Dealing with PDF documents online is always surprisingly easy using our PDF tool. You can fill in coverplus extra application here effortlessly. To make our editor better and simpler to work with, we consistently develop new features, with our users' suggestions in mind. If you are seeking to begin, this is what it will require:

Step 1: Click on the "Get Form" button at the top of this page to get into our editor.

Step 2: When you open the file editor, there'll be the form made ready to be completed. Apart from filling in different blanks, you may as well do various other things with the Document, that is adding any text, editing the original textual content, inserting graphics, putting your signature on the form, and more.

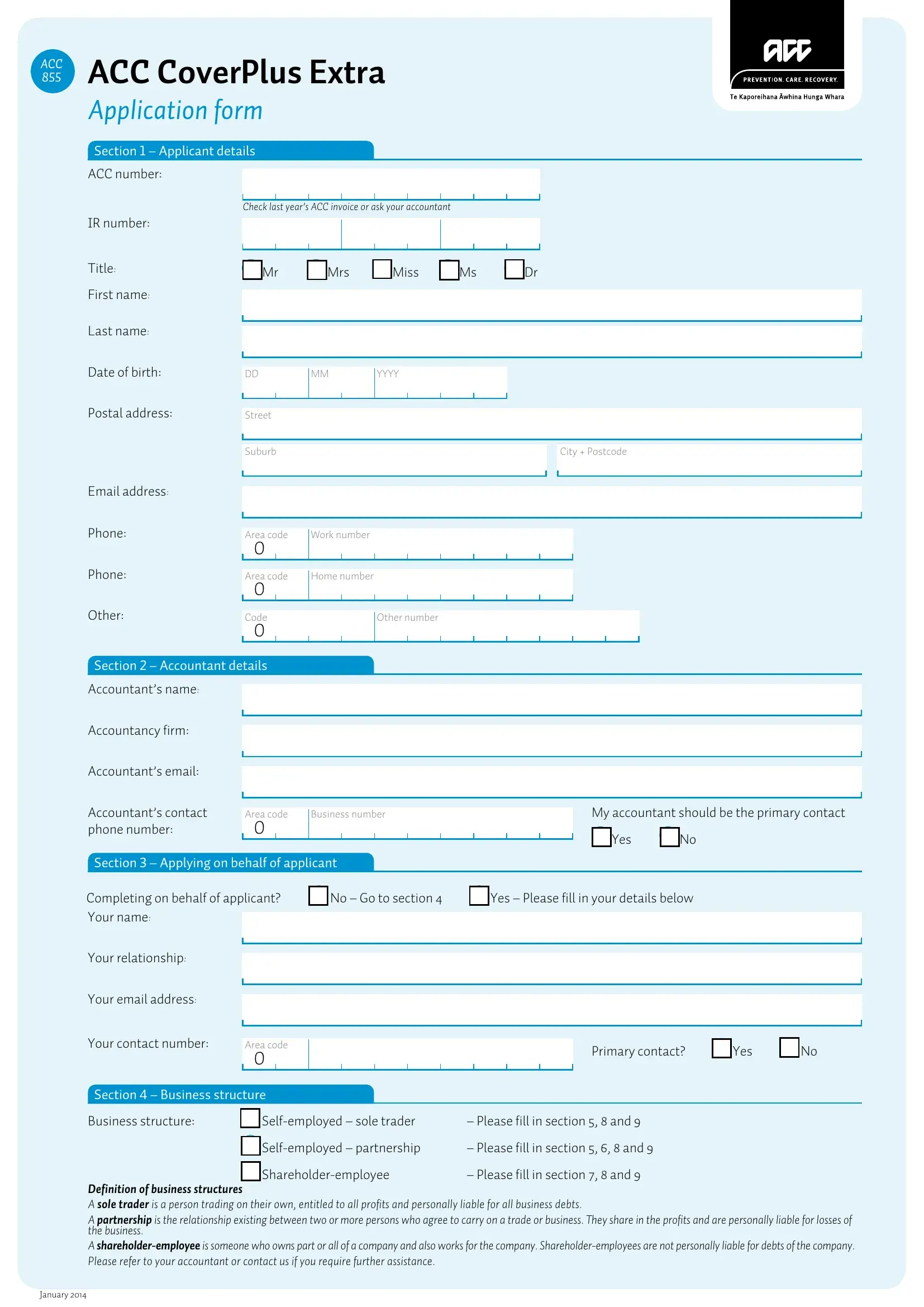

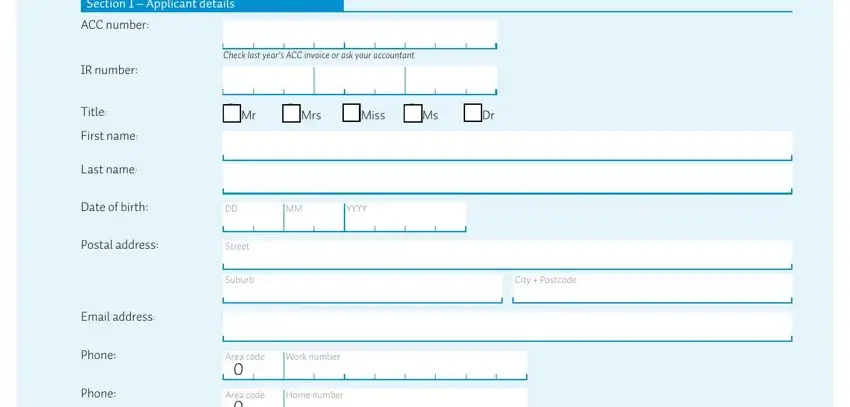

As a way to finalize this document, ensure that you enter the necessary details in each blank field:

1. When submitting the coverplus extra application, make certain to incorporate all necessary blank fields within its relevant section. It will help to speed up the process, allowing for your information to be processed promptly and appropriately.

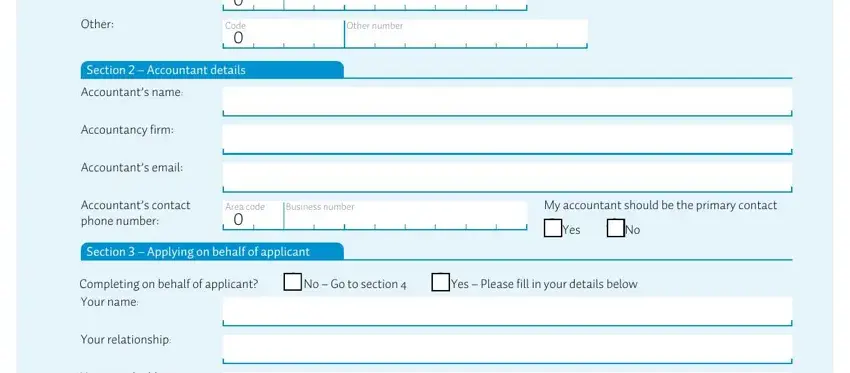

2. After performing the last section, go to the subsequent step and fill out all required particulars in these blanks - Other number, Other, Code , Section Accountant details, Accountants name, Accountancy firm, Accountants email, Accountants contact phone number, Area code, Business number, Section Applying on behalf of, My accountant should be the, Yes, Completing on behalf of applicant, and No Go to section .

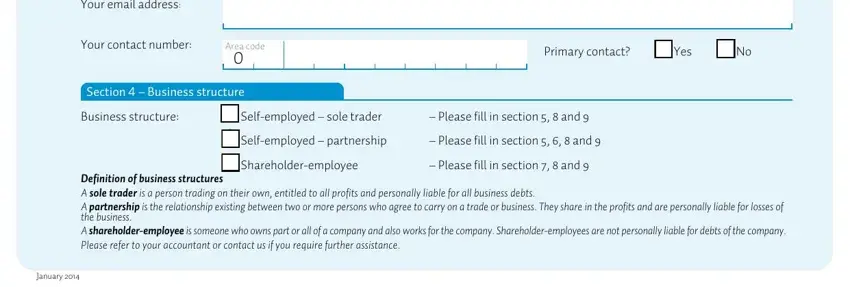

3. This step is normally simple - fill in all the form fields in Your email address, Your contact number, Area code, Section Business structure, Primary contact, Yes, Business structure, Selfemployed sole trader, Please fill in section and , Selfemployed partnership, Please fill in section and , Shareholderemployee, Definition of business structures, Please fill in section and , and January to complete the current step.

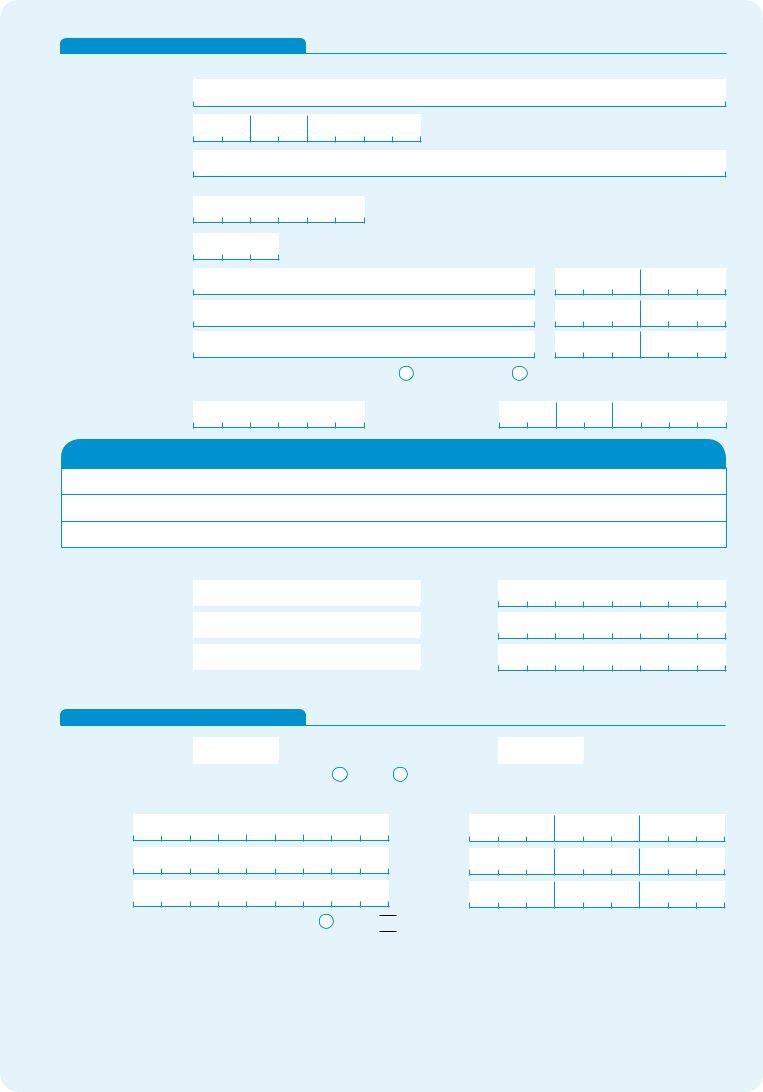

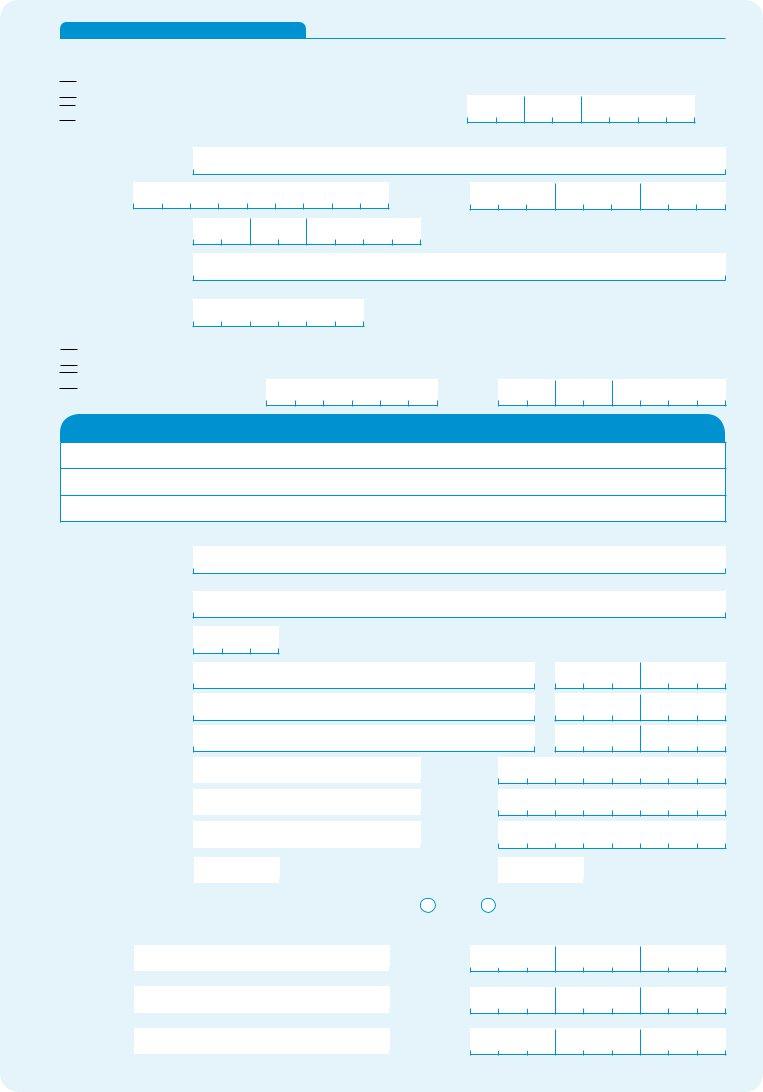

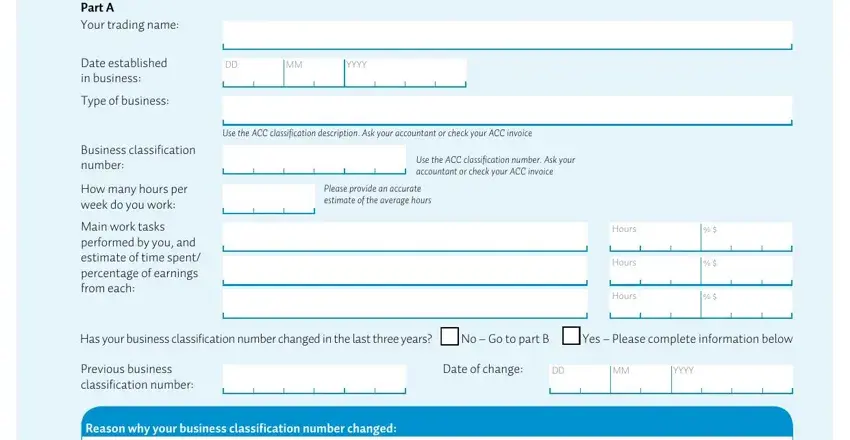

4. Completing Part A Your trading name, Date established in business, Type of business, Business classification number, How many hours per week do you work, Main work tasks performed by you, YYYY, Use the ACC classification, Use the ACC classification number, Please provide an accurate, Hours, Hours, Hours, Has your business classification, and No Go to part B is paramount in this stage - make sure to invest some time and fill out each and every blank area!

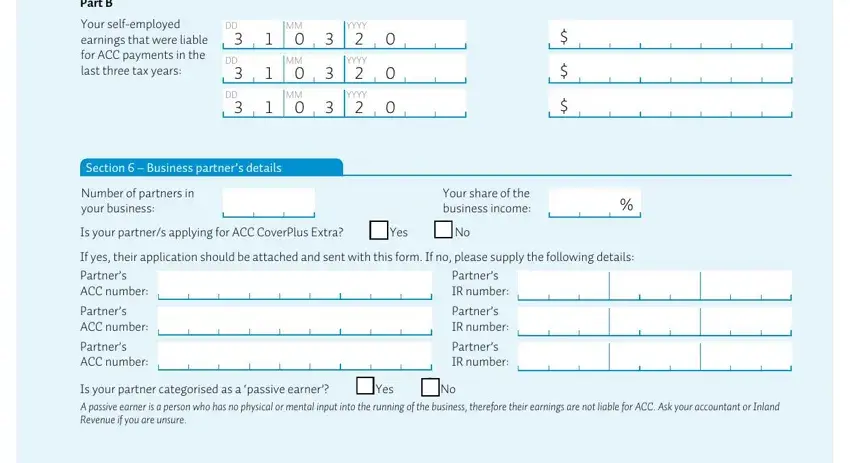

5. The last step to complete this document is essential. Ensure you fill in the appropriate blank fields, for instance Part B, Your selfemployed earnings that, DD , DD , DD , YYYY , YYYY , YYYY , Section Business partners details, Number of partners in your business, Your share of the business income, Is your partners applying for ACC, Yes, If yes their application should be, and Partners ACC number, prior to using the form. Neglecting to do this can contribute to an unfinished and probably incorrect paper!

In terms of YYYY and DD , be certain that you review things here. Both these are the most important ones in the form.

Step 3: Proofread the details you have entered into the form fields and click on the "Done" button. Join FormsPal today and easily get coverplus extra application, ready for download. All modifications you make are kept , which means you can customize the document later if needed. At FormsPal.com, we strive to be sure that all of your details are maintained secure.