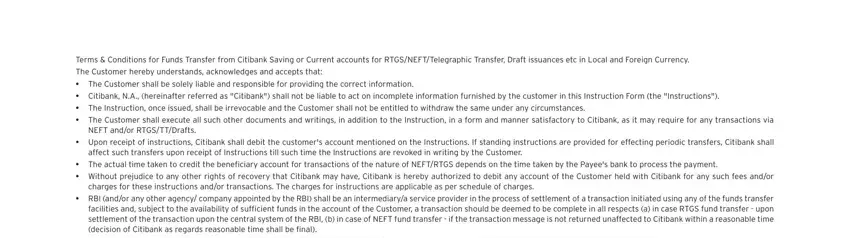

Terms & Conditions for Funds Transfer from Citibank Saving or Current accounts for RTGS/NEFT/Telegraphic Transfer, Draft issuances etc in Local and Foreign Currency. The Customer hereby understands, acknowledges and accepts that:

•The Customer shall be solely liable and responsible for providing the correct information.

•Citibank, N.A., (hereinafter referred as "Citibank") shall not be liable to act on incomplete information furnished by the customer in this Instruction Form (the "Instructions").

•The Instruction, once issued, shall be irrevocable and the Customer shall not be entitled to withdraw the same under any circumstances.

•The Customer shall execute all such other documents and writings, in addition to the Instruction, in a form and manner satisfactory to Citibank, as it may require for any transactions via NEFT and/or RTGS/TT/Drafts.

•Upon receipt of instructions, Citibank shall debit the customer's account mentioned on the Instructions. If standing instructions are provided for effecting periodic transfers, Citibank shall affect such transfers upon receipt of Instructions till such time the Instructions are revoked in writing by the Customer.

•The actual time taken to credit the beneficiary account for transactions of the nature of NEFT/RTGS depends on the time taken by the Payee's bank to process the payment.

•Without prejudice to any other rights of recovery that Citibank may have, Citibank is hereby authorized to debit any account of the Customer held with Citibank for any such fees and/or charges for these instructions and/or transactions. The charges for instructions are applicable as per schedule of charges.

•RBI (and/or any other agency/ company appointed by the RBI) shall be an intermediary/a service provider in the process of settlement of a transaction initiated using any of the funds transfer facilities and, subject to the availability of sufficient funds in the account of the Customer, a transaction should be deemed to be complete in all respects (a) in case RTGS fund transfer - upon settlement of the transaction upon the central system of the RBI, (b) in case of NEFT fund transfer - if the transaction message is not returned unaffected to Citibank within a reasonable time (decision of Citibank as regards reasonable time shall be final).

• The account to be credited, in accordance with the Instructions, is not an account on which there are restrictions, as per applicable law, on crediting monies.

•The transaction includes various counter-parties and Citibank shall not be liable or responsible for delays/deficiencies in settlement of the transaction due to system constraints, actions of other parties or any other circumstances outside the control of Citibank.

•Citibank may amend the terms and conditions from time to time, and the same are binding on the Customer.

•The Customer hereby agrees to unconditionally and irrevocably indemnify against any or and all consequences , losses, including but not limited to costs of legal proceedings, which Citibank may suffer or sustain or incur at anytime as consequence of or arising out of any funds transfer facility provided to the Customer by Citibank in good faith, including commission or omission of any Instruction of the Customer including due to any regulatory, judiciary, statutory, quasi judiciary order or notice or any other cause beyond Citibank's control. Without prejudice to the generality of the foregoing, the Customer shall indemnify and save, keep harmless and indemnified Citibank against any improper/fraudulent instructions.

•The provision of the transfer of funds via RTGS/NEFT/ telegraphic transfer, demand draft is subject to Indian laws and the guidelines and regulations issued from time to time by the RBI in this behalf.

•In the event of delay in effecting the transfer for any reasons whatsoever, any interest payment for the delayed period shall be subject to the compensation policy of the Bank.

•The encashment of the drafts or payment of transferred funds is subject to clearing or any rules, regulations, sanctions and restrictions of the country, if any, where the draft is to be encashed or transferred. The Customer also agrees that neither Citibank nor its correspondents or agents shall be liable for any delay or loss caused by any act or order of any government or government agency or as a result of any other cause whatsoever.

•The Customer understands that a refund or repurchase of the amount of the draft or of the transferred funds desired shall be made at Citibank's options and only to or from the applicant. In case of a draft, it shall be made upon receipt of the original draft duly endorsed by the applicant. The Customer agrees and acknowledges that refund or repurchase shall be made at the current buying rate for the currency in question less the costs, charges, expenses and interest and further the same can be provided only when Citibank is in possession of the funds for which the payment instructions were issued and they are free from any exchange or other restrictions.

•Unless otherwise expressly and specifically agreed in writing, Citibank may at its discretion, convert into foreign values, the funds received from the applicant, at Citibank's selling rate of the day such funds are received. Citibank's statement, in writing for such conversion shall be conclusive and binding upon the customer. The remittance made shall be payable in the currency of the country to which the remittance has been made and will be at the buying rate of Citibank's correspondents or agents unless the payee by separate arrangement with paying correspon- dent or agent obtains payment in some other currency.

•Citibank may take its customary steps for issue of drafts or for remittance. In doing so Citibank shall be free, on behalf of the Customer, to make use of any correspondent, sub-agent or other agency.

•In no case will Citibank or any of its correspondents or agents be liable for interruptions, errors or delays occurring in the wire cable or mails or on the part of any postal authority, telecom, cable or wireless company or any employee or such authority or any company, or through any other cause. Citibank may send any message related to the transfer in explicit language, code or cipher.

•The beneficiary banks will credit RTGS/NEFT proceeds solely based upon the beneficiary account number provided and the beneficiary name details may not be used.

•These Terms & Conditions shall be in addition to the Citibank Account Terms and conditions and shall bind the customer upon submission of duly executed form.

•All such funds transfer transactions shall be initiated by Citibank as per cutoff timings as on display at the respective branches or Citibank website, from time to time.