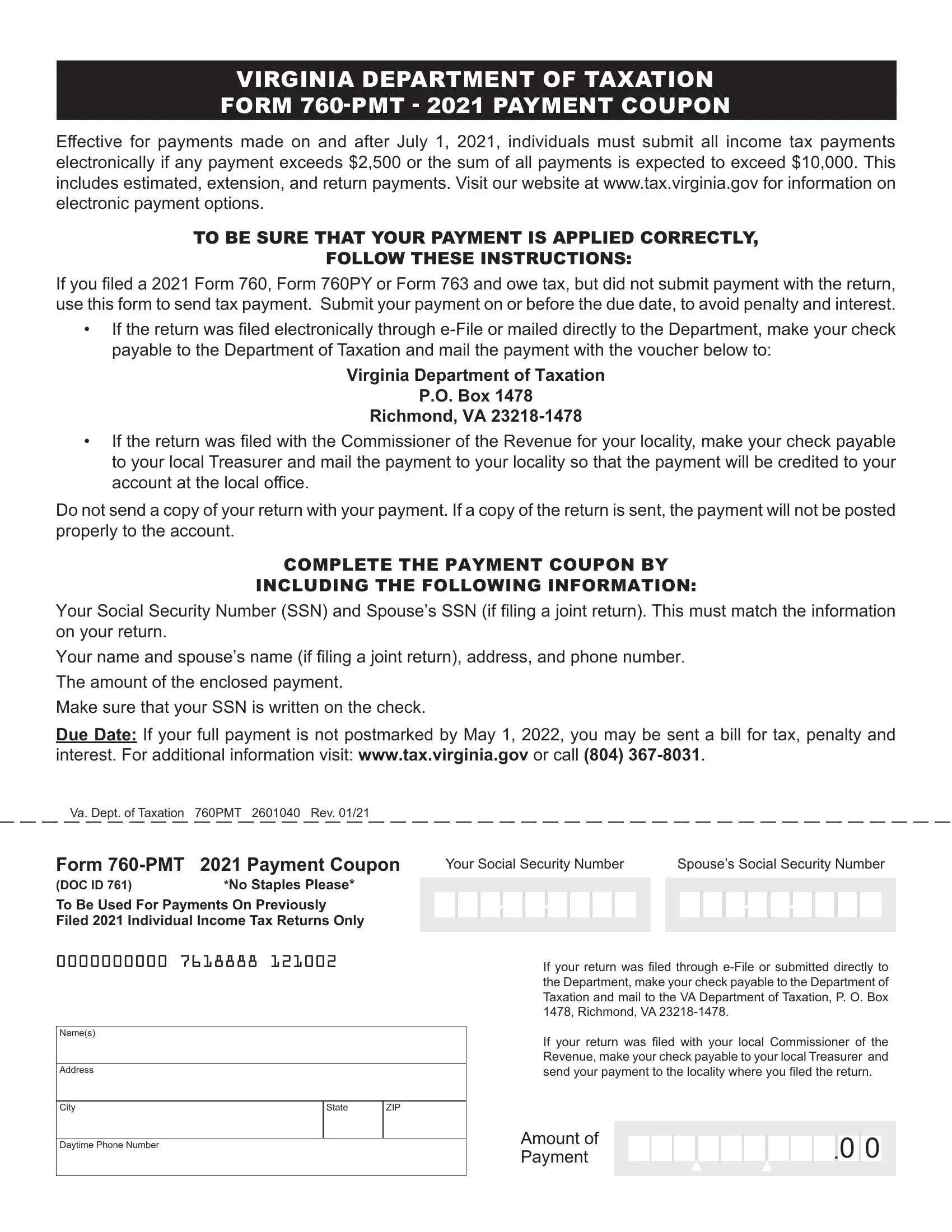

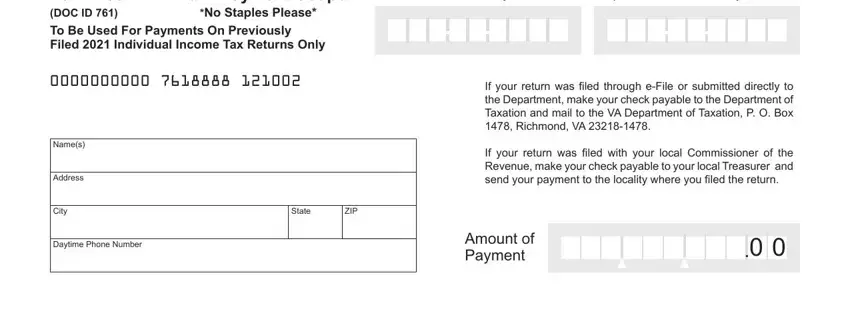

1. Fill out the 760 pmt form with a selection of major fields. Collect all the important information and be sure nothing is left out!

Step 3: Reread the details you've entered into the blanks and then press the "Done" button. Sign up with FormsPal now and instantly gain access to 760 pmt form, ready for download. Each modification made is handily saved , making it possible to edit the document later if needed. When using FormsPal, you can easily complete documents without worrying about information incidents or data entries being shared. Our secure software helps to ensure that your private data is maintained safe.