|

FORM |

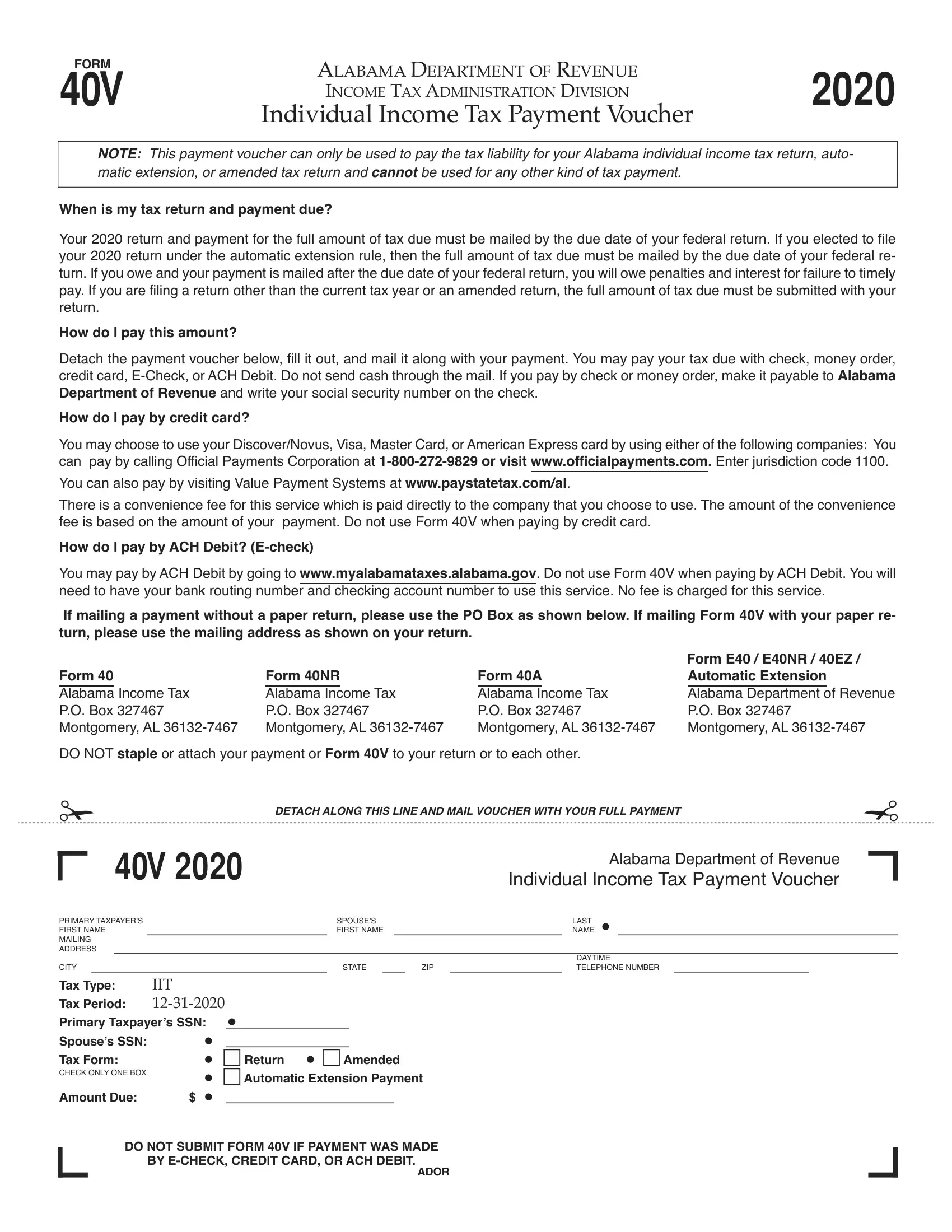

ALABAMA DEPARTMENT OF REVENUE |

|

|

40V |

2020 |

|

INCOME TAX ADMINISTRATION DIVISION |

|

|

Individual Income Tax Payment Voucher |

|

NOTE: This payment voucher can only be used to pay the tax liability for your Alabama individual income tax return, auto- matic extension, or amended tax return and CANNOT be used for any other kind of tax payment.

When is my tax return and payment due?

Your 2020 return and payment for the full amount of tax due must be mailed by the due date of your federal return. If you elected to file your 2020 return under the automatic extension rule, then the full amount of tax due must be mailed by the due date of your federal re- turn. If you owe and your payment is mailed after the due date of your federal return, you will owe penalties and interest for failure to timely pay. If you are filing a return other than the current tax year or an amended return, the full amount of tax due must be submitted with your return.

How do I pay this amount?

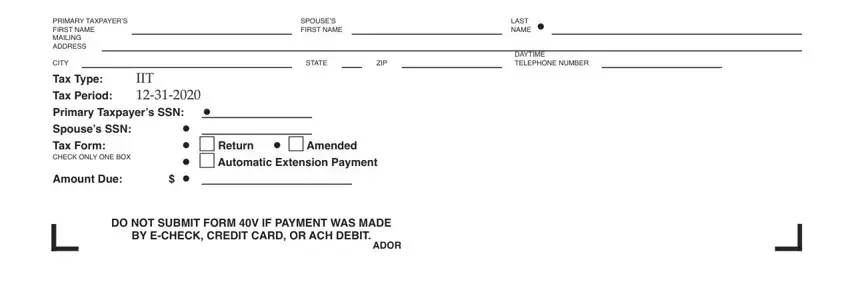

Detach the payment voucher below, fill it out, and mail it along with your payment. You may pay your tax due with check, money order, credit card, E-Check, or ACH Debit. Do not send cash through the mail. If you pay by check or money order, make it payable to Alabama Department of Revenue and write your social security number on the check.

How do I pay by credit card?

You may choose to use your Discover/Novus, Visa, Master Card, or American Express card by using either of the following companies: You can pay by calling Official Payments Corporation at 1-800-272-9829 or visit www.officialpayments.com. Enter jurisdiction code 1100.

You can also pay by visiting Value Payment Systems at www.paystatetax.com/al.

There is a convenience fee for this service which is paid directly to the company that you choose to use. The amount of the convenience fee is based on the amount of your payment. Do not use Form 40V when paying by credit card.

How do I pay by ACH Debit? (E-check)

You may pay by ACH Debit by going to www.myalabamataxes.alabama.gov. Do not use Form 40V when paying by ACH Debit. You will need to have your bank routing number and checking account number to use this service. No fee is charged for this service.

If mailing a payment without a paper return, please use the PO Box as shown below. If mailing Form 40V with your paper re- turn, please use the mailing address as shown on your return.

|

|

|

|

|

|

Form E40 / E40NR / 40EZ / |

Form 40 |

Form 40NR |

Form 40A |

Automatic Extension |

|

|

|

|

|

|

|

|

Alabama Income Tax |

Alabama Income Tax |

Alabama Income Tax |

Alabama Department of Revenue |

P.O. Box 327467 |

P.O. Box 327467 |

P.O. Box 327467 |

P.O. Box 327467 |

Montgomery, AL 36132-7467 |

Montgomery, AL 36132-7467 |

Montgomery, AL 36132-7467 |

Montgomery, AL 36132-7467 |

DO NOT staple or attach your payment or Form 40V to your return or to each other.