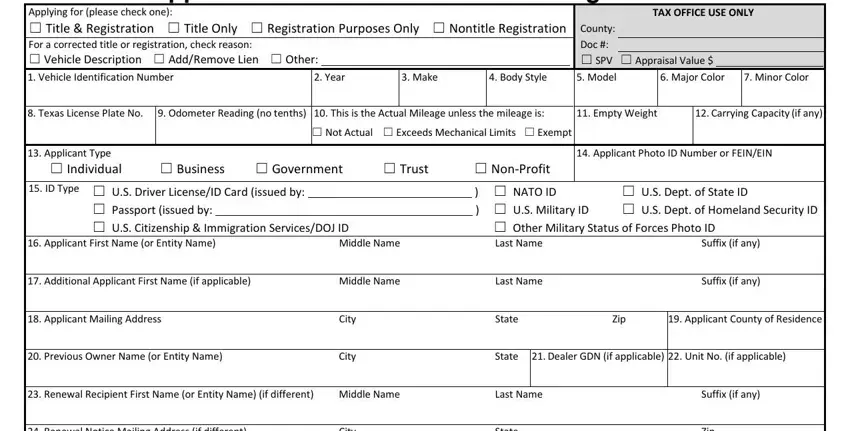

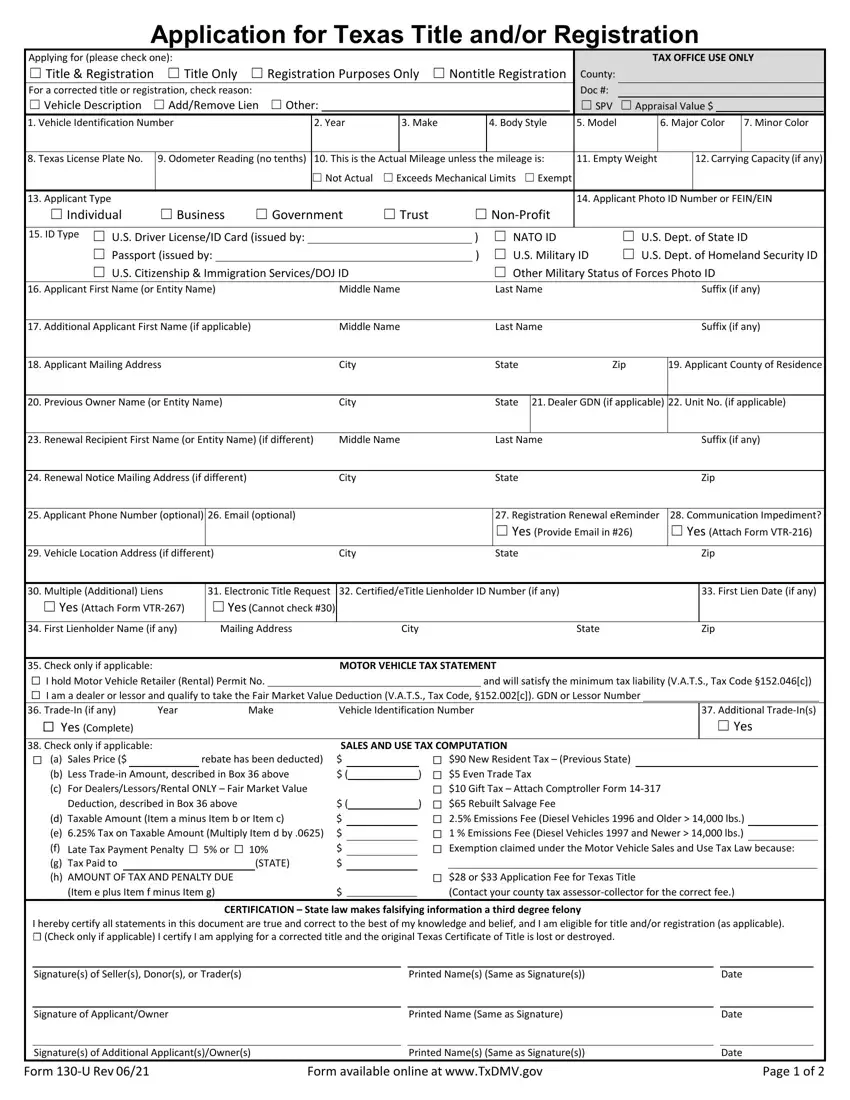

Application for Texas Title and/or Registration

General Instructions

With a few exceptions, you are entitled to be informed about the information the department collects about you. The Texas Government Code entitles you to receive and review the information and to request that the department correct any information about you that is incorrect. Please contact the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000 for details.

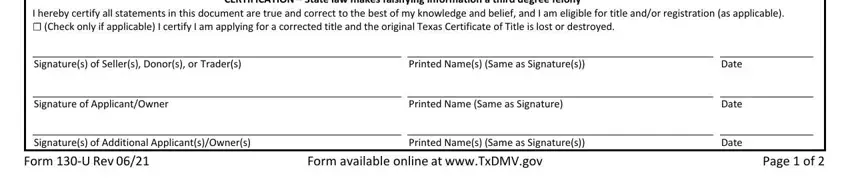

This form must be completed and submitted to your county tax assessor-collector accompanied by any required application fee, supporting documents, registration fee, if applicable, and any motor vehicle tax due. An application form may be reproduced or faxed. A completed form must contain the original signature of the buyer. The seller's signature may be reproduced or faxed. All title applications must include one of the government-issued photo IDs listed in Box 15. Detailed instructions for completing this form are located in the Detailed Instructions for Application for Texas Title and/or Registration (Form VTR-130-UIF).

AVAILABLE HELP

•For assistance in completing this form, contact your county tax assessor-collector.

•For information about motor vehicle sales and use tax or emission fees, contact the Texas Comptroller of Public Accounts, Tax Assistance Section, at 1-800-252-1382 toll free nationwide or call 512-463-4600.

•For title or registration information, contact your county tax assessor-collector or the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000.

Additional Details

Title Only: License plates and registration insignia previously issued for this motor vehicle must be surrendered in accordance with Transportation Code §501.0275, if applicable, unless this vehicle displays a license plate under an applicable status of forces agreement. The following types of vehicles are not eligible for Title Only: construction machinery (unconventional vehicles), water well drilling units, machinery used exclusively for drilling water wells, construction machinery not designed to transport persons or property, implements of husbandry, farm equipment (including combines), golf carts, slow moving vehicles, or any vehicle with a suspended or revoked title. Registration Purposes Only: Do not surrender an original out of state title with this application. A Texas title will NOT be issued for a vehicle applying for Registration Purposes Only. The receipt issued upon filing this application will serve as the registration receipt and proof of application for Registration Purposes Only.

•Foreign Vehicles: Foreign vehicles applying for Registration Purposes Only must attach DOT Form HS-7 or U.S. Customs Form CF-7501 to

indicate the vehicle is: 1) over 25 years old, or 2) complies with Federal Motor Vehicle Safety Standards, or 3) is being imported in the United States for a temporary period by a nonresident or a member of the armed forces of a foreign country on assignment in the U.S., and does not conform to the Federal Motor Vehicle Standards and cannot be sold in the U.S.

Nontitle Registration: Certain trailers, farm equipment, construction machinery, oil well servicing machinery, water well drilling units, etc. are either exempt from, or not eligible for title, but are eligible for, or required to, obtain registration or a specialty plate in order to operate on the highway. Applicants should mark this box only when applicable. Note: A lien cannot be recorded on this type of application.

Out of State Vehicles: If the applicant certifies the vehicle is located out of state, self-certification of the Vehicle Identification Number (VIN) is allowed if a VIN verification form issued by a Texas state-approved safety inspection station is not included with the submission of this application. See Vehicle Identification Number Certification (Form VTR-270) for more information.

Notice

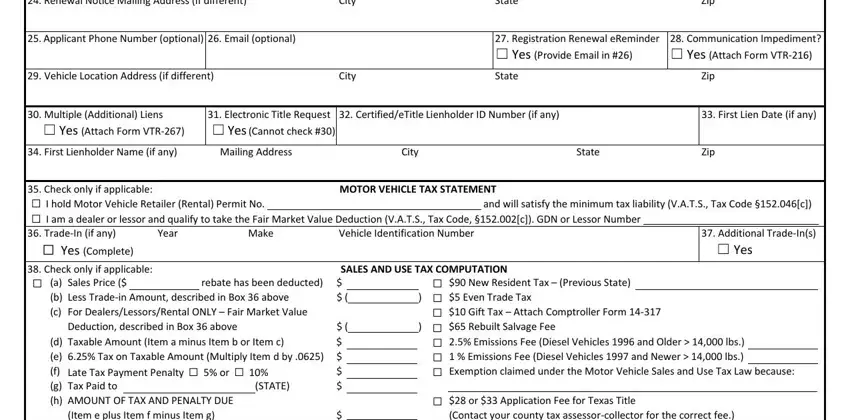

•The sales and use tax must be paid to the county tax assessor-collector within 30 days from the date of purchase or entry of the vehicle into Texas.

•A $2.50 transfer fee is paid to transfer current registration to the new owner in addition to the title application fee and other applicable fees. If the registration is not current, full registration fees are due unless applying for Title Only.

•A 6.25 percent motor vehicle sales and use tax is imposed on the sales price (less trade-in allowance) of motor vehicles for use in Texas or a motor vehicle purchased outside of the state and later brought into this state by a Texas resident.

•Standard Presumptive Value (SPV) applies to private-party sales of most used motor vehicles purchased or brought into Texas. The tax is computed on the greater of the sales price or 80 percent of the SPV on the day of title application.

•New Texas residents are subject to a $90 use tax on a vehicle brought into this state that was previously registered to the new resident in another state or foreign country. This is in lieu of the 6.25 percent use tax imposed on a Texas resident.

•A $10 gift tax is due when a person receives a motor vehicle as a gift from an immediate family member, guardian, or a decedent's estate. A vehicle donated to, or given by, a non-profit service organization qualifying under IRC 501(c)(3) is also taxed as a gift. Both donor and recipient must sign the Comptroller's joint affidavit, Affidavit of Motor Vehicle Gift Transfer (Form 14-317). The affidavit and the title application must be submitted in person by either the donor or recipient.

•A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift described above is a sale and will be subject to tax calculated on the vehicle's standard presumptive value.

•A late penalty equal to 5 percent of the tax will be charged if the tax or surcharge is paid from 1 to 30 calendar days late. If more than 30 calendar days late, the penalty will be 10 percent of the tax; minimum penalty is $1.

•In addition to the late tax payment penalty, Texas Transportation Code provides for an escalating delinquent transfer penalty of up to $250 for failure to apply for title within 30 days from the date of title assignment. Submit this application along with proper evidence of ownership and appropriate valid proof of financial responsibility such as a liability insurance card or policy.

•All new residents applying for a Texas title and registration for a motor vehicle must file at the county tax assessor-collector of the county in Texas where the applicant resides within 30 days of establishing residency. Texas law requires that all vehicles previously registered and titled or registered in another state or country be inspected for safety and the vehicle identification number verified before such vehicles may be registered in Texas. These inspections must be made by a state appointed safety inspection station that will complete a Texas Vehicle Inspection Report. This form must be submitted to the county tax assessor-collector with your application for registration and Texas title.