The intricacies of managing an estate or trust in Alabama necessitate a thorough understanding of certain tax obligations, one of which is encapsulated in the Alabama Form 41, a Fiduciary Income Tax Return designed for the calendar year 2006 or fiscal years beginning in 2006. This form serves as a crucial tool for entities such as decedent's estates, various types of trusts including simple, complex, and bank estates under Chapters 7 and 11, in navigating their tax responsibilities. The form demands detailed information about the estate or trust, including the employer identification number, name, and contact details of the fiduciary, and specifics about the entity's income sources, deductions, and computations for taxable income and net tax due. Alongside, the form mandates a declaration from a fiduciary or an officer representing the fiduciary, attesting to the accuracy and completeness of the information provided under penalties of perjury. Additionally, it encompasses schedules for charitable deductions, computing Alabama income distribution deductions, and adjustments to reported federal income, thereby highlighting the state-specific tax implications for fiduciaries. With changes in tax laws, such as the Subchapter J and Business Trust Conformity Act effective retroactively after December 31, 2004, this form also serves as a reflection of evolving legal precedents, emphasizing the importance of staying informed about legislative updates that impact fiduciary income tax filings in Alabama.

| Question | Answer |

|---|---|

| Form Name | Alabama Form 41 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 13c, Nonresident, Preparer, Grantor |

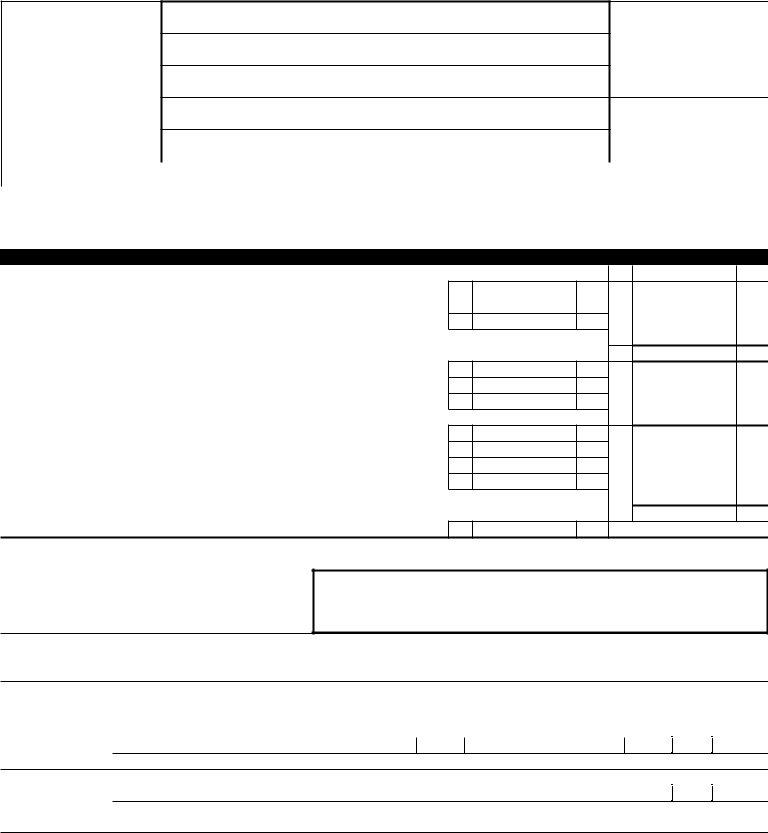

FORM |

|

*0612830141* |

41 |

2006 |

(Rev. 11/06)

ALABAMA DEPARTMENT OF REVENUE

Fiduciary Income Tax Return

For the calendar year 2006 or fiscal year beginning

__________________________, 2006, and ending ____________________________, ___________

Type of entity (see instructions): Decedent’s estate

Simple trust

Complex trust

Qualified disability trust

ESBT (S portion only)

Grantor type trust

Bankruptcy estate – Ch. 7

Bankruptcy estate – Ch. 11

Pooled income fund

Employer Identification Number

Name of Estate or Trust

Name and Title of Fiduciary

Address of Fiduciary (number and street)

City, State, and Zip Code

FN

Initial Return

Amended Return

Final Return

|

|

Address change |

Entity has income from more than one state |

Fiduciary or name change |

||||

|

|

|

|

|

|

|

|

|

Date entity created |

|

|

|

Number of |

|

|

|

|

Return is Filed on Cash Basis |

|

Nonresident estate or trust |

Trust has a nonresident beneficiary |

|

|

|||

A complete copy of the Federal Form 1041 must be attached for this return to be considered complete.

COMPUTATION OF ALABAMA TAXABLE INCOME AND NET TAX DUE |

|

|

1 |

Alabama Adjusted Total Income or (Loss) (Schedule C, Line 18c) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 |

|

Special Deductions Available to Trusts: |

|

2 |

Alabama Income Distribution Deduction (Schedule B, Line 16) |

2 |

3 |

Exemption (Allowed the Estate or Trust by |

3 |

4 |

Total of Special Trust Deductions (Total of Lines 2 and 3) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

5 |

Alabama Taxable Income (Line 1 less Line 4) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 |

6a |

$__________________ at 2 percent (On first $500, or fraction thereof, of AL Taxable Income) . . . |

6A |

b$__________________ at 4 percent (On next $2,500, or fraction thereof, of AL Taxable Income) . 6B |

||

c $__________________ at 5 percent (On all over $3,000 of AL Taxable Income) |

6C |

|

7 |

TOTAL INCOME TAX DUE (See instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 |

8 |

Credits: a Income tax paid to other states (See instructions for limitations) |

8A |

|

b Capital Credit (See instructions for limitations) |

8B |

|

c Amount paid with Form 4868A |

8C |

|

d Composite payments. Paid by __________________ TIN _____________________ |

8D |

9 |

Total Credits (Total of Lines 8a through 8d) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 |

10 |

NET TAX DUE (Subtract Line 9 from Line 7) PAY THIS AMOUNT IN FULL WITH RETURN |

. . . . . . . . . . . . . . . . . . . . . . . . . . . 10 |

11 |

NET REFUND (If Line 9 is larger than Line 7, enter overpayment here) |

11 |

(For official use only) |

|

|

|

CN |

|

(For official use only)

Returns with payments must be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327444, Montgomery, AL

Please

Sign

Here

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

( )

Signature of fiduciary or officer representing fiduciary |

Date |

Daytime Telephone No. |

Social Security Number |

Paid

Preparer’s

Use Only

Preparer’s signature

Firm’s name (or yours, if

|

|

Date |

|

Preparer’s Social Security Number |

|

|

|

Check if |

|

|

|

|

|

|

|

Tel. ( |

) |

E.I. No. |

|

|

|

|

|

|

|

|

|

ZIP Code |

|

|

|

|

|

|

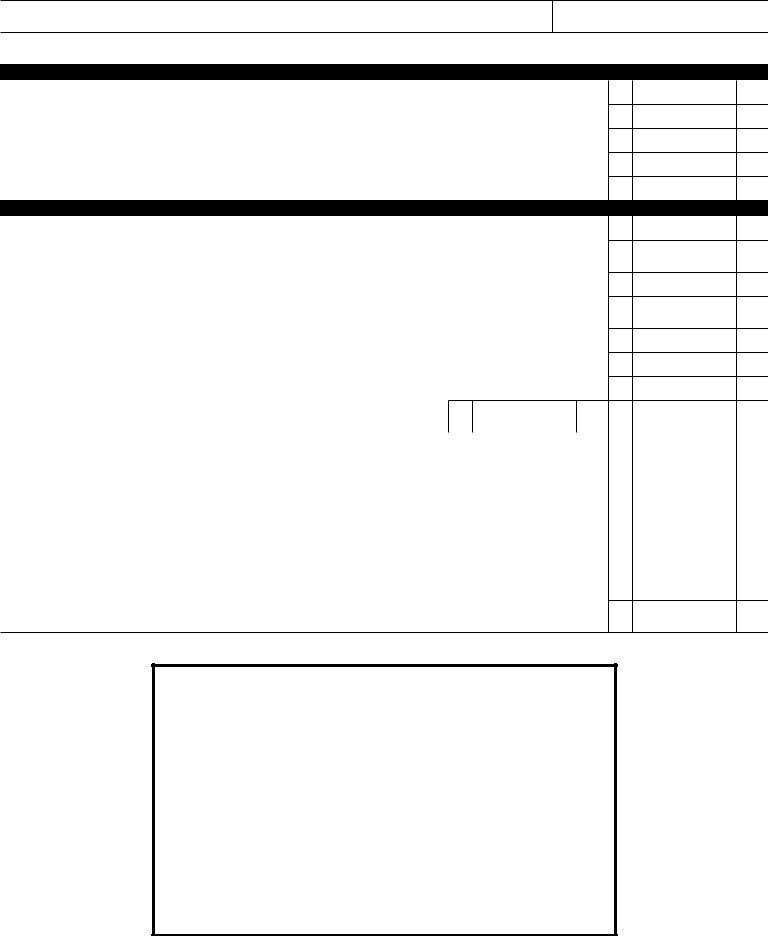

FORM |

*0612830241* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 2

Name of estate or trust

Employer identification number

Name and title of fiduciary

SCHEDULE A – ALABAMA CHARITABLE DEDUCTION. Do not complete for a simple trust or a pooled income fund.

|

|

1 |

1 |

Amounts paid or permanently set aside for charitable purposes from gross income |

|

|

|

2 |

2 |

Alabama |

|

|

|

3 |

3 |

Subtract line 2 from line1 |

|

|

|

4 |

4 |

Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes |

|

|

|

5 |

5 |

Alabama Charitable Deduction.Add Line 3 and Line 4. Enter total here and on Page 3, Schedule C, Line 13, Column C |

|

SCHEDULE B – COMPUTATION OF ALABAMA INCOME DISTRIBUTION DEDUCTION |

|

|

|

|

1 |

1 |

Alabama Adjusted Total Income (Page 1, Lne 1) |

|

2The amount of gain from the sale of capital assets, but only if the gain was allocated to corpus and not paid, credited,

|

2 |

or required to be distributed to any beneficiary during the taxable year or not included in Line 4, Schedule A (see instructions) |

|

|

3 |

3 Subtract the amount entered on Line 2 from the amount entered on Line 1, and enter in Line 3 |

|

4The amount of loss from the sale of capital assets – entered as a positive number, only if the loss was not considered

|

in the determination of the amount to be paid, credited, or required to be distributed to any beneficiary during taxable year |

4 |

5 |

Amount of tax exempt interest income excluded in computing Alabama taxable income |

5 |

6 |

Other adjustments – see instructions |

6 |

7 |

Alabama Distributable Net Income (Sum of Lines 3 through 6) |

7 |

8If a complex trust, enter accounting income for the tax year as determined under the

|

governing instrument and applicable local law |

8 |

|

|

|

|

|

|

|

|

|

9 Income required to be distributed currently |

9 |

||

|

|

|

|

10 |

Other amounts paid, credited, or otherwise required to be distributed |

10 |

|

|

|

|

|

11 |

Total distributions. add Lines 9 and 10 |

11 |

|

|

|

|

|

12 |

Enter the amount of |

12 |

|

|

|

|

|

13 |

Tentative income distribution deduction. Subtract Line 12 from Line 11 |

13 |

|

|

|

|

|

14 |

Tentative income distribution deduction. Subtract Line 5 from Line 7. If zero or less, enter |

14 |

|

|

|

|

|

15 |

Special Alabama Income Distribution Deduction (see instructions for applicability of the special limitation) |

15 |

|

16Alabama Income Distribution Deduction. Enter the smallest of Line 13, Line 14, or, if applicable, Line 15,

on this line and on Page 1, Line 2. (Do not enter less than zero.) |

16 |

CHANGE IN ALABAMA TAX LAW

CONCERNING ESTATES AND TRUSTS

The Alabama Legislature passed the Subchapter J and Business Trust Conformity Act (Act Number

At the time the 2006 Form 41 was being developed, the promulgation process had begun for the regulations to implement the Act.

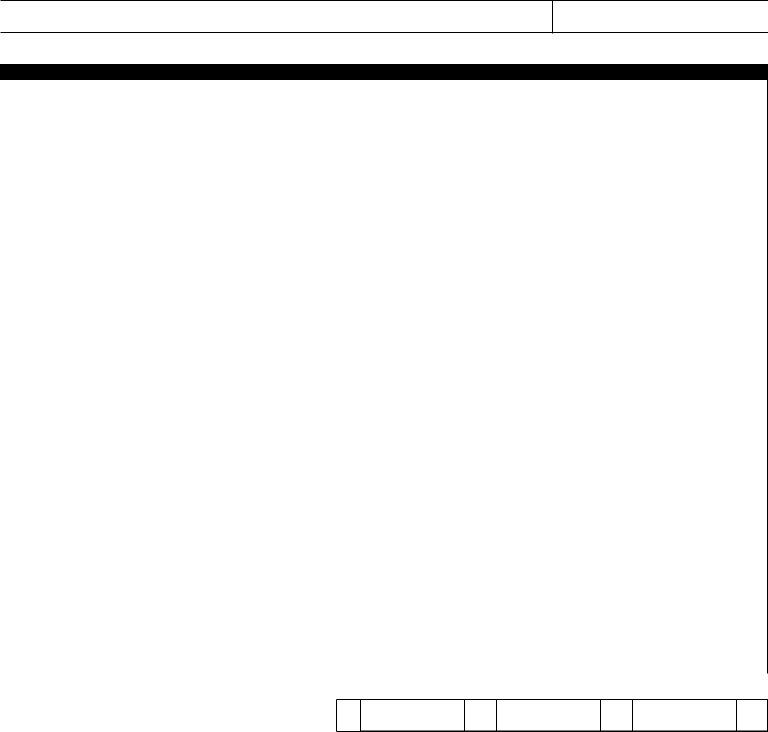

FORM |

*0612830341* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 3

Name of estate or trust

Employer identification number

Name and title of fiduciary

SCHEDULE C – COMPUTATION OF ALABAMA ADJUSTED TOTAL INCOME

|

|

|

Column A |

|

|

Column B |

|

Column C |

|||

|

|

|

AS REPORTED ON |

|

|

ALABAMA |

|

ALABAMA AMOUNT |

|||

|

|

|

FEDERAL FORM 1041 |

|

|

ADJUSTMENTS |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Interest income |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Ordinary dividends |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Business income or (loss) |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Capital gain or loss (see instructions) |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Rents, royalties, partnerships, and other estates and trusts |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Farm income or (loss) |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Ordinary gain or (loss) from Form 4797 |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Other income |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9 |

Total Income (Sum of Lines 1 through 8) |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Deductions: |

|

|

|

|

|

|

|

|

|

|

10 |

Interest |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Taxes (include federal estate and income taxes) |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Fiduciary fees |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Charitable deduction |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Attorney, accountant, and return preparer fees |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Other deductions not subject to the 2% floor |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Allowable miscellaneous itemized deductions subject to the 2% floor . . |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Total Ordinary Deductions (Sum of Lines 10 through 16) |

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18a |

Federal Adjusted Total Income (Line 9 less Line 17 – the amount |

|

|

|

|

|

|

|

|

|

|

|

entered on this line in Column A must equal the amount entered on |

|

|

|

|

|

|

|

|

|

|

|

Page 1, Line 17, Form 1041) |

18A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

Net Alabama Adjustments (Column B, Line 9 less Line 17) |

|

|

|

18B |

|

|

|

|

|

|

. . . . . |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

||

18c |

Alabama Adjusted Total Income (Column C, Line 9 less Line 17). Enter here and on Page 1, Line 1 |

|

|

|

|

18C |

|

|

|||

. . . . |

. |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|||||

19 Alabama Tax Exempt Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

Attach a complete explanation, showing all computations, for each item of income or deduction included in Column B (Alabama Adjustments), include also a complete explanation and computation for the items of exempt income. See instructions.

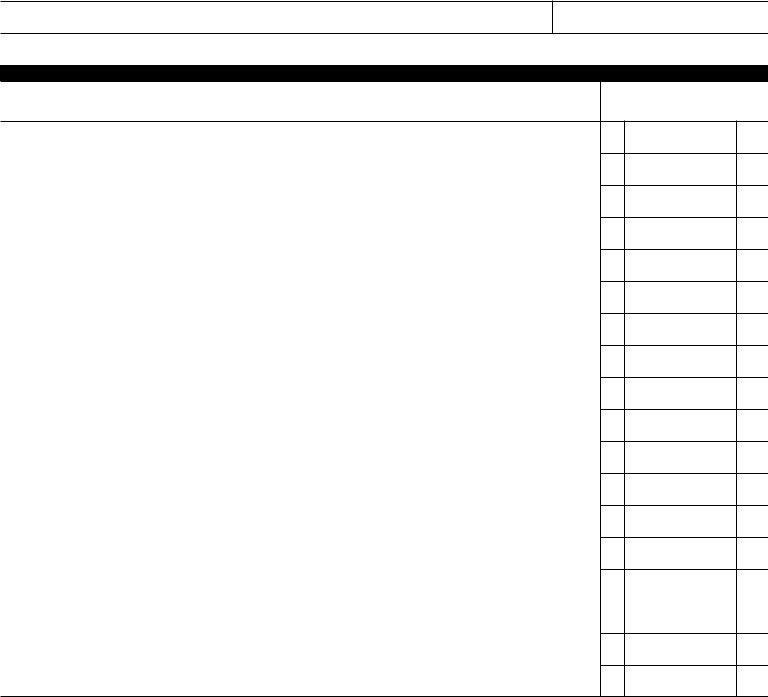

FORM |

*0612830441* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 4

Name of estate or trust

Employer identification number

Name and title of fiduciary

SCHEDULE K – SUMMARY OF

TOTAL ALABAMA AMOUNT

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Net Alabama capital gain or loss (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Rents, royalties, partnerships, and other estates and trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Ordinary gain or (loss) from Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Alabama Tax Exempt Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10a Grantor Trust Income (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10A

10b Grantor trust Deductions (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10B

10c Net Grantor Trust Income (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10C

11 Nonresident Beneficiary – Alabama Source Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Nonresident Beneficiary –

12

Directly apportioned deductions:

13a Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13A

13b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13B

13c Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13C

Schedule K is a summary of the information reported on the

CHARACTER OF INCOME – In accordance with

ALLOCATION OF THE ALABAMA INCOME DISTRIBUTION DEDUCTION – The amount entered in Page 1, Line 2 (Alabama Income Distribution Deduction) must be allocated to resident beneficiaries and owners, so that the income reported by the beneficiaries or owners will retain its character . Generally the allocation is completed in accordance with Internal Revenue Code §§652 and 662. No amount may be included in the Alabama Income Distribution Deduction which is not included in the gross income of the estate or trust. See the instructions for more guidance concerning the allocation of income to the beneficiaries and owners.