Embarking on the world of charitable giving and the benefits it entails opens up a gateway to understanding the complexities of tax deductions. Central to this journey is the IRS' Form 8283, a document of paramount importance for taxpayers who donate property valued over $500 and seek to claim a deduction on their tax return. This form not only assists in detailing the information about the donated property but also necessitates the acknowledgment of the receiving organization regarding the contribution. The implications of accurately filling out this form stretch far beyond the initial charitable act, affecting both the donor's tax obligations and the recipient organization's accountability. Exploring the nuances of Form 8283 introduces donors to the requirements set forth by the IRS, including the need for a qualified appraisal for items valued over $5,000, and highlights the significance of meticulous record-keeping. As such, the form acts as a critical bridge between charitable intentions and fiscal responsibility, ensuring that generosity is both recognized and rewarded in the realm of tax deductions.

| Question | Answer |

|---|---|

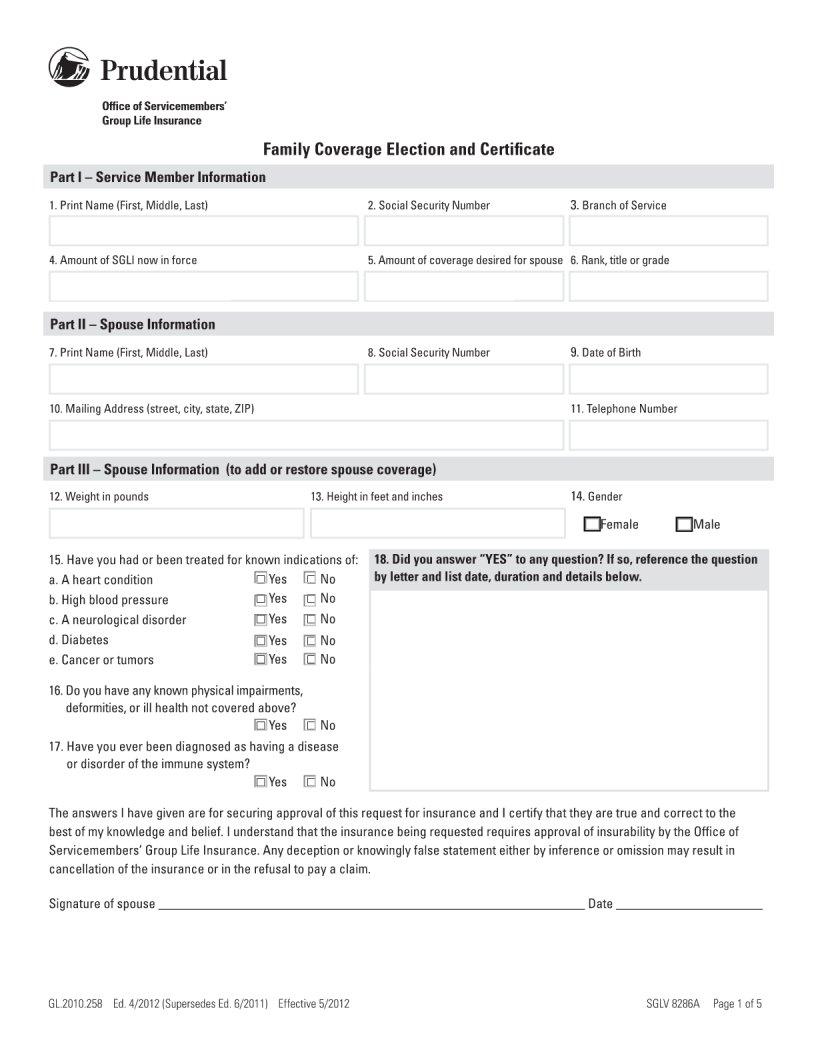

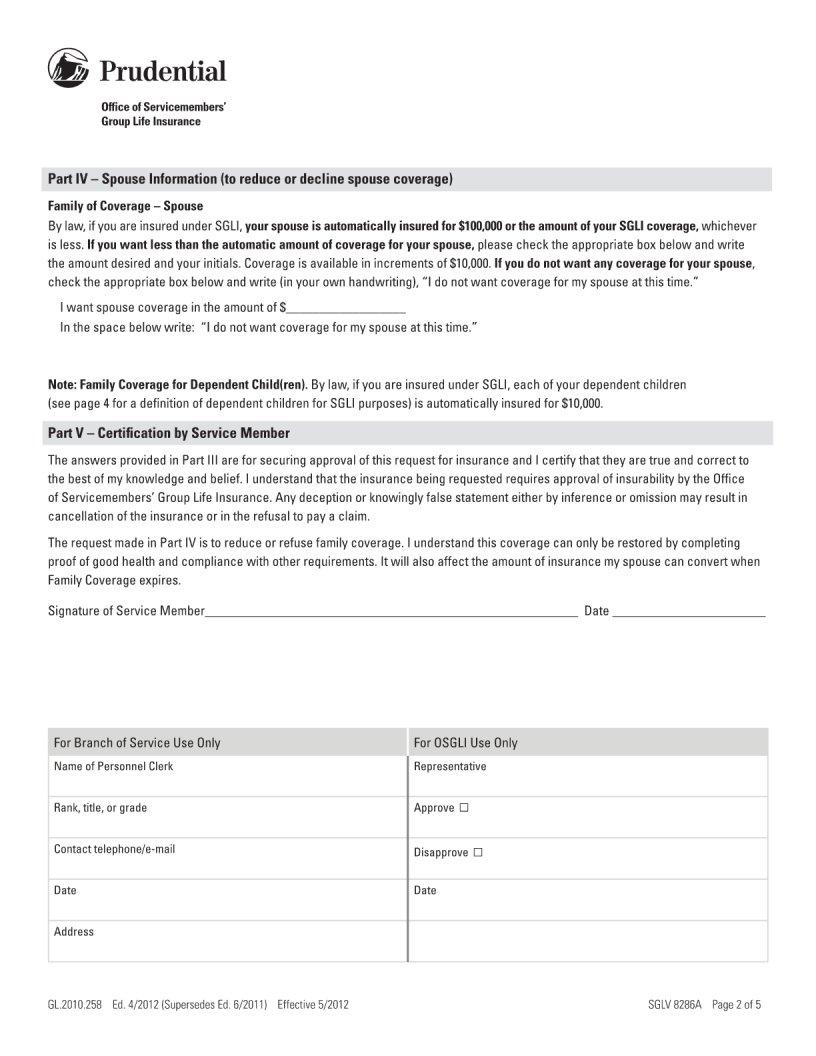

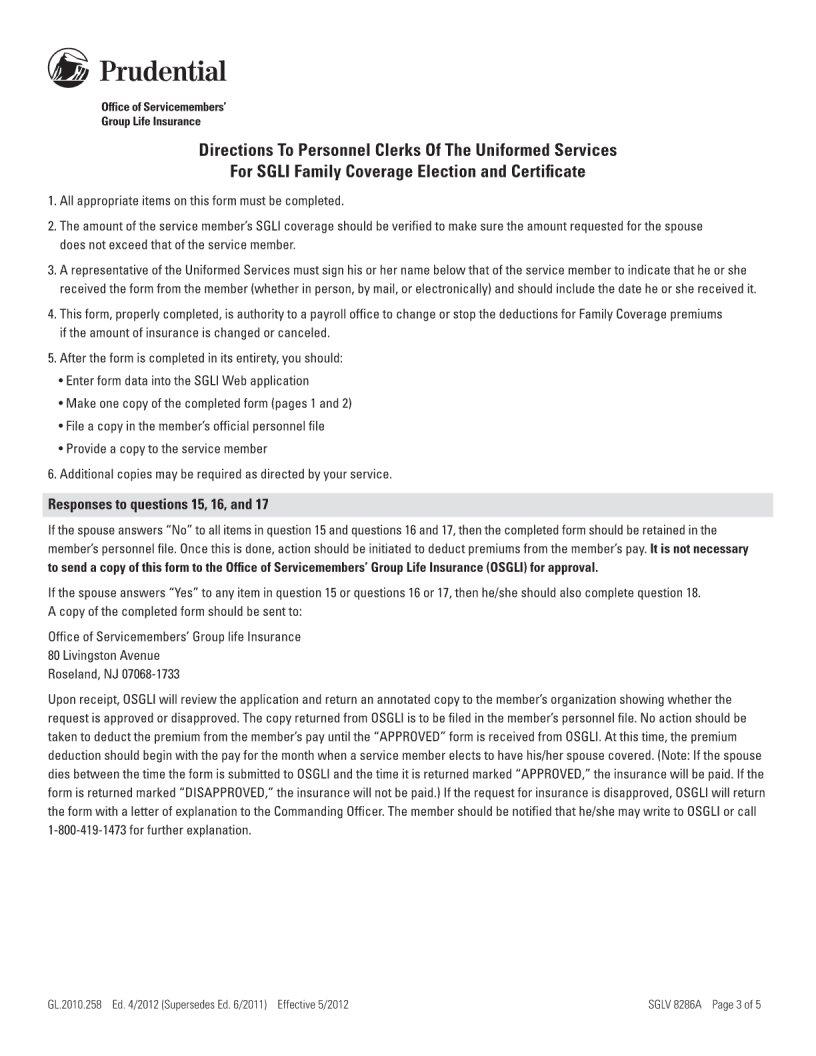

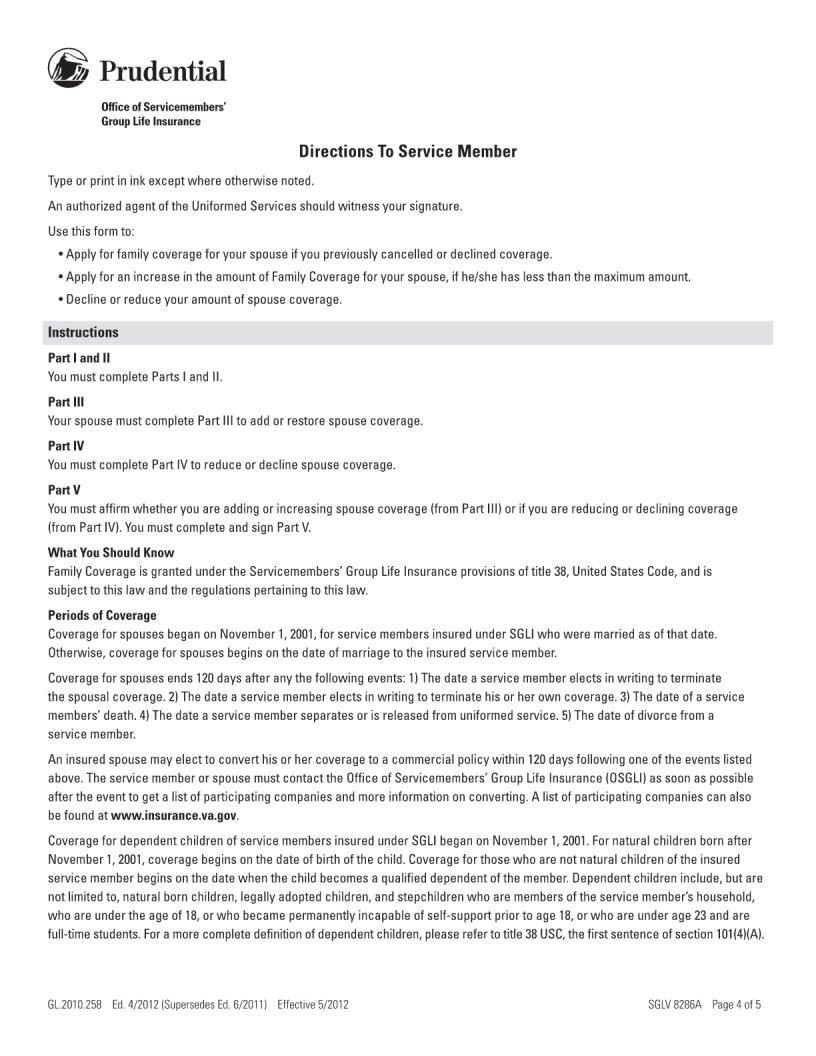

| Form Name | 8286A Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names |