It shouldn’t be hard to get irs withholding tables taking advantage of our PDF editor. This is how you could instantly design your form.

Step 1: Find the button "Get Form Here" on this website and click it.

Step 2: You can now modify the irs withholding tables. This multifunctional toolbar allows you to insert, remove, improve, and highlight content or perhaps carry out other commands.

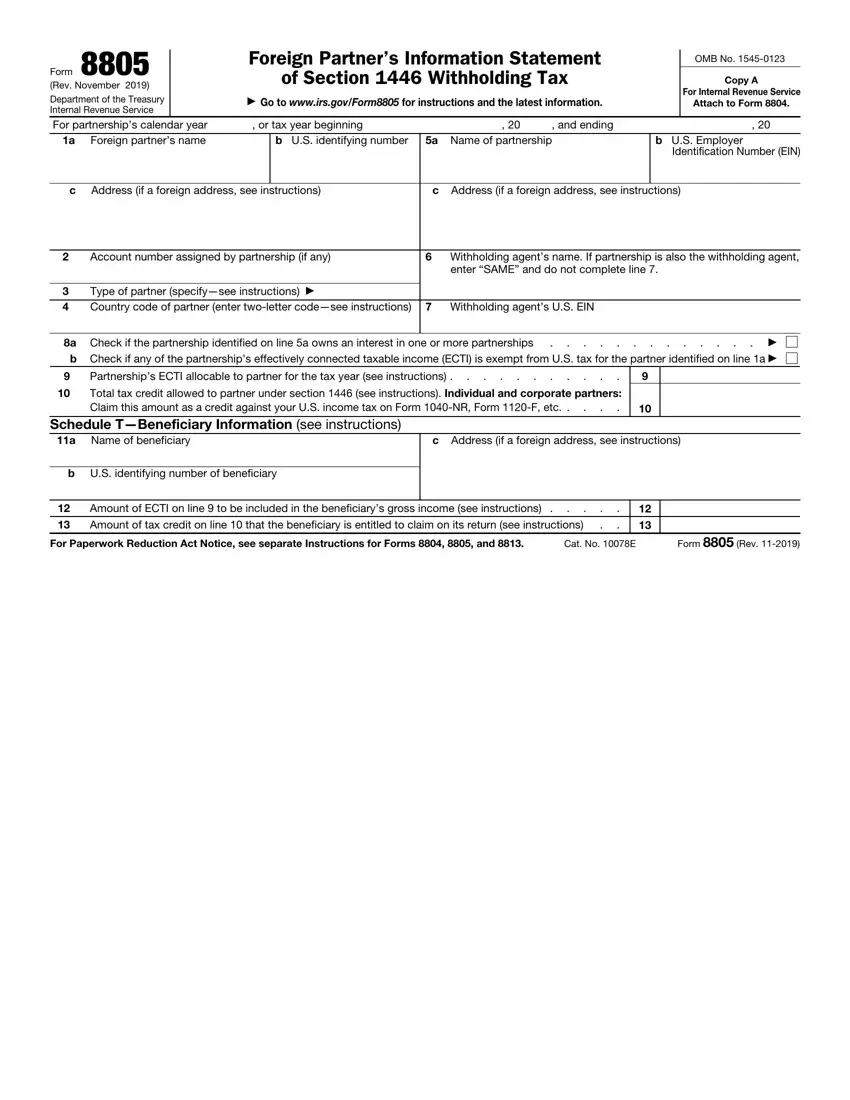

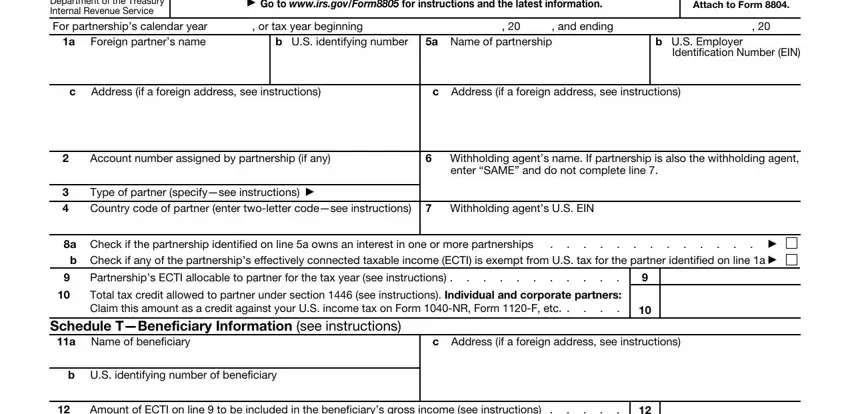

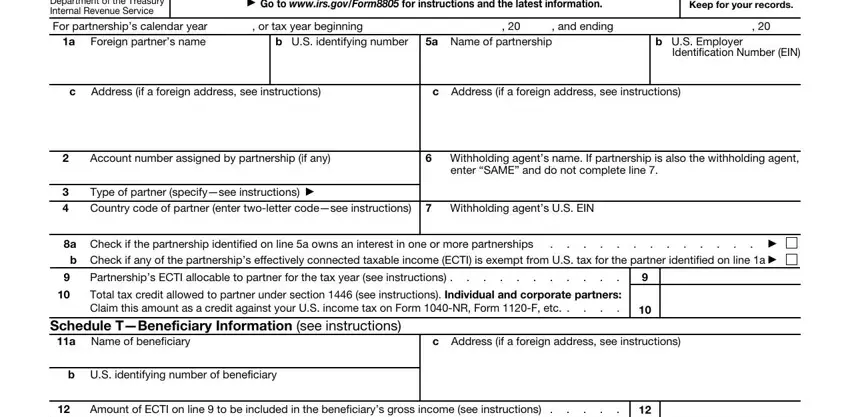

To be able to prepare the document, type in the data the program will request you to for each of the appropriate areas:

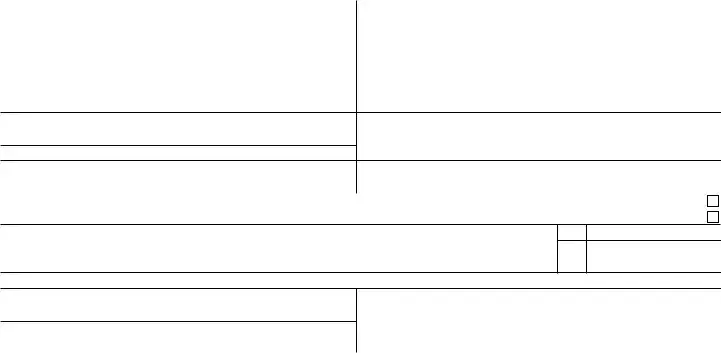

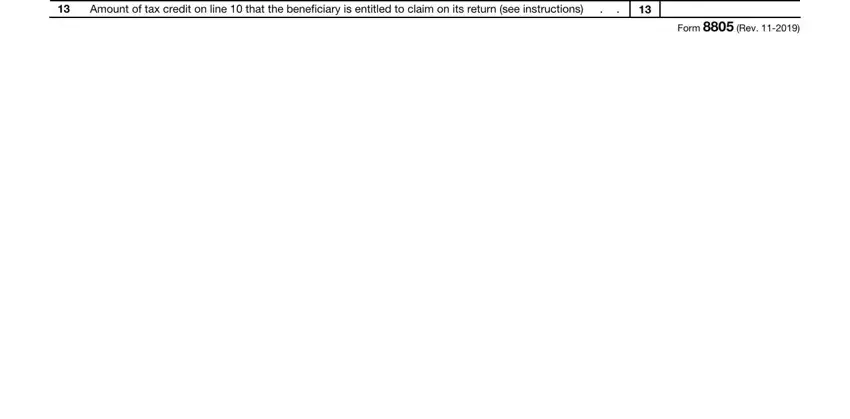

Type in the required information in the Amount of ECTI on line to be, For Paperwork Reduction Act Notice, Cat No E, and Form Rev box.

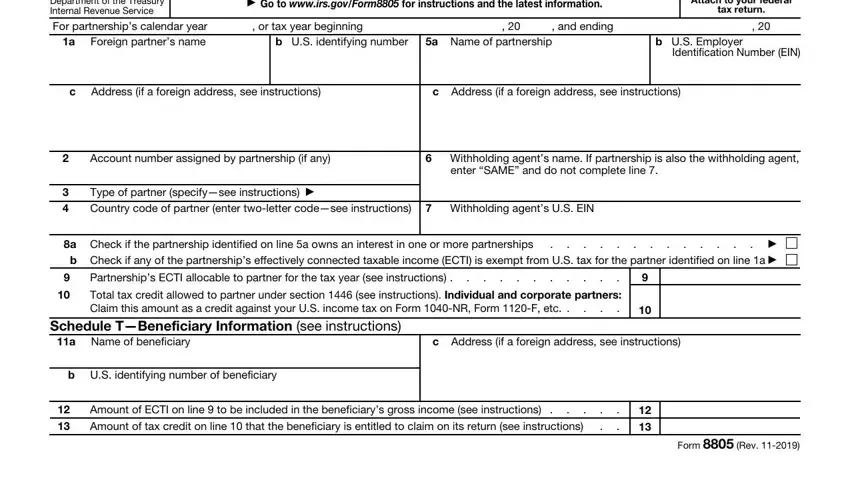

The program will require you to present specific significant particulars to conveniently submit the part Rev November Department of the, Foreign Partners Information, Copy B For Partner Keep for your, or tax year beginning, and ending, b US identifying number, a Name of partnership, b US Employer, Identification Number EIN, c Address if a foreign address see, c Address if a foreign address see, Account number assigned by, Withholding agents name If, enter SAME and do not complete, and Type of partner specifysee.

The Amount of ECTI on line to be, and Form Rev segment should be applied to record the rights or obligations of each party.

End by reading all these sections and filling them out accordingly: Rev November Department of the, Foreign Partners Information, Copy C For Partner Attach to your, or tax year beginning, and ending, b US identifying number, a Name of partnership, b US Employer, Identification Number EIN, c Address if a foreign address see, c Address if a foreign address see, Account number assigned by, Withholding agents name If, enter SAME and do not complete, and Type of partner specifysee.

Step 3: Hit the Done button to be sure that your finalized form is available to be exported to every gadget you prefer or sent to an email you indicate.

Step 4: Attempt to make as many duplicates of the form as possible to prevent future complications.