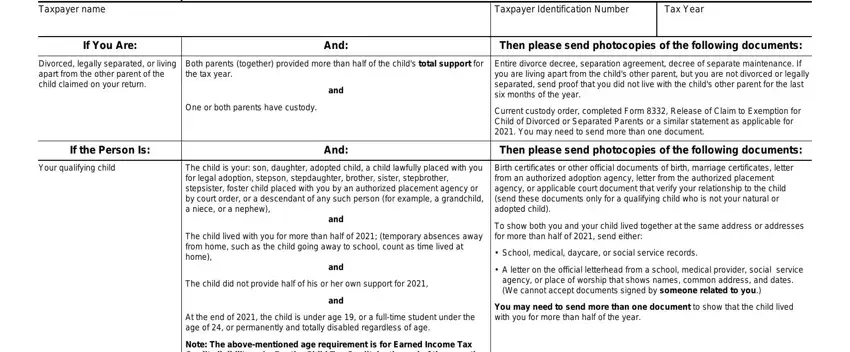

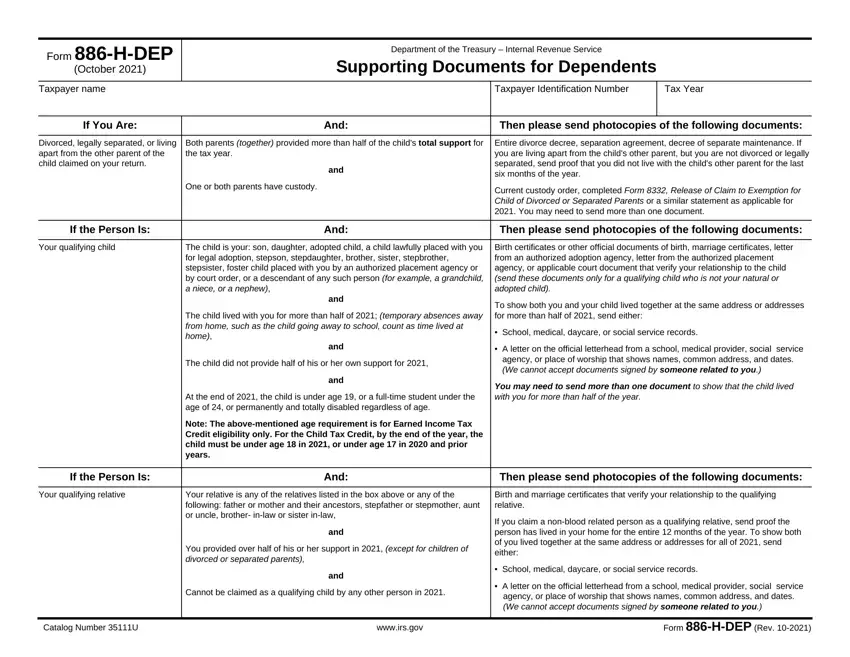

If You Are: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

Divorced, legally separated, or living |

Both parents (together) provided more than half of the child's total support for |

Entire divorce decree, separation agreement, decree of separate maintenance. If |

apart from the other parent of the |

the tax year. |

you are living apart from the child's other parent, but you are not divorced or legally |

child claimed on your return. |

and |

separated, send proof that you did not live with the child's other parent for the last |

|

six months of the year. |

|

|

|

One or both parents have custody. |

Current custody order, completed Form 8332, Release of Claim to Exemption for |

|

|

|

|

Child of Divorced or Separated Parents or a similar statement as applicable for |

|

|

2021. You may need to send more than one document. |

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

Your qualifying child |

The child is your: son, daughter, adopted child, a child lawfully placed with you |

Birth certificates or other official documents of birth, marriage certificates, letter |

|

for legal adoption, stepson, stepdaughter, brother, sister, stepbrother, |

from an authorized adoption agency, letter from the authorized placement |

|

stepsister, foster child placed with you by an authorized placement agency or |

agency, or applicable court document that verify your relationship to the child |

|

by court order, or a descendant of any such person (for example, a grandchild, |

(send these documents only for a qualifying child who is not your natural or |

|

a niece, or a nephew), |

adopted child). |

|

and |

To show both you and your child lived together at the same address or addresses |

|

|

|

The child lived with you for more than half of 2021; (temporary absences away |

for more than half of 2021, send either: |

|

from home, such as the child going away to school, count as time lived at |

• |

School, medical, daycare, or social service records. |

|

home), |

|

|

|

|

and |

• |

A letter on the official letterhead from a school, medical provider, social service |

|

The child did not provide half of his or her own support for 2021, |

|

agency, or place of worship that shows names, common address, and dates. |

|

|

(We cannot accept documents signed by someone related to you.) |

|

and |

|

|

You may need to send more than one document to show that the child lived |

|

At the end of 2021, the child is under age 19, or a full-time student under the |

|

with you for more than half of the year. |

|

age of 24, or permanently and totally disabled regardless of age. |

|

|

|

Note: The above-mentioned age requirement is for Earned Income Tax |

|

|

|

Credit eligibility only. For the Child Tax Credit, by the end of the year, the |

|

|

|

child must be under age 18 in 2021, or under age 17 in 2020 and prior |

|

|

|

years. |

|

|

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

Your qualifying relative |

Your relative is any of the relatives listed in the box above or any of the |

Birth and marriage certificates that verify your relationship to the qualifying |

|

following: father or mother and their ancestors, stepfather or stepmother, aunt |

relative. |

|

or uncle, brother- in-law or sister in-law, |

If you claim a non-blood related person as a qualifying relative, send proof the |

|

and |

|

person has lived in your home for the entire 12 months of the year. To show both |

|

You provided over half of his or her support in 2021, (except for children of |

of you lived together at the same address or addresses for all of 2021, send |

|

either: |

|

divorced or separated parents), |

|

• |

School, medical, daycare, or social service records. |

|

and |

|

• |

A letter on the official letterhead from a school, medical provider, social service |

|

Cannot be claimed as a qualifying child by any other person in 2021. |

|

|

agency, or place of worship that shows names, common address, and dates. |

|

|

|

|

|

|

(We cannot accept documents signed by someone related to you.) |

|

|

|

|

Catalog Number 35111U |

www.irs.gov |

|

Form 886-H-DEP (Rev. 10-2021) |