Our PDF editor was created to be so simple as it can be. When you keep to these steps, the process of managing the exemption payment document will undoubtedly be trouble-free.

Step 1: Get the button "Get Form Here" and hit it.

Step 2: Now, you are on the document editing page. You may add content, edit existing data, highlight certain words or phrases, insert crosses or checks, add images, sign the file, erase unnecessary fields, etc.

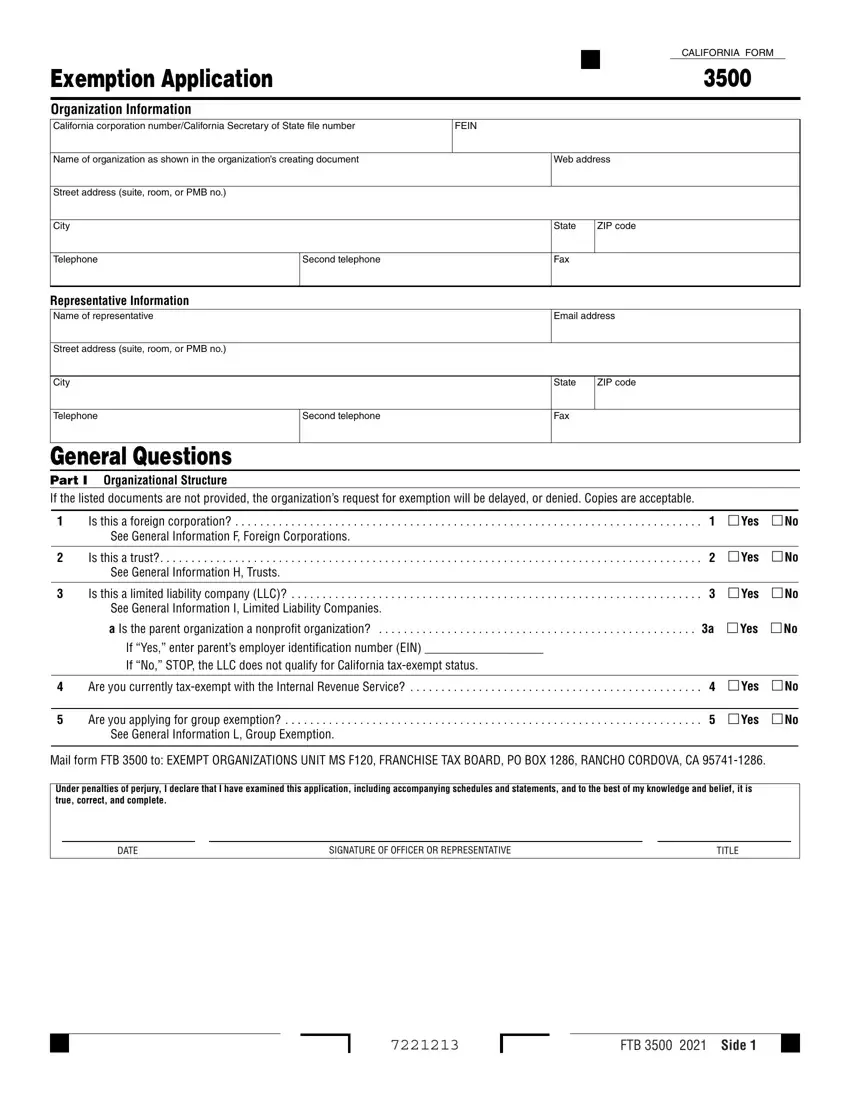

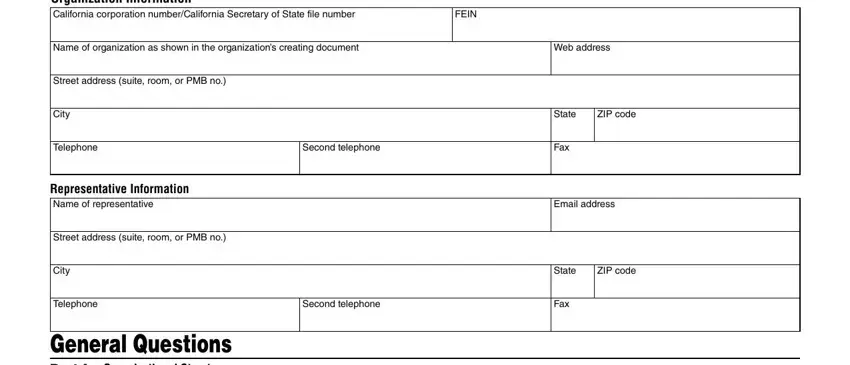

You have to provide the following details in order to prepare the file:

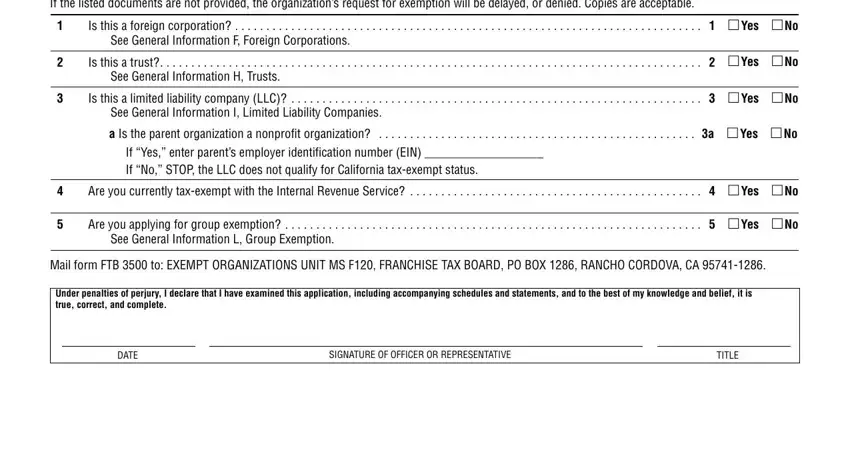

Complete the General Questions Part I, Is this a foreign corporation, See General Information F Foreign, Is this a trust, Yes, See General Information H Trusts, Is this a limited liability, Yes, See General Information I Limited, a Is the parent organization a, Yes, If Yes enter parents employer, Are you currently taxexempt with, Yes, and Are you applying for group areas with any content that is required by the platform.

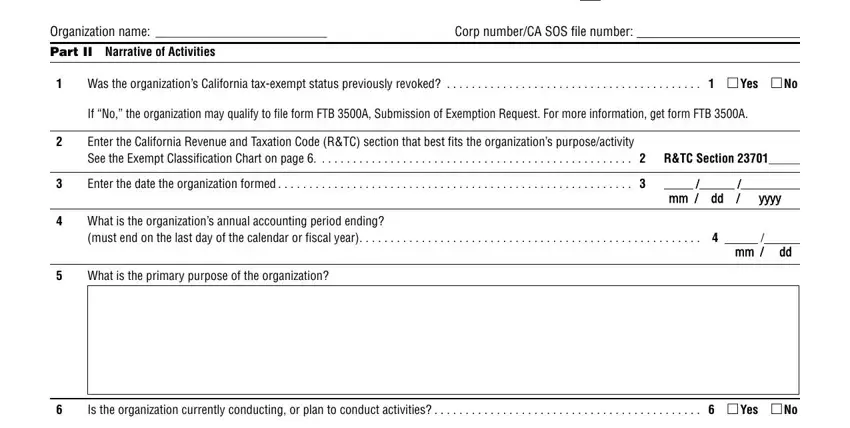

You may be demanded specific valuable particulars so that you can fill up the Organization name, Corp numberCA SOS file number, Part II Narrative of Activities, Was the organizations California, Yes, If No the organization may qualify, Enter the California Revenue and, Enter the date the organization, yyyy, What is the organizations annual, What is the primary purpose of the, Is the organization currently, and Yes segment.

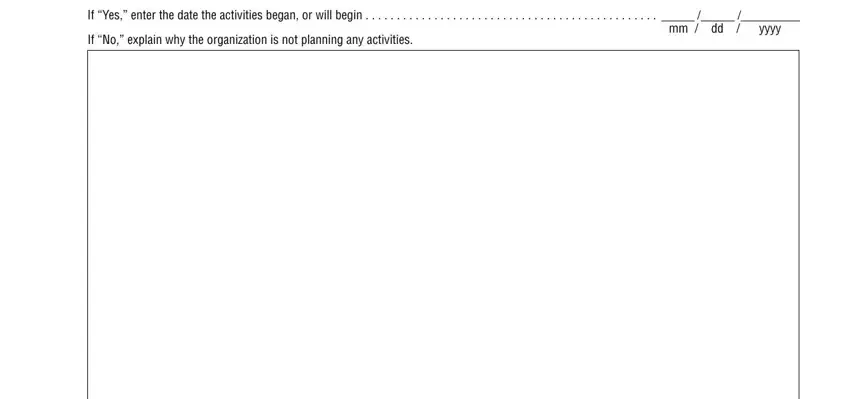

The area If Yes enter the date the, If No explain why the organization, mm dd, and yyyy should be where you can insert all parties' rights and obligations.

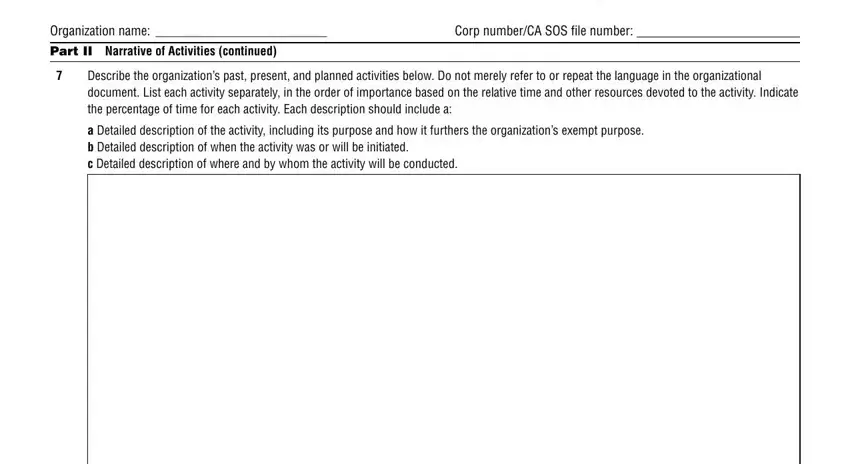

Finalize by analyzing these areas and submitting the pertinent details: Organization name, Corp numberCA SOS file number, Part II Narrative of Activities, Describe the organizations past, and a Detailed description of the.

Step 3: Select the Done button to save the form. Now it is offered for upload to your gadget.

Step 4: To avoid all of the headaches in the long run, be sure to generate around a couple of copies of the form.