When working in the online editor for PDFs by FormsPal, it is easy to fill in or modify Printable ... here and now. Our editor is constantly evolving to give the best user experience attainable, and that's because of our resolve for continuous improvement and listening closely to customer feedback. To get the process started, consider these easy steps:

Step 1: Just click on the "Get Form Button" in the top section of this page to get into our pdf editor. This way, you will find everything that is required to work with your document.

Step 2: This editor offers the ability to modify most PDF files in a variety of ways. Transform it by including customized text, adjust what's already in the file, and place in a signature - all when it's needed!

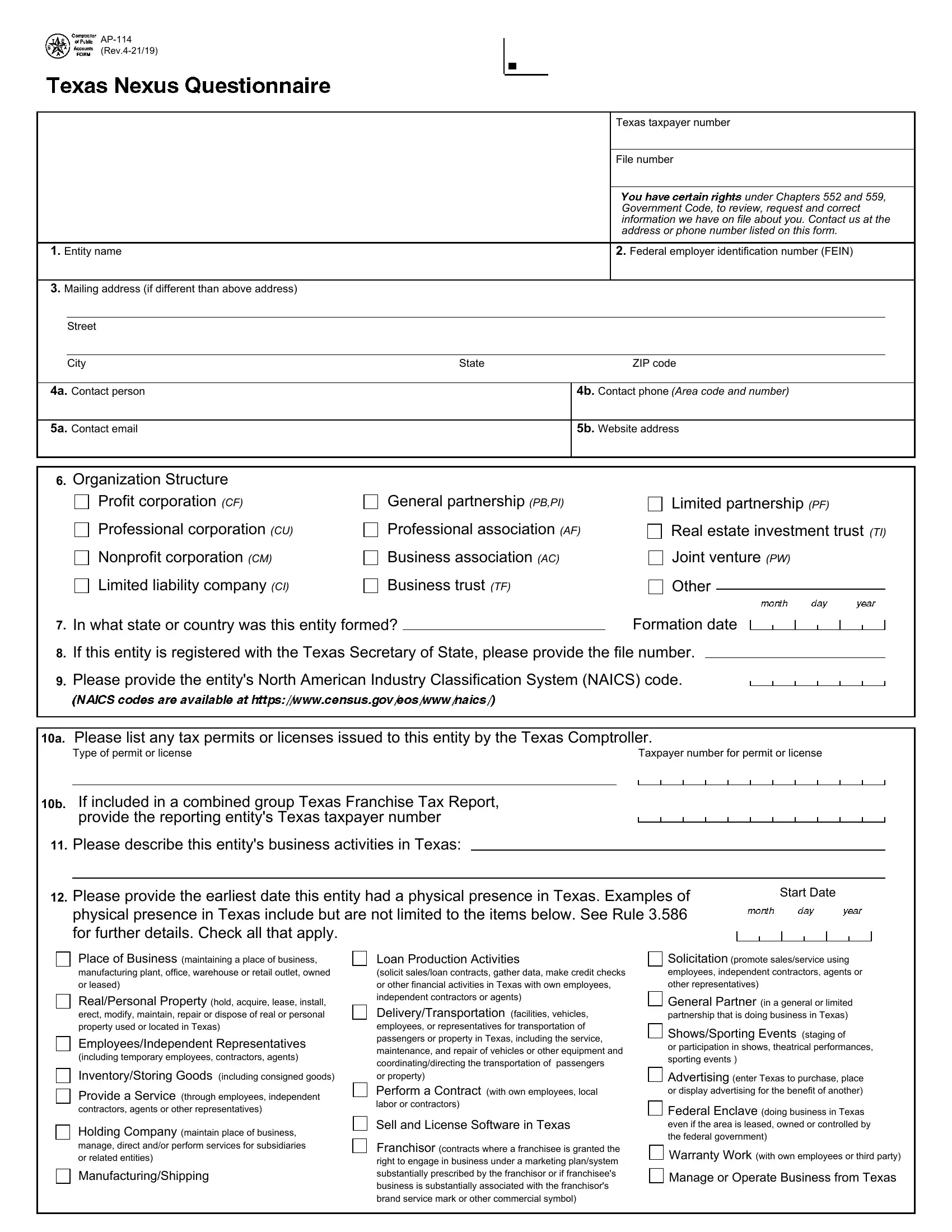

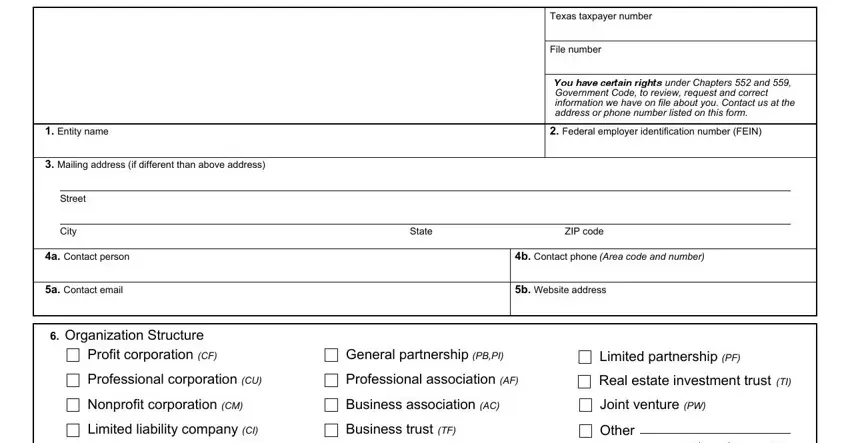

This form will involve some specific information; in order to guarantee accuracy and reliability, remember to consider the guidelines further down:

1. It is important to complete the Printable ... properly, thus be attentive when filling out the parts containing these specific blank fields:

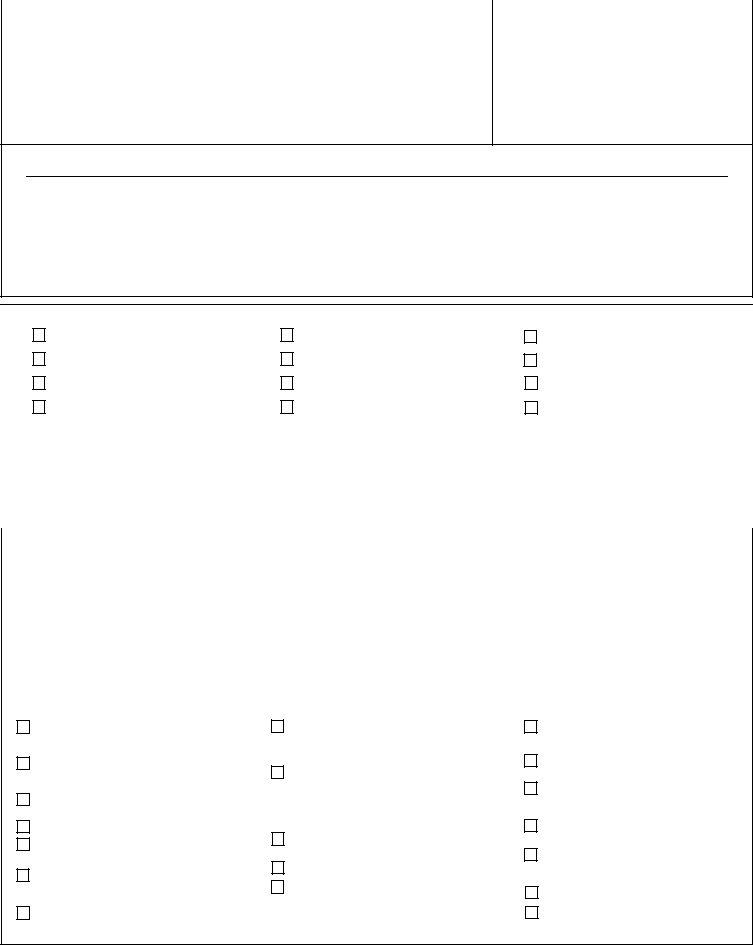

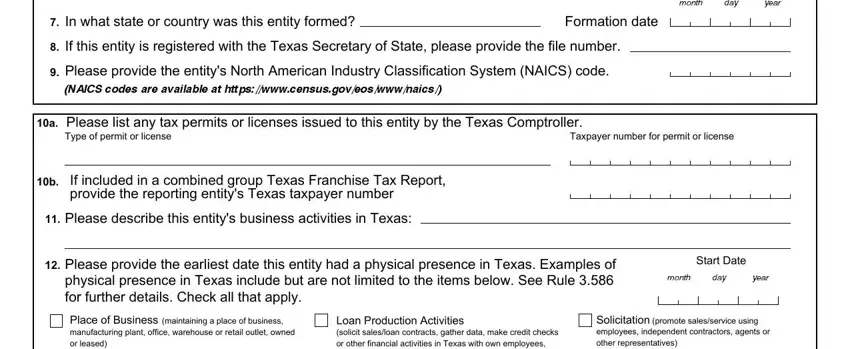

2. Your next stage is to fill out the next few fields: month, day, year, In what state or country was this, Formation date, NAICS codes are available at, a Please list any tax permits or, Type of permit or license, Taxpayer number for permit or, If included in a combined group, Please describe this entitys, Please provide the earliest date, Loan Production Activities solicit, Start Date, and month.

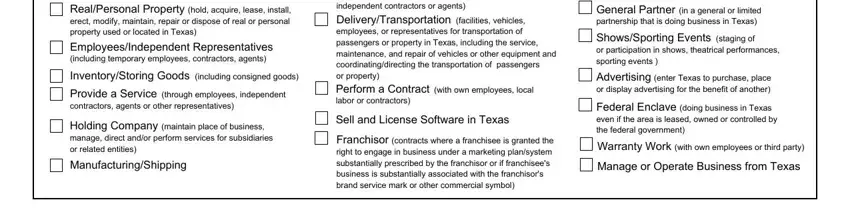

3. This third part is generally simple - fill in all of the form fields in Please provide the earliest date, Loan Production Activities solicit, and Solicitation promote salesservice in order to complete this part.

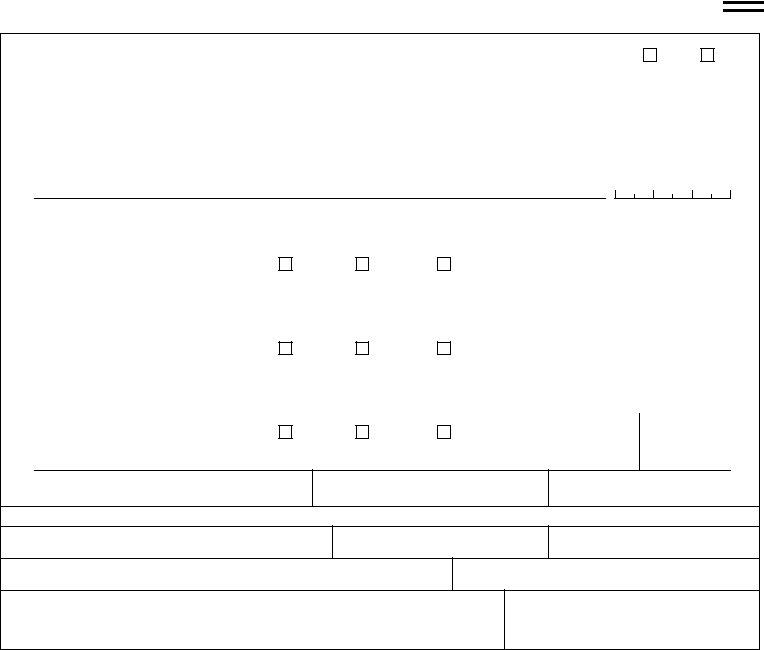

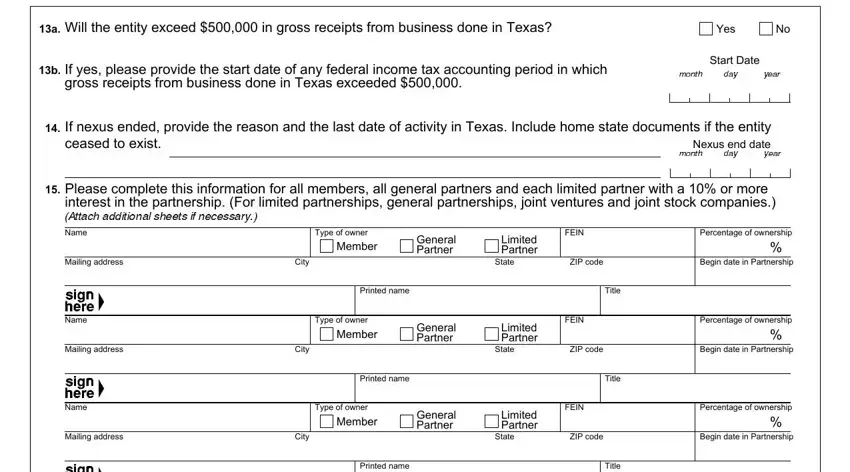

4. This paragraph comes with all of the following blanks to complete: a Will the entity exceed in gross, b If yes please provide the start, gross receipts from business done, Yes, Start Date, month, day, year, If nexus ended provide the reason, ceased to exist, month, day, year, Please complete this information, and Type of owner.

In terms of Please complete this information and Type of owner, be sure that you take another look here. Both these could be the most important ones in the page.

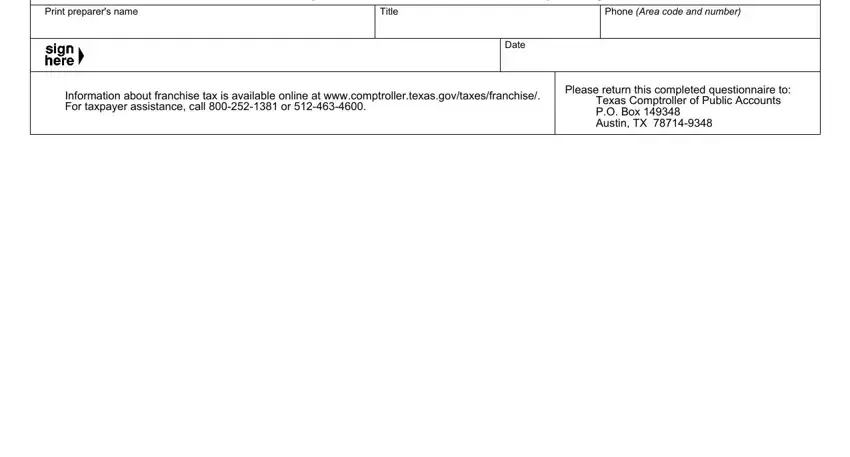

5. To conclude your form, the final part has some additional fields. Typing in I declare that the information in, Title, Phone Area code and number, Date, Information about franchise tax is, and Please return this completed will wrap up everything and you will be done quickly!

Step 3: Before submitting this form, check that all form fields were filled out correctly. When you think it's all good, press “Done." Join FormsPal today and immediately use Printable ..., prepared for downloading. Every single modification you make is conveniently saved , meaning you can change the file at a later stage if required. FormsPal is focused on the privacy of all our users; we make sure all personal information handled by our system continues to be secure.