When working in the online PDF tool by FormsPal, you're able to complete or edit agricultural timber here and now. We at FormsPal are aimed at making sure you have the ideal experience with our tool by constantly adding new functions and enhancements. Our tool has become a lot more user-friendly with the most recent updates! So now, filling out PDF forms is a lot easier and faster than ever. To get started on your journey, take these basic steps:

Step 1: Open the PDF in our tool by clicking the "Get Form Button" at the top of this page.

Step 2: This editor helps you work with your PDF file in a variety of ways. Transform it by including any text, correct original content, and add a signature - all at your fingertips!

Pay close attention while filling in this pdf. Make sure that each and every blank field is filled in accurately.

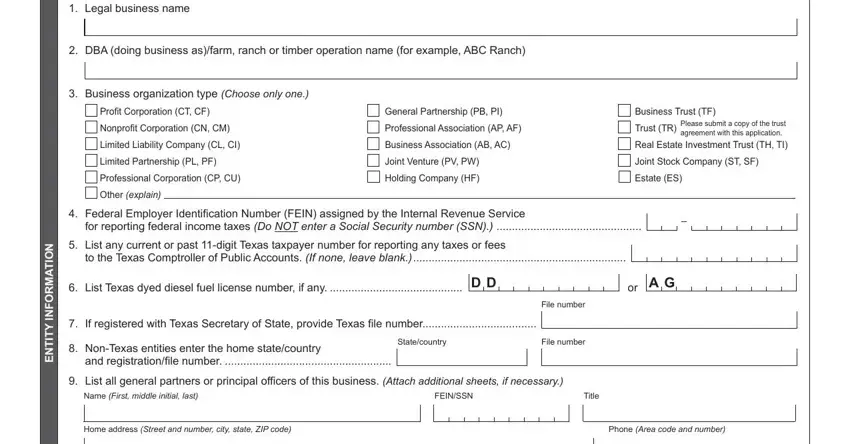

1. The agricultural timber usually requires specific details to be inserted. Make sure the following blanks are filled out:

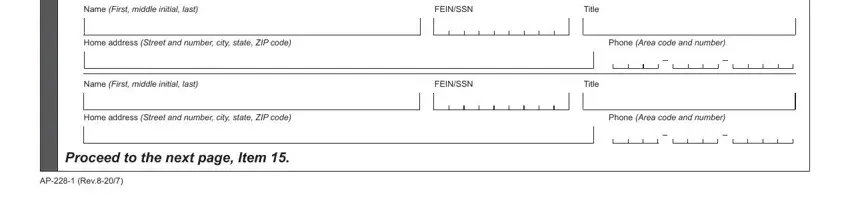

2. Soon after this section is done, go to type in the applicable information in all these - Name First middle initial last, Home address Street and number, Name First middle initial last, FEINSSN, FEINSSN, Title, Title, Phone Area code and number, Home address Street and number, code, Phone, Area code and number, Proceed to the next page Item , and AP Rev.

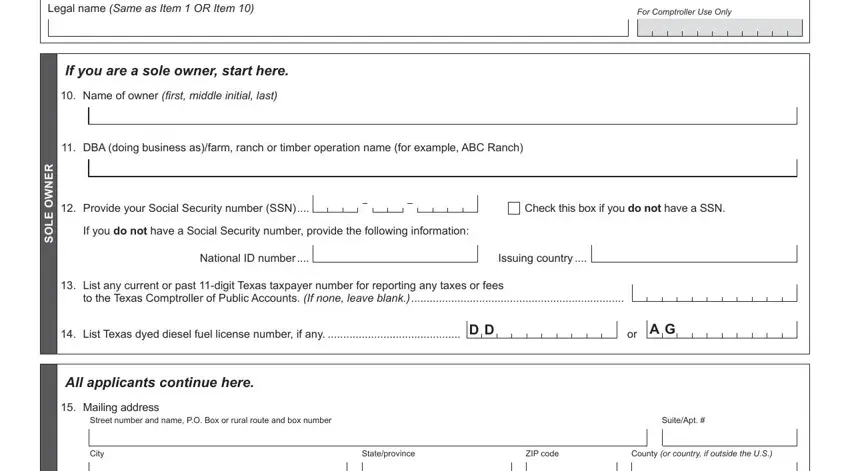

3. Completing Legal name Same as Item OR Item , For Comptroller Use Only, If you are a sole owner start here, Name of owner first middle, DBA doing business asfarm ranch, Provide your Social Security, Check this box if you do not have, If you do not have a Social, National ID number , Issuing country , R E N W O E L O S, List any current or past digit, to the Texas Comptroller of Public, List Texas dyed diesel fuel, and D D is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

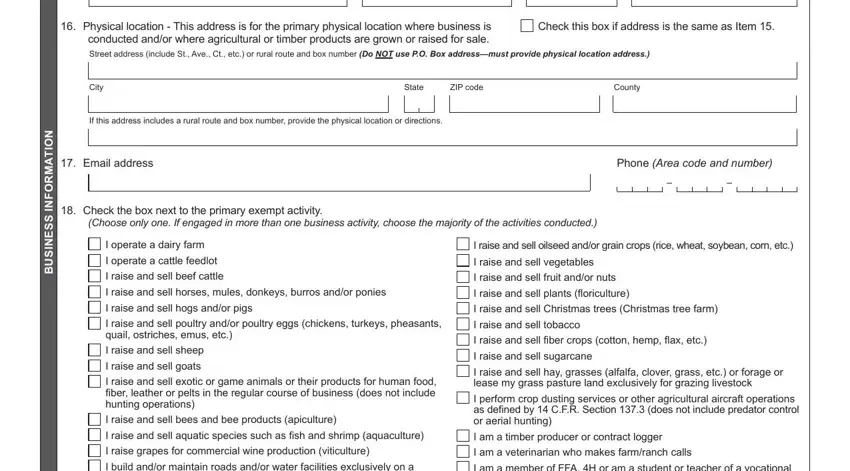

4. All set to fill in this fourth section! In this case you have all of these N O T A M R O F N, S S E N S U B, Physical location This address, Check this box if address is the, conducted andor where agricultural, City, State, ZIP code, County, If this address includes a rural, Email address, Phone Area code and number, Check the box next to the primary, Choose only one If engaged in more, and I operate a dairy farm form blanks to do.

It's very easy to make errors when filling out the N O T A M R O F N, therefore be sure to go through it again prior to deciding to finalize the form.

5. Now, this last part is precisely what you have to finish prior to finalizing the form. The blank fields you're looking at include the next: I raise and sell bees and bee, I am a timber producer or contract, and I am a custom harvester paid to.

Step 3: Make sure that your details are accurate and then click on "Done" to progress further. Find your agricultural timber once you join for a 7-day free trial. Easily gain access to the pdf within your personal account, together with any modifications and adjustments being all saved! We do not share any information that you enter while working with forms at FormsPal.