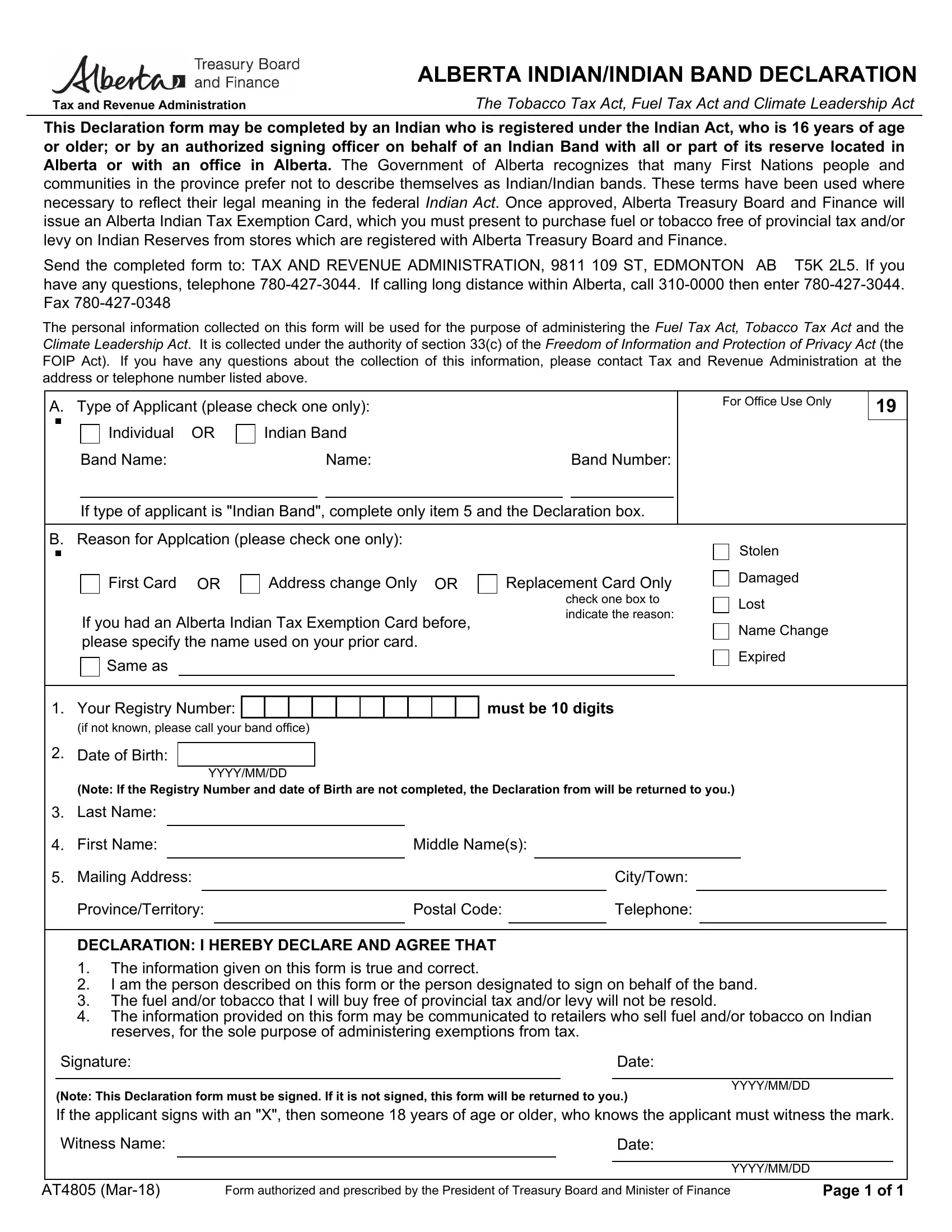

With the help of the online PDF tool by FormsPal, you are able to fill out or edit T5K right here. To keep our editor on the leading edge of convenience, we aim to adopt user-driven capabilities and enhancements on a regular basis. We are routinely thankful for any feedback - play a pivotal role in remolding PDF editing. This is what you would want to do to begin:

Step 1: Click on the orange "Get Form" button above. It'll open up our pdf editor so you can begin filling in your form.

Step 2: Using this advanced PDF tool, you can do more than simply complete forms. Try each of the features and make your documents look sublime with custom textual content added in, or fine-tune the original content to perfection - all that accompanied by an ability to add any images and sign the PDF off.

It will be an easy task to complete the document using out practical tutorial! Here is what you must do:

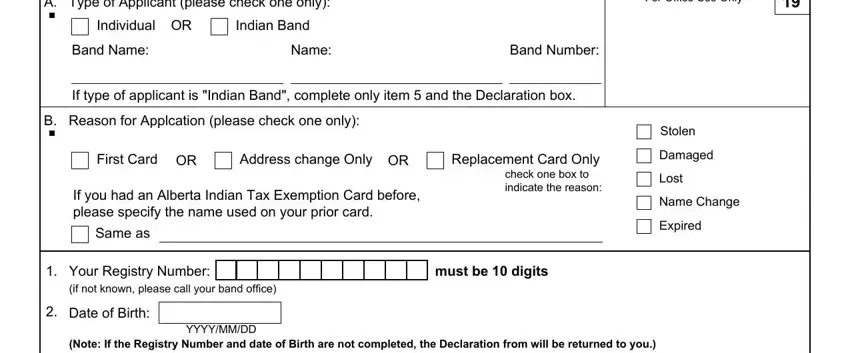

1. First, once completing the T5K, start with the section containing next blank fields:

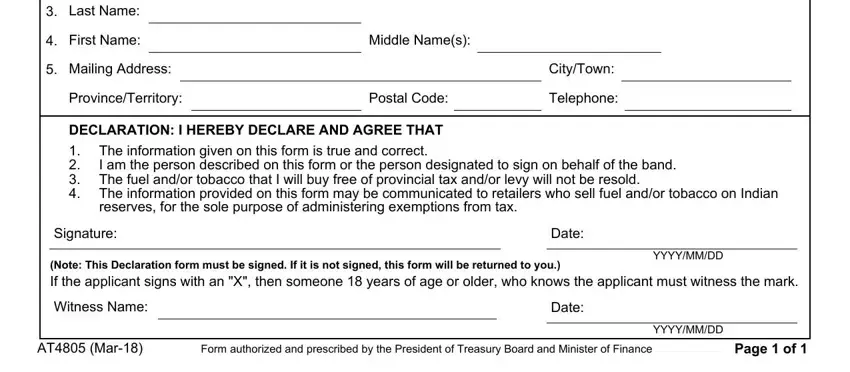

2. Immediately after the last section is filled out, proceed to enter the applicable details in all these - Last Name, First Name, Mailing Address, ProvinceTerritory, Middle Names, Postal Code, CityTown, Telephone, DECLARATION I HEREBY DECLARE AND, The information given on this form, Signature, Date, Note This Declaration form must be, YYYYMMDD, and Witness Name.

People generally make errors while filling out Middle Names in this section. Make sure you read again whatever you type in right here.

Step 3: Ensure the information is correct and then press "Done" to complete the project. Join us now and easily get access to T5K, ready for downloading. All modifications made by you are saved , meaning you can customize the form at a later point if needed. FormsPal guarantees risk-free form editing without personal information recording or distributing. Feel at ease knowing that your data is secure here!