The Anthem W-9 form serves as a critical document for temporary physicians joining the Anthem Blue Cross and Blue Shield network, especially those operating within Maine for less than a six-month period and holding a Maine permanent license. This introduction into Anthem's temporary physician application process not only facilitates financial transactions by ensuring that claims are paid efficiently but also establishes the importance of adhering to specific requirements before providing services. Crucial attachments alongside the form include a detailed description of the need for temporary physician services, a completed Provider Application for Temporary Participation, the physician's Maine medical license, malpractice insurance certificate, DEA certificate, and the IRS Form W-9 bearing the tax identification number used for billing purposes. Anthem emphasizes the necessity of these documents to streamline the temporary participation process, ensuring that the effective date of service is acknowledged, thus, circumventing retroactive compensation issues. Providers are directed to submit their documentation via fax or mail, with additional support provided through a dedicated Provider Service contact number. This effort underscores Anthem’s commitment to maintaining a robust network of healthcare providers to enhance member health outcomes, highlighting the procedural and regulatory landscape that temporary physicians must navigate to become part of Anthem's network in Maine.

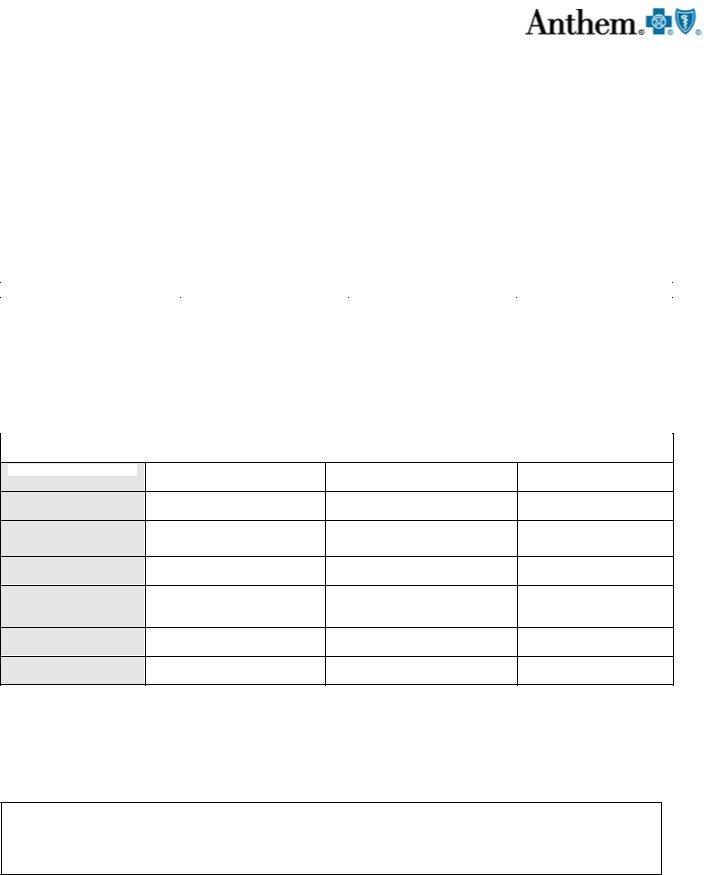

| Question | Answer |

|---|---|

| Form Name | Anthem W 9 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | black national anthem lyrics printable, anthem substitute w 9, anthem w 9 form, black national anthem words |

Dear Provider:

Thank you for your interest in the Anthem Blue Cross and Blue Shield temporary physician application process. A temporary physician is defined as a physician hired by a locum tenens agency or an individual practice and who will be practicing in Maine for less than a six (6) month period and has a Maine permanent license. If you will be practicing for longer than six (6) months, you should pursue credentialing with our Plan, giving ample time for the completion of that approval process.

The attached Provider Application for Temporary Participation and the IRS Form

Please include the following documents with your submission:

A description of the circumstances that require the use of a temporary physician

Completed Provider Application for Temporary Participation

Copy of the professional’s Maine medical license

Copy of current malpractice insurance certificate

Copy of the DEA Certificate

Completed IRS Form

Return the information listed above to fax number

Anthem Blue Cross Blue Shield

Mail Stop –

2 Gannett Drive

South Portland, ME

If you have any question, please contact Provider Service at

We are committed to improving the health of our members. Our provider network plays an important role in achieving this goal. We look forward to you being a temporary part of our network.

Sincerely,

Provider Engagement & Contracting

Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans of Maine, Inc. Independent licensee of the Blue Cross and Blue Shield Association ® ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association.

Provider Application for Temporary Participation

(no longer than six (6) months)

Complete this application if you are a physician hired by a locum tenens agency or an individual practice and you will be practicing in Maine for less than a six (6) month period and you have a permanent or temporary Maine license. If you are planning to practice for longer than a six (6) month period, you must apply to be credentialed and to participate with Anthem in order to remain active and receive reimbursement. If you have questions, please call your Network Relations Consultant whose contact information is available on anthem.com.

Anthem Blue Cross and Blue Shield |

|

|

Fax: |

|

|

|

|

|||||||

Mail Stop: |

|

|

|

|

|

|

|

|

|

|

|

|||

2 Gannett Drive |

|

|

|

|

|

|

|

|

|

|

|

|||

South Portland, ME |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

First Name |

|

Middle Name |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Sr. |

Jr. |

II |

|

|

|

|

|

|

|

|

|

|

|

|

III |

IV |

|

|

|

|

Date of Birth |

|

|

Gender |

|

Office Contact Person |

|

Office Contact Phone |

|

||||

|

___/___/___ |

|

|

|

Male |

Female |

|

|

|

|

|

|

|

|

|

|

National Provider ID (NPI) |

|

|

Taxonomy Code |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dates of Office Coverage: |

From:______________ |

To:________________ (Not to Exceed 6 Months) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

Office Information |

|

Primary Office Location |

|

Billing Location |

|

Mail/Correspondence |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address

Town, State, Zip

Phone Number

Fax Number

Group, Partnership or

Corporation Name

Federal Tax ID Number

Specialty

I am applying to Anthem Blue Cross and Blue Shield as a temporary provider for up to a six (6) month period only and agree to abide by the terms and conditions of the written contract between Anthem Blue Cross and Blue Shield and the practice in which I will serving on a temporary basis, except that as a temporary agreement, the following terms will not apply: the provisions relating to credentialing; the term of the agreement. I acknowledge that the term (length) of the agreement is available to me upon request.

Please briefly explain why you have been hired as a temporary provider.

Name: ____________________________________

(Please Print)

Signature: __________________________________ |

Date: ____________________________ |

Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans of Maine, Inc. Independent licensee of the Blue Cross and Blue Shield Association ® ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association.

Form

Department of the Treasury Internal Revenue Service

Request for Taxpayer

Identification Number and Certification

Give form to the requester. Do not send to the IRS.

Print or type See Specific Instructions on page 2.

Name (as shown on your income tax return)

Business name, if different from above

Check appropriate box: |

Individual/Sole proprietor |

Corporation |

Partnership |

|

Exempt |

|

Limited liability company. Enter the tax classification (D=disregarded entity, C=corporation, P=partnership) |

▶ |

|||||

payee |

||||||

|

|

|

|

|

||

Other (see instructions) |

▶ |

|

|

|

|

|

|

|

|

|

|||

Address (number, street, and apt. or suite no.) |

|

Requester’s name and address (optional) |

||||

City, state, and ZIP code

List account number(s) here (optional)

Part I Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box. The TIN provided must match the name given on Line 1 to avoid backup withholding. For individuals, this is your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN on page 3.

Note. If the account is in more than one name, see the chart on page 4 for guidelines on whose number to enter.

Social security number

or

Employer identification number

Part II Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3. I am a U.S. citizen or other U.S. person (defined below).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN. See the instructions on page 4.

Sign |

Signature of |

|

|

|

Here |

U.S. person ▶ |

Date ▶ |

|

|

General Instructions |

Definition of a U.S. person. For federal tax purposes, you are |

|||

Section references are to the Internal Revenue Code unless |

considered a U.S. person if you are: |

|

||

● An individual who is a U.S. citizen or U.S. resident alien, |

||||

otherwise noted. |

||||

● A partnership, corporation, company, or association created or |

||||

Purpose of Form |

||||

organized in the United States or under the laws of the United |

||||

A person who is required to file an information return with the |

States, |

|

||

● An estate (other than a foreign estate), or |

||||

IRS must obtain your correct taxpayer identification number (TIN) |

||||

to report, for example, income paid to you, real estate |

● A domestic trust (as defined in Regulations section |

|||

transactions, mortgage interest you paid, acquisition or |

|

|||

abandonment of secured property, cancellation of debt, or |

Special rules for partnerships. Partnerships that conduct a |

|||

contributions you made to an IRA. |

||||

trade or business in the United States are generally required to |

||||

Use Form |

||||

pay a withholding tax on any foreign partners’ share of income |

||||

resident alien), to provide your correct TIN to the person |

||||

from such business. Further, in certain cases where a Form |

||||

requesting it (the requester) and, when applicable, to: |

||||

has not been received, a partnership is required to presume that |

||||

|

|

|||

1. Certify that the TIN you are giving is correct (or you are |

a partner is a foreign person, and pay the withholding tax. |

|||

waiting for a number to be issued), |

Therefore, if you are a U.S. person that is a partner in a |

|||

2. Certify that you are not subject to backup withholding, or |

partnership conducting a trade or business in the United States, |

|||

provide Form |

||||

3. Claim exemption from backup withholding if you are a U.S. |

||||

status and avoid withholding on your share of partnership |

||||

exempt payee. If applicable, you are also certifying that as a |

income. |

|

||

U.S. person, your allocable share of any partnership income from |

The person who gives Form |

|||

a U.S. trade or business is not subject to the withholding tax on |

||||

purposes of establishing its U.S. status and avoiding withholding |

||||

foreign partners’ share of effectively connected income. |

||||

on its allocable share of net income from the partnership |

||||

|

|

|||

Note. If a requester gives you a form other than Form |

conducting a trade or business in the United States is in the |

|||

request your TIN, you must use the requester’s form if it is |

following cases: |

|

||

substantially similar to this Form |

● The U.S. owner of a disregarded entity and not the entity, |

|||

|

|

|||

|

|

|

||

|

Cat. No. 10231X |

Form |

||

Form |

Page 2 |

|

|

●The U.S. grantor or other owner of a grantor trust and not the trust, and

●The U.S. trust (other than a grantor trust) and not the beneficiaries of the trust.

Foreign person. If you are a foreign person, do not use Form

Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes.

If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form

1.The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien.

2.The treaty article addressing the income.

3.The article number (or location) in the tax treaty that contains the saving clause and its exceptions.

4.The type and amount of income that qualifies for the exemption from tax.

5.Sufficient facts to justify the exemption from tax under the terms of the treaty article.

Example. Article 20 of the

If you are a nonresident alien or a foreign entity not subject to backup withholding, give the requester the appropriate completed Form

What is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 28% of such payments. This is called “backup withholding.” Payments that may be subject to backup withholding include interest,

You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return.

Payments you receive will be subject to backup withholding if:

1.You do not furnish your TIN to the requester,

2.You do not certify your TIN when required (see the Part II instructions on page 3 for details),

3.The IRS tells the requester that you furnished an incorrect

TIN,

4.The IRS tells you that you are subject to backup withholding because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only), or

5.You do not certify to the requester that you are not subject to backup withholding under 4 above (for reportable interest and dividend accounts opened after 1983 only).

Certain payees and payments are exempt from backup withholding. See the instructions below and the separate Instructions for the Requester of Form

Also see Special rules for partnerships on page 1.

Penalties

Failure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty.

Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.

Misuse of TINs. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties.

Specific Instructions

Name

If you are an individual, you must generally enter the name shown on your income tax return. However, if you have changed your last name, for instance, due to marriage without informing the Social Security Administration of the name change, enter your first name, the last name shown on your social security card, and your new last name.

If the account is in joint names, list first, and then circle, the name of the person or entity whose number you entered in Part I of the form.

Sole proprietor. Enter your individual name as shown on your income tax return on the “Name” line. You may enter your business, trade, or “doing business as (DBA)” name on the “Business name” line.

Limited liability company (LLC). Check the “Limited liability company” box only and enter the appropriate code for the tax classification (“D” for disregarded entity, “C” for corporation, “P” for partnership) in the space provided.

For a

For an LLC classified as a partnership or a corporation, enter the LLC’s name on the “Name” line and any business, trade, or DBA name on the “Business name” line.

Other entities. Enter your business name as shown on required federal tax documents on the “Name” line. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on the “Business name” line.

Note. You are requested to check the appropriate box for your status (individual/sole proprietor, corporation, etc.).

Exempt Payee

If you are exempt from backup withholding, enter your name as described above and check the appropriate box for your status, then check the “Exempt payee” box in the line following the business name, sign and date the form.

Form |

Page 3 |

Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends.

Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding.

The following payees are exempt from backup withholding:

1.An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2),

2.The United States or any of its agencies or instrumentalities,

3.A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities,

4.A foreign government or any of its political subdivisions, agencies, or instrumentalities, or

5.An international organization or any of its agencies or instrumentalities.

Other payees that may be exempt from backup withholding include:

6.A corporation,

7.A foreign central bank of issue,

8.A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States,

9.A futures commission merchant registered with the Commodity Futures Trading Commission,

10.A real estate investment trust,

11.An entity registered at all times during the tax year under the Investment Company Act of 1940,

12.A common trust fund operated by a bank under section 584(a),

13.A financial institution,

14.A middleman known in the investment community as a nominee or custodian, or

15.A trust exempt from tax under section 664 or described in section 4947.

The chart below shows types of payments that may be exempt from backup withholding. The chart applies to the exempt payees listed above, 1 through 15.

IF the payment is for . . . |

THEN the payment is exempt |

|

for . . . |

Interest and dividend payments |

All exempt payees except |

|

for 9 |

|

|

Broker transactions |

Exempt payees 1 through 13. |

|

Also, a person registered under |

|

the Investment Advisers Act of |

|

1940 who regularly acts as a |

|

broker |

|

|

Barter exchange transactions |

Exempt payees 1 through 5 |

and patronage dividends |

|

|

|

Payments over $600 required |

Generally, exempt payees |

to be reported and direct |

1 through 7 2 |

sales over $5,000 1 |

|

|

|

1See Form

2However, the following payments made to a corporation (including gross proceeds paid to an attorney under section 6045(f), even if the attorney is a corporation) and reportable on Form

Part I. Taxpayer Identification

Number (TIN)

Enter your TIN in the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN, see How to get a TIN below.

If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN. However, the IRS prefers that you use your SSN.

If you are a

Note. See the chart on page 4 for further clarification of name and TIN combinations.

How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form

If you are asked to complete Form

Note. Entering “Applied For” means that you have already applied for a TIN or that you intend to apply for one soon.

Caution: A disregarded domestic entity that has a foreign owner must use the appropriate Form

Part II. Certification

To establish to the withholding agent that you are a U.S. person, or resident alien, sign Form

For a joint account, only the person whose TIN is shown in Part I should sign (when required). Exempt payees, see Exempt Payee on page 2.

Signature requirements. Complete the certification as indicated in 1 through 5 below.

1.Interest, dividend, and barter exchange accounts opened before 1984 and broker accounts considered active during 1983. You must give your correct TIN, but you do not have to sign the certification.

2.Interest, dividend, broker, and barter exchange accounts opened after 1983 and broker accounts considered inactive during 1983. You must sign the certification or backup withholding will apply. If you are subject to backup withholding and you are merely providing your correct TIN to the requester, you must cross out item 2 in the certification before signing the form.

Form |

Page 4 |

|

|

3.Real estate transactions. You must sign the certification. You may cross out item 2 of the certification.

4.Other payments. You must give your correct TIN, but you do not have to sign the certification unless you have been notified that you have previously given an incorrect TIN. “Other payments” include payments made in the course of the requester’s trade or business for rents, royalties, goods (other than bills for merchandise), medical and health care services (including payments to corporations), payments to a nonemployee for services, payments to certain fishing boat crew members and fishermen, and gross proceeds paid to attorneys (including payments to corporations).

5.Mortgage interest paid by you, acquisition or abandonment of secured property, cancellation of debt, qualified tuition program payments (under section 529), IRA, Coverdell ESA, Archer MSA or HSA contributions or distributions, and pension distributions. You must give your correct TIN, but you do not have to sign the certification.

What Name and Number To Give the Requester

|

For this type of account: |

Give name and SSN of: |

|

|

|

1. |

Individual |

The individual |

2. |

Two or more individuals (joint |

The actual owner of the account or, |

|

account) |

if combined funds, the first |

|

|

individual on the account 1 |

3. |

Custodian account of a minor |

The minor 2 |

|

(Uniform Gift to Minors Act) |

|

4. |

a. The usual revocable savings |

The |

|

trust (grantor is also trustee) |

|

|

b. |

The actual owner 1 |

|

not a legal or valid trust under |

|

|

state law |

|

5. |

Sole proprietorship or disregarded |

The owner 3 |

|

entity owned by an individual |

|

|

|

|

|

For this type of account: |

Give name and EIN of: |

|

|

|

6. |

Disregarded entity not owned by an |

The owner |

|

individual |

|

7. |

A valid trust, estate, or pension trust |

Legal entity 4 |

8. |

Corporate or LLC electing |

The corporation |

|

corporate status on Form 8832 |

|

9. |

Association, club, religious, |

The organization |

|

charitable, educational, or other |

|

|

|

|

10. |

Partnership or |

The partnership |

11. |

A broker or registered nominee |

The broker or nominee |

12. |

Account with the Department of |

The public entity |

|

Agriculture in the name of a public |

|

|

entity (such as a state or local |

|

|

government, school district, or |

|

|

prison) that receives agricultural |

|

|

program payments |

|

|

|

|

1List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that person’s number must be furnished.

2Circle the minor’s name and furnish the minor’s SSN.

3You must show your individual name and you may also enter your business or “DBA” name on the second name line. You may use either your SSN or EIN (if you have one), but the IRS encourages you to use your SSN.

4List first and circle the name of the trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.) Also see Special rules for partnerships on page 1.

Note. If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.

Secure Your Tax Records from Identity Theft

Identity theft occurs when someone uses your personal information such as your name, social security number (SSN), or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your SSN to receive a refund.

To reduce your risk:

●Protect your SSN,

●Ensure your employer is protecting your SSN, and

●Be careful when choosing a tax preparer.

Call the IRS at

Victims of identity theft who are experiencing economic harm or a system problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS

Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft.

The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.

If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS personal property to the Treasury Inspector General for Tax Administration at

Visit the IRS website at www.irs.gov to learn more about identity theft and how to reduce your risk.

Privacy Act Notice

Section 6109 of the Internal Revenue Code requires you to provide your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA, or Archer MSA or HSA. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The IRS may also provide this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to a payer. Certain penalties may also apply.