The Company You Keep®

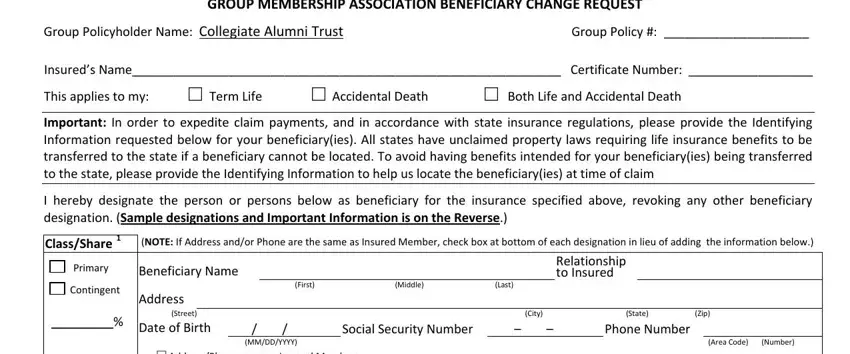

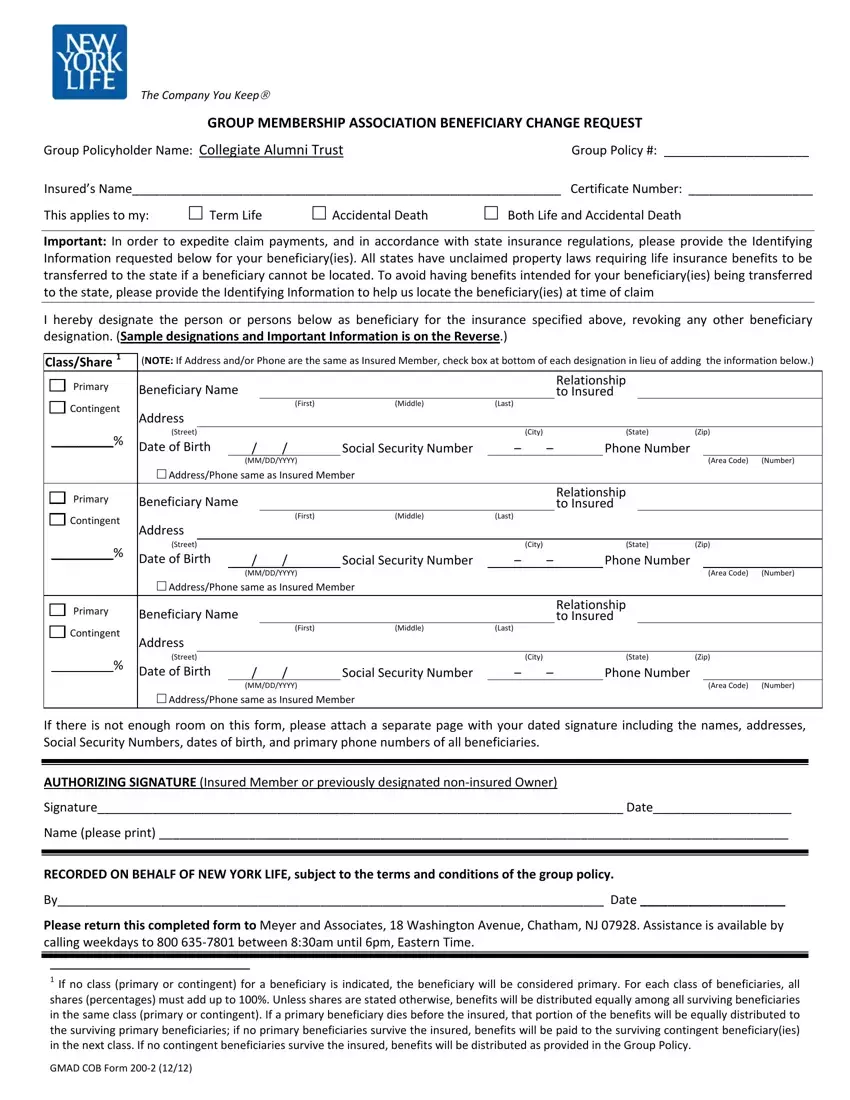

GROUP MEMBERSHIP ASSOCIATION BENEFICIARY CHANGE REQUEST

Group Policyholder Name: Collegiate Alumni TrustGroup Policy #: _____________________

Insured’s Name______________________________________________________________ Certificate Number: __________________

This applieS to my: |

□ Term Life |

□ Accidental Death |

□ Both Life and Accidental Death |

Important: In order to expedite claim payments, and in accordance with state insurance regulations, please provide the Identifying Information requested below for your beneficiary(ies). All states have unclaimed property laws requiring life insurance benefits to be transferred to the state if a beneficiary cannot be located. To avoid having benefits intended for your beneficiary(ies) being transferred to the state, please provide the Identifying Information to help us locate the beneficiary(ies) at time of claim

I hereby designate the person or persons below as beneficiary for the insurance specified above, revoking any other beneficiary designation. (Sample designations and Important Information is on the Reverse.)

Class/Share 1 |

(NOTE: If Address and/or Phone are the same as Insured Member, check box at bottom of each designation in lieu of adding the information below.) |

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

|

to Insured |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

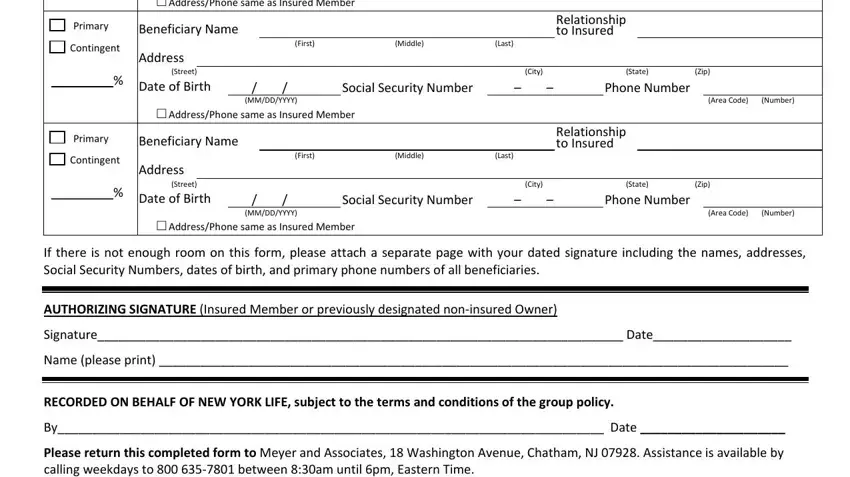

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

|

to Insured |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

|

to Insured |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

If there is not enough room on this form, please attach a separate page with your dated signature including the names, addresses, Social Security Numbers, dates of birth, and primary phone numbers of all beneficiaries.

AUTHORIZING SIGNATURE (Insured Member or previously designated non‐insured Owner)

Signature____________________________________________________________________________ Date____________________

Name (please print) ___________________________________________________________________________________________

RECORDED ON BEHALF OF NEW YORK LIFE, subject to the terms and conditions of the group policy.

By_______________________________________________________________________________ Date _____________________

Please return this completed form to Meyer and Associates, 18 Washington Avenue, Chatham, NJ 07928. Assistance is available by calling weekdays to 800 635‐7801 between 8:30am until 6pm, Eastern Time.

1If no class (primary or contingent) for a beneficiary is indicated, the beneficiary will be considered primary. For each class of beneficiaries, all shares (percentages) must add up to 100%. Unless shares are stated otherwise, benefits will be distributed equally among all surviving beneficiaries in the same class (primary or contingent). If a primary beneficiary dies before the insured, that portion of the benefits will be equally distributed to the surviving primary beneficiaries; if no primary beneficiaries survive the insured, benefits will be paid to the surviving contingent beneficiary(ies) in the next class. If no contingent beneficiaries survive the insured, benefits will be distributed as provided in the Group Policy.

GMAD COB Form 200‐2 (12/12)

SAMPLES OF BENEFICIARY DESIGNATIONS: Below are examples of some common beneficiary designations that may be helpful as you complete this form.

1. Specific unequal shares (NOTE: Insert “Per Stirpes” after % to have any Benefits due any deceased beneficiary payable to his/her descendents)

|

Class/Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

John |

J. |

|

Smith |

to Insured |

Brother |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

Address |

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

99999‐1111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 Bay Ridge Boulevard |

Smithville |

AK |

|

|

__60%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

Per stirpes |

Date of Birth |

|

11 / 15 / 1974 |

|

Social Security Number |

123 – 45 – 6789 |

Phone Number |

(111) 234‐5678 |

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

Antoinette |

Dubois |

|

Jones |

to Insured |

Sister |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

2201‐1870 Southwest Third Avenue |

|

|

Ocean City |

KS |

11111‐2222 |

|

|

|

|

|

|

__40%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

Per stirpes |

Date of Birth |

|

5 / |

7 / 1979 |

|

Social Security Number |

987 – 65 – 4321 |

Phone Number |

|

(999) 876‐5432 |

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

2. Trust as Beneficiary:

“John Smith and Mary Jones as Trustees of the Jones Family Trust under the Trust document dated December 1, 2012.” [Please provide Identifying Information for all Trustees.]

3.Minor Beneficiary ‐ Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) Designation:

“[Name of Adult] as Custodian for [Name of Minor] under [Insured Member’s or Minor’s State of Residence] Uniform Transfers/Gifts to Minors Act.” [Please provide Identifying Information for the minor and adult Custodian.]

NOTICE REGARDING DESIGNATING A MINOR BENEFICIARY

Unless a UTMA/UGMA designation is used, or there is an existing court appointed guardian of the minor’s estate who can make financial decisions for the minor, a claims payment to a minor may be delayed until a surviving parent, relative, or other interested party obtains a court appointment as financial guardian of the minor’s estate, for the purpose of receiving the proceeds on behalf of the child.

NOTICE REGARDING TESTAMENTARY TRUST UNDER LAST WILL AND TESTAMENT AS BENEFICIARY

The following is understood and agreed when naming a Testamentary Trust under the Last Will and Testament as beneficiary of a specified decedent (Insured Member or non‐insured owner).

Proceeds shall be paid to the named contingent beneficiary if the decedent dies intestate (without a Last Will and Testament), or with a Last Will and Testament but (1) it does not create a Trust and name a Trustee or (2) no court proceeding has been started to probate the Last Will and Testament or no Trustee qualifies and claims the proceeds within 12 months (18 in Mississippi, New York, Texas; 6 months in Florida and North Carolina) after the decedent’s death. If the named contingent beneficiary is not living, and no further beneficiary is named, payment shall be made in accordance with the Group Policy.

New York Life is not obligated to inquire about the terms of any Trust affecting this policy or its proceeds, and shall not be held responsible for knowing the terms of any such Trust.

Payment to and receipt by said Trustee(s) or any successor Trustee(s), or payment to and receipt by the contingent beneficiary or insured’s estate shall constitute a full discharge and releases the New York Life Insurance Company to the extent of such payment. The full discharge and release of the New York Life Insurance Company’s obligation for payment applies to all persons and fiduciaries having any interest in such proceeds.

NOTICE REGARDING NON‐INSURED OWNER

A non‐insured owner who wishes to name a person other than themselves as beneficiary should do so only after receiving advice from their Counsel as to the possible tax consequences in light of existing decisional law to the effect that, when the proceeds are paid to someone other than the non‐insured owner, the proceeds constitute a taxable gift from the owner to the beneficiary at the time of the insured’s death.

*Per Stirpes means that any interest in a life insurance policy that a deceased beneficiary would have, if living, will be shared equally by all living children of that deceased beneficiary.

GMAD COB Form 200‐2 (12/12)