ARIS SOLUTIONS

CHOICES FOR CARE and PARTICIPANT DIRECTED ATTENDANT CARE

EMPLOYEE HIRING PACKET

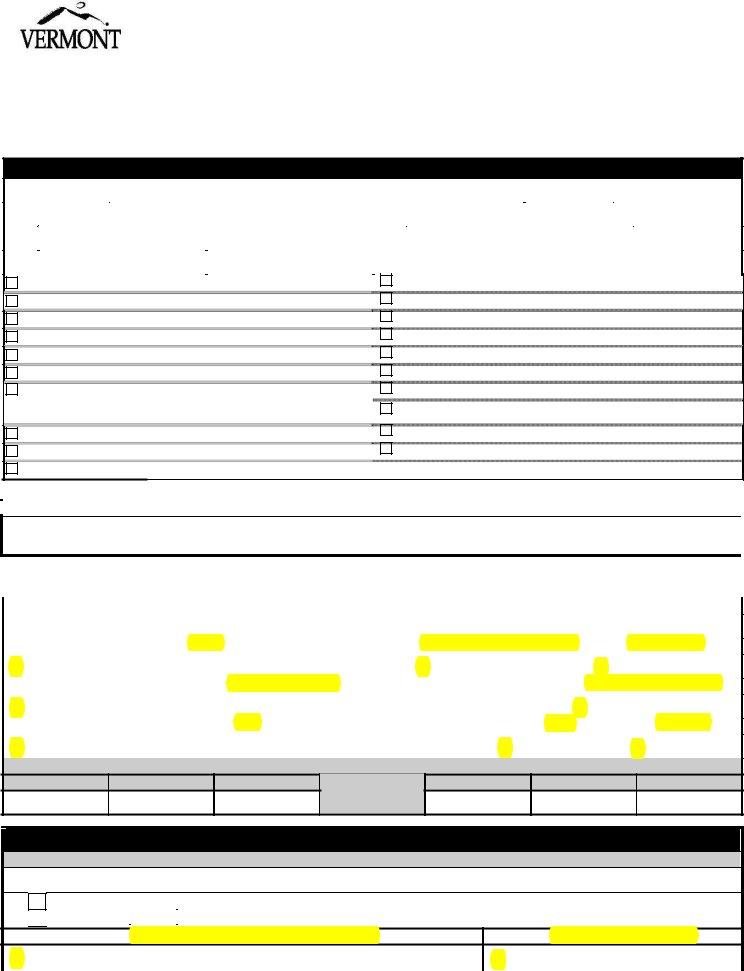

Please assure that all highlighted areas on each form are completed. Employers must complete areas highlighted in pink. Employees must complete areas highlighted in yellow. ARIS Solutions must return any hiring packet which is not complete to the Employer. Employee paychecks cannot be processed until the packet is returned with all highlighted areas complete.

ALL STARRED (*) FORMS MUST BE COMPLETED AND RETURNED TO ARIS SOLUTIONS

Employee Hiring Notice *

Employee Compliance with Agency of Human Services Background Check Policy *

W-4 and Vermont W-4 Withholding Tax Forms *

Employment Eligibility Verification Form *

Important Note: Employers must look at the Employee’s forms of Identification Documentation and must write that information directly on this form. Photo copies of identification information do not take the place of the employer looking at and writing down this information on the form.

Important information for all Employees *

Employees must review this document and sign the certification page.

Agency of Human Services Adult Protection Services and Child Abuse Registry Check*

Request for Criminal Information Check *

Vermont Driver Information Check * (No need to send payment)

If your employee will not be driving as part of his/her job, please write “will not be driving” across this form.

Direct Deposit Form

Pay Schedule – Please keep this schedule for your reference.

MAIL COMPLETED PACKET TO:

ARIS SOLUTIONS

P0 BOX 4409

WHITE RIVER JUNCTION, VT. 05001

1-800-798-1658

Employers may verify that ARIS Solutions has received the Employee Hiring Packet by calling our office

and speaking with a Payroll Support Specialist.

Please call ARIS Solutions with any questions you may have when completing these forms. Additional forms may be obtained by calling ARIS Solutions or by going to our website at:

w w w .arissolut ions.org

FORMS TO BE COMPLETED WHEN HIRING AN EMPLOYEE

All forms are color highlighted for your convenience. Pink highlighted areas are to be completed by the employer. All yellow highlighted areas are to be completed by the employee. Please be sure that all highlighted areas are completed.

Employee Hiring Notice - This form is to be completed by the employer. It tells ARIS Solutions who you are hiring, what the employee’s address is for mailing paychecks, along with their Social Security number. The employer signs this form to authorize hiring the employee.

Employee Compliance with Agency of Human Services Background Check Policy This form must be reviewed and signed by the employee. Employees having convictions or findings as indicated on the form may not be paid by ARIS Solutions to provide services.

Forms W-4 and W-4 VT - These forms are completed by the employee. The forms are required as they provide specific tax withholding information for each employee.

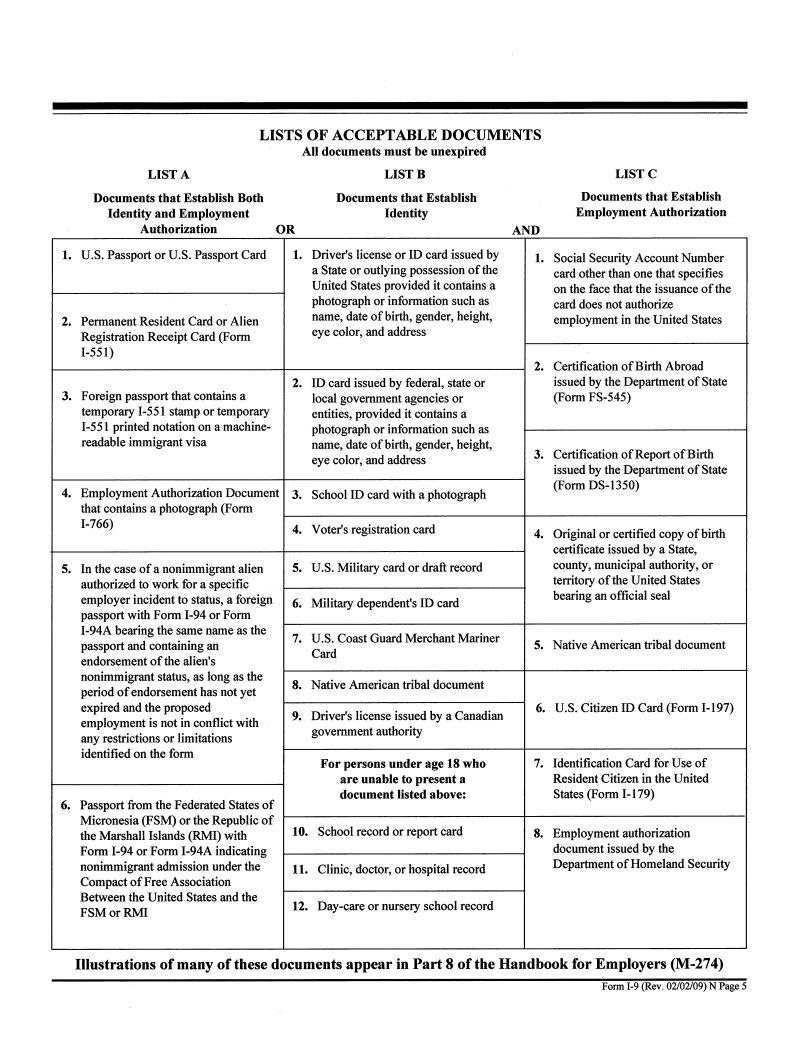

Employment Eligibility Verification - This form is required by the Department of Justice. The purpose of the form is to assure the Dept. of Justice that the person being hired is legally able to work in the United States. The employer must look at the original identification information (see List of Acceptable Documents) and write this information down directly on the form. It is not necessary to send in photo copies of the identification documents. The employee fills out and signs the top yellow highlighted section of the form. The employer fills out and signs the middle pink highlighted section of the form.

Background Check Forms - All employees are required by the State of Vermont to have background checks completed whenever working for a new employer. These background checks must be filled out by the employee and signed by the employee. They include a check of the Vermont Adult Abuse and Child Abuse Registries, the Vermont Crime Information Center along with the Department of Motor Vehicles. All forms must be submitted when hiring an employee. If your employee will not be driving while working please indicate this in writing directly on the DMV form. The employer will be notified in writing once all background checks have been completed. Please be aware that background checks are run for Vermont findings, only. Background checks provided by ARIS Solutions will not result in notification of criminal convictions or abuse substantiations founded in any state other than Vermont. Employers may choose to go online to conduct their own independent background checks at their own cost.

Direct Deposit Form - This is an optional form. We strongly encourage employees to use Direct Deposit to receive their pay. This eliminates any possible delays in the mail and assures that funds are automatically deposited into the employees account on payday. It may take up to two payroll periods for the Direct Deposit process to take place. Regular checks will be mailed to employees until the Direct Deposit account information is secured in our system.

#2

CHOI CES FOR CARE

PARTI CI PANT DI RECTED ATTENDANT CARE SERVI CES

REASONS FOR NON- PAYMENT OF EMPLOYEE TI MESHEETS

On occasion it may be necessary for ARI S Solutions to return employee timesheets to employers. This may result in employee paychecks being delayed. ARI S Solutions will attempt to contact employers by telephone to discuss timesheet errors or omissions whenever possible. ARI S Solutions is unable to process any timesheet which does not have the original signatures* of both the employer and the employee.

Reasons for non- payment of employee timesheets:

Absence of employee name or consumer name

Lack of I n and Out times or note of AM or PM hours (employees who reside with a consumer may write “ Live I n” as long as there are no other care providers)

Absence of employee or employer signature *

Lack of indication as to whether hours provided are for Personal Care, Respite or Companionship (CFC only, not for Flexible Choices or PDAC)

Missing dates of service

Photocopied or faxed employee or employer signatures on timesheets or packets cannot be accepted*

Lack of approved Service Plan

Patient Share (when applicable) has not been paid.

Submission of duplicate dates and hours of service

ARI S Solutions Payroll Support Staff call employers at least one time each payroll week to obtain missing information (* with the exception of missing signatures or photo copied forms) . I f the employer cannot be reached or does not return our call with the needed information, timesheets will be returned to the employer.

Additional causes for an employee not to receive a paycheck:

Late time sheets. Time sheets must be received in the ARI S Solutions office no later than Monday of each pay week, according to the Payroll Schedule.

Lack of or incomplete Employer enrollment forms.

Lack of or incomplete Employee enrollment forms.

Should a timesheet be returned to the employer for one of the above reasons, the employer should complete or correct the identified error, and re-submit the timesheet to ARI S Solutions. The timesheet will be processed and paid in the next pay period

following receipt in the ARI S Solutions office. |

# 3 |

ARIS SOLUTIONS

CHOICES FOR CARE/PDAC

EMPLOYEE HIRING NOTICE

EMPLOYEE NAME:______________________CONSUMER NAME: _________________

(This is the person who provides the care) (This is the person who receives the care)

EMPLOYEE MAILING ADDRESS:______________________________________________

CITY:_______________________________ STATE:______________ ZIP CODE:________

TELEPHONE NUMBER:_______________________________________________________

EMPLOYEE SOCIAL SECURITY NUMBER: _____________________________

WORK START DATE:_________________________________________________________

I,______________________________(employee), confirm that I am 18 years of age or older, have

completed high school or have a GED, and that I am not the legal guardian of the individual I am providing supports for.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

EMPLOYER NAME:___________________________________________________________

EMPLOYER ADDRESS:________________________________________________________

______________________________________________________________________________

EMPLOYER SIGNATURE:_____________________________________________________

PLEASE BE SURE ALL HIGHLIGHTED AREAS ARE COMPLETED USING BLUE OR BLACK INK

IMPORTANT NOTE:

EMPLOYEES MUST BE 18 YEARS OF AGE OR OLDER

EMPLOYEEE MUST HAVE A HIGH SCHOOL DIPLOMA OR GED

EMPLOYEES MAY NOT BE LEGAL GUARDIANS

EMPLOYERS/SURROGATES MAY NOT BE PAID TO PROVIDE SERVICES

PLEASE NOTIFY ARIS SOLUTIONS IN WRITING WHEN AN EMPLOYEE IS TERMINATED FROM EMPLOYMENT

PLEASE NOTIFY ARIS SOLUTIONS IN WRITING IMMEDIATELY IF AN EMPLOYEE

HAS A CHANGE IN ADDRESS OR A NAME CHANGE. NAME CHANGES MUST BE ACCOMPANIED BY A COPY OF A SOCIAL SECURITY CARD DOCUMENTING THE

Employee Compliance with State of Vermont

Agency of Human Services

Background Check Policy

I, __________________________________, employee, have reviewed the State of Vermont, Agency

of Human Services Background Check Exclusions below and confirm that I do not have any convictions, substantiations or findings as outlined from this Policy which exclude me from being paid to provide supports under the State of Vermont Consumer Directed programs funded by DAIL and/or Medicaid.

I understand that ARIS Solutions will conduct background checks for me on behalf of my employer. I further understand that should any excluding conviction, substantiation or finding be identified as a result of these background checks that ARIS Solutions will be unable to process any further payroll for me effective the date of that finding.

_________________________________ |

|

__________________ |

|

OR |

Employee |

|

|

Date |

|

|

I, __________________________ do have findings as outlined in the Policy. My employer

will be requesting a waiver of this policy from DAIL. I understand that unless a waiver is approved by DAIL that I will not be paid for any services I provide.

******************************************************************************

“Funds administered by DAIL (including Medicaid) may not be used to employ, place or contract with a person who has:

a.A substantiated record of abuse, neglect, or exploitation of a child or a vulnerable adult;

b.Been excluded from participation in Medicaid or Medicare services, programs, or facilities by the federal Department of Health and Human Services’ Office of the Inspector General; and/or,

c.A criminal conviction for an offense involving bodily injury, abuse of a vulnerable person, a felony drug offense, or a property/money crime involving violation of a position of trust, including, but not limited to:

Aggravated assault |

Hate motivated crime |

Aggravated stalking |

Kidnapping |

Aggravated sexual assault |

Lewd and lascivious conduct |

Assault and robbery |

Simple assault |

Manslaughter |

Sexual assault |

Assault upon law enforcement |

Murder |

Cruelty to children |

Domestic assault |

Arson |

Stalking |

Extortion |

Embezzlement |

Abuse, neglect, or exploitation |

Recklessly endangering another |

of a vulnerable adult or child |

person while driving” |

Cruelty to Animals |

#5 |

|

9/11 |

Form W-4 (2011)

Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

Exemption from withholding. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2011 expires February 16, 2012. See Pub. 505, Tax Withholding and Estimated Tax.

Note. If another person can claim you as a dependent on his or her tax return, you cannot claim exemption from withholding if your income exceeds $950 and includes more than $300 of unearned income (for example, interest and dividends).

Basic instructions. If you are not exempt, complete the Personal Allowances Worksheet below. The worksheets on page 2 further adjust your withholding allowances based on itemized deductions, certain credits, adjustments to income, or two-earners/multiple jobs situations.

Complete all worksheets that apply. However, you may claim fewer (or zero) allowances. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages.

Head of household. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s) or other qualifying individuals. See Pub. 501, Exemptions, Standard Deduction, and Filing Information, for information.

Tax credits. You can take projected tax credits into account in figuring your allowable number of withholding allowances. Credits for child or dependent care expenses and the child tax credit may be claimed using the Personal Allowances Worksheet below. See Pub. 919, How Do I Adjust My Tax Withholding, for information on converting your other credits into withholding allowances.

Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax payments using

Form 1040-ES, Estimated Tax for Individuals. Otherwise, you may owe additional tax. If you have pension or annuity income, see Pub. 919 to find out if you should adjust your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a working spouse or more than one job, figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Your withholding usually will be most accurate when all allowances are claimed on the Form W-4 for the highest paying job and zero allowances are claimed on the others. See Pub. 919 for details.

Nonresident alien. If you are a nonresident alien, see Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form.

Check your withholding. After your Form W-4 takes effect, use Pub. 919 to see how the amount you are having withheld compares to your projected total tax for 2011. See Pub. 919, especially if your earnings exceed $130,000 (Single) or $180,000 (Married).

Personal Allowances Worksheet (Keep for your records.)

A |

Enter “1” for yourself if no one else can claim you as a dependent |

. . . . . . . . . |

A |

|

Enter “1” if: { |

• You are single and have only one job; or |

} . . . |

|

B |

• You are married, have only one job, and your spouse does not work; or |

B |

• Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

CEnter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

|

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) |

C |

D |

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return |

D |

E |

Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above) . . |

E |

F |

Enter “1” if you have at least $1,900 of child or dependent care expenses for which you plan to claim a credit . . . |

F |

|

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.) |

|

GChild Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

•If your total income will be less than $61,000 ($90,000 if married), enter “2” for each eligible child; then less “1” if you have three or more eligible children.

•If your total income will be between $61,000 and $84,000 ($90,000 and $119,000 if married), enter “1” for each eligible

child plus “1” additional if you have six or more eligible children . . . . . . . . . . . . . . . . . . G

HAdd lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.) ▶ H

|

|

|

|

For accuracy, |

{ |

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions |

complete all |

and Adjustments Worksheet on page 2. |

thatworksheetsapply. |

• If you have more than one job or are married and you and your spouse both work and the combined earnings from all jobs exceed |

$40,000 ($10,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to avoid having too little tax withheld. |

|

|

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below. |

|

|

|

|

|

Cut here and give Form W-4 to your employer. Keep the top part for your records. |

|

Form |

W-4 |

Employee's Withholding Allowance Certificate |

OMB No. 1545-0074 |

|

▶ Whether you are entitled to claim a certain number of allowances or exemption from withholding is |

2011 |

|

Department of the Treasury |

|

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS. |

|

Internal Revenue Service |

|

|

1 |

Type or print your first name and middle initial. |

Last name |

|

|

|

|

2 Your social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street or rural route) |

|

3 |

Single |

Married |

Married, but withhold at higher Single rate. |

|

|

|

|

|

|

|

|

|

|

|

|

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box. |

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code |

|

4 |

If your last name differs from that shown on your social security card, |

|

|

|

|

|

|

|

|

|

|

|

|

|

check here. You must call 1-800-772-1213 for a replacement card. ▶ |

|

5 |

Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2) |

5 |

|

6 |

Additional amount, if any, you want withheld from each paycheck |

|

. . . . . . . . . . . . . . |

6 $ |

7I claim exemption from withholding for 2011, and I certify that I meet both of the following conditions for exemption.

•Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and

•This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . ▶ 7

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature |

|

|

(This form is not valid unless you sign it.) ▶ |

|

Date ▶ |

|

|

|

|

8 |

Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.) |

9 Office code (optional) |

10 Employer identification number (EIN) |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 10220Q |

Form W-4 (2011) |

Form W-4 (2011) |

Page 2 |

|

|

Deductions and Adjustments Worksheet |

|

Note. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income. |

|

1Enter an estimate of your 2011 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes, medical expenses in excess of 7.5% of your income, and

|

miscellaneous deductions |

1 |

$ |

|

Enter: { |

$11,600 if married filing jointly or qualifying widow(er) |

} |

|

|

2 |

$8,500 if head of household |

2 |

$ |

|

$5,800 if single or married filing separately |

|

|

|

|

|

|

|

3 |

Subtract line 2 from line 1. If zero or less, enter “-0-” |

3 |

$ |

4 |

Enter an estimate of your 2011 adjustments to income and any additional standard deduction (see Pub. 919) |

4 |

$ |

5Add lines 3 and 4 and enter the total. (Include any amount for credits from the Converting Credits to

|

Withholding Allowances for 2011 Form W-4 Worksheet in Pub. 919.) |

5 |

$ |

6 |

Enter an estimate of your 2011 nonwage income (such as dividends or interest) |

6 |

$ |

7 |

Subtract line 6 from line 5. If zero or less, enter “-0-” |

7 |

$ |

8 |

Divide the amount on line 7 by $3,700 and enter the result here. Drop any fraction |

8 |

|

9 |

Enter the number from the Personal Allowances Worksheet, line H, page 1 |

9 |

|

10Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earners/Multiple Jobs Worksheet,

also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, page 1 |

10 |

Two-Earners/Multiple Jobs Worksheet (See Two earners or multiple jobs on page 1.)

Note. Use this worksheet only if the instructions under line H on page 1 direct you here. |

|

1 |

Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet) |

1 |

2Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if you are married filing jointly and wages from the highest paying job are $65,000 or less, do not enter more

3If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter

“-0-”) and on Form W-4, line 5, page 1. Do not use the rest of this worksheet |

3 |

Note. If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4 through 9 below to figure the additional

|

withholding amount necessary to avoid a year-end tax bill. |

|

|

|

|

4 |

Enter the number from line 2 of this worksheet |

4 |

|

|

|

5 |

Enter the number from line 1 of this worksheet |

5 |

|

|

|

6 |

Subtract line 5 from line 4 |

6 |

|

7 |

Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here . . . . |

7 |

$ |

8 |

Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed . . |

8 |

$ |

9Divide line 8 by the number of pay periods remaining in 2011. For example, divide by 26 if you are paid every two weeks and you complete this form in December 2010. Enter the result here and on Form W-4,

line 6, page 1. This is the additional amount to be withheld from each paycheck . . . . . . . . 9 $

|

|

|

|

|

Table 1 |

|

|

|

|

|

|

|

|

Table 2 |

|

|

|

|

Married Filing Jointly |

|

|

All Others |

|

Married Filing Jointly |

|

|

All Others |

|

|

|

|

|

|

|

|

|

|

|

|

If wages from LOWEST |

|

Enter on |

If wages from LOWEST |

|

Enter on |

If wages from HIGHEST |

Enter on |

If wages from HIGHEST |

|

Enter on |

paying job are— |

|

|

line 2 above |

paying job are— |

|

|

line 2 above |

paying job are— |

line 7 above |

paying job are— |

|

line 7 above |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

- $5,000 - |

|

0 |

$0 - $8,000 - |

|

0 |

$0 - $65,000 |

$560 |

$0 - $35,000 |

|

$560 |

5,001 |

- |

12,000 |

- |

|

1 |

8,001 |

- |

15,000 |

- |

|

1 |

65,001 |

- |

125,000 |

930 |

35,001 |

- |

90,000 |

|

930 |

12,001 |

- |

22,000 |

- |

|

2 |

15,001 |

- |

25,000 |

- |

|

2 |

125,001 |

- |

185,000 |

1,040 |

90,001 |

- |

165,000 |

|

1,040 |

22,001 |

- |

25,000 |

- |

|

3 |

25,001 |

- |

30,000 |

- |

|

3 |

185,001 |

- |

335,000 |

1,220 |

165,001 |

- |

370,000 |

|

1,220 |

25,001 |

- 30,000 - |

|

4 |

30,001 |

- 40,000 - |

|

4 |

335,001 and over |

1,300 |

370,001 and over |

|

1,300 |

30,001 |

- |

40,000 |

- |

|

5 |

40,001 |

- |

50,000 |

- |

|

5 |

|

|

|

|

|

|

|

|

|

40,001 |

- |

48,000 |

- |

|

6 |

50,001 |

- |

65,000 |

- |

|

6 |

|

|

|

|

|

|

|

|

|

48,001 |

- |

55,000 |

- |

|

7 |

65,001 |

- |

80,000 |

- |

|

7 |

|

|

|

|

|

|

|

|

|

55,001 |

- |

65,000 |

- |

|

8 |

80,001 |

- |

95,000 |

- |

|

8 |

|

|

|

|

|

|

|

|

|

65,001 |

- |

72,000 |

- |

|

9 |

95,001 |

-120,000 |

- |

|

9 |

|

|

|

|

|

|

|

|

|

72,001 |

- 85,000 - |

|

10 |

120,001 and over |

|

|

10 |

|

|

|

|

|

|

|

|

|

85,001 |

- |

97,000 |

- |

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97,001 |

-110,000 |

- |

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

110,001 |

-120,000 - |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

120,001 |

-135,000 - |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

135,001 and over |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Privacy Act and Paperwork |

|

Reduction Act Notice. We ask for the information on this form to |

You are not required to provide the information requested on a form that is |

|

carry out the Internal Revenue laws of the United States. Internal Revenue Code sections |

subject to the Paperwork Reduction Act unless the form displays a valid OMB |

3402(f)(2) and 6109 and their regulations require you to provide this information; your employer |

control number. Books or records relating to a form or its instructions must be |

uses it to determine your federal income tax withholding. Failure to provide a properly |

retained as long as their contents may become material in the administration of |

completed form will result in your being treated as a single person who claims no withholding |

any Internal Revenue law. Generally, tax returns and return information are |

allowances; providing fraudulent information may subject you to penalties. Routine uses of this |

confidential, as required by Code section 6103. |

|

|

|

|

information include giving it to the Department of Justice for civil and criminal litigation, to |

The average time and expenses required to complete and file this form will vary |

|

cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in |

depending on individual circumstances. For estimated averages, see the |

|

administering their tax laws; and to the Department of Health and Human Services for use in |

|

instructions for your income tax return. |

|

the National Directory of New Hires. We may also disclose this information to other countries |

|

If you have suggestions for making this form simpler, we would be happy to hear |

|

under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to |

|

from you. See the instructions for your income tax return. |

|

federal law enforcement and intelligence agencies to combat terrorism. |

|

|

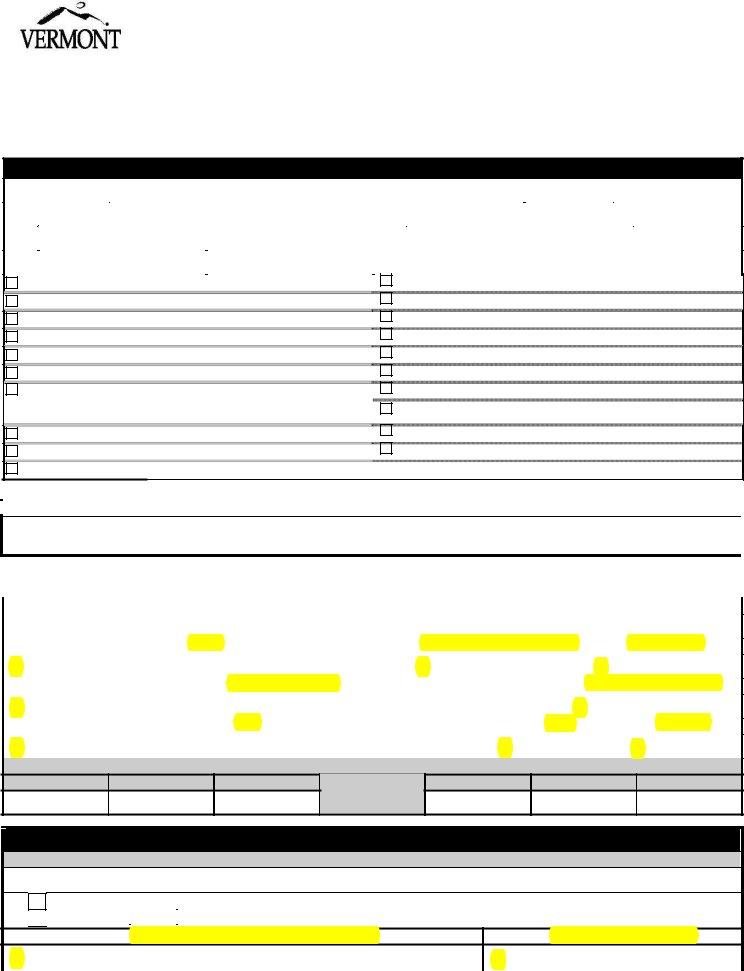

Instructions for completing Form W-4VT

Who must complete Form W-4VT:

Any person whose employer requires this form. ( State Employees MUST Complete This Form)

Any person requiring Vermont withholding to be based on W-4 information which is different from the federal W-4. This would include employees anticipating Child Tax Credit, Hope Credit, or other federal credits which do not pass through to Vermont income tax and employees who are in civil unions.

Completing Form W-4VT: This form is completed in the same manner as the federal W-4. Complete the federal form first, following the instructions on the form or IRS publication 919, How Do I Adjust My Tax Withholding?.

Parts 1 and 2: Print clearly or type your Name and Social Security Number.

Part 3: Enter any information required by your employer.

Part 4: a. If you are a partner in a civil union, check either “Civil Union” or “Civil Union, but withhold at the higher single rate”. Otherwise, check the filing status used on the Federal W-4.

b. Enter the number of withholding allowances for Vermont withholding. If you claimed additional allowances for Federal tax because of an anticipated child credit or education credit, do not claim these additional allowances for Vermont withholding.

c.If you want an additional amount of Vermont withholding to be deducted from each paycheck, enter that amount.

Part 5: Sign and date the form and return it to your employer.

This form may be photocopied as needed

______________________________________________________________________________________________________

|

W-4VT |

|

State of Vermont Department of Taxes |

|

|

|

|

Vermont Employee’s Withholding Allowance Certificate |

|

Part 1 |

|

|

|

|

|

Part |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

First Name |

Initial |

Last Name |

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3 |

|

Employee Number: ____________________________ |

|

|

|

|

|

|

|

(or other employer information required by employer) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.Is your Vermont filing status:

|

|

Single |

Married |

Married, but withhold at the higher Single Rate |

|

Part 4 |

|

Civil Union |

Civil Union, but withhold at the higher Single Rate |

b.Total number of Vermont Withholding allowances ………………………………………b.

c. Additional amount, if any, of Vermont tax to be withheld from each paycheck…………c. $

I certify that I am entitled to the number to withholding allowances claimed on this certificate.

Part 5

ATTENTION!

Important information regarding the

Employment Eligibility Verification Form

One of the most common causes of returned employee hiring packets is that the Employment Eligibility Verification Form incomplete or incorrectly completed. To help with this we ask that both the Employer and the Employee complete this checklist together to ensure that the following items are complete on the form.

Incomplete packets must be returned to the employer. This slows down the enrollment process for employees and often delays paychecks for employees. Please be sure that this form is completed as required.

Make sure the Employee has completed the following:

□Name and address

□Date of Birth

□Social Security number

□Citizen Status (check one)

□Signature and date

Make sure the Employer has completed the following:

□Written down the identification information and numbers from the forms of identification given by the employee (i.e. license number, social security number, etc.). Please refer to list of acceptable documents.

Note: One form of ID is needed if using list A. Or, two forms of documents are needed; one from list B and one from list C.

□Written down the expiration date for any document with an expiration date.

□Written in the date under “Documentation Certification”

□Signed and printed their name.

#9

9/11

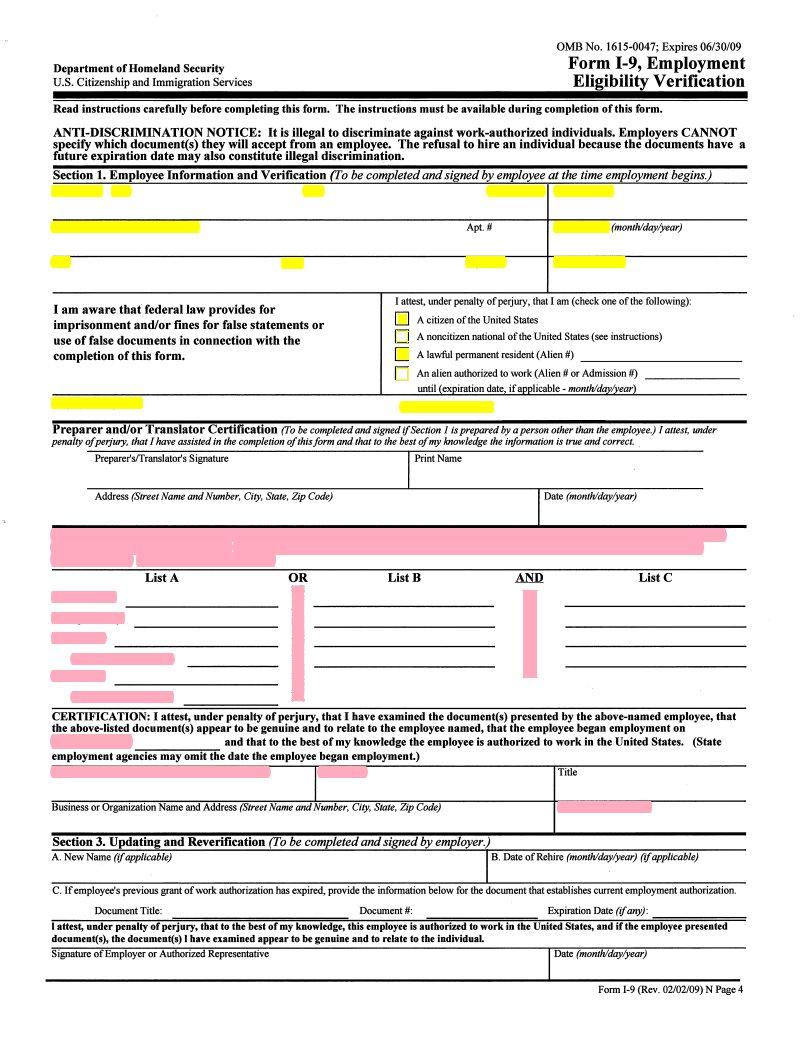

OMB No. 1615-0047; Expires 06/30/09

Department of Homeland Security

U.S. Citizenship and Immigration Services

Form 1-9, Employment Eligibility Verification

Read instructions carefully before completing this form. The instructions must be available during completion of this form.

ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work-authorized individuals. Employers CANNOT specify which document(s) they will accept from an employee. The refusal to hire an individual because the documents have a future expiration· date may also constitute illegal discrimination.

Section 1. Employee Information and Verification (To be completed and signed by employee at the time employment begins.)

Print Name: Last |

First |

Address (Street Name and Number) |

|

City |

State |

I am aware that federal law provides for imprisonment and/or fines for false statements or use of false documents in connection with the completion of this form.

Employee's Signature

Middle Initial Maiden Name

Apt. #Date of Birth (monthlday/year)

Zip Code |

Social Security # |

I attest, under penalty of perjury, that I am (check one of the following): D A citizen of the United States

D A noncitizen national of the United States (see instructions)

D A lawful permanent resident (Alien #) ------------------------

D An alien authorized to work (Alien # or Admission #) ______________

until (expiration date if applicable - month/day/year) Date (monthlday/year)

Preparer and/or Translator Certification (fo be completed AND signed ifSection 1 is prepared by a person other than the employee.) I attest, under penalty o/perjury, that I have assisted in the completion o/this/orm and that to the best o/my knowledge the iriformation is true and correct..

Preparer'sffranslator's Signature |

Print Name |

Address (Street Name AND Number, City, State, Zip Code) |

Date (month/day/year) |

Section 2. Employer Review and Verification (To be completed and signed by employer. Examine one documentfrom List A OR examine one document from List B and one from List C, as listed on the reverse ofthis form, and record the title, number, and expiration date, ifany, ofthe document(s).}

List A |

OR |

List B |

AND |

List C |

Document title:

Issuing authority:

Document#:

Expiration Date (ifany):

Document#:

Expiration Date (ifany):

CERTIFICATION: I attest, under penalty of perjury, that I have examined the document(s) presented by the above-named employee, that the above-listed document(s) appear to be genuine and to relate to the employee named, that the employee began employment on

(month/day/year) |

and that to the best of my knowledge the employee is authorized to work in the United States. (State |

employment agencies may omit the date the employee began employment.)

Signature of Employer or Authorized Representative |

Print Name |

Title |

Business or Organization Name and Address (Street Name AND Number, City, State, Zip Code) |

Date (month/day/year) |

Section 3. Updating and Reverification (To be completed and signed by employer.)

A. New Name (ifapplicable)B. Date of Rehire (monthldaylyear) (ifapplicable)

C. Ifemployee's previous grant of work authorization has expired, provide the information below for the document that establishes current employment authorization.

Document Title: |

Document#: |

Expiration Date (ifany): |

I attest, under penalty or perjury, that to the best or my knowledge, this employee is authorized to work in the United States, and ifthe employee presented document(s), the document(s) I have examined appear to be genuine and to relate to the individuaL

Signature of Employer or Authorized Representative |

Date (month/day/year) |

Form 1-9 (Rev. 02102/09) N Page 4

IMPORTANT INFORMATION FOR ALL EMPLOYEES

Please review this information and sign where indicated at the end

of this document.

1.Who is your employer?

Your employer is the person who hires you and who will be signing your timesheets. You are not employed by ARIS Solutions, by the State of Vermont or by an agency.

2.What is the role of ARIS Solutions?

ARIS Solutions is a payroll agent, only. We act on behalf of your employer to process and issue payroll checks along with providing a number of additional tax and state required payments and reporting.

3.Where does the funding for payroll come from?

All of the funding for employees’ pay comes from Medicaid or in rare cases, the General Fund of the State of Vermont.

4.Who is responsible for assuring that employees are paid?

It is the responsibility of the employer to assure that employees are paid. The employer must submit timesheets on a bi-weekly basis according to the payroll schedule we provide for them. The employer is responsible for scheduling the employee within the budget or hour limits in the approved service plan. Neither ARIS Solutions, the agency, nor the State of Vermont is responsible for assuring that funds are available. Employers are mailed a budget statement every two weeks so that they may monitor available funds.

5.Who is responsible to pay the employee if funds for the consumer run out or if the consumer is no longer eligible for Medicaid?

Your employer is responsible for making sure you are paid. If there are no funds or hours remaining in the consumer’s budget or service plan your employer must assure that you are paid. Neither ARIS Solutions, the agency, nor the State of Vermont can give you a paycheck if there are no funds remaining in the consumers’ budget. The State of Vermont Department of Labor requires that all employees be paid for hours worked even if there are no funds or hours remaining in the consumer’s budget or service plan.

6.Who should submit employee timesheets to ARIS Solution?

The employer is required to submit your timesheet to ARIS Solutions according to the payroll schedule. This requirement is based upon an advisory from the State of Vermont Office of the Attorney General. No employee should ever submit their own timesheets to ARIS Solutions.

7.When should the employee sign the timesheet?

Timesheets should be signed together with the employer. Employees and employers both should never sign a blank timesheet. It is important that both the employer and employee agree on the hours that are submitted on the timesheet for payment.

8.When must ARIS Solutions have timesheets in order for the employee to receive a paycheck on the scheduled pay date?

All timesheets must arrive in the ARIS Solutions office no later than Monday of the pay week in order to assure payment on the Friday pay date. ARIS Solutions requests that all timesheets be mailed no later than Friday prior to the pay week in order to assure that the timesheets arrive by Monday of the pay week. If a timesheet arrives at ARIS Solutions after Monday of the pay week and it is postmarked on the previous Friday, ARIS Solutions will assure that the employee is paid for that scheduled Friday pay day. ARIS Solutions maintains the mailing envelope of all timesheets which arrive after the required Monday date. These envelopes are discarded only after the timesheet has been paid.

9.What happens if the employer sends in employee timesheets before there is an approved budget or service plan for the consumer? ARIS Solutions cannot issue any paychecks to an employee until an approved budget (Service Plan or Notice of Decision, etc.) is sent to ARIS Solutions. ARIS Solutions will hold on to any timesheets submitted and will pay the employee in the next payroll after ARIS Solutions has received approval for a budget or service plan. Neither ARIS Solutions nor anyone else can guarantee that an approved Service Plan will actually be received. Anyone working when a consumer does not have an authorized Service Plan runs the risk of having the employer having to provide the funds for payroll.

10.What paperwork does ARIS Solutions need in order to begin to issue payroll?

In order for payroll to be issued, ARIS Solutions must have the following:

a.Completed Employer Enrollment Packet (done when the employer first enrolls with ARIS Solutions)

b.Completed Employee Hiring Packet (employees must complete this packet, including all background checks, for any employer hiring them).

c.Current approved budget or service plan with sufficient funds or hours to cover payroll.

d.Current, complete signed timesheet submitted by employer.

11.Are there other reasons paychecks may not be issued to employees?

Yes. Please see attachment “Causes for Non-Payment of

Timesheets” in your hiring packet. Please be reminded that the employer is responsible to assure that all timesheets are signed, complete and are submitted by them in accordance with the payroll schedule. Additionally, the employer is responsible to assure that funds or hours are available to cover the payroll.

PLEASE SI GN THE ATTACHED FORM I NDI CATI NG THAT YOU HAVE READ

THI S I NFORMATI ON

The signed form must be returned to ARI S Solutions w ith your hiring packet .

Please keep t he information sheet s for your records.

9/ 11

3

Confirmation of Receipt of

Important Information for All Employees

I, ____________________________, employee for ________________________

have received and reviewed the Important Information for All Employees document.

______________________________ |

|

____________________ |

Employee |

Date |

This form must be returned with the employee hiring packet. Employees cannot be paid until this form has been returned to ARIS Solutions.

9/11

4

Vermont Agency of Human Services

Adult Protective Services, 103 S. Main Street, Ladd Hall, Waterbury, VT 05671-2306 Child Protection Registry Unit, 103 S. Main Street, Waterbury, VT 05671-2401

CONSENT FOR RELEASE OF INFORMATION

PLEASE PRINT OR TYPE. THIS FORM WILL BE RETURNED IF ALTERED OR STAPLED.

If requesting information from both registries, please fill out one form and submit copies to each division....

I hereby request the Commissioner of the Department of Disabilities, Aging and Independent Living to release to me any information in the Adult Abuse Registry pursuant to 33 V.S.A 6911(C)(3) involving the individual listed below in Section II.

I hereby request information from the Child Protection Registry maintained by the Department for Children and Families.

Section I. Employer Requesting Registry Check

Employer name: __________________________________________________________________________________

Employer address: _________________________________________________________________________________

Employer telephone number: _________________________ Employer fax number: ______________________

Employer email address: _____________________________________________________________________

I certify that this individual is a current employee, contractor or volunteer of this facility/agency or has been given a conditional offer of employment. I understand this information is only for the purposes of determining whether to hire or retain the individual to provide care, custody, treatment, transportation, or supervision of children or vulnerable adults.

____________________________________________________ |

_______________________________________ |

(Authorized) Facility/Agency Signature |

Date |

Note: if you are a regulated childcare provider in Vermont, this process does not apply to you.

Section II. Consent From Current or Prospective Employee, Contractor, or Volunteer

Full Name: |

|

|

|

Gender: |

|

|

(Type or Print Clearly) |

|

|

|

|

|

|

Address (including City, State, Zip Code): |

|

|

|

|

|

|

Phone number: |

|

Birth Date |

Place of Birth: |

|

|

|

|

|

|

|

|

|

Last four digits of social security number: XXX-XX-

Other names I have used, if any (including maiden name):

(Type or Print Clearly)

I hereby authorize release of any information of reports of abuse, neglect or exploitation substantiated against me and contained in the Vermont Adult Abuse Registry and/or the Vermont Child Protection Registry to the Owner/Operator of the above named facility/agency.

(Prospective) Staff, Contractor, or Volunteer Signature |

Date |

Section III. Response from the Agency of Human Services (Office Use Only)

Vermont Adult Abuse Registry |

|

|

|

Vermont Child Protection Registry |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's name not found in registry |

|

|

initials |

Employee's name not found in registry |

|

|

initials |

Employee's name found in registry |

|

initials |

Employee's name found in registry |

|

initials |

|

|

|

|

|

|

|

|

|

|

Nature of any finding: ________________________________________________________________________

Date of such finding: _______________________________________________________________________

_________________________________________ |

________________________ |

Signature of Commissioner's Designee |

Date |

**** A self-addressed, stamped envelope must be included****

ARIS SOLUTIONS

ISO

CONSENT FOR RELEASE OF INFORMATION

REQUEST FOR VERMONT CRIMINAL RECORD CHECK

It is important to put your FULL, LEGAL name

1.Employee: ________________________________________________________

2.Maiden or Alias Names:_____________________________________________

3.Social Security Number_________/_________/___________

4.Place of Birth____________________________/__________________

5.Date of Birth____________/_________/___________

Month Day Year

6.Telephone Number_____________________________

RELEASE

I, _______________________________ herby acknowledge and agree to a check of any

criminal record of convictions which may be maintained by the Vermont Criminal Information Center. I understand that the results of that check will be made available to ARIS Solutions for use in reviewing my suitability as an employee to consumers. I further understand that I have the right to appeal the results of the criminal record check to the Vermont Criminal Information Center, Department of Public Safety, 103 South Main Street, Waterbury, VT, 05671.

Signature of Employee:______________________________________Date_______________

|

State of Vermont |

www.dmv.vermont.gov |

|

DEPARTMENT OF MOTOR VEHICLES |

[Phone] 802-828-2000 |

|

120 State Street |

[Fax] 802-828-2098 |

|

[TTD] 711 |

|

Montpelier, VT 05603-0001 |

|

|

|

VERMONT DMV RECORD REQUEST |

|

Requests for Vermont Department of Motor Vehicles records must be submitted on this form. This form may be photocopied for your convenience. The form must be completed in ink. Please print all information, except signatures, which must be written.

* ALL APPLICABLE SECTIONS OF THIS FORM (FRONT AND BACK) MUST BE COMPLETED TO OBTAIN THE REQUESTED INFORMATION. *

Signature Required on Back of Form

|

Requester Name: |

$5 ,6 6 ROXWLRQV |

|

D.B.A./Company: |

|

|

|

|

|

|

|

Street/Box Number: |

32%R[ |

|

|

|

|

|

Telephone #: |

|

|

|

|

City: |

:KLWH5 LYHU- XQFWLRQ |

|

|

State: |

97 |

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to (if different than mailing): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Listings of 1 through 4 current or expired registrations - $6.00 |

|

Certified copy of suspension notice - $6.00 |

|

|

|

|

|

|

|

Certified copy of current or original registration application - $6.00 |

|

Certified copy of vehicle title search, title info, lien info. - $20.00 |

|

Listing of 1 through 4 current or expired operator’s license - $6.00 |

|

Certified copy of vessel, snowmobile or ATV title search - $13.00 |

|

Certified copy of expired operator’s license application - $6.00 |

|

Insurance information of accident - $6.00 |

|

|

|

|

X Certified copy of 3 year operating record (Vermont only) - $11.00 |

|

Periodic inspection sticker record - $6.00 |

|

Statistics and research - $35.00 per hour |

|

Certified copy of complete operating record (Vermont only) - $16.00 |

|

|

|

Certified copy of reinstatement notice - $6.00 |

|

|

|

Lists of registered dealers, transporters, periodic inspection stations, |

|

|

|

|

rental vehicle companies, fuel dealers and distributors (including |

|

Certified copy of proof of mailing - $6.00 |

|

|

|

|

|

|

|

gallons sold or delivered) - $6.00 per page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified copy individual accident report - $10.00 |

|

Certified copy of mail receipt - $6.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified copy police accident report - $15.00 |

|

Certified copy of title - $6.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other – Write explanation on reverse side of this form. All other items of information requested will be furnished at a minimum charge of $4.00.

DO NOT MAIL CASH. |

MAKE CHECK OR MONEY ORDER PAYABLE (IN U.S. FUNDS ONLY) TO: |

VT DEPARTMENT OF MOTOR VEHICLES. |

|

|

|

|

FOR DEPARTMENT USE ONLY |

|

|

|

|

Audit Line:

I am requesting information concerning:

|

VIN Number |

|

Vehicle Make |

Vehicle Year |

|

VT License Plate Number |

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

VT Driver License Number |

|

|

Date of Birth |

|

; |

|

|

; |

|

|

|

|

; |

|

|

Street/Box Number |

|

|

|

|

|

|

Social Security Number |

|

; |

|

|

|

|

|

; |

|

|

|

City |

|

|

|

State |

|

|

Zip Code |

|

; |

|

|

|

|

; |

|

|

; |

Date(s) you want covered, if applicable (does not apply to driving records)

AUTHORIZATION OF RELEASE OF INFORMATION

I hereby, with my signature, authorize (print name of person or business you are authorizing):

$5 ,6 6 ROXWLRQV

;To perform a one-time search of the VT Department of Motor Vehicles files (pertaining to me) and any resulting reports. To perform a one-time authorization to transact business (pertaining to me) with the VT Department of Motor Vehicles.

Signature of individual authorizing release: |

Date authorization given: |

; |

; |

TA-VG-116 (d) INTERNET 5/09 JTB - VTDRIVES |

|

|

|

Payroll Agent Use , Only

(not for LSI, UVS, SAS, FF or CCS employees)

DIRECT DEPOSIT AUTHORIZATION

Payroll checks must be deposited into ONE ACCOUNT only.

NAME:_____________________________________________

TELEPHONE:________________________________________

BANK NAME:________________________________________

A VOIDED CHECK, COPY OF A CANCELED CHECK, DEPOSIT SLIP OR OTHER BANK DOCUMENT WITH YOUR ROUTING AND ACCOUNT NUMBERS MUST BE ATTACHED TO THIS REQUEST.

SAVINGS ACCOUNT |

CHECKING ACCOUNT |

(CIRCLE ONE OF THE ABOVE)

PLEASE NOTE THAT IT MAY TAKE ONE FULL PAYROLL PERIOD FOR YOUR DIRECT DEPOSIT TO BE IN EFFECT. YOU WILL RECEIVE HARD COPY CHECKS UNTIL THE DIRECT DEPOSIT PROCESS HAS BEEN COMPLETED

***To make changes to your account please mail or fax a written request to ARIS Solutions. For your protection, we are unable to accept changes by phone.

#16

!"###$%&"'(%)**##!&+ !#!$