For individuals and businesses in West Virginia seeking to leverage benefits for environmentally friendly choices, the AFTC-1 form serves as a crucial document. This comprehensive form pertains to claiming various segments of the Alternative-Fuel Tax Credit, catering to different categories such as the Alternative-Fuel Motor Vehicle Tax Credit, Qualified Alternative-Fuel Vehicle Home Refueling Infrastructure Tax Credit, and Qualified Alternative-Fuel Vehicle Refueling Infrastructure Tax Credit. Moreover, it outlines the procedure for owners who have received tax credits via a pass-through entity. With its introduction for tax periods after January 1, 2015, this form mandates meticulous completion of specific sections corresponding to the type of credit being claimed. Detailed documentation and adherence to specified guidelines are imperative to validate claims. The AFTC-1 form not only underscores the state's commitment to promoting alternative fuel usage but also emphasizes the importance of accuracy and honesty in the claiming process, as evidenced by the declaration that the submission is true and complete under penalties of perjury. Facilitation of this tax credit represents a step towards sustainable development and encourages taxpayers to contribute to a greener environment by investing in alternative fuel vehicles and infrastructure.

| Question | Answer |

|---|---|

| Form Name | Aftc 1 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | wv aftc 1 form, wv alternative fuel credit, wv alternative fuel tax credit, wv alternative |

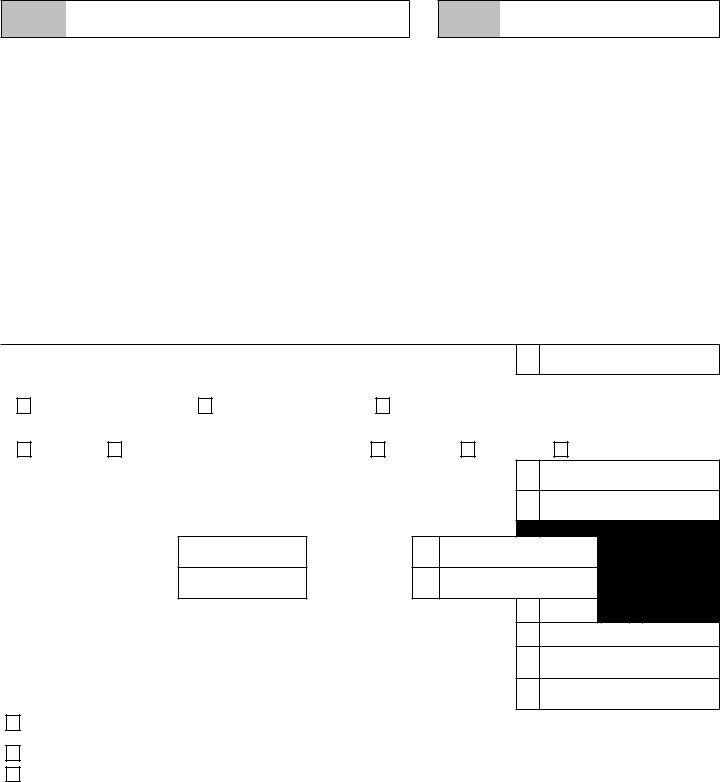

West Virginia Schedule |

West Virginia |

|

|||

|

|

|

|

||

State Tax |

|

||||

REV. 02/2020 |

(For periods AFTER January 1, 2015) |

Department |

|

||

|

|

|

|

|

|

Taxpayer |

|

|

ID |

|

|

Name |

|

|

Number |

|

|

|

|

|

|

|

|

TAX PERIOD

BEGINNING

MM

DD

YYYY

ENDING

MM

DD

YYYY

►Taxpayers desiring to claim the

►Taxpayers desiring to claim the Qualified

►Taxpayers desiring to claim the Qualified

►An OWNER TAXPAYER desiring to claim

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and statements) and to the best of my knowledge it is true and complete.

Signature of Taxpayer |

Name of Taxpayer (type or print) |

Title |

|

Date |

|||

|

|

|

|

|

|

|

|

Person to contact concerning this return |

|

|

|

Telephone Number |

|

||

|

|

|

|

|

|

|

|

Signature of Preparer other than Taxpayer |

Address |

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

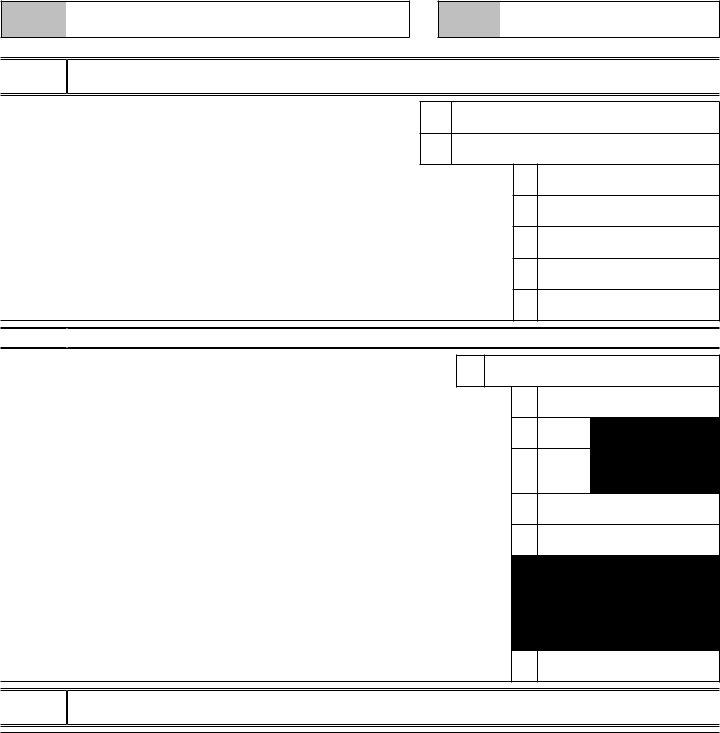

PART A |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

1. Current year |

|

|

|||||

supported by Part B will be denied |

|

|

|

1 |

$ |

||

2. Current year Qualified |

|

|

|||||

|

|

||||||

supported by Part C will be denied |

|

|

|

2 |

$ |

||

3. Current year Qualified |

|

|

|||||

|

|

||||||

qualifying refueling infrastructure). Amounts not supported by Part D will be denied |

|

|

3 |

$ |

|||

4. |

|

|

|||||

|

|

||||||

Owner of a |

4 |

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Unused, unallocated Alternative Fuel Tax Credit from prior years: |

2015 |

$ |

|

|

|

||

|

|

|

|

|

|||

An amended tax return (2011 and/or 2012 |

2016 |

$ |

|

|

|

||

|

|

|

|

|

|||

2017 |

$ |

|

|

|

|||

or |

|

|

|

||||

Fuel Tax Credits (AFTC). If the unclaimed AFTC is associated |

2018 |

$ |

|

|

|

||

with previously unfiled 2011 and/or 2012 tax returns, an original |

|

|

|

||||

|

|

|

|

|

|||

2019 |

$ |

|

|

|

|||

return is required for the tax years claimed. Any and all supporting |

|

|

|

||||

documentation must be present or the claim for credit will be denied. |

|

|

|

|

|

||

2020 |

$ |

|

|

|

|||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

2021 |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

5 |

$ |

|

|

|

|

|

|

|

|

6. Total |

|

|

6 |

$ |

|||

|

|

|

|

|

|

|

|

Continued on the next page…

Schedule

Taxpayer

Name

Part A

ID

Number

7. |

...............................................................................................................Personal Income Tax liability (from line 10 of Form |

7 |

$ |

||

8. |

|

|

|||

|

|

||||

|

amount on line 7 here and on the Tax Credit Recap Schedule |

8 |

$ |

||

|

|

|

|

|

|

9. |

Available |

9 |

$ |

||

|

|

|

|

||

10. Corporation Net Income Tax liability (from line 16 of Form |

10 |

$ |

|||

11. |

|

|

|||

|

|

||||

|

|

and the amount on line 10 here and on the Tax Credit Recap Schedule |

11 |

$ |

|

|

|

|

|

|

|

12. |

Available |

12 |

$ |

||

13. |

|

|

|||

|

|

||||

|

|

allocated to the owners of the |

13 |

$ |

|

14. |

Unused, unallocated |

|

|

||

|

|

||||

|

|

the amount on line 12 |

14 |

$ |

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

PART B |

|

|

|||

|

|

|

A COPY OF THE BILL OF SALE IS REQUIRED FOR NEW VEHICLE PURCHASES OR ANY INVOICES ASSOCIATED WITH A CONVERSION. |

||

1.

2.

1

A.

Compressed Natural Gas |

B. |

Liquefied Natural Gas |

C. |

Liquefied Petroleum Gas

***OPTIONS D, E, F, G, AND H ARE NOT AVAILABLE FOR VEHICLES PURCHASED ON OR AFTER APRIL 15, 2013.***

D.

Hydrogen E.

Electricity |

85% or more by volume fuel mixture: F. |

Methanol G.

EthanolH.

Other alcohols

3. West Virginia Division of Motor Vehicles Registration Number |

|

3 |

||

4. |

Gross Vehicle Weight (in pounds) |

|

4 |

|

5. |

New Purchase or conversion: |

|

|

|

|

A. Date of new purchase: |

|

|

|

|

**Bill of sale must be attached** |

Purchase Price* |

5A |

$ |

|

or B. Date of conversion: |

Actual cost of conversion |

5B |

$ |

lbs.

6.Credit factor. If new purchase, enter 0.35 (35%). If conversion of previously registered vehicle, enter .50 (50%)............................

7.Potential Credit – Multiply the price (line 5A) or the actual cost of conversion (line 5B) by the value on line 6.................................

8.Maximum Allowable Credit – If the Gross Vehicle Weight (from line 4) is less than 26,000 pounds, enter $7,500. Otherwise, enter $25,000............................................................................................................................................................................

9.Available

60.

7 $

8$

9 $

Payment for the vehicle entered on line 1 has been made after January 1, 2011 and on or before April 14, 2013 (Final payment includes arrangements/acceptance for financing on/or before April 14, 2013 for vehicle fuel type other than A, B, and C listed above).

Purchaser of the vehicle has taken possession of the vehicle after January 1, 2011 and on or before April 14, 2013 for vehicle fuel type other than A, B, and C listed above.

Person claiming the credit on line 9 maintained ownership of the vehicle entered on line 1 through December 31 of purchased year.

By checking these boxes and signing the tax return, purchaser certifies this information to be true.

____________

*Purchase price means the sale price of the vehicle less any amount deducted therefrom for any

Schedule

Taxpayer

Name

ID

Number

PART C

Qualified

(APPLICABLE ONLY FOR INSTALLATIONS MADE PRIOR TO APRIL 15, 2013)

1.Location of Qualified

2.Date of installation of Qualified

1

2

3.Total Cost of Qualified

4.Credit Factor – 0.50 (50%)................................................................................................................................................................

5.Potential Credit – Multiply the actual Total Cost of the Qualified

6.Maximum Allowable Credit – $10,000...............................................................................................................................................

7.Available Qualified

3$

40.50

5$

6$ 10,000

7$

PART D Qualified

1. Location of Qualified

1

2.Total Cost directly associated with the construction or purchase of the Qualified

3.Accessibility – If the Qualified

4.Credit Factor – For refueling infrastructure placed in service before January 1, 2014, enter 0.625 (62.5%) if the value on line 3 is 1.25, otherwise enter 0.50 (50%). For infrastructure placed in service on or after January 1, 2014, enter 0.20 (20%) unless the note below applies.....................................................................................................................................................................

5.Potential Credit – Multiply the Actual Total Cost of the Qualified

6.Maximum Allowable Credit – Determine this amount by following instructions below.

(a)For tax periods after December 31, 2010 but prior to January 1, 2014 – If line 3 is 1.00, maximum credit is $250,000. If line 3 is 1.25, maximum credit is $312,500.

(b)For tax periods after January 1, 2014 but prior to January 1, 2018 – Maximum credit is 20% of the total costs per facility, up to a maximum of $400,000.

NOTE: When the purchase and installation of qualified alternative fuel vehicle infrastructure begins prior to January 1, 2014, but is not completed and placed into service until after January 1, 2014, the taxpayer may choose to fall under the rules of either (a) or (b) but not both.

7.Available Qualified

2$

31.___

40.___

5$

6 $

7$

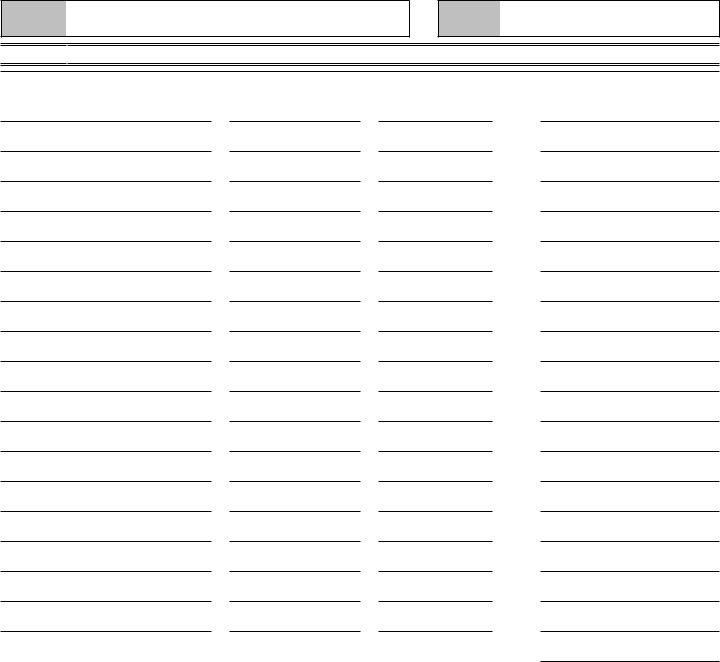

PART E

|

|

|

|

|

|

|

Employer Identification Number (EIN) |

|

Amount of Credit Allocated |

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Schedule |

|

|

TOTAL $ |

||

Rev.02/2020 |

|

|

|||

|

|

|

|

|

|

Taxpayer

Name

ID

Number

PART F Unused

Owner Name |

Owner EIN/SSN |

Owner % |

Credit Allocated |

|

|

|

|

% $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $ % $

TOTAL ALLOCATED CREDIT $

Schedule