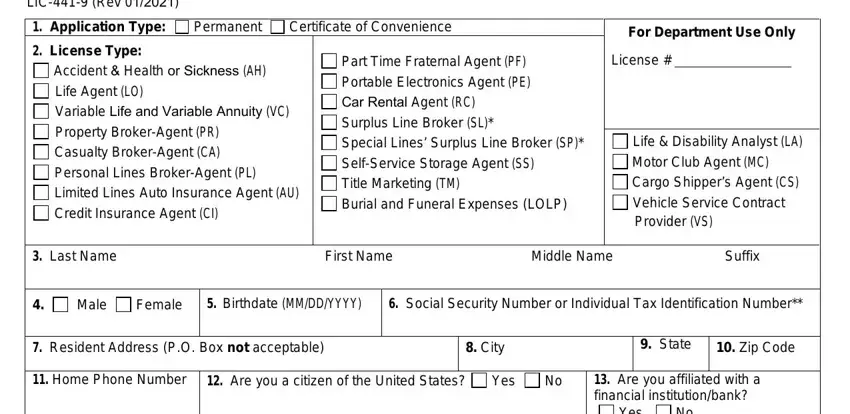

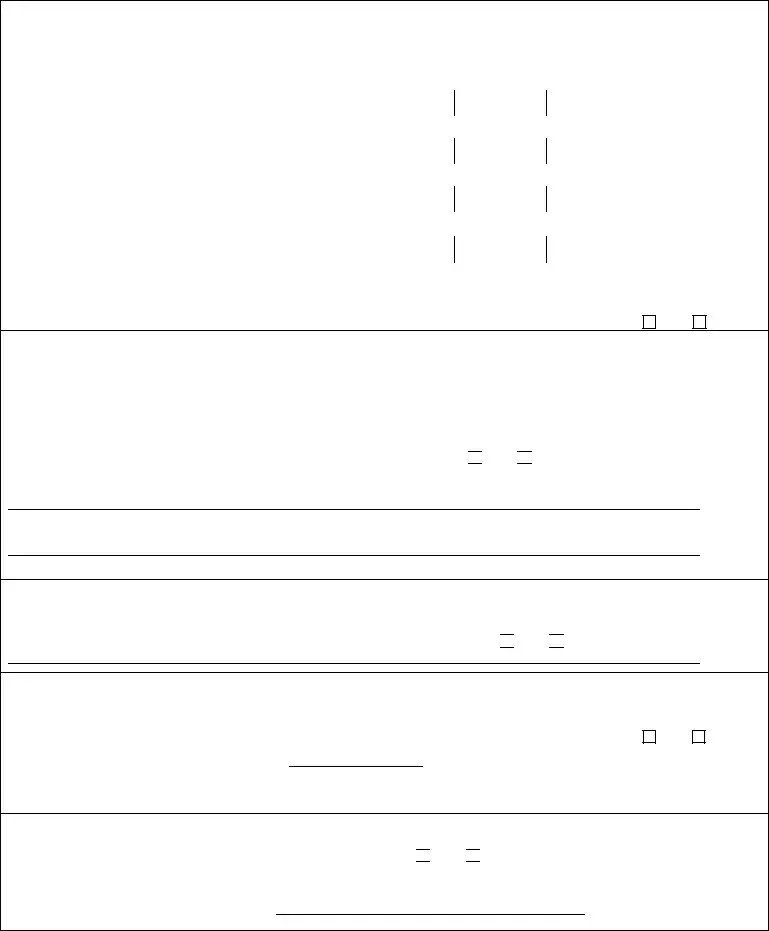

Notice: Information collection and Access

Section 1798.17 of the California Civil Code requires the following information to be provided when collecting information from individuals to determine compliance with the group and corporate practice provisions of the law, and to establish positive identification, to match the names of the certified list provided by the Department of Child Support Services to applicants and licensees, and of responding to requests for this information made by child support agencies.

Agency: Department of Insurance, Address: 320 Capitol Mall, Sacramento, CA 95814-4309, Telephone number: (800) 967-9331.

Title of official responsible for information maintenance: Chief, Producer Licensing Bureau.

Authority which authorizes the maintenance of the information: California Insurance Code, Chapters 5, 6, 7, 8-Part 2, Division 1.

The consequences, if any, of not providing all of part of the requested information: It is mandatory that you provide all information requested. Omission of any item of requested information will result in the application being rejected as incomplete.

The principal purpose(s) for which the information is to be used: The information requested will be used to determine qualifications for licensure or certification, to determine compliance with the group and corporate practice provisions of the law and to establish positive identification.

Each individual has the right to review files maintained on them by the agency, unless the information is classified as confidential under section 1798.34 of the Civil code.

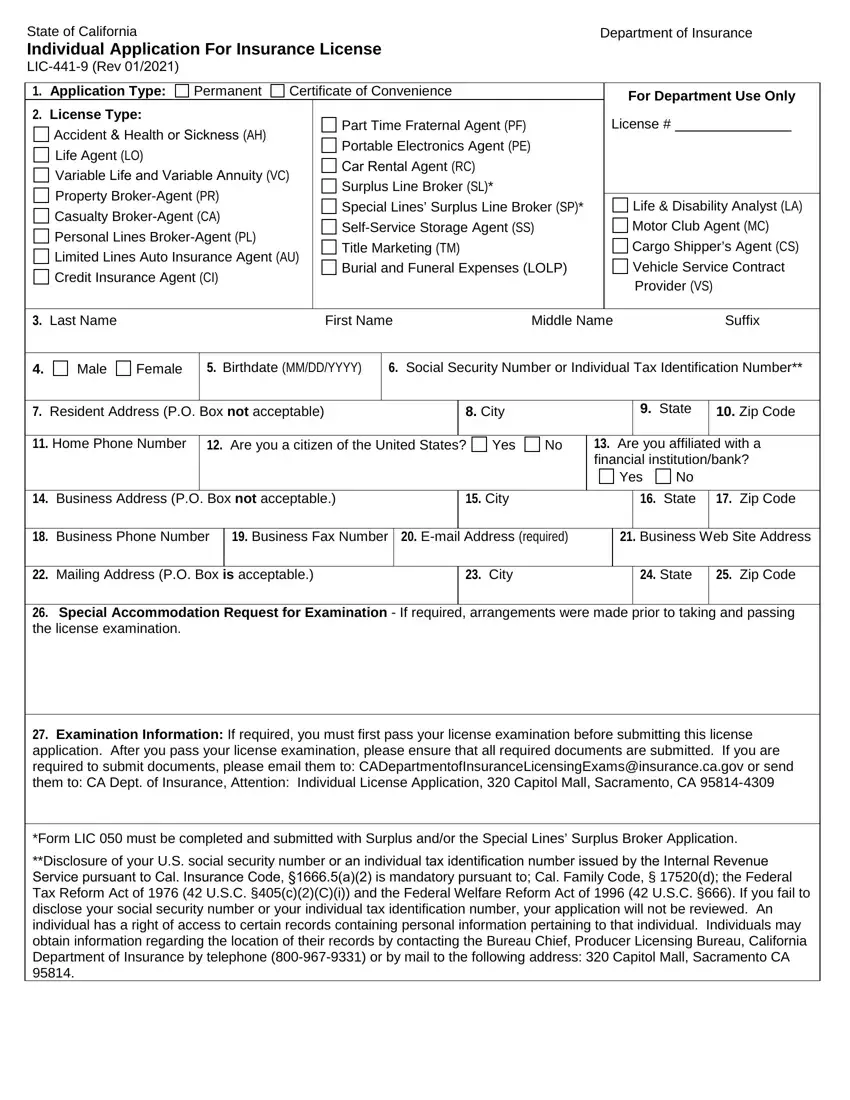

Instructions for completing application

RE: "Applicant name" Enter full legal name. If no middle name, enter (NMN). If any part of your legal name is an initial only, place parentheses around such initial.

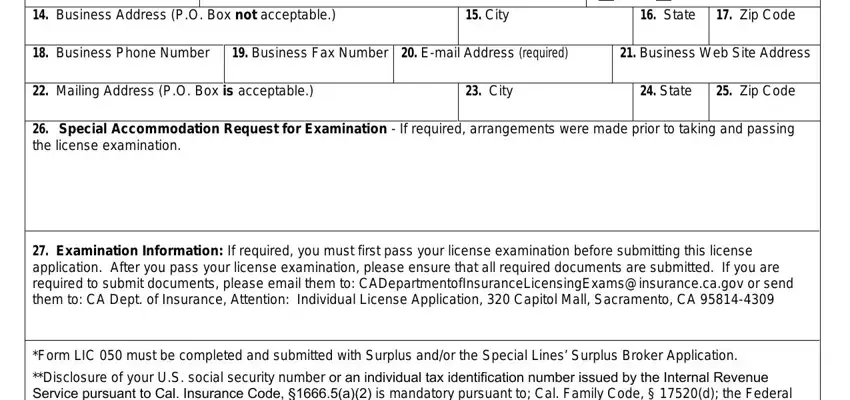

RE: "Address information" Do not enter the word "same" in any address area. Enter the appropriate address. P0 Box is not acceptable for a resident or business address. Business and mailing addresses are public record and are available to the public. It is the applicant’s/licensee’s responsibility to immediately notify the department of any change in address.

RE: Additional "Exam information". If you fail to appear for a scheduled examination, an additional examination fee will be required for rescheduling.

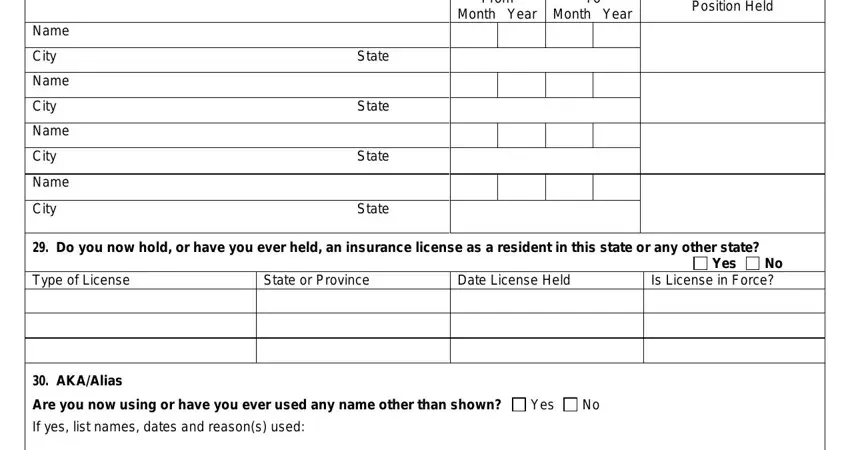

RE: "AKA/Alias" List previously and currently used aliases and maiden names, if any. If you are currently using an "also known as" (AKA) name which you desire to be noted on record, so state. Abbreviations of true name or "nick" names are not acceptable.

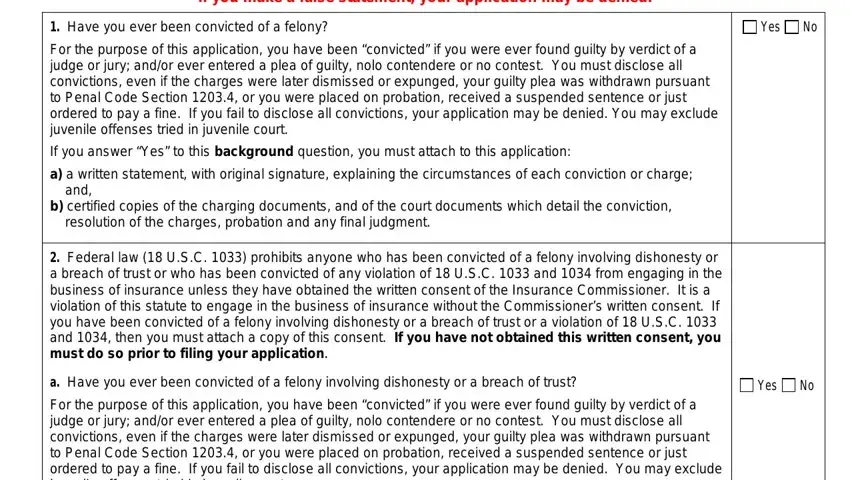

RE: "Background questions" If you answer yes to any of these questions, you must submit a signed statement, with your original signature summarizing the details of each event. You must also provide the additional certified documentation described with each question.

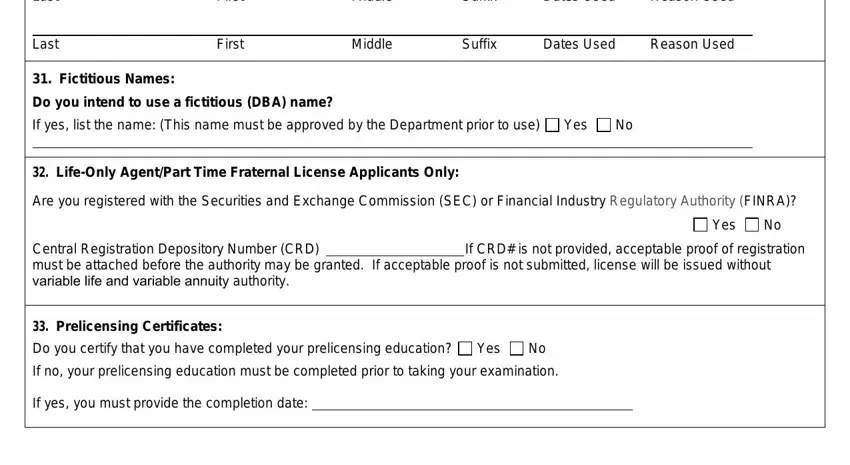

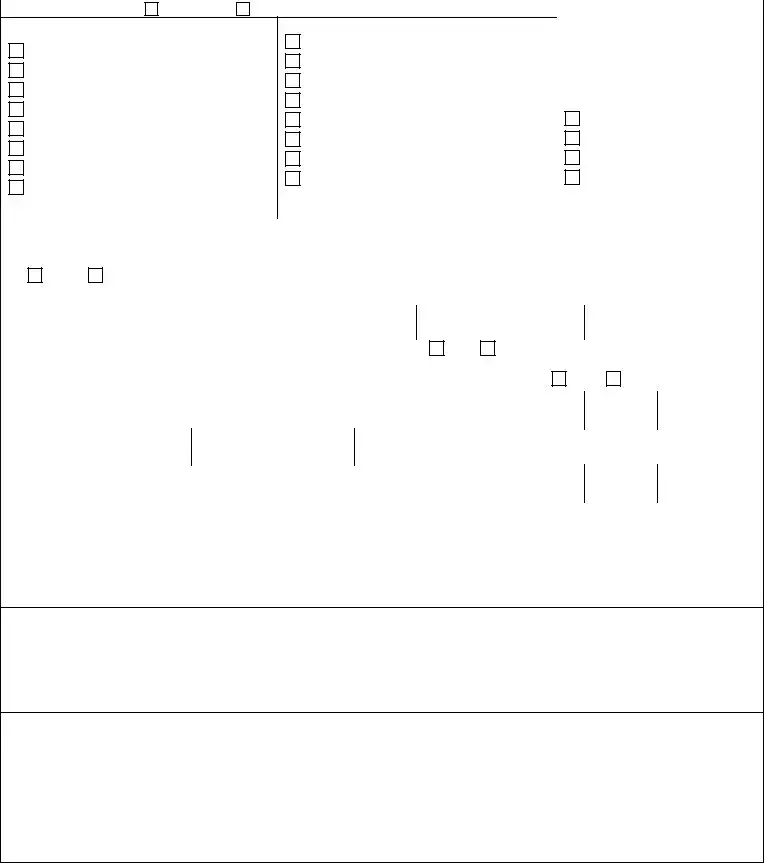

Prelicensing Education requirements: As of January 1, 2011 all new resident applicants must:

A.take an approved minimum 20-hour class for the property broker-agent license exam, and/or;

B.take an approved minimum 20-hour class for the casualty broker-agent license exam, and/or;

C.take an approved minimum 40 hour class for property broker-agent and casualty broker-agent license examination, and/or;

D.take an approved minimum 20-hour class for the life-only agent license exam and/or;

E.take an approved minimum 20 hour class for accident and health agent license exam, and/or;

F.take an approved minimum 40 hour class for life-only and accident and health agent license examination, and/or;

G.take an approved minimum 20-hour class for the personal lines broker-agent license exam, and/or;

H.take an approved minimum 20 hour class for the limited lines automobile insurance agent license examination, and/or;

I.take an approved minimum 12-hour class on ethics and the California Insurance Code.

An applicant will be taking 32 hours (20 and 12), 52 hours (40 and 12 or 20, 20 and 12), and 72 hours (20, 40 and 12 or 20, 20, 20 and 12) of prelicensing class hours depending on which combination of licenses are being sought.

The following documents are required to be submitted with the application for the specific license types as listed:

SL - $50,000 bond form LIC 447-31 with a properly executed Power of Attorney form attached or a Business Entity Endorsement form LIC 411-8A completed by sponsoring Business Entity and Form LIC 050 must be completed and submitted with Surplus and/or the Special Lines’ Surplus Broker Application.

SP - $10,000 bond form LIC 447-32 with a properly executed Power of Attorney form attached or a Business Entity Endorsement form LIC 411-8A completed by sponsoring Business Entity and Form LIC 050 must be completed and submitted with Surplus and/or the Special Lines’ Surplus Broker Application.

CS - $10,000 bond form LIC 447-70 with a properly executed Power of Attorney form attached.

CI - Action Notice of Appointment form LIC 447-54A from the sponsoring insurance company and/or Business Entity Endorsement form LIC 411-8A completed by sponsoring Business Entity.

MC - Action Notice of Appointment form LIC 447-54A from the sponsoring insurance company

Forms are available on our website at www.insurance.ca.gov. To obtain insurance licensing forms by mail, send request to: Department of Insurance, 320 Capitol Mall, Sacramento, CA 95814-4309, or you may phone Sacramento toll free at (800) 967-9331.

Mail application with attachments and fees to Department of Insurance, 320 Capitol Mall, Sacramento, CA 95814-4309.

Yes

Yes

No

No

Yes

Yes

No

No