You can complete maryland annual update of registration form easily using our PDFinity® PDF editor. Our tool is consistently developing to grant the very best user experience achievable, and that is thanks to our commitment to constant improvement and listening closely to customer feedback. With just a few basic steps, you can start your PDF editing:

Step 1: Access the PDF file in our editor by pressing the "Get Form Button" in the top part of this webpage.

Step 2: With this handy PDF tool, you're able to accomplish more than just fill out forms. Edit away and make your documents look sublime with customized text put in, or adjust the file's original content to perfection - all that accompanied by an ability to add any kind of pictures and sign the PDF off.

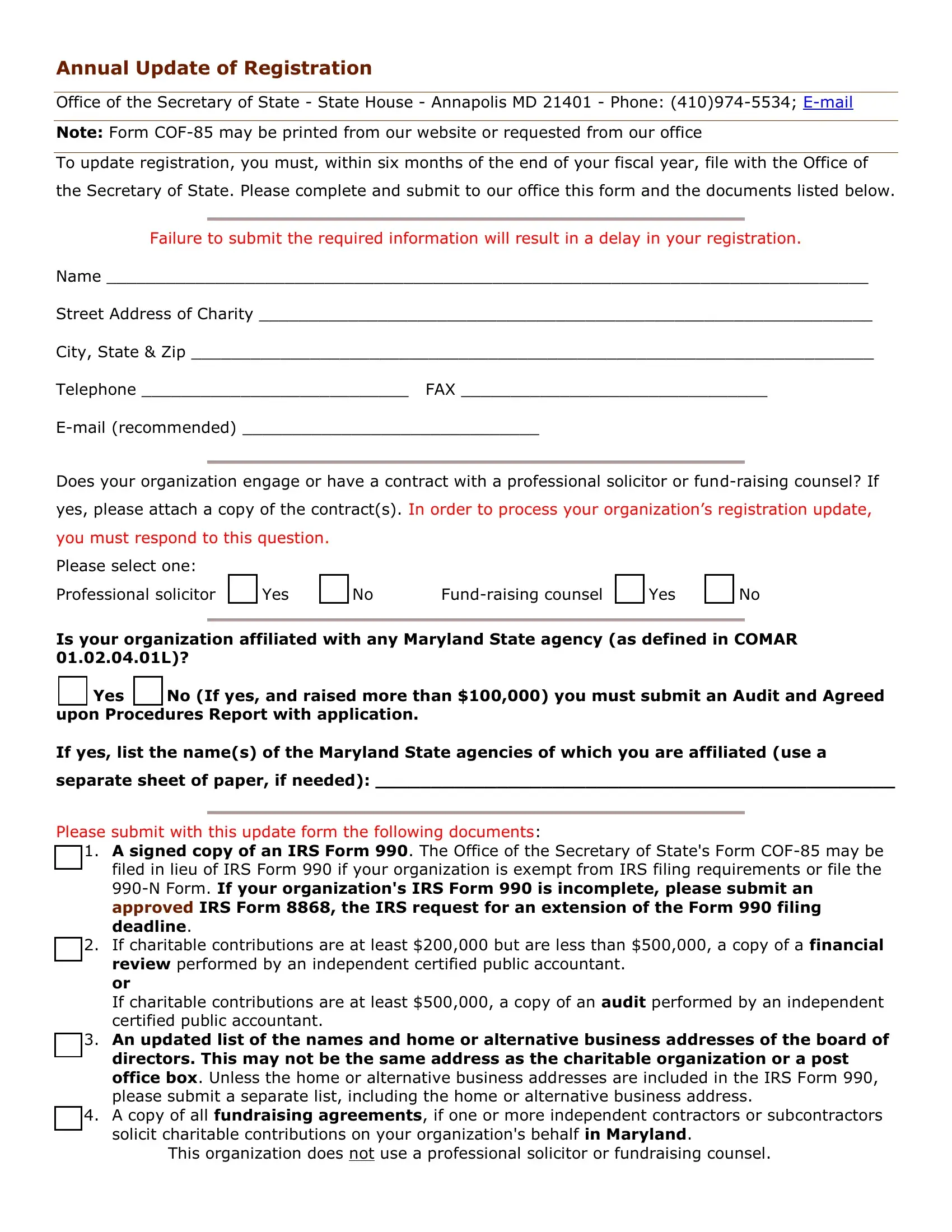

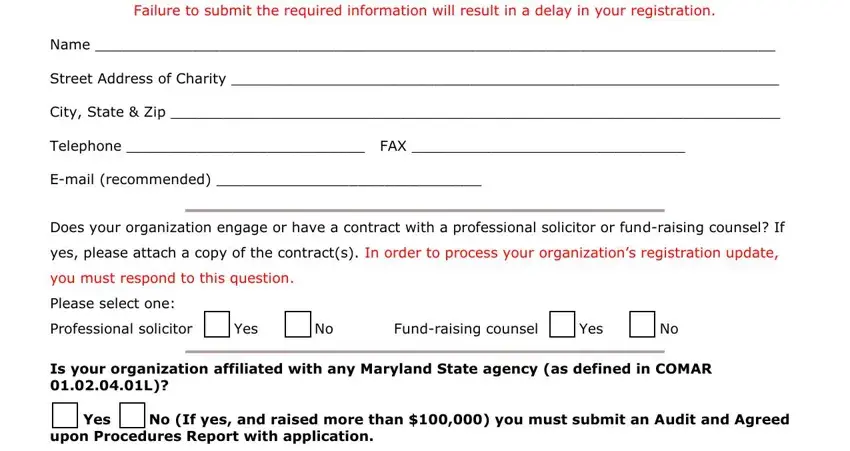

This PDF doc needs some specific details; in order to ensure correctness, take the time to heed the recommendations down below:

1. It is crucial to complete the maryland annual update of registration form correctly, therefore take care when filling out the segments that contain these specific blanks:

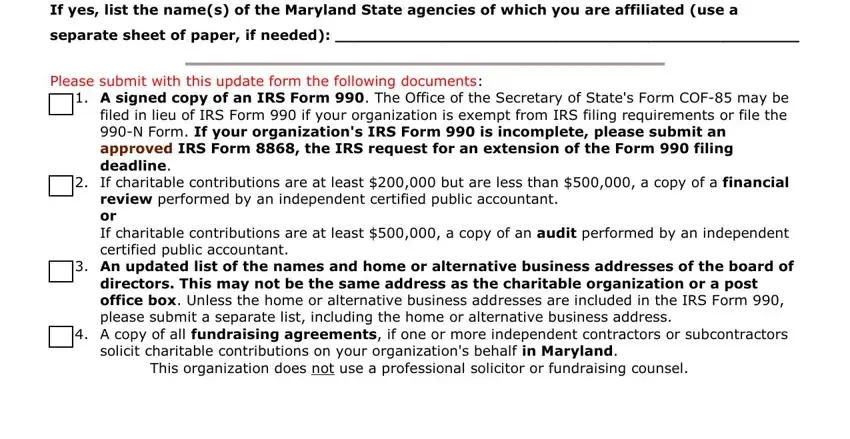

2. Immediately after the first section is completed, proceed to type in the applicable details in these: Is your organization affiliated, separate sheet of paper if needed , Please submit with this update, A signed copy of an IRS Form The, If charitable contributions are, review performed by an independent, An updated list of the names and, directors This may not be the same, A copy of all fundraising, solicit charitable contributions, and This organization does not use a.

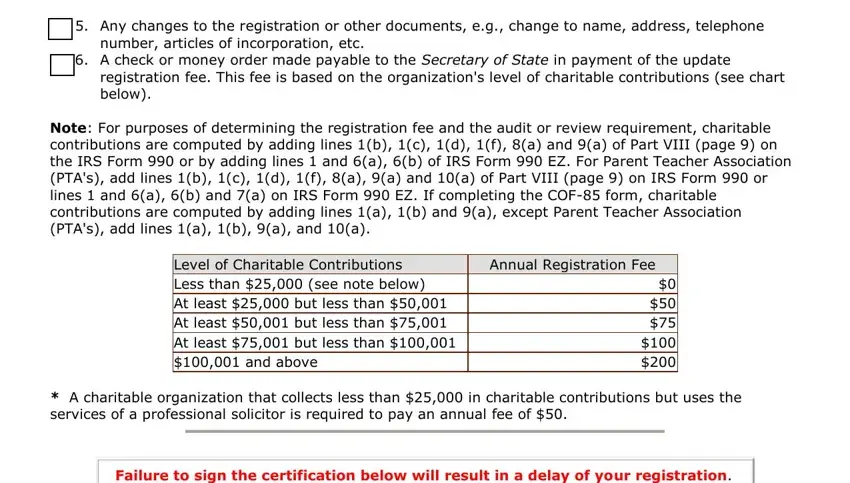

3. This next part is focused on Any changes to the registration, number articles of incorporation, A check or money order made, registration fee This fee is based, Note For purposes of determining, Level of Charitable Contributions, Annual Registration Fee, and A charitable organization that - fill out each of these fields.

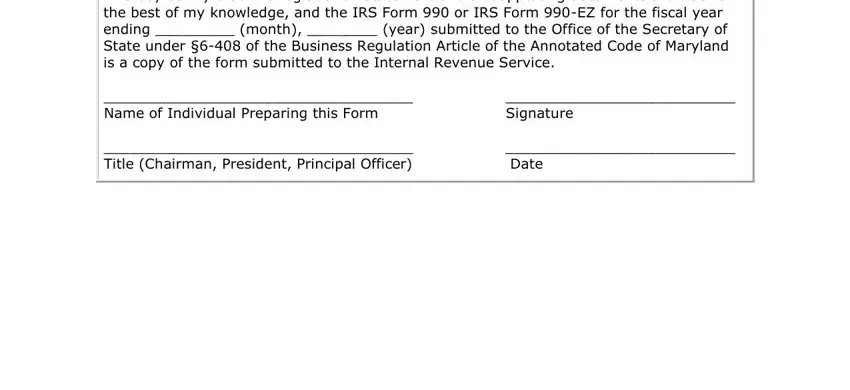

4. The next part requires your information in the following areas: I hereby certify that this. Ensure that you enter all of the requested information to go onward.

Be really attentive while filling in I hereby certify that this and I hereby certify that this, since this is the section where most people make errors.

Step 3: Check that your information is accurate and then click on "Done" to proceed further. Sign up with FormsPal now and easily obtain maryland annual update of registration form, available for download. Every edit you make is conveniently preserved , enabling you to customize the form later on if required. FormsPal provides risk-free form editing with no data recording or any sort of sharing. Feel comfortable knowing that your information is secure with us!