With the online tool for PDF editing by FormsPal, you're able to fill out or modify the Commonwealth of the Northern Mariana Islands here. FormsPal team is aimed at giving you the absolute best experience with our tool by regularly presenting new functions and upgrades. With all of these improvements, using our editor gets easier than ever! All it requires is a couple of basic steps:

Step 1: Press the "Get Form" button above. It is going to open up our pdf tool so you can start completing your form.

Step 2: This editor provides you with the opportunity to work with your PDF file in a variety of ways. Enhance it by including customized text, adjust original content, and add a signature - all when you need it!

Completing this PDF will require care for details. Make sure every field is done accurately.

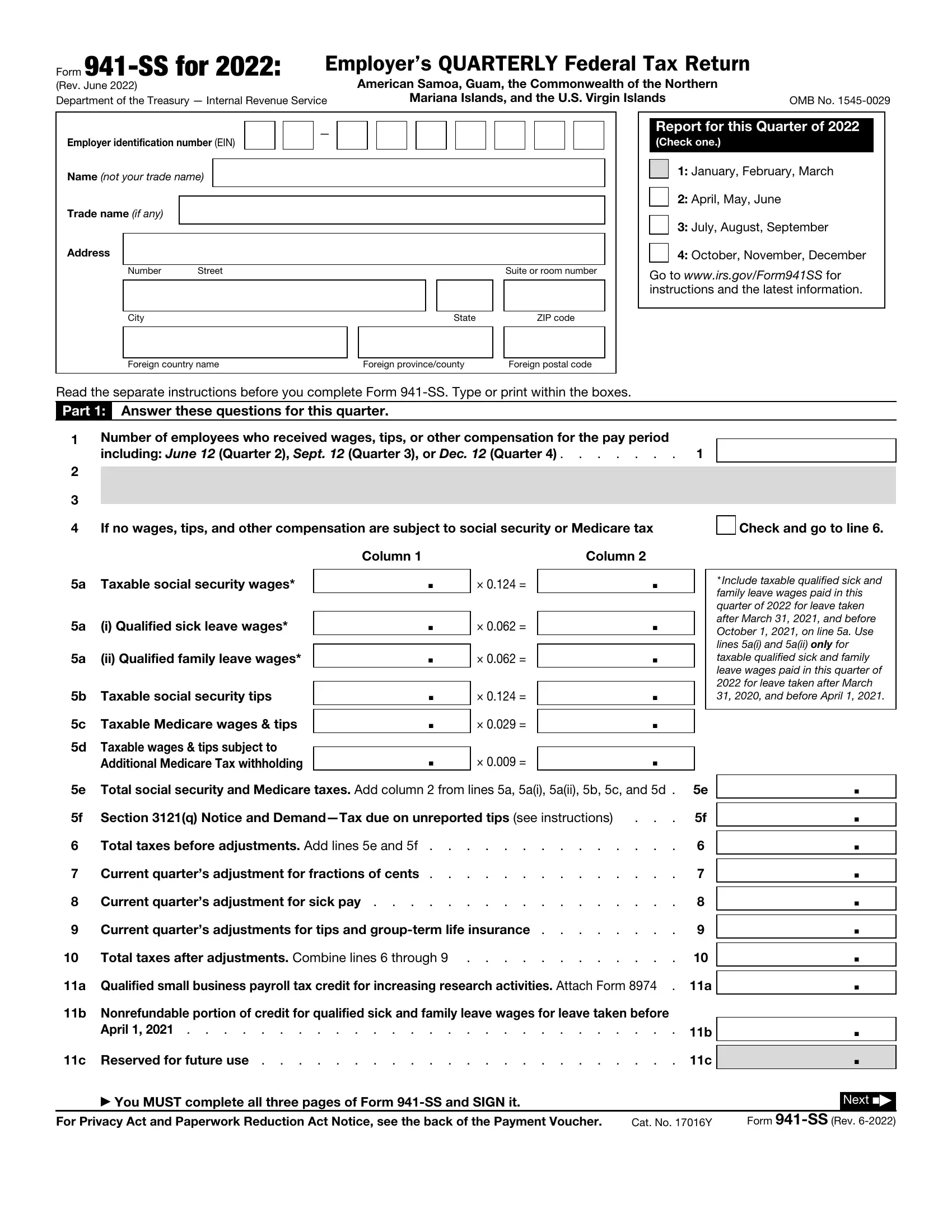

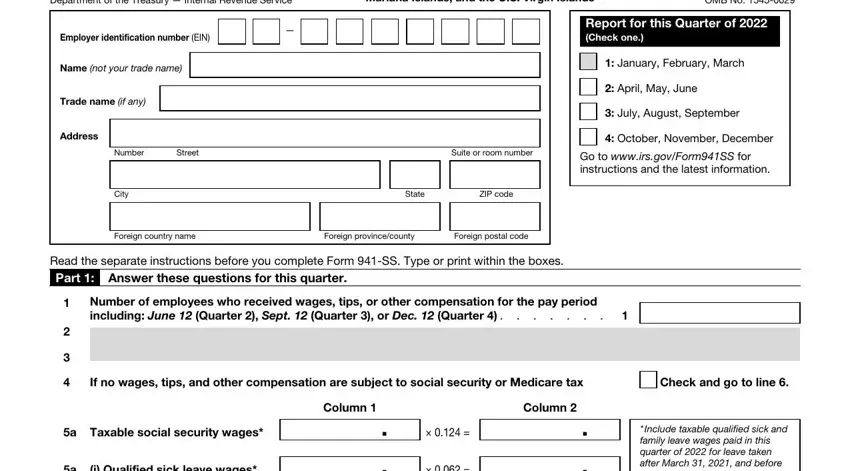

1. You'll want to fill out the the Commonwealth of the Northern Mariana Islands accurately, thus be mindful when filling in the sections including these blanks:

2. Once the previous array of fields is done, you have to put in the needed particulars in a i Qualified sick leave wages, a ii Qualified family leave wages, b Taxable social security tips, c Taxable Medicare wages tips, d Taxable wages tips subject to, Additional Medicare Tax withholding, Include taxable qualified sick, e Total social security and, Section q Notice and DemandTax due, Total taxes before adjustments Add, Current quarters adjustment for, Current quarters adjustment for, Current quarters adjustments for, Total taxes after adjustments, and a Qualified small business payroll so you're able to move forward to the next step.

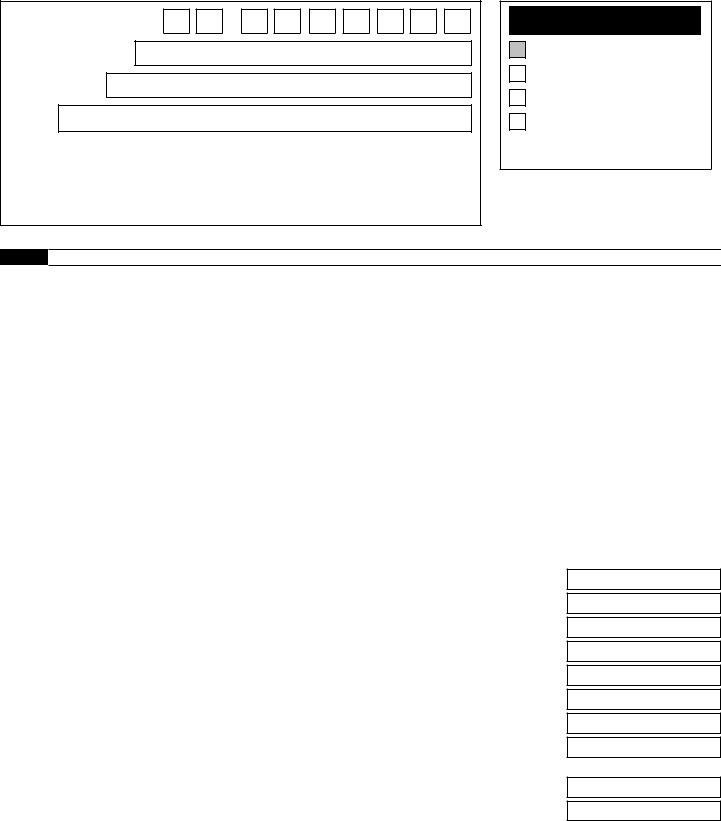

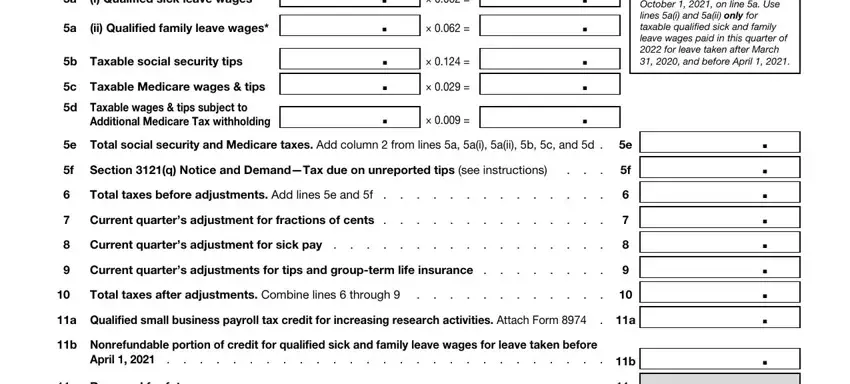

3. Your next stage is normally hassle-free - complete all the blanks in Name not your trade name, Employer identification number EIN, Part Answer these questions for, d Nonrefundable portion of credit, after March and before October , e Reserved for future use , f Reserved for future use, g Total nonrefundable credits Add, Total taxes after adjustments and, a Total deposits for this quarter, overpayments applied from Form X X, b Reserved for future use , c Refundable portion of credit, April , and d Reserved for future use to finish this process.

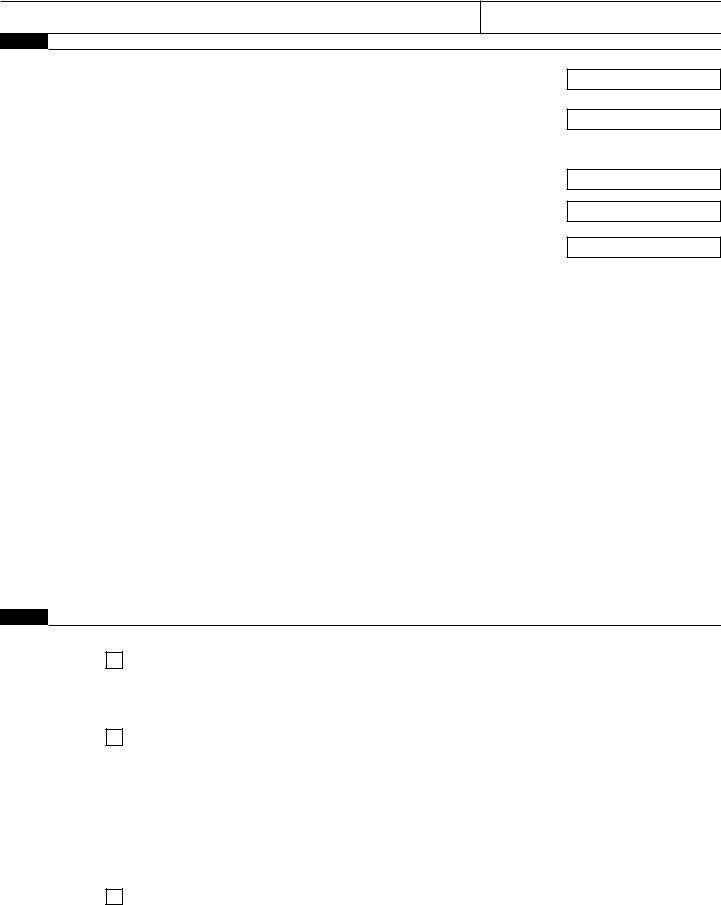

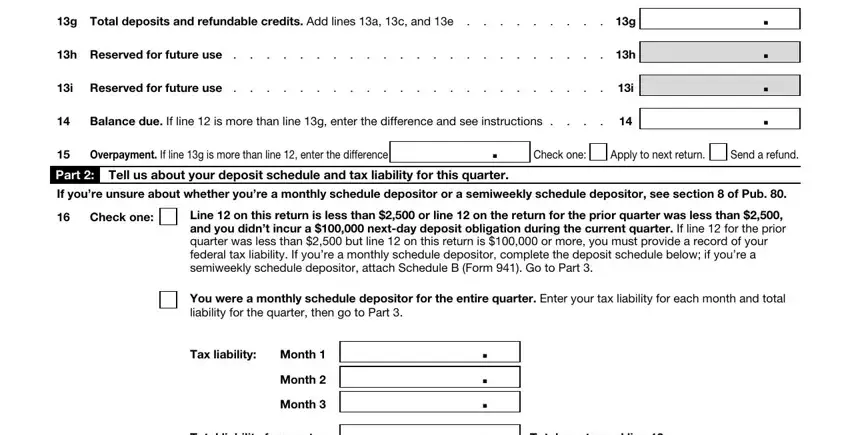

4. Filling in g Total deposits and refundable, h Reserved for future use , i Reserved for future use , Balance due If line is more than, Part Tell us about your deposit, Overpayment If line g is more than, Check one, Apply to next return, Send a refund, If youre unsure about whether, Check one, Line on this return is less than , You were a monthly schedule, Tax liability, and Month is crucial in this fourth section - don't forget to be patient and be attentive with each empty field!

As for Month and Balance due If line is more than, make certain you take a second look in this section. Those two are the key fields in the page.

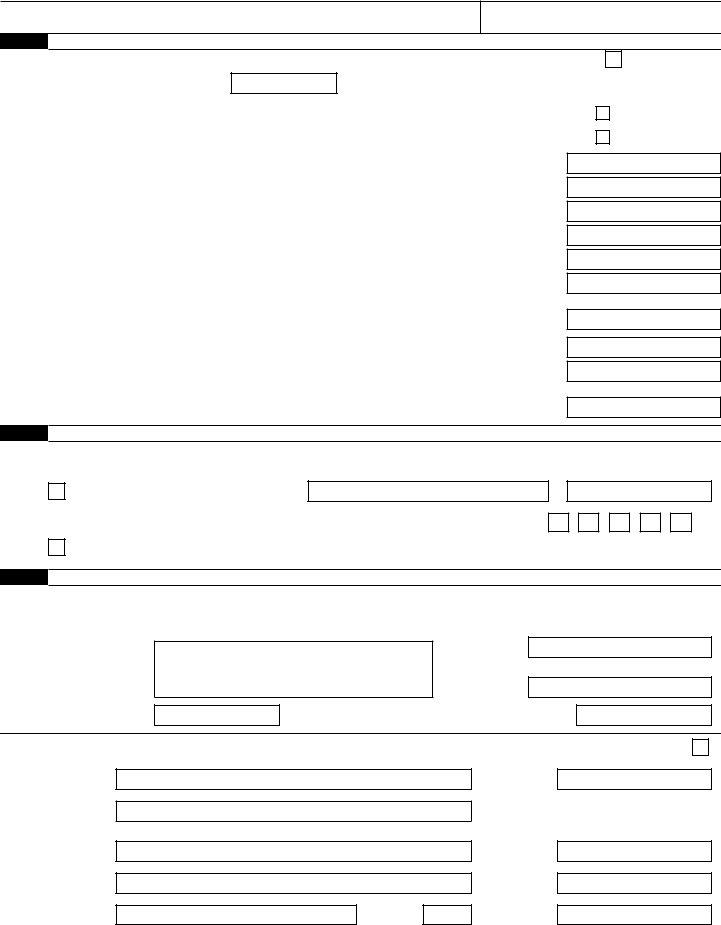

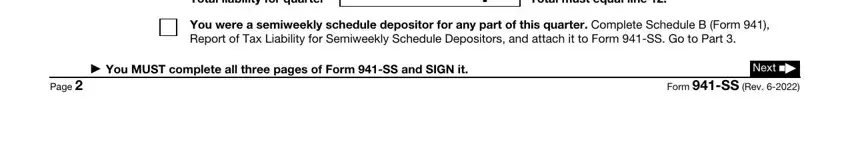

5. As you draw near to the last parts of your form, you'll find a couple more requirements that need to be met. Notably, Total liability for quarter, Total must equal line , You were a semiweekly schedule, You MUST complete all three pages, Page , and Next Form SS Rev must be filled in.

Step 3: Just after proofreading the filled in blanks, click "Done" and you're done and dusted! Sign up with us right now and immediately obtain the Commonwealth of the Northern Mariana Islands, available for download. All alterations made by you are kept , so that you can modify the document at a later time if needed. At FormsPal, we do our utmost to make sure that your details are kept private.