PLEASE NOTE

PAYMENTS OF $750 OR MORE MUST BE FILED AND PAID ELECTRONICALLY.

TO PREPARE, FILE AND PAY THIS RETURN ON-LINE.

GENERAL INSTRUCTIONS

DUE DATE – Form A-1, Employer’s Quarterly Return of Income Tax Withheld, is due on or before the last day of the month following the end of the quar- ter being filed. For example, Form A-1 for Quarter Ending March 31st is due on or before April 30th.

FIRST RETURN – New employers must apply for a withholding tax account number at www.myalabamataxes.alabama.gov.

ROUTINE FILING – Blank forms may be used only when personalized coupons cannot be obtained in time to file a return by the due date. Unless filing or required to file electronically, each employer is furnished personalized coupons with the employer’s name, address, withholding tax account number, period covered, and due date.

FINAL RETURN – When an employer ceases to withhold Alabama income tax, an “X” should be placed in the space provided in Line 1 of the return.

INSTRUCTIONS FOR PREPARING FORM A-1

LINE 1 – If you have discontinued withholding Alabama income tax, and wish for your account to be closed, place an “X” in the blank on this line to indi- cate a final return.

LINE 2 – Enter number of employees from whose wages Alabama income tax has been withheld during this reporting period. LINE 3 – Enter total Alabama income tax withheld during the quarter covered by return. (3 months)

LINE 4 – Enter total Alabama withholding tax previously remitted for the first and/or second months of quarter.

LINE 5 – Use this line to claim credit for an overpayment of Alabama withholding tax for prior periods. If a credit memorandum has not been issued by the Alabama Department of Revenue, the return on which credit is claimed must be accompanied by documentation to substantiate the overpayment.

LINE 6 – Penalty for late filing of Form A-1 is 10% of the tax due (Line 3 minus Line 4) or $50.00, whichever is greater. Penalty for late payment of with- holding tax is 10% of the tax due. In cases where both return and payment are delinquent, the two penalties should be added and shown as one figure on Line 6. Report and payment of tax must be postmarked on or before the due date to avoid delinquent penalty and interest charges.

LINE 7 – Interest is computed at the rate applicable to federal tax deficiencies and is subject to change each quarter. Call the Withholding Tax Section for the current interest rate.

LINE 8 – Add Lines 3, 6, and 7; subtract Lines 4 and 5; show balance on Line 8.

LINE 9 – Indicate on Line 9 the amount remitted with the return. If amount remitted is different from amount on Line 8, a detailed explanation of the dif- ference should accompany the return. Make check or money order for amount on Line 9 payable to Alabama Department of Revenue. Mail re- turn and check to Income Tax Administration Division, Withholding Tax Section, P.O. Box 327483, Montgomery, AL 36132-7483 (phone 334-242-1300).

Revised 9/20

PLEASE CUT HERE

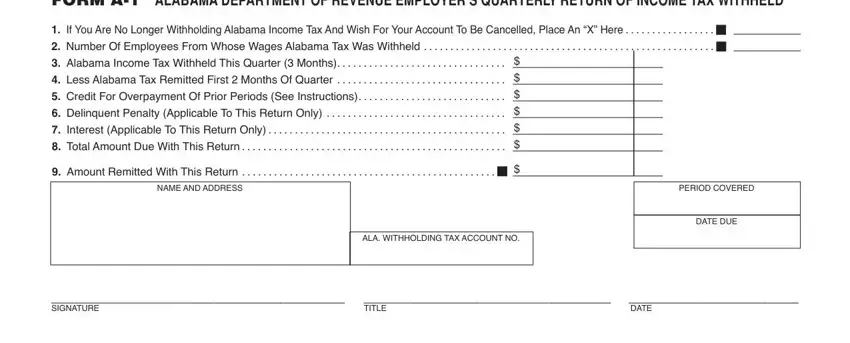

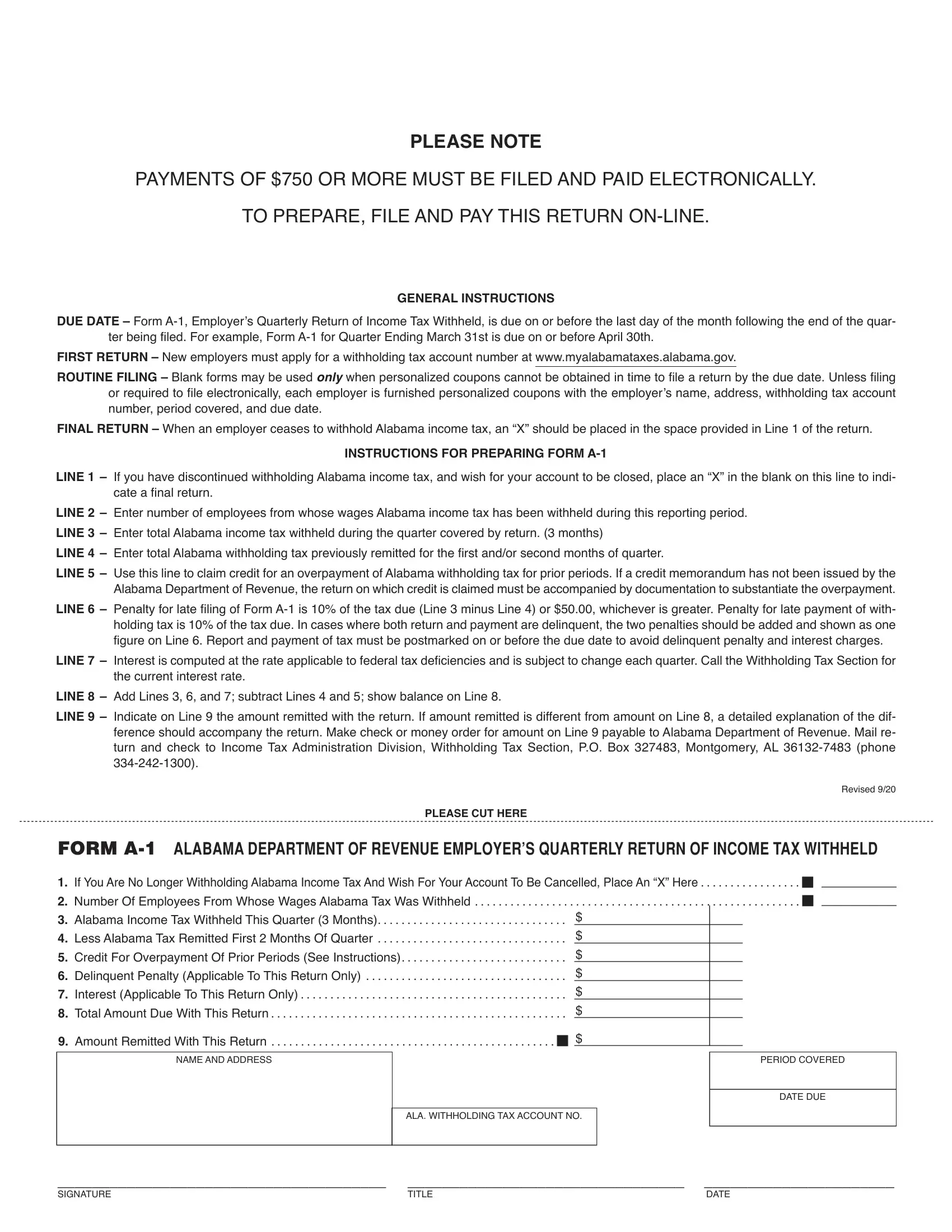

FORM A-1 ALABAMA DEPARTMENT OF REVENUE EMPLOYER’S QUARTERLY RETURN OF INCOME TAX WITHHELD

1. If You Are No Longer Withholding Alabama Income Tax And Wish For Your Account To Be Cancelled, Place An “X” Here . . . . . . . . . . . . . . . . . y

2. Number Of Employees From Whose Wages Alabama Tax Was Withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . y 3. Alabama Income Tax Withheld This Quarter (3 Months). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

4. Less Alabama Tax Remitted First 2 Months Of Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5. Credit For Overpayment Of Prior Periods (See Instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . $

6. Delinquent Penalty (Applicable To This Return Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

7. Interest (Applicable To This Return Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

8. Total Amount Due With This Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

9. Amount Remitted With This Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . y $

NAME AND ADDRESS |

PERIOD COVERED |

DATE DUE

ALA. WITHHOLDING TAX ACCOUNT NO.

______________________________________ ________________________________ ______________________