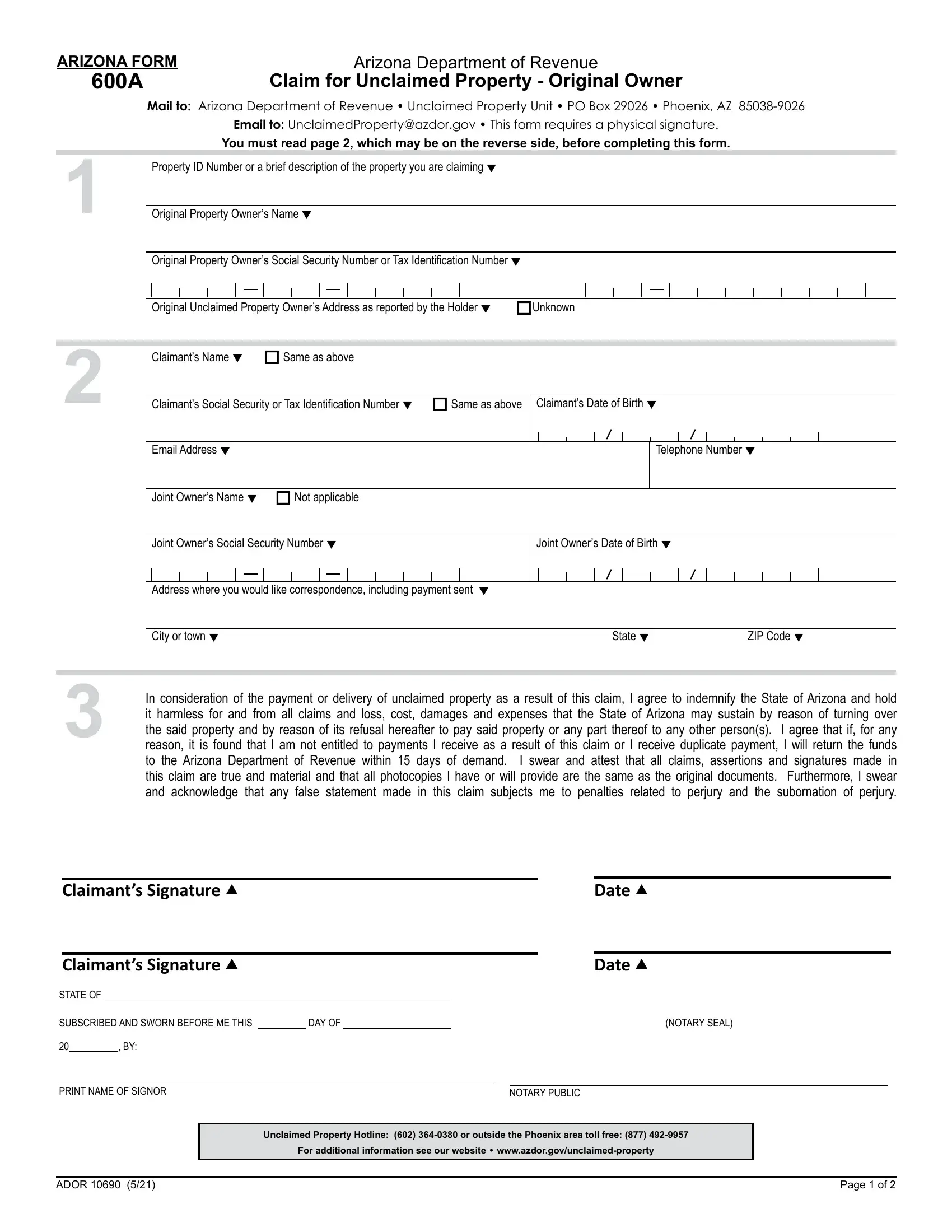

ARIZONA FORM |

Arizona Department of Revenue |

600A |

Claim for Unclaimed Property - Original Owner |

This form should only be used to claim property of which you are the original owner.

If you are claiming property as the heir or beneficiary of a deceased owner (Form 600B), the agent of an entity (Form 600C) or the agent of a living owner (Form 600D), you must complete the appropriate form.

FORM INSTRUCTIONS

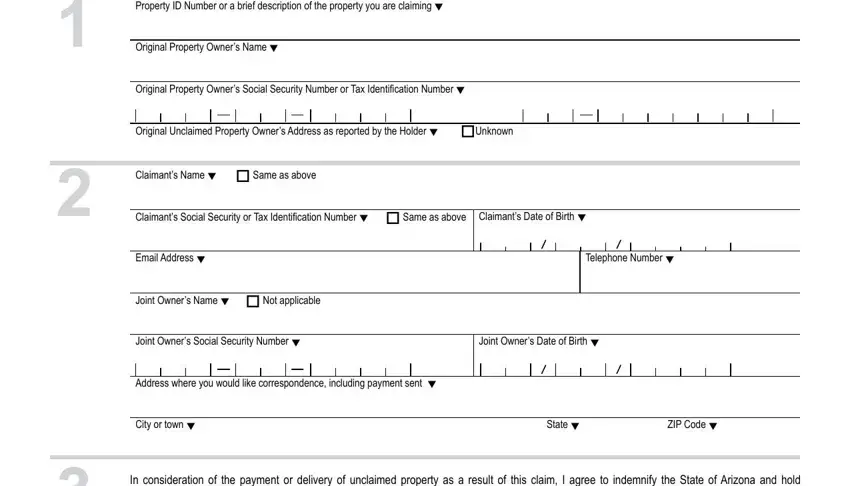

Section 1 of page 1

Regardless of how you answer this Section, we will do a complete search of our database to identify and work to return all unclaimed property belonging to the pertinent owner.

•In this section, we ask that you please provide the property ID or a brief description of the property you are claiming. It is not required to complete this section but we ask, if known, that you provide the property ID, if not known it is not required nor helpful to collect this number. If you do not know the property ID number, but are looking for a specific lost asset, it is helpful to give us a brief description, such as, “Southwest Cactus Wren Federal Credit Union Money Order Check #1008 321 6587” or “IRA funds from employer Jackson and Lynch Welding”. Lastly, if you simply wish to collect all miscellaneous unclaimed property you may leave the section blank.

•In the remaining questions in this section, you are required to provide the name of the individual you believe to be the owner, this may be your name, and if known, the address, and tax ID number reported by the business or entity that remitted the property to the State of Arizona. If unknown you may leave this Section blank.

Section 2 of page 1

It is very important that you complete this Section fully and accurately. You are required to provide us with your current or correct name and your current/correct contact information. If you provide an email address, we will provide you with a receipt of your claim with 15 to 20 business days of receipt; this information is no longer provided in hard copy. Providing an email address also expedites communication and helps us more efficiently serve you. The address that you record in this Section will be the address that payment will be sent to should your claim be approved.

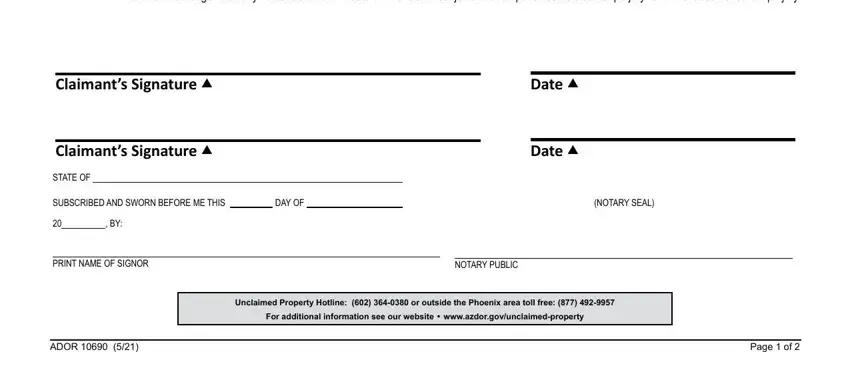

Section 3 of page 1

You must sign and date the form, we require a physical signature. In this section, please read the declarations carefully. There is a notary section under the signature, you may choose to have the form notarized or provide a legible photocopy of valid government issued photo identification; such as a driver’s license or passport. If there are joint owners, they must also sign the claim form (see evidence requirements below for all joint owner exceptions).

YOU ARE REQUIRED TO SUBMIT THE FOLLOWING EVIDENCE WITH THIS FORM:

You must provide proof of your identity as the claimant. Please provide a clear copy of official photo identification or have your signature on the claim form notarized. If your name has changed since the property was reported to the State of Arizona, you must provide verification of your name change, such as, a court order, marriage license or divorce decree.

You must provide proof of ownership. The Arizona Unclaimed Property Section does not release funds based on name similarity alone, must provide a match to another reported factor, most commonly social security number or match to the reported (not current) address.

•Provide proof that you lived at or received mail at the address reported to the State of Arizona as the last known address of the original owner. If you do not know what address was reported to the State of Arizona, you can complete an inquiry at www. missingmoney.com. Acceptable proof includes; the original financial instrument, a statement from the entity that originally held the asset, a canceled envelope addressed to you, a credit report, lease/mortgage, property/income tax documentation, school/military records, past government issued identification or utility bills/statements. Please see our website: azdor.gov/unclaimed-property for a full list of acceptable proof. If you cannot find acceptable proof or do not know the reported address you may provide proof of your social security number and we will attempt to connect you to the reported address.

•Provide proof of your social security number. Providing your Social Security number (SSN) is optional. However, if you choose not to provide your SSN, there may be insufficient information available to determine whether you are the owner of the unclaimed property held by the Section and in some cases may result in your claim being denied. If you provide your SSN, the Section will only disclose it to employees involved in paying your claim and to the federal government as required by law.

Joint owners must file together unless:

•One of the owners is deceased. In this case, a copy of the joint owner’s death certificate is required.

•The owners are now divorced. In this case, a certified copy of the divorce decree and complete property settlement are required.

•The owners have lost contact. In this case, a notarized statement that confirms that the owners had no marital relationship, and have lost all contact is required.

Please be aware that each claim is unique and that once your claim is received, the Section may need to request additional information and will allow you an opportunity to provide the additional evidence rather than denying your claim. If you have any questions or

cannot provide the evidence requested we recommend that you complete the claim form and submit the evidence, you can provide, along with a note explaining your circumstances. A claims specialist may be able to clarify and assist you with the evidence requirement.

Mail to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ 85038-9026

Email to: UnclaimedProperty@azdor.gov • This form requires a physical signature.

For additional information see our website • www.azdor.gov/unclaimed-property.