Our PDF editor allows you to manage the form 8863 credit limit worksheet 2020 form. You will be able to generate the file instantly through these simple steps.

Step 1: The following website page includes an orange button that says "Get Form Now". Hit it.

Step 2: You will find all of the functions that it's possible to use on your file once you have accessed the form 8863 credit limit worksheet 2020 editing page.

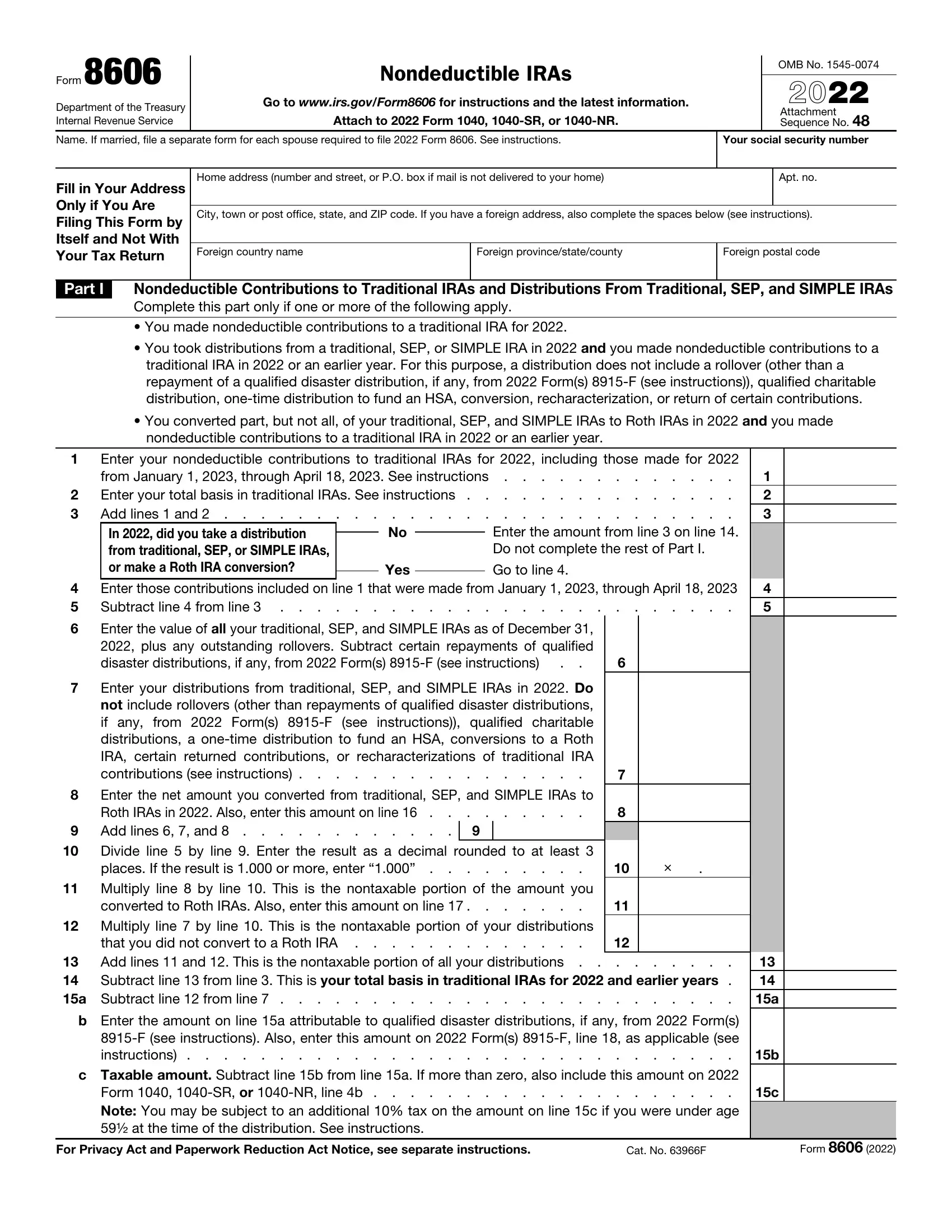

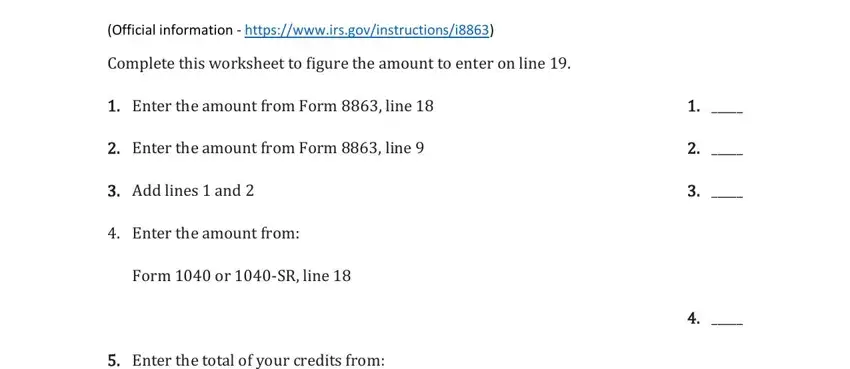

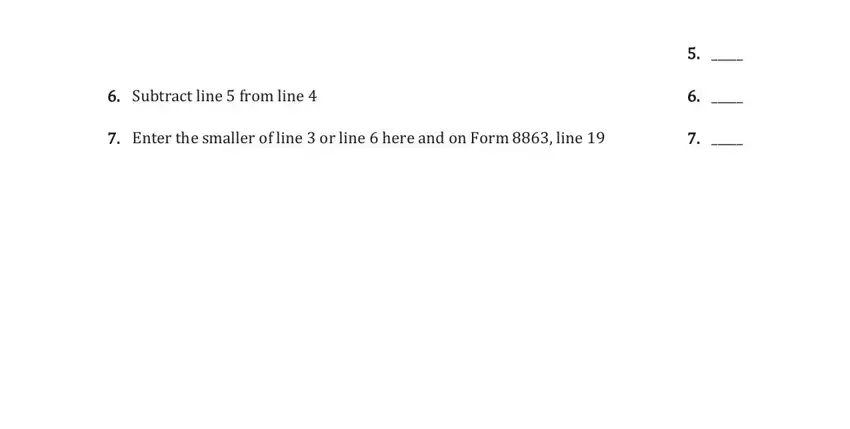

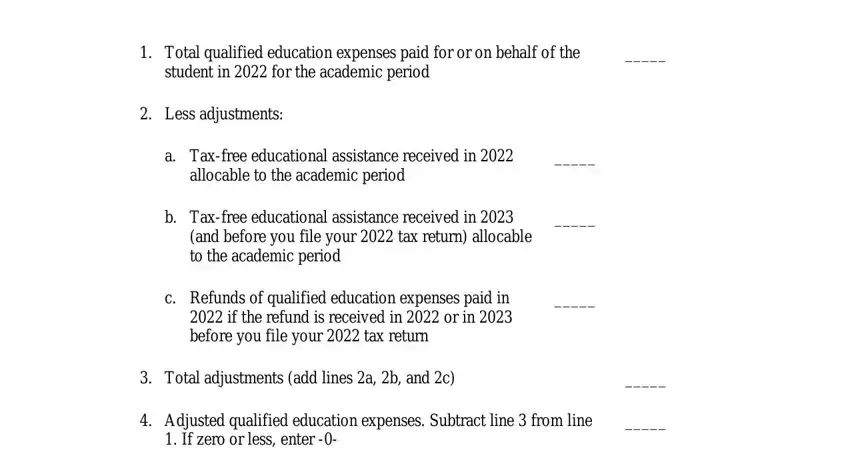

The PDF form you desire to create will consist of the following parts:

Feel free to submit the Subtract line from line, and Enter the smaller of line or box with the necessary information.

Highlight the most crucial details about the Total qualified education, student in for the academic period, Less adjustments, a Taxfree educational assistance, allocable to the academic period, b Taxfree educational assistance, and before you file your tax, c Refunds of qualified education, Total adjustments add lines a b, Adjusted qualified education, and If zero or less enter field.

Step 3: Select "Done". It's now possible to transfer your PDF form.

Step 4: Get a minimum of several copies of your form to keep away from all of the potential problems.